Environmental Factors >

Climate Strategy and Management

Climate Strategy and Management

Climate change governance

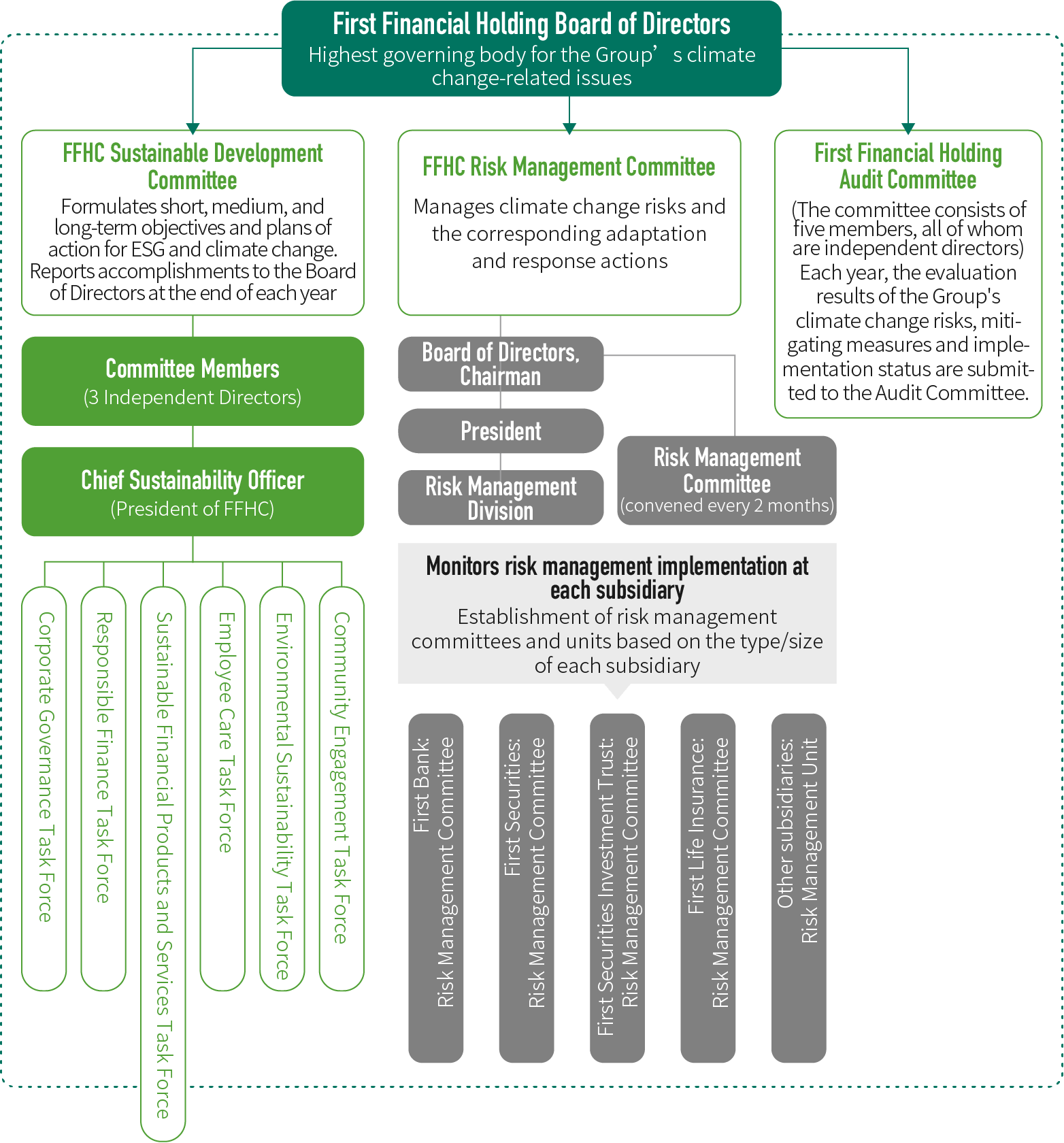

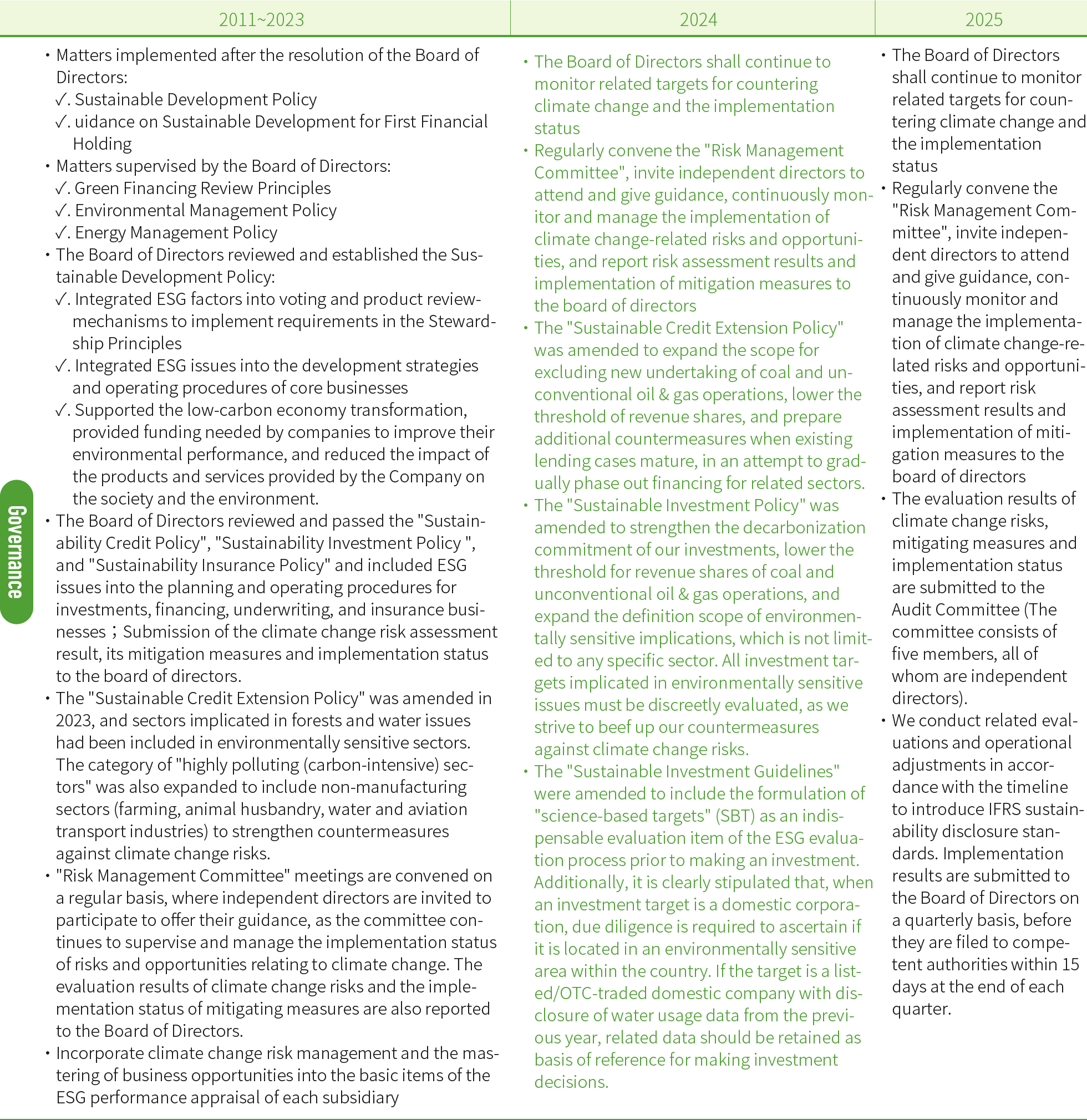

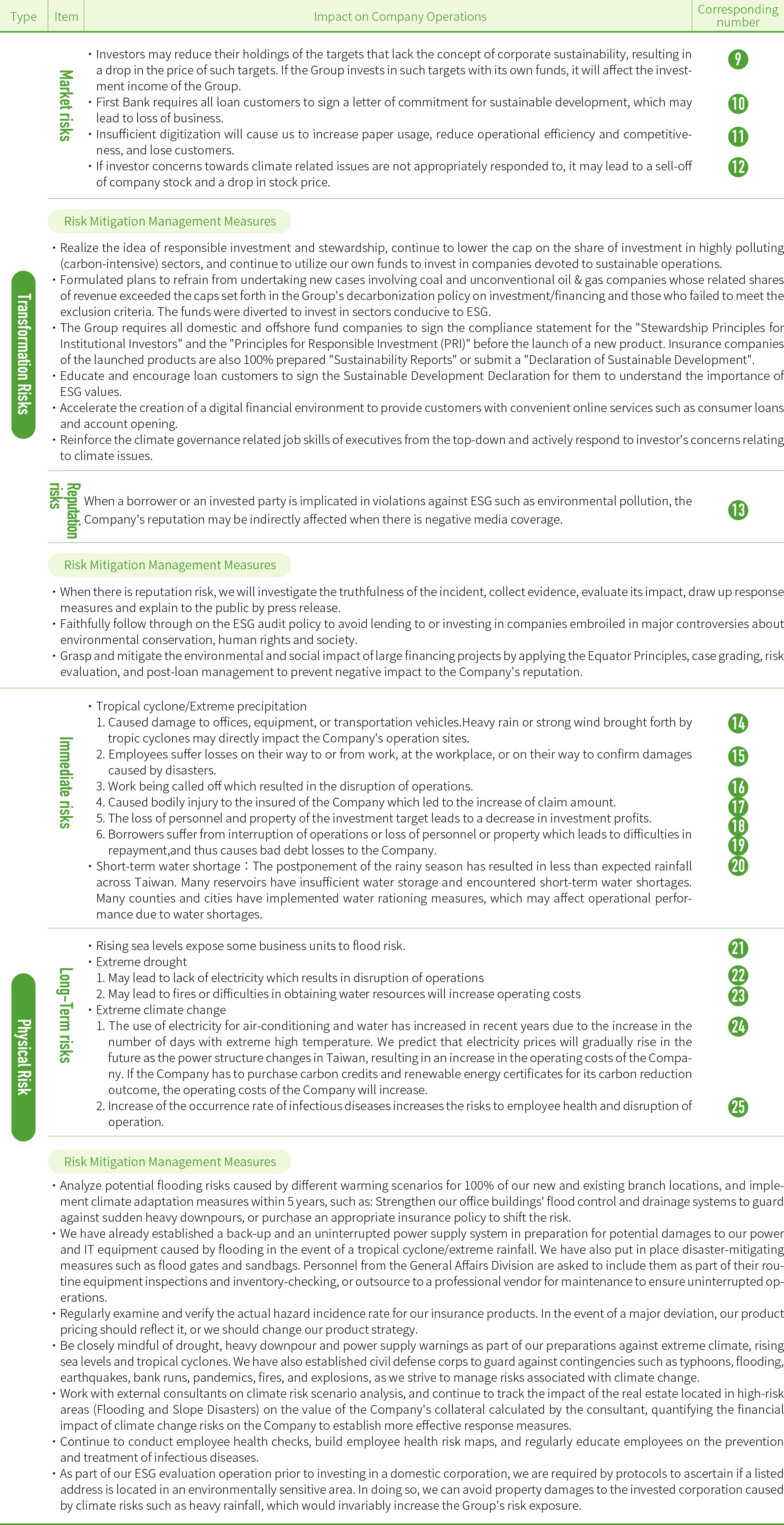

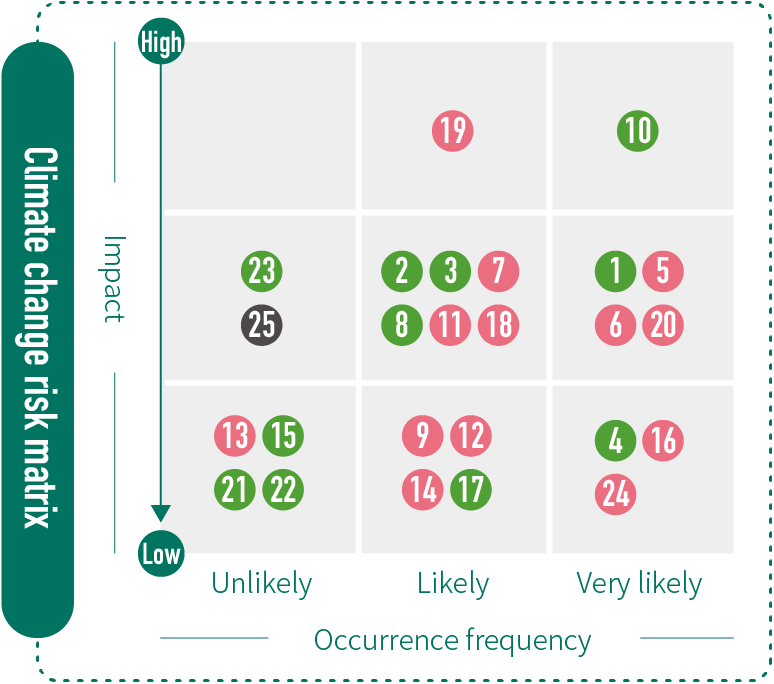

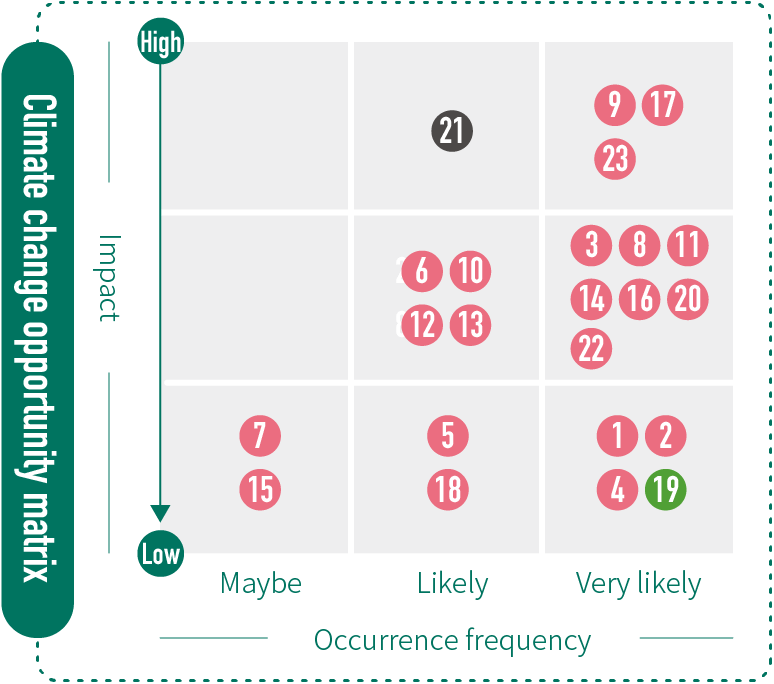

First Financial Holding's Board of Directors is the highest governing body for the Group's climate-related risks; it is responsible for approving, guiding, and ensuring the effective operation of risk management policies. Under the supervision of the Board of Directors, the Sustainable Development Committee and Risk Management Committee are responsible for supervising the group's key climate strategies.It uses the "Climate-Related Financial Disclosures Recommendations published by the Task Force on Climate-Related Financial Disclosures (TCFD) to check and identify the operation risks and opportunities of the Company due to physical, transformation aspects. It shall establish a materiality of risks and possibility of opportunity matrix and use the outcomes of the matrix analysis to establish risk management strategy regarding the major risks as the core response action to the climate change accordingly.

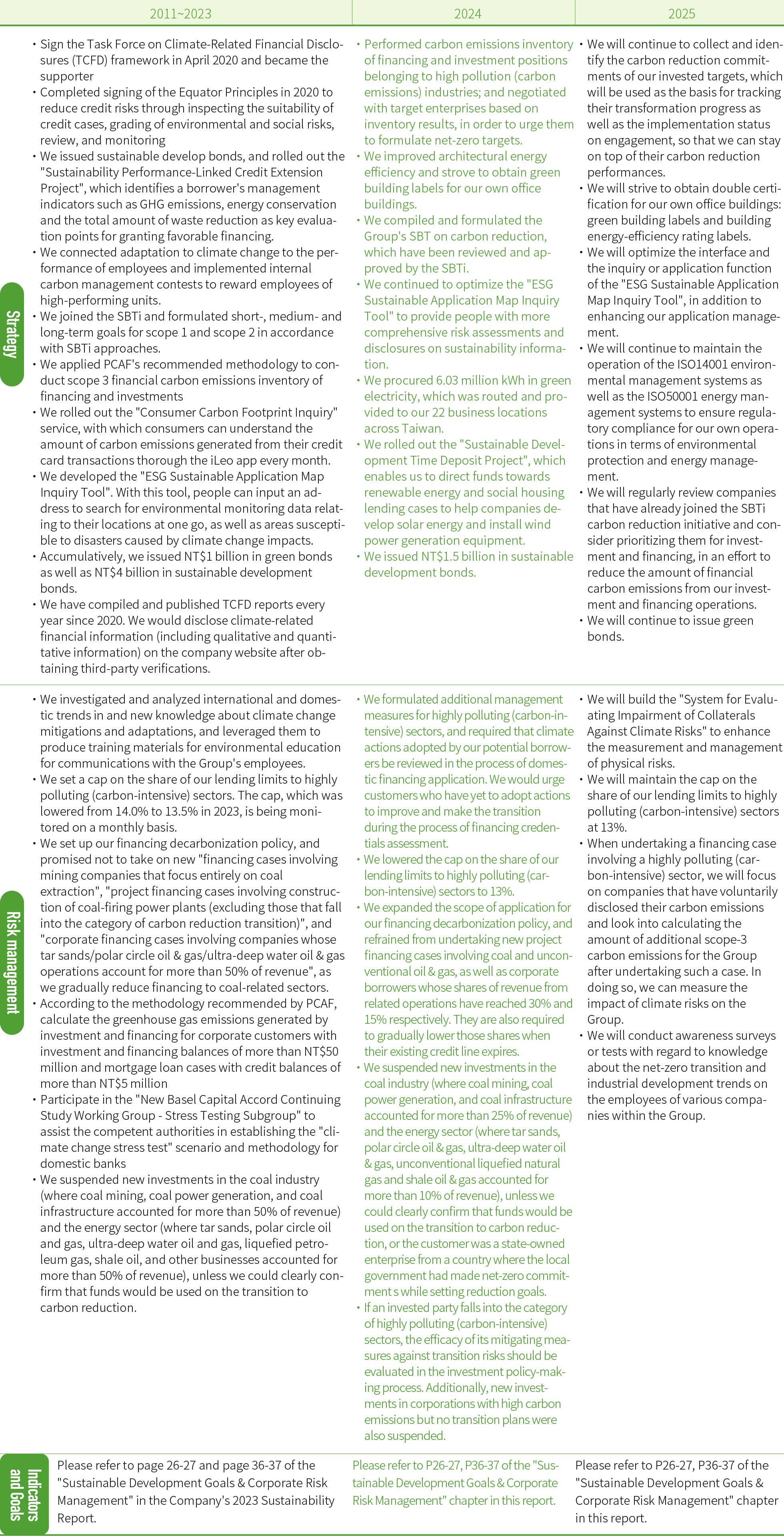

After the review of and approval by the Board of Directors in 2020, emerging risks, including climate change risks, were incorporated in the Group's risk management policy. With effect from 2021, the evaluation results of climate change risks, mitigating measures and implementation status have been submitted to the Board of Directors. The subsidiary bank also invited independent directors to offer guidance to the Risk Management Committee in September 2021, allowing for effective, top-to-bottom supervision over various climate governance actions. In August 2022, we officially joined the "Partnership for Carbon Accounting Financials" (PCAF), conducted scope-3 financial carbon emissions inventory for investment and financing in accordance with PCAF's suggested methodology, and formulated near-term carbon emissions targets, which were submitted to the SBTi for review. Those targets were officially approved in June 2024, which in turn serve as foundation for implementation. We continue to incorporate the net-zero mentality in our investment and financing policy-making process, and reduce our share of investment/financing in highly polluting (carbon-intensive) sectors, in order to achieve our SBT on carbon reduction.

◎ First Financial Holding's Organizational Chart for Climate Risk Governance

◎ FFHC TCFD Indicator Disclosure Framework and Actions

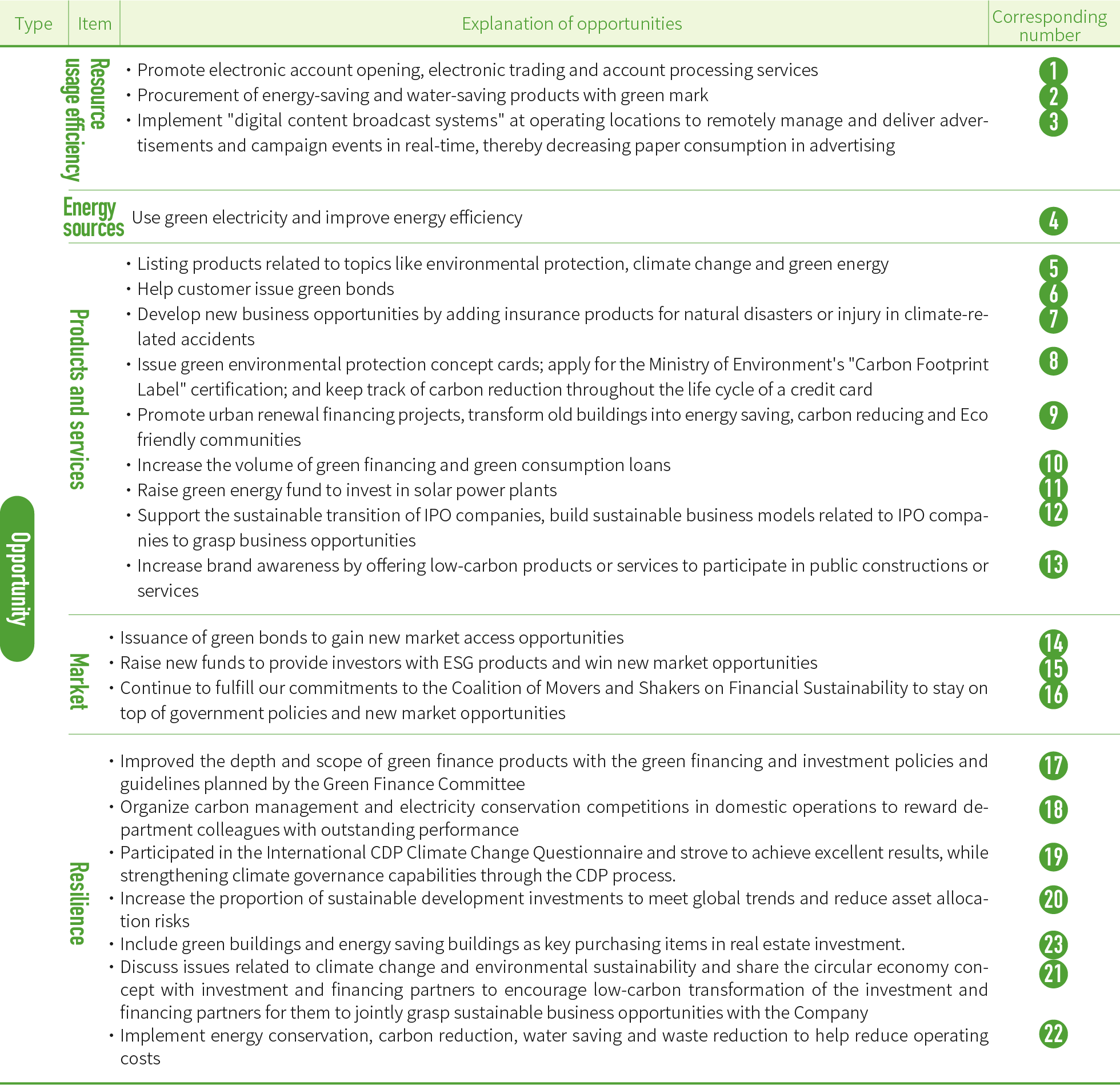

Climate change risks and opportunities

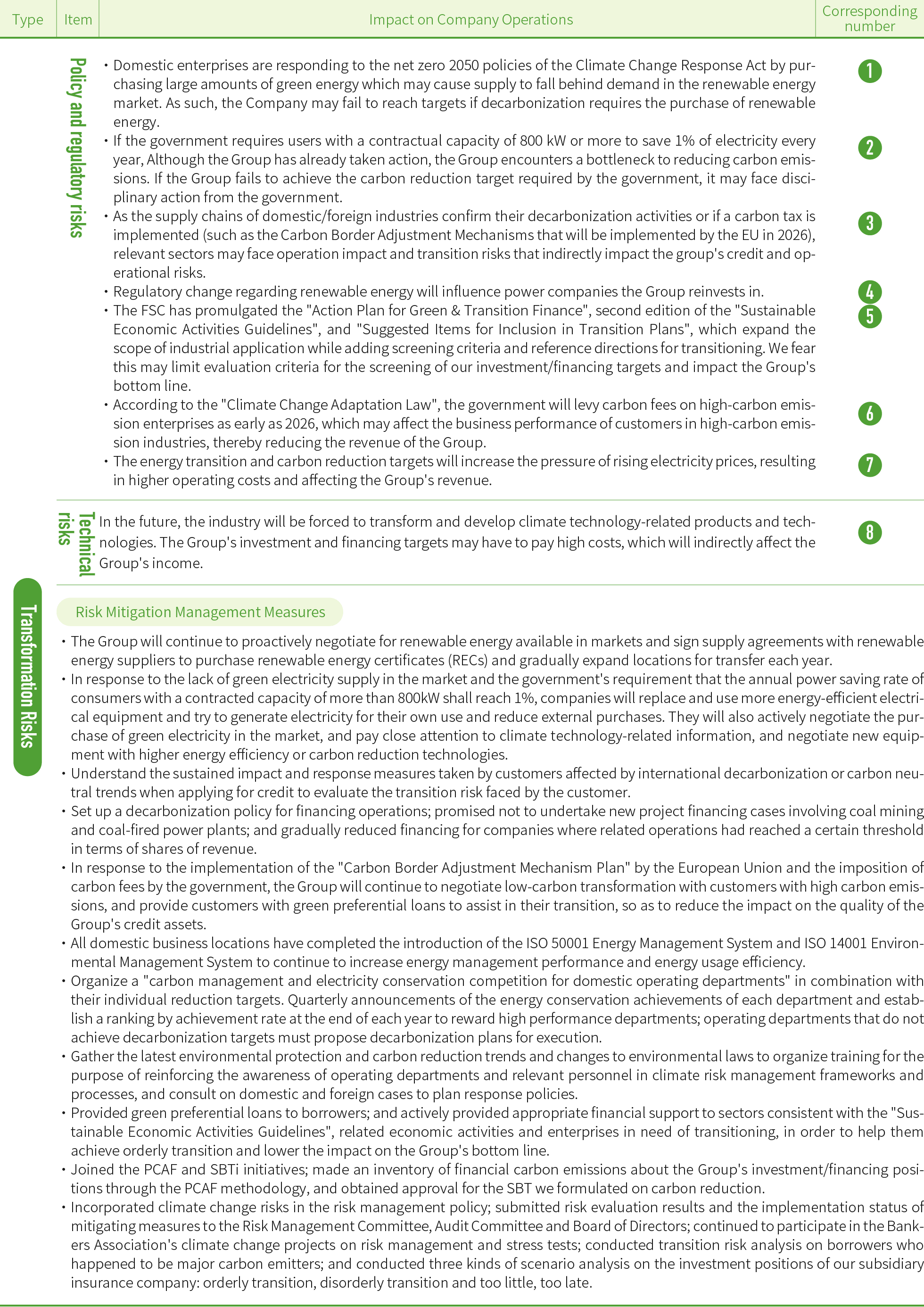

◎ FFHC Identify the risks of climate change

◎ FFHC Identify the opportunities of climate change

*:Short-term opportunities: Estimated to occur within 5 year (in red); Medium-term opportunities: Estimated to occur within 5-15 years

(in green); Long-term opportunities: Estimated to occur after 15 years (in black)

Damage Potential and Hazard Levels for Suppliers

Two-dimensional matrix likelihood analysis was performed on the climate-related physical risks of the Group's 37 major suppliers in 2021; the analysis involved comparing the time and scale of the potential for three climate change-related natural disasters, flooding, mudflow, and landslide (where disaster potential is classified into three levels: low [Grade 1 and 2], medium [Grade 3], and high [Grade 4 and 5]) to calculate hazard level (low [0–50], medium [51–100], and high [101–125]). Results of the analysis indicate that among 37 primary suppliers, 5.41% (2 companies) possess level 4 high risk for flooding potential, while 10.81% (4 companies) possess level 3 moderate risk for flooding potential. All suppliers possess level 1 low risk for mudflow potential and level 2 low risk or below for landslide potential. Hazard calculation results showed that all suppliers exhibited low hazard level.

◎ Suppliers disaster potential levelUnit: (%)

Quantified Financial Data of the Impact of Climate Change on the Company and Scenario Analysis

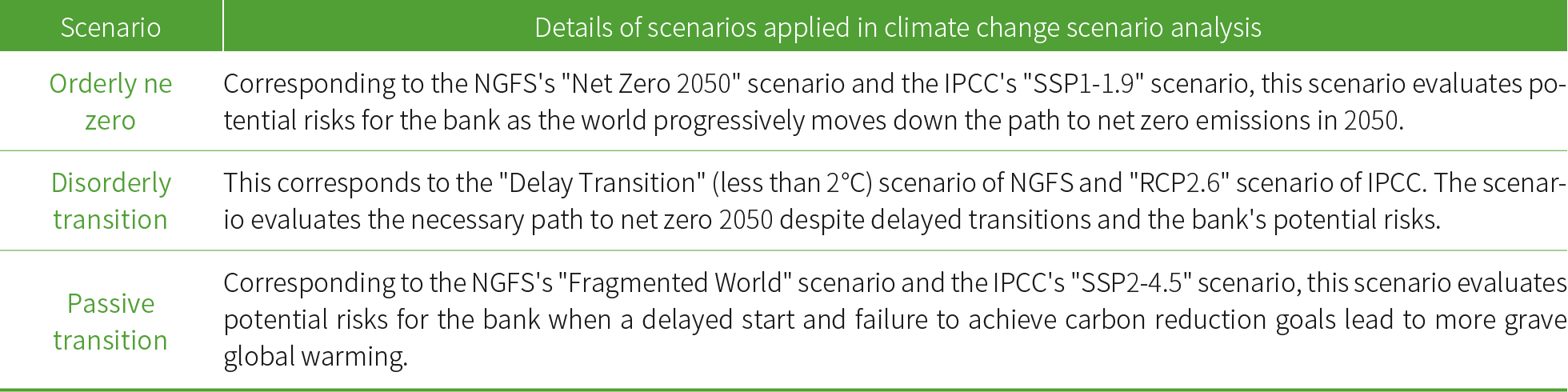

In accordance with the "Plan for Climate Change Scenario Analysis of Domestic Banks" (2024 version; abbreviated as the "Plan" hereafter) promulgated by the competent authority, the Group's climate scenarios have been developed to include two kinds of stress scenarios with different temporal scales - the long-term scenario and the short-term scenario - for conducting climate scenario analysis after taking into account the transition status in Taiwan and the level of climate risks.

In particular, the long-term scenario takes into account the temporal scales of climate change and banks' business cycles, and incorporates Phase IV scenario data from The Network for Greening the Financial System (NGFS) as well as IPCC's Sixth Assessment Report. Two points in time (2030 and 2050) and three simulated climate scenarios (orderly net zero, disorderly transition and passive transition) are drawn up for conducting scenario analysis on climate risks. The scenarios are illustrated as follows:

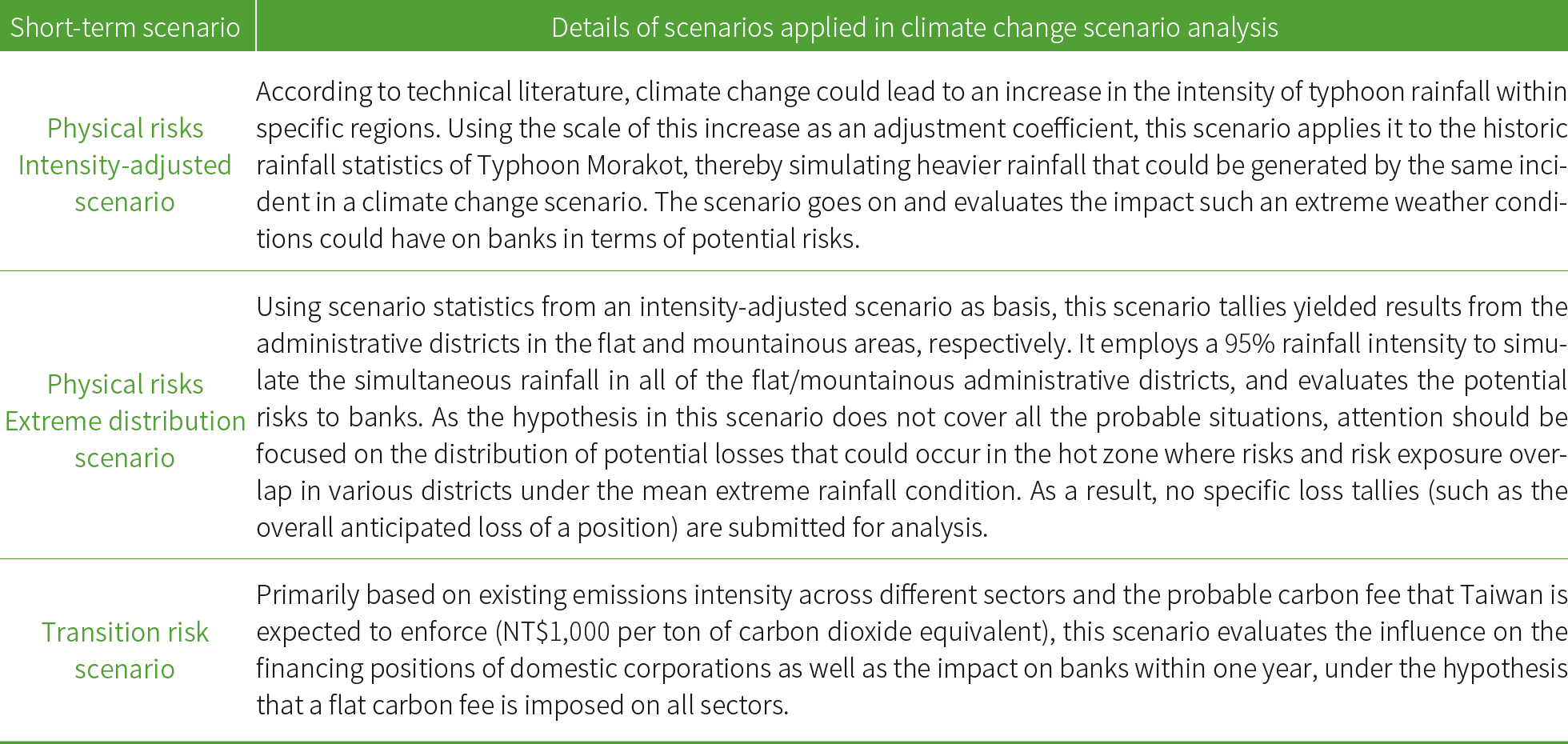

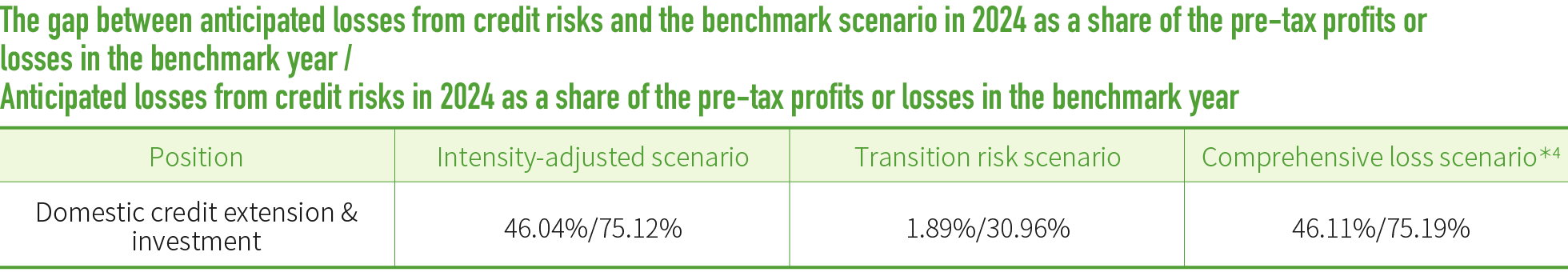

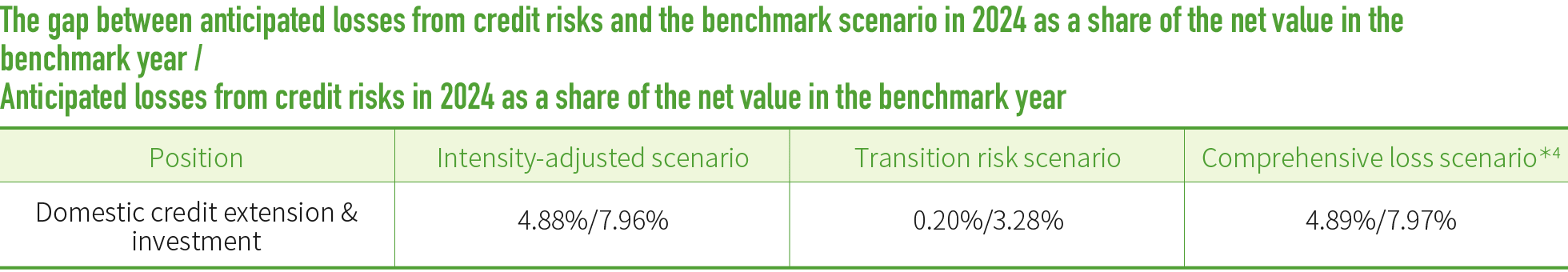

The short-term scenario uses climate incidents occurring within the next year as an evaluation scale to measure the impact on domestic investment/financing positions when a particular physical/transition impact incident occurs within that time frame. Analysis is conducted with regard to the anticipated losses in comparison with the benchmark scenario's relatively extended degree. They are divided into three scenarios as described below:

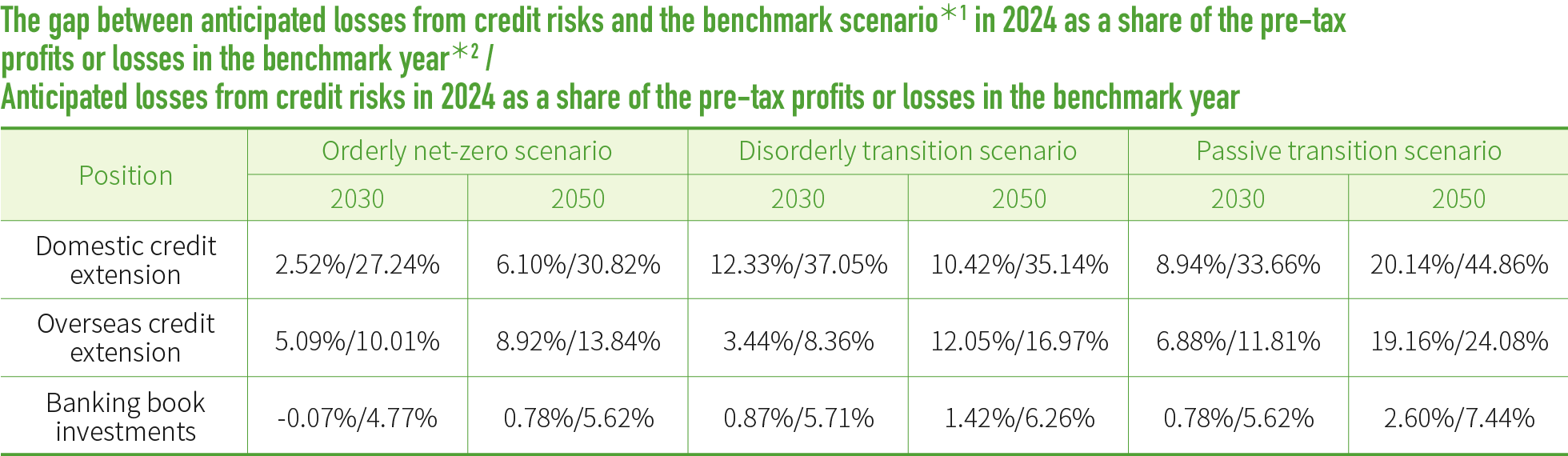

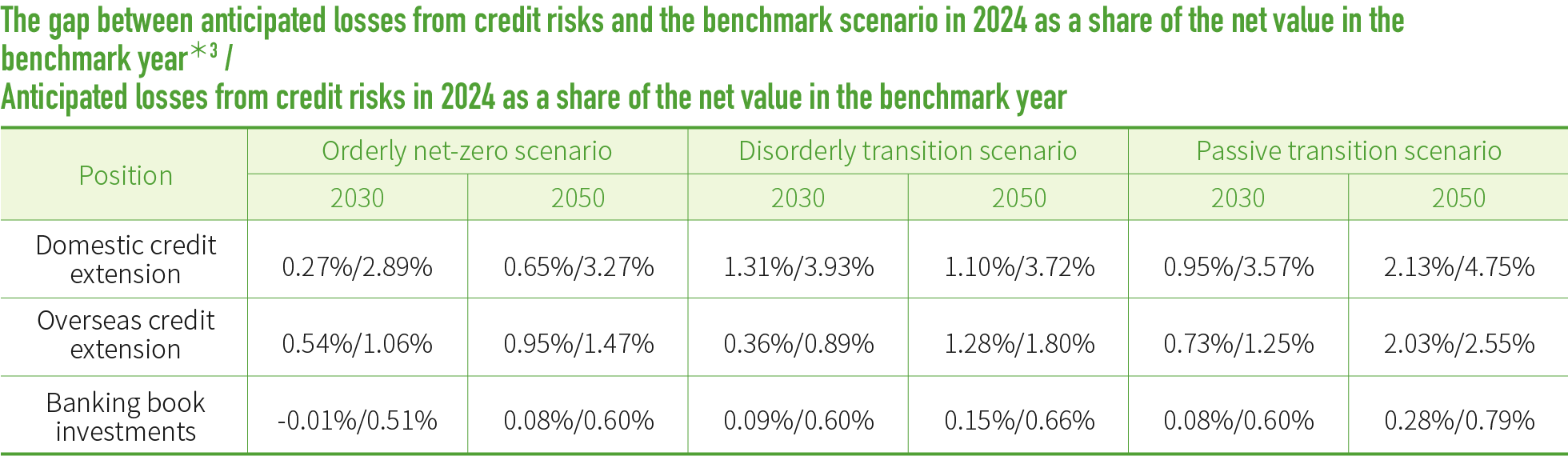

Referencing the FSC's "operation plan" on climate change scenario analysis, we have progressively completed the task of defining impact factors of climate hazards and identified steps such as the climate-linked financial elements of various business positions, as we conduct basic scenario analysis on climate change. We further calculate credit risks for various positions in climate change scenarios. Tally results in the long-term scenario are shown in the following table:

◎ Tally results in the short-term scenario are shown in the following table

*1:Base scenario refers to 2024 values without pressurization.

*2:Pre-tax profits or losses in the benchmark year refer to a pre-tax net profit of NT$29,243 million booked by the subsidiary bank in 2024.

*3:Net value in the benchmark year refers to the subsidiary bank's net value of NT$275,866 million in 2024.

*4:The "comprehensive loss scenario" in the short-term scenario is an aggregate of losses from the "transition risk scenario" and "physical risk scenario minus intensity-adjusted scenario".

*5:The above-mentioned positions do not include public enterprises.

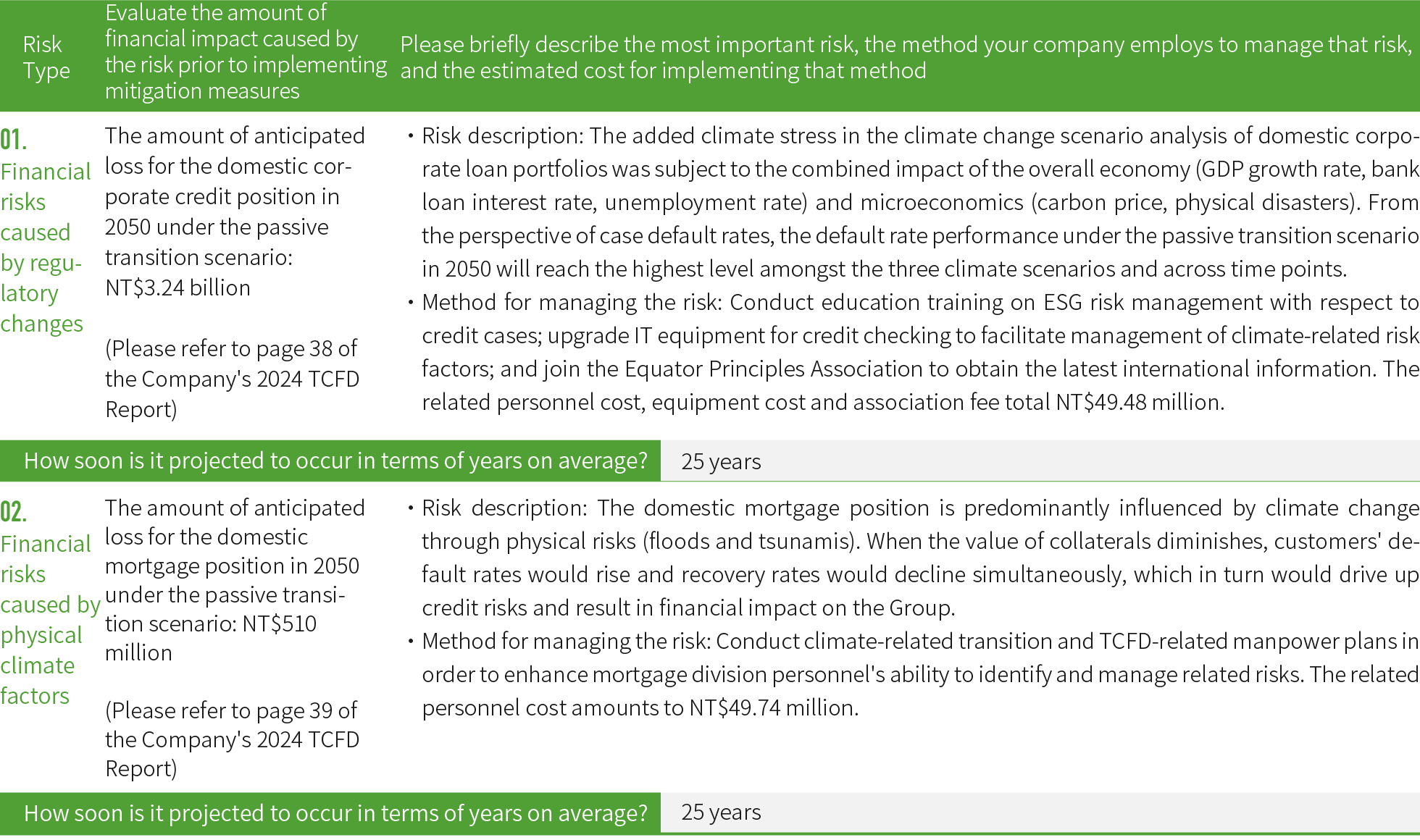

◎ Financial risks caused by regulatory changes and physical climate factors

ESG Sustainable Application Map Inquiry Tool

First Financial Holding has created the industry's first "ESG Sustainable Application Map Inquiry Platform" incorporating geographic information system (GIS) and data application, which links up API data on the government open data platform, and compiles & includes government data relating to climate change, ecology, water, environmentally sensitive areas and green life. Through approaches such as address matching, coordinate positioning or click-to-map points positioning, we have utilized big data analysis to provide a range of simulated information about environmental changes, so that users understand disaster and risk potential as well as information on environmentally sensitive areas. This makes ESG policy-making and risk management more efficient and scientific. Based on Google Analytics' analysis, the platform had recorded 29,400 pageviews as of the end of 2024.