Social Factors >

Diverse Talent Recruitment and Skill Cultivation

Diverse Talent Recruitment and Skill Cultivation

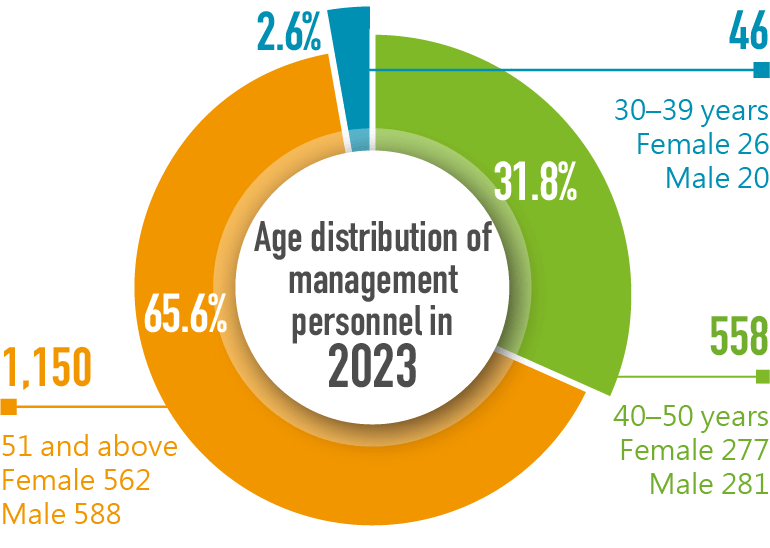

Employee composition and diversity

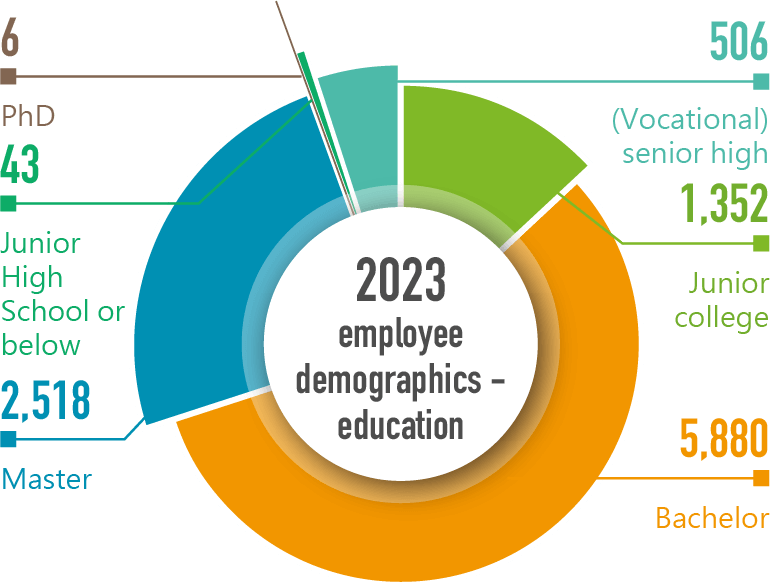

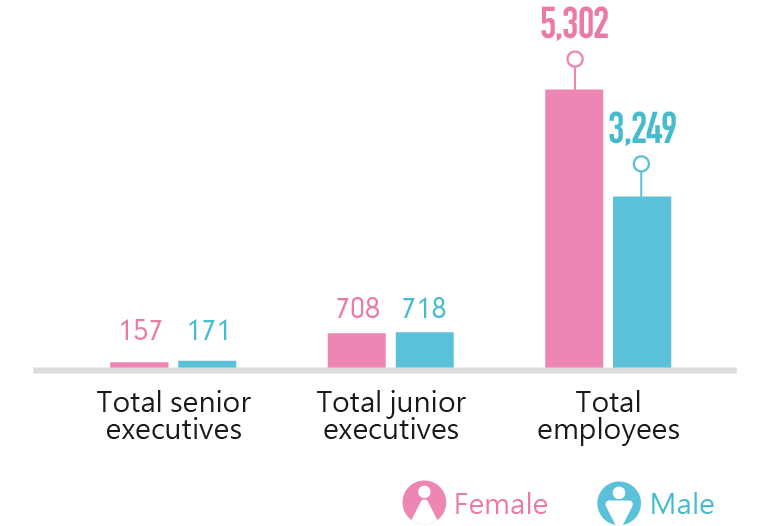

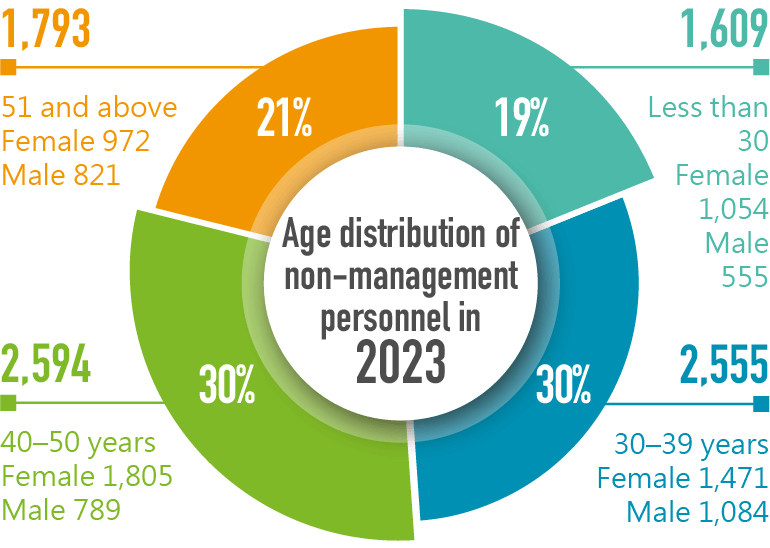

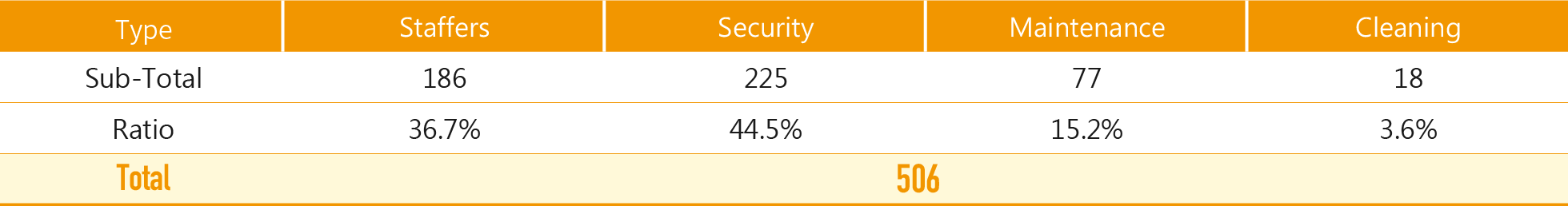

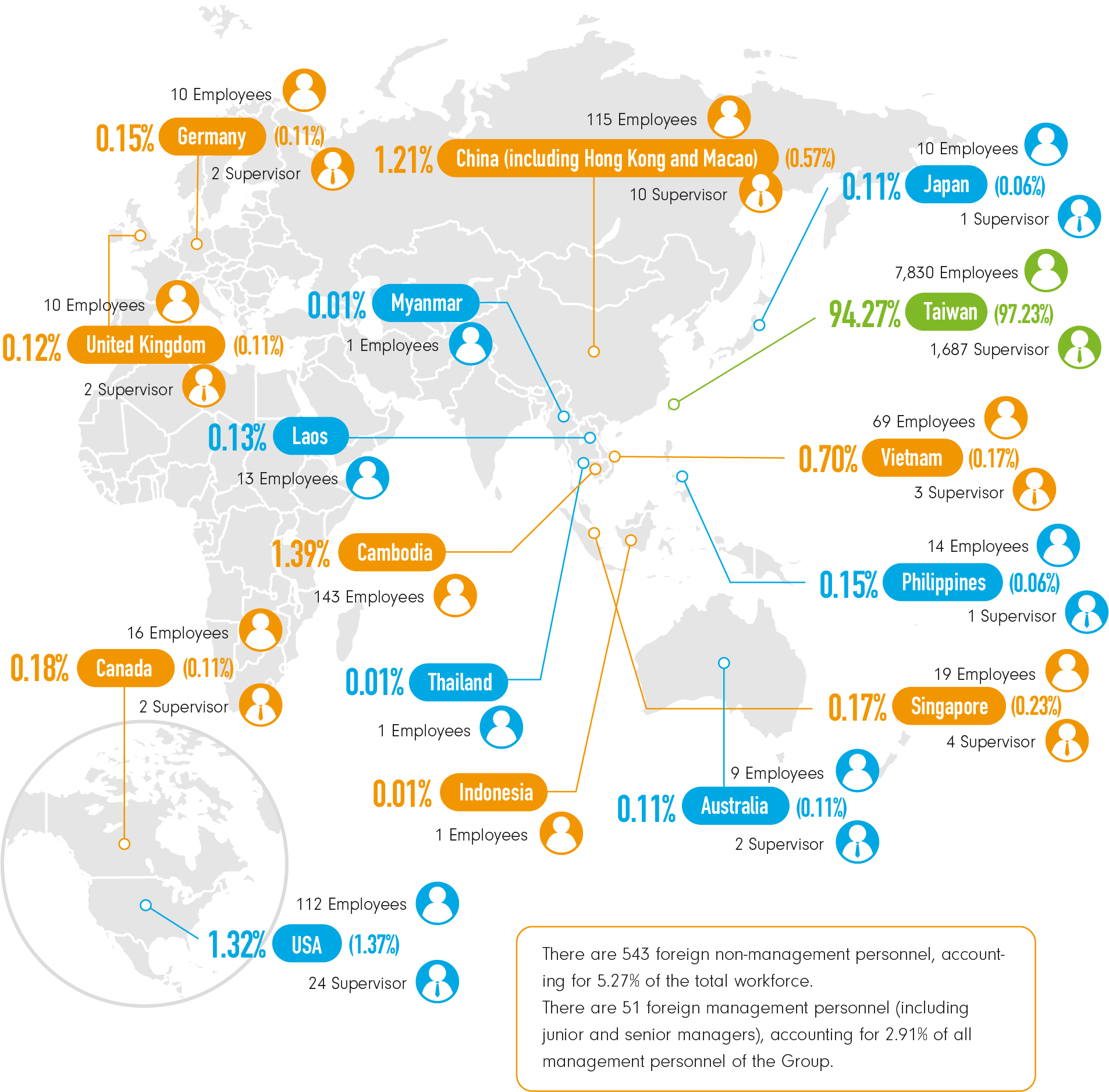

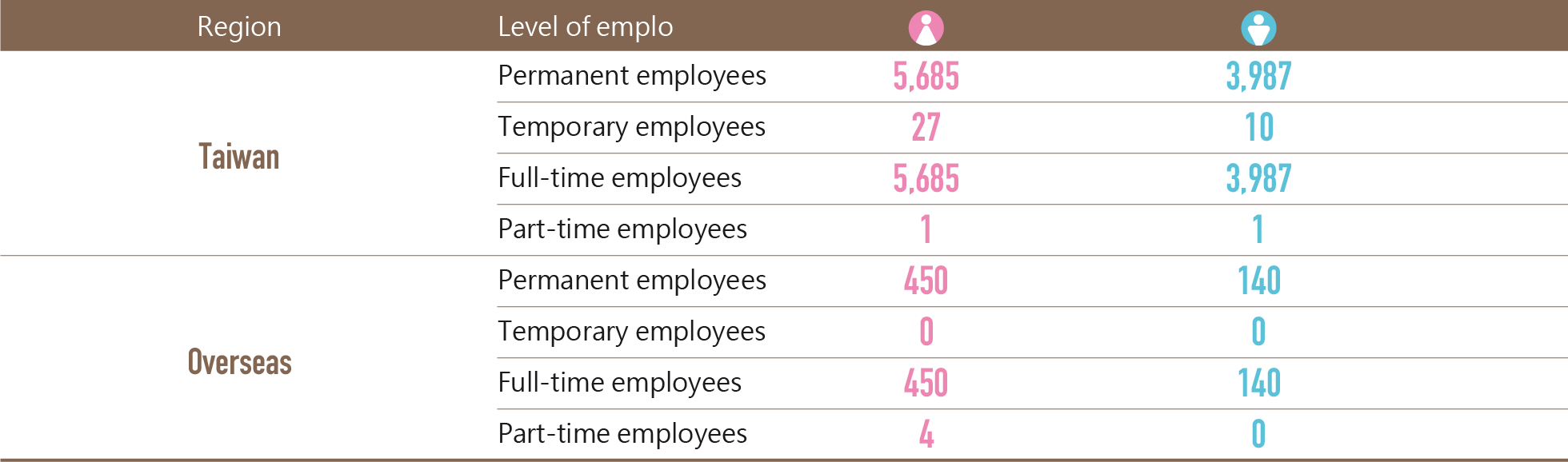

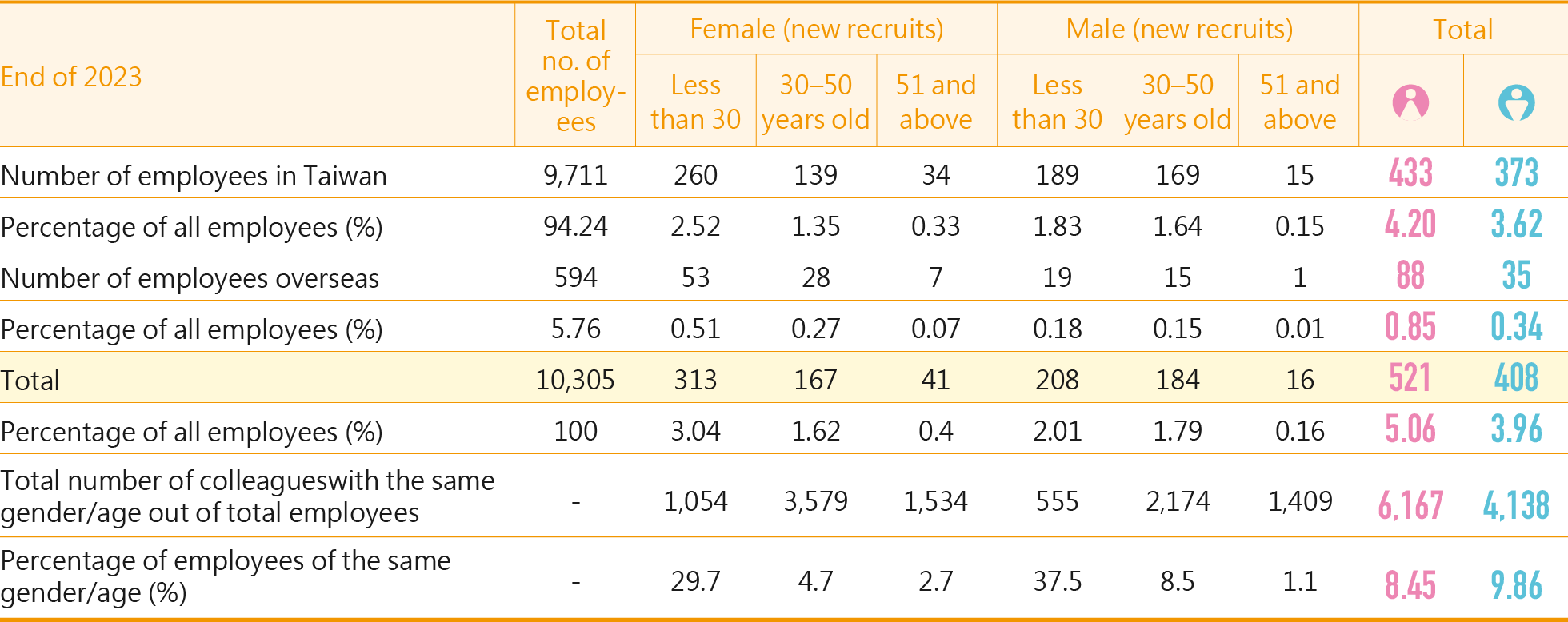

Employees form the core of the financial service industry. FFHC has not only established a brand image of sound management in the minds of the general public but is also working actively to build a "happy workplace." We have long adhered to our philosophy of "employees are the company's most valuable asset." We are committed to creating an ethical, transparent, caring and cooperative working environment for employees. Employees are also encouraged to realize their full potential and create value.As of 2023, the number of full-time employees in the group is 10,305 (594 foreign personnel (including 123 new employees), 6,167 female employees, 4,138 male employees, female to male ratio of approximately 6:4, managerial personnel account for 17.0%, female managerial personnel account for 49.3%, the proportion of female managers and employees is higher than their male counterparts; The proportion of senior management hired from domestic residents was 100%. Additionally, there were a total of 506 non-employee workers (includes staffers, security, maintenance, and cleaning personnel) at the Group in 2023.

■ Total number of employees in 2023 - By role

Unit: person

■ 2023 Statistics of Non-Employee WorkersUnit: People

*:This statistic refers to the personnel dispatched from Headquarters who are non-employee workers covered by the occupational health and

safety management system.

■ Location distribution of foreign employees 2023unit: people

■ Employee Composition Statistics of the GroupUnit: People

*:There are 0 employees without guaranteed hours. This refers to how there are no employees with guaranteed minimum or fixed work hours such as employees on zero hour contracts and standby.

Human Capital and Recruitment

To catalyze the development of innovative financial products and services, we recruit top professionals with a background in business management, information science, science and engineering, law or psychology. Since 2014, we have recruited more than 300 professional personnel and high-level managers with related digital technology expertise such as information safety management, big data analysis, social media management, and Internet marketing management. In coordination with the global strategy of dedicating recruitment efforts in the ASEAN region, the search for talent also continues in overseas locations across the U.S. and Europe. The addition of an overseas group when hiring reserve managers has resulted in the active recruitment of talent with language skills such as English, French, German, and Spanish into the operations team to implement an elite talent cultivation policy based in diversity.

On the other hand, the Company focuses on the observable professional capabilities of employees as well as their internal personality traits to predict the future job performance of employees. As such, a variety of digital tools have been introduced for this purpose, such as: AI video interviews and talent assessment systems to improve the efficiency of talent selection and act as a basis for refining human resource development. In order to understand the leadership potential of employees, the bank introduced the Career Personality Aptitude System (CPAS) for the selection of deputy manager reserves in 2014. The result of aptitude tests provides an objective assessment of managerial capabilities and were given to interviewers for reference and improving the identification of professional ability as managers. Starting in 2016, the test was also implemented into the selection process of core reserve talent (MA).

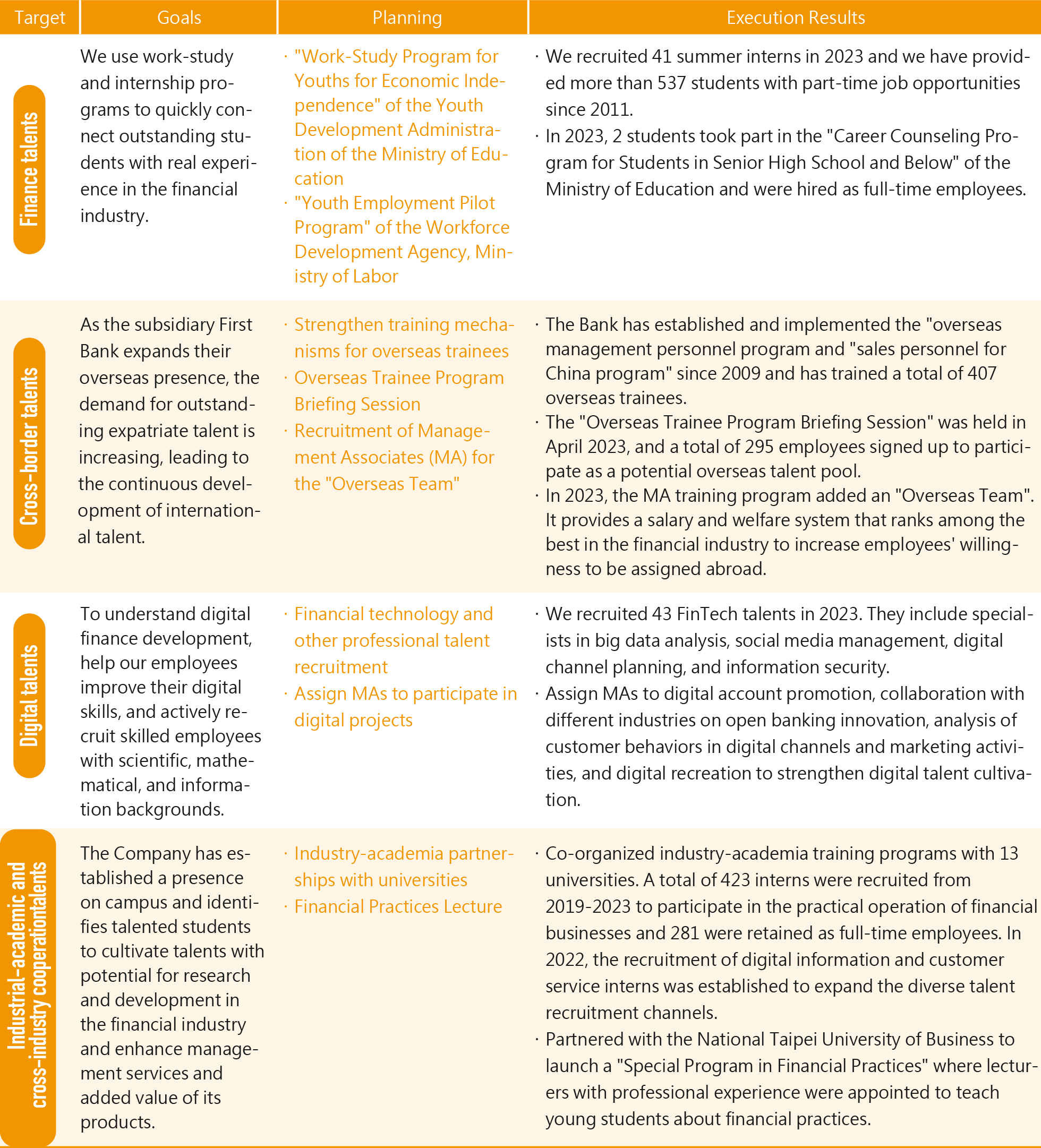

■ Status of diverse talent recruitment in 2023

The Group recruits new employees each year, embracing multicultural diversity without restrictions on school, major, age, class, or gender. In 2023, we recruited a total of 929 new employees, with a female-to-male ratio of approximately 6:4. Our overseas operations also prioritize providing employment opportunities to local residents, highlighting our group's commitment to cultural diversity and inclusion. In 2023, all subsidiaries employed people with disabilities at rates that met or exceeded the standards set by regulatory authorities, and they received the same salary and benefits as regular employees.

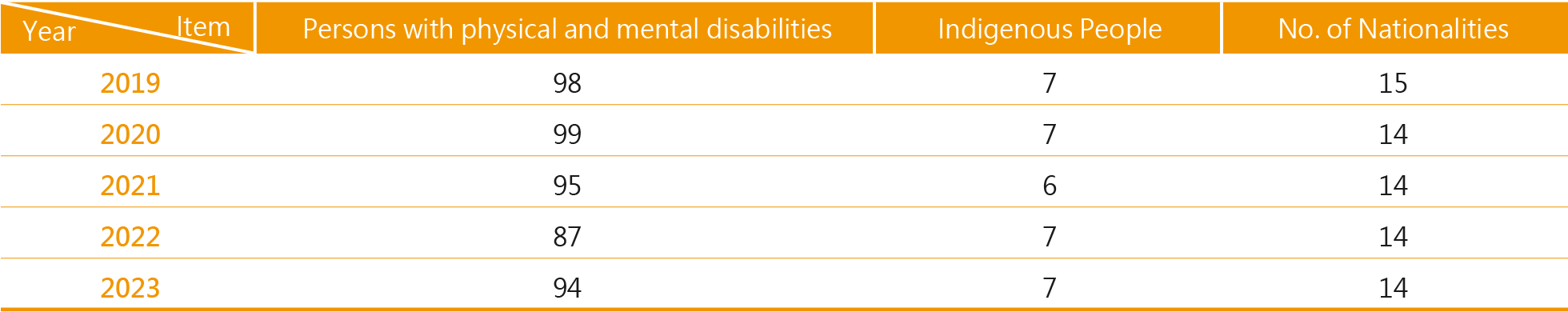

■ Overview of employee diversity in past yearsUnit: Persons

■ Statistics of new recruits and total number of employees in 2023

■ Statistics of new recruits in past yearsUnit: person

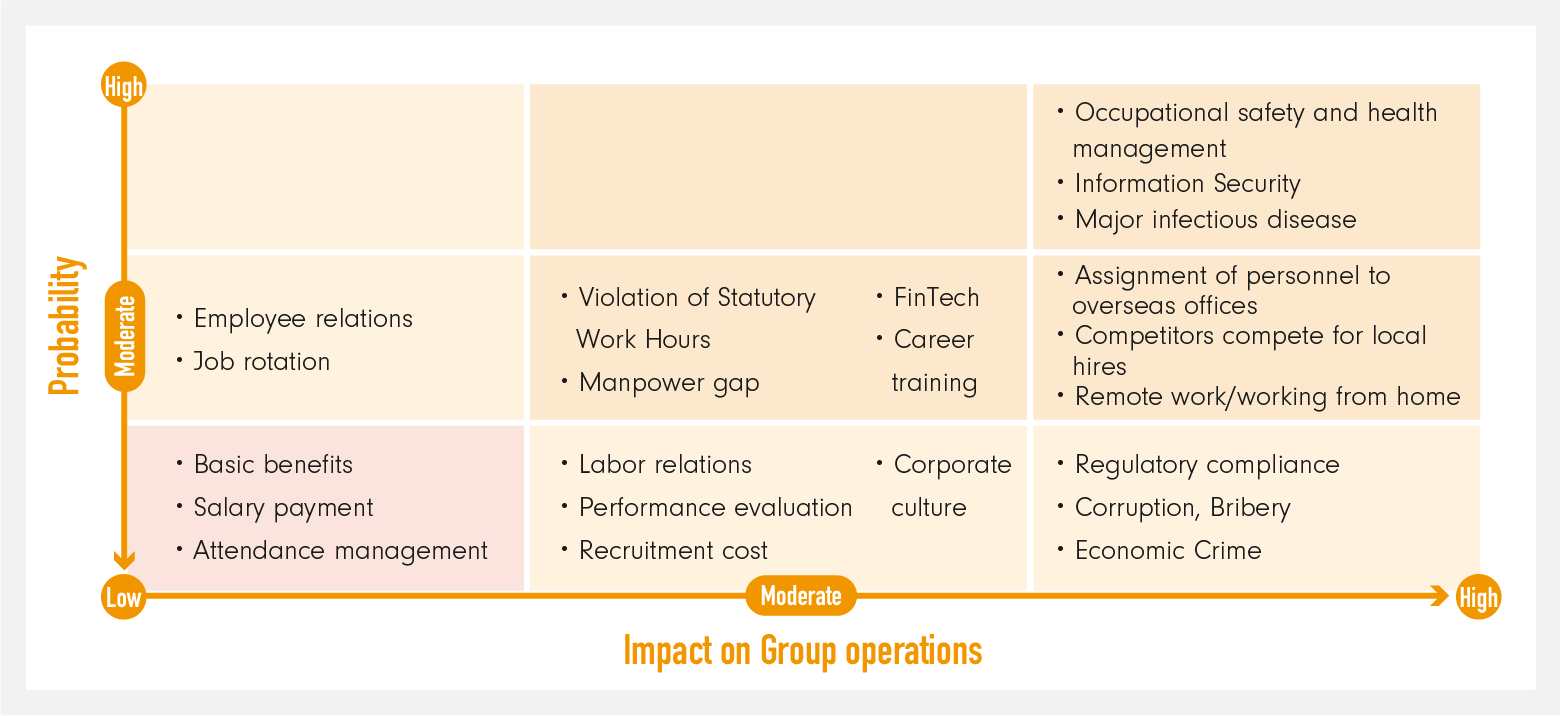

Human Resource Management Risk Map

FFHC evaluates the impact of ESG risk factors on the Group's operations in the establishment of business locations, new business development, loan investments, procurements, planning of business strategies, and human resource development.The human resource management risk graph drawn up based on the 22 selected evaluated factors in 2023, with the vertical axis as incidence probability and horizontal axis as the impact on company operations, is as follows. The 10 factors designated as medium to high probability incidence were categorized as those requiring risk management.

■ Human Resource Management Risk Map

In 2023, due diligence investigations were conducted to identify the occurrence rate and impact level of major issues such as "occupational safety and health management", "information security", and "major infectious diseases" to establish and implement plans that can mitigate relevant risks and their impact on this Group, such as: In response to natural disasters such as earthquakes and fires and geopolitical risks of overseas operating locations, the task group method is used to form crisis management teams that seek solutions to prevent the risk of interruption to operations in the event of a crisis or disaster.

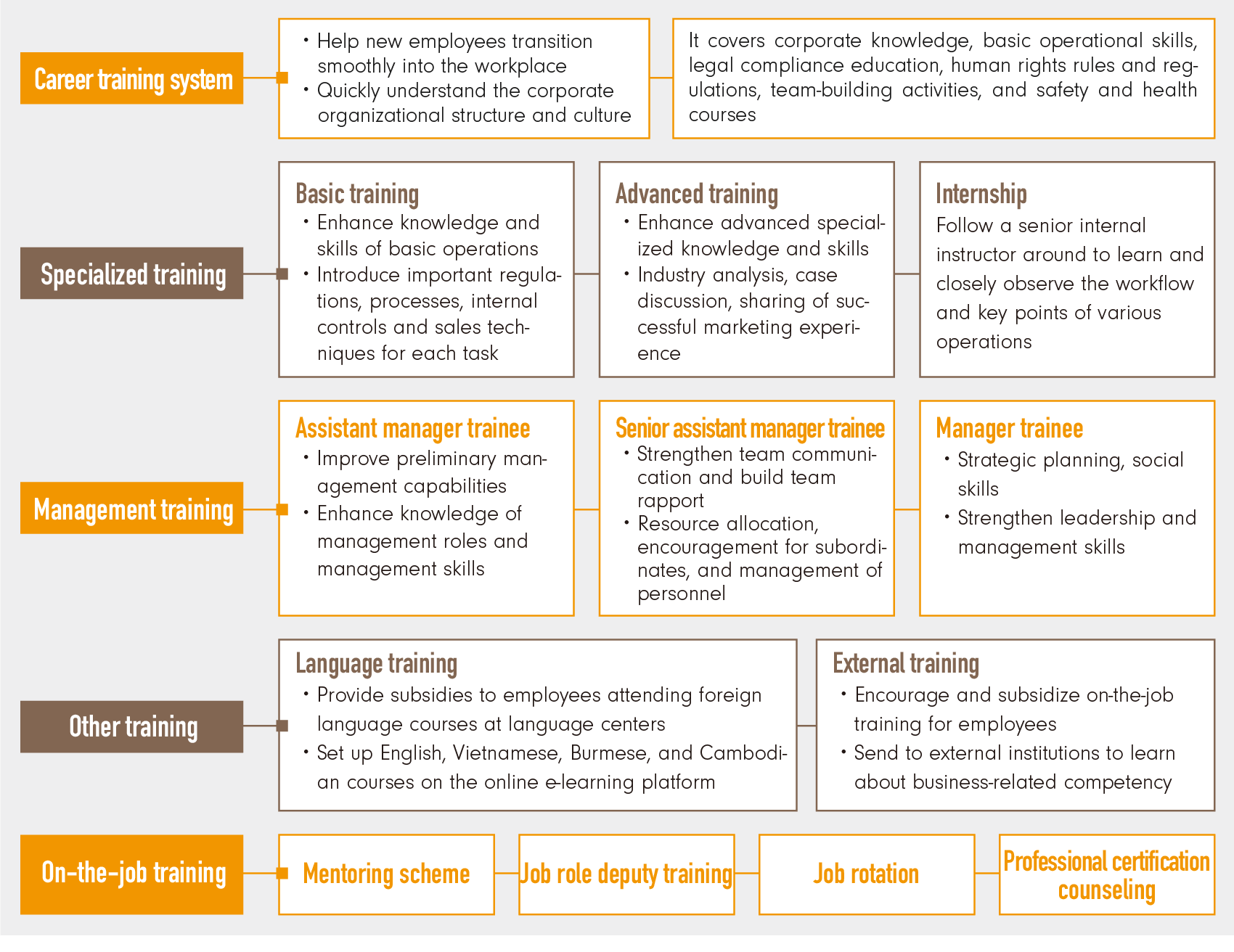

Complete development system

New employees immediately enter our training system upon reporting for work. Comprehensive training plans are available from basic, advanced professional, deputy managers, managers, and senior management. For those that meet management personnel selection qualifications, we organize related training courses and tests and used one or two phases of interviews, 270-degree evaluations (supervisors, peers, and subordinates) to evaluate employees' management and leadership skills.

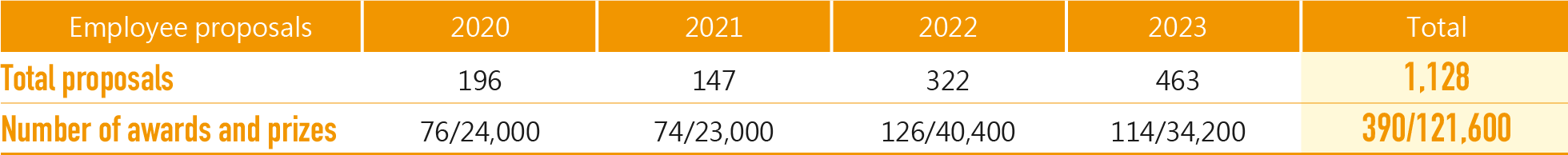

Regarding employee training, active participation in training courses and obtaining certifications required for relevant business operations are encouraged, as well as the submission of innovative work proposals. Professional certifications are considered a bonus item in the annual performance evaluations, and adopted innovative proposals are rewarded with bonuses. The Group also organizes a variety of professional training, online training, internships, language training, internal certification testing and management competency training. To acquire new financial knowledge and understand the latest industry developments, personnel are frequently sent to attend training courses organized by professional training bodies.

■ Career training system

■ Bonuses awarded for innovative employee proposals over the yearsUnit: case/NTD

Talent training program

We use the performance evaluation matrix to identify employees with high performance or potential then tailor "Individual Development Plans" to their professional background, language skills, and competency analysis. We continue to work with external professional training institutions to provide financial knowledge and skill training, which includes First Bank collaborates with the Academy of Banking and Finance and the Taipei Foundation of Finance to conduct professional training in areas such as foreign exchange derivatives, trust, regulatory compliance, anti-money laundering, and training for overseas reserve personnel. Additionally, we organize various professional training and language courses to enhance language skills, business acumen, and diverse management capabilities, preparing a pool of overseas professional talent. First Securities and First Securities Investment Trust arrange professional training courses such as pre-service training, on-the-job training, and business seminars through related business associations and the Securities and Futures Institute.

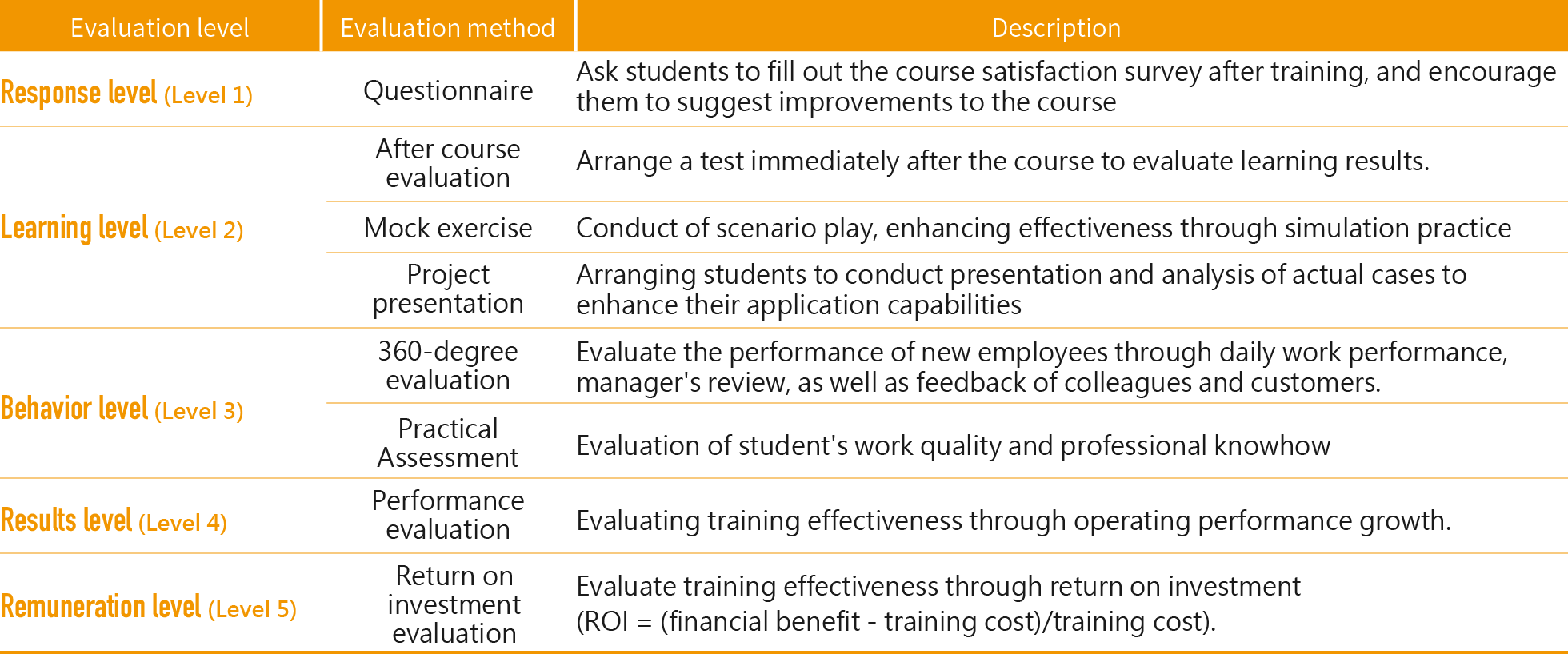

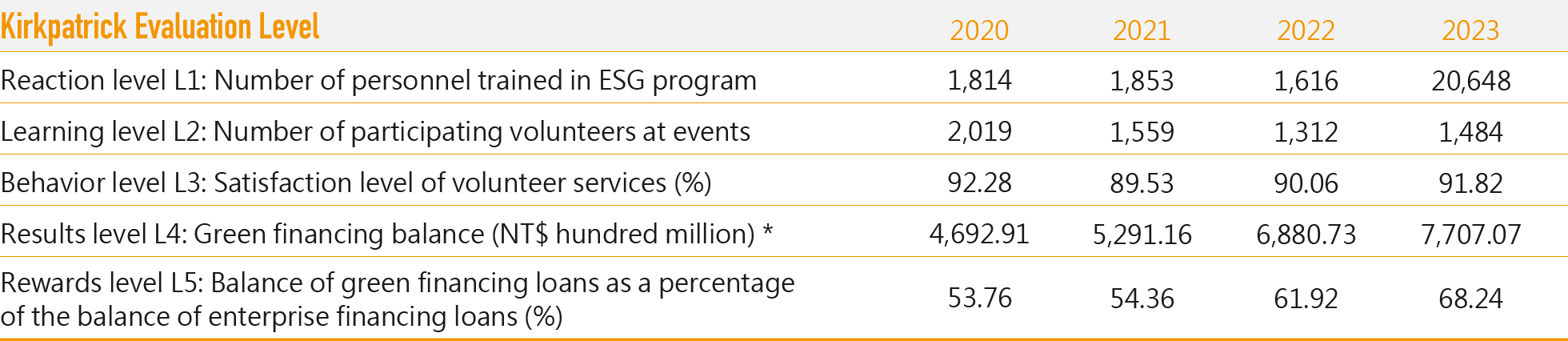

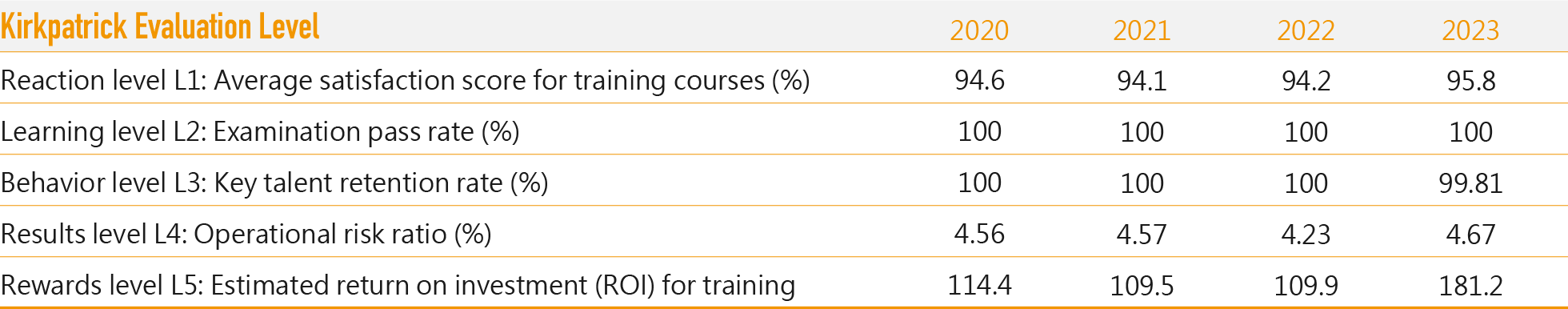

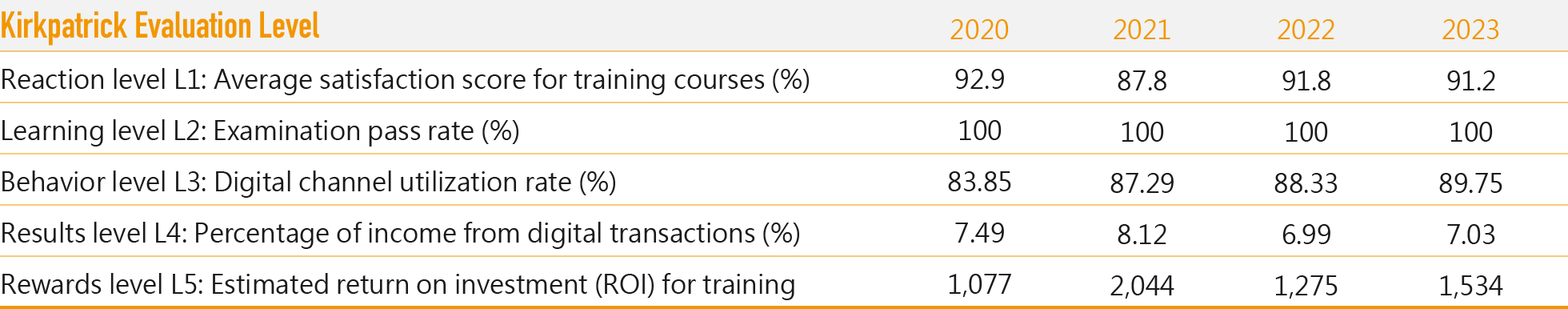

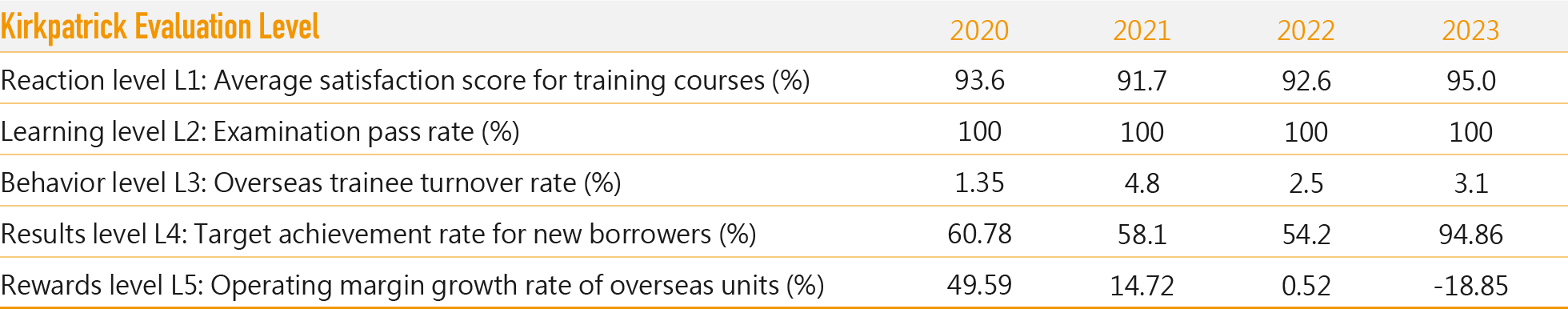

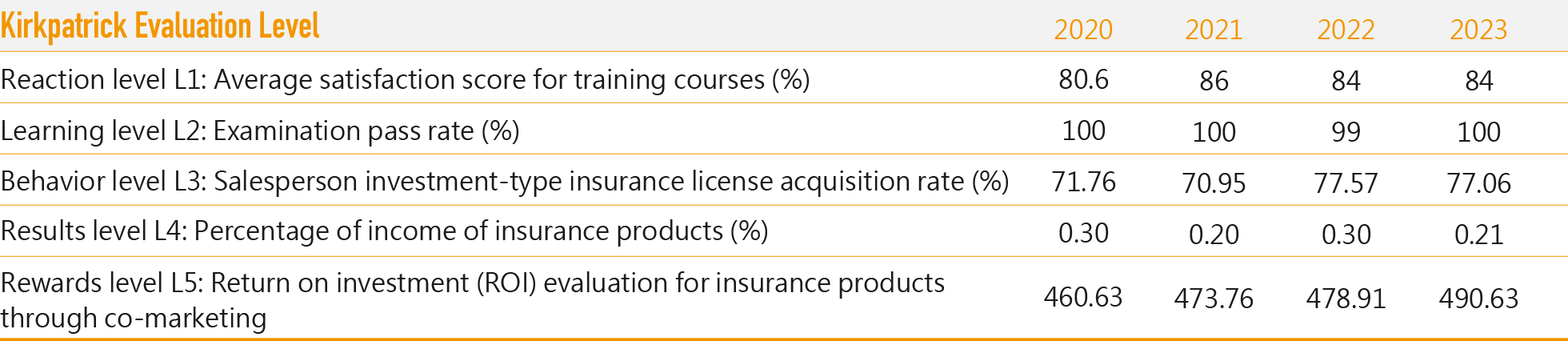

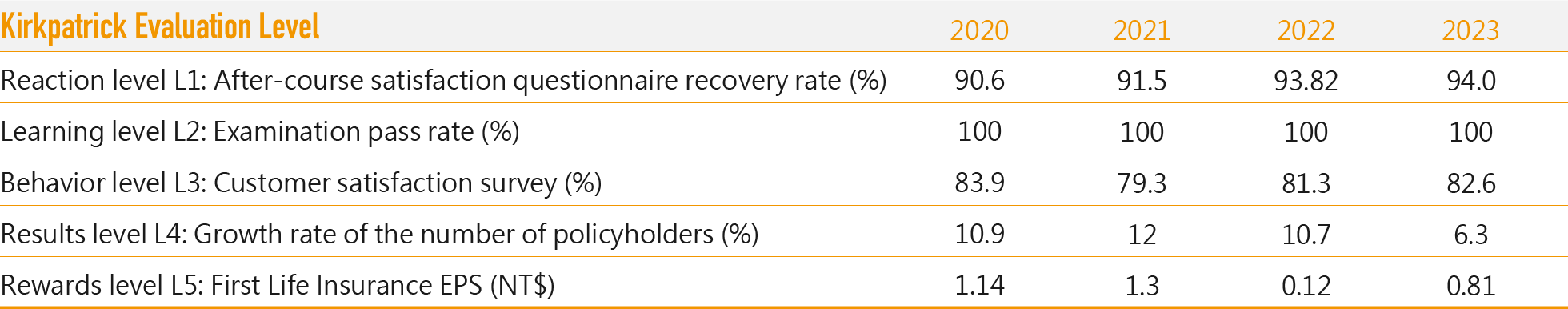

To assess the effectiveness of training, the group’s subsidiaries use the Kirkpatrick Model and Human Capital ROI to evaluate changes in employee behavior, attitudes, and job performance after completing training programs.

■ Training effectiveness statistics table of the Kirkpatrick Model over the years

Training program to link ESG and operations

Objective: Implement ESG concepts in core financial operations to exert sustainable impact.

Benefits: Enhance employees' knowledge of sustainable finance and business capabilities, increase social participation, and boost the proportion of green financing business.

Number of participants: 8,627 people, accounting for 100%

*:The green financing balance refers to the (sum of renewable energy sustainable loans + green industry and green enterprise preferential financing projects + ESG infrastructure financing + sustainability-linked credit projects + preferential financing for the six core strategic industries).

Management Trainee Succession and Training Program

Objective: Improve the leadership and management functions of managers to achieve business goals.

Benefits: Arrange courses to strengthen leadership skills to enhance talent retention and reduce operational risks.

Number of participants: 543 people accounting for 7.7%

*:Operational risk ratio = (Operational risks/Total risk-weighted assets) *100%

*:Estimated return on investment (ROI) for training = 〔Revenue - (operating expenses - (salary cost + benefit cost))〕 ÷ (salary cost + benefit cost)

Digital Banking Talent Transformation Program

Objective: Strengthen employees’ expertise in digital finance products and services, as well as marketing capability.

Benefits: We acquired 164 patents on FinTech inventions and new models and 3,721 employees passed the "FinTech knowledge certification". Transaction fee earnings and enhanced digital marketing effects by improving the smart customer service system, digital welcome system and new functions in the mobile sales platform app.

Number of participants: 3,721 people accounting for 43.1

*:Digital transaction income = Processing fees and interest income from electronic transactions.

Overseas Trainee Program

Objective: Accelerate the cultivation of necessary business expertise for overseas talents.

Benefits: Improve the business capabilities of overseas personnel, reduce their turnover rate, and increase overseas profits.

Number of participants: 57 people, accounting for 0.8%

*:The negative growth in the gross profit growth rate of overseas units in 2023 was due to the decrease in gross profit from foreign currency credit cases handled by the designated foreign exchange unit (DBU) acting as an agent for the overseas banking unit (OBU).

Securities Salesperson Transformation Program

Objective: Guide salespeople in their transformation into all-rounded financial management advisors in response to digital developments.

Benefits: To enhance marketing synergy and improve insurance sales capabilities, in 2023, a total of 168 securities brokers obtained investment-type insurance licenses, resulting in an 11% growth in the return on investment for co-marketing insurance products.

Number of participants: 337 people, accounting for 100%

*:Insurance product income = Service fee income for sales of insurance products.

Professional Insurance Talent Training Program

Objective: Strengthen professional insurance to enhance marketing momentum.

Benefits: First Life Insurance added 7,724 accounts in 2023 while customer satisfaction level increased by 1.6%.

Number of participants: 100 people, accounting for 100%

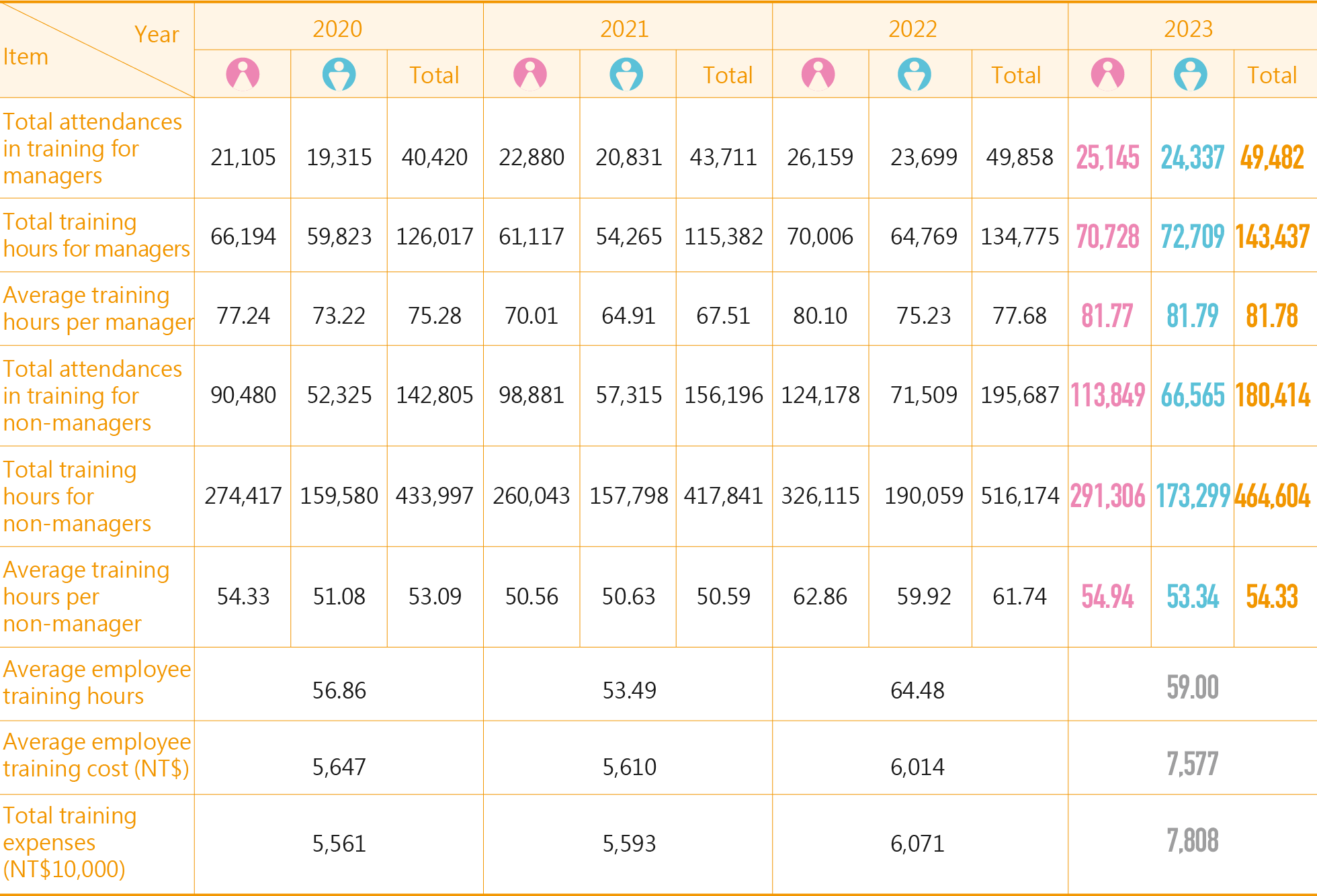

Employee Training and Development

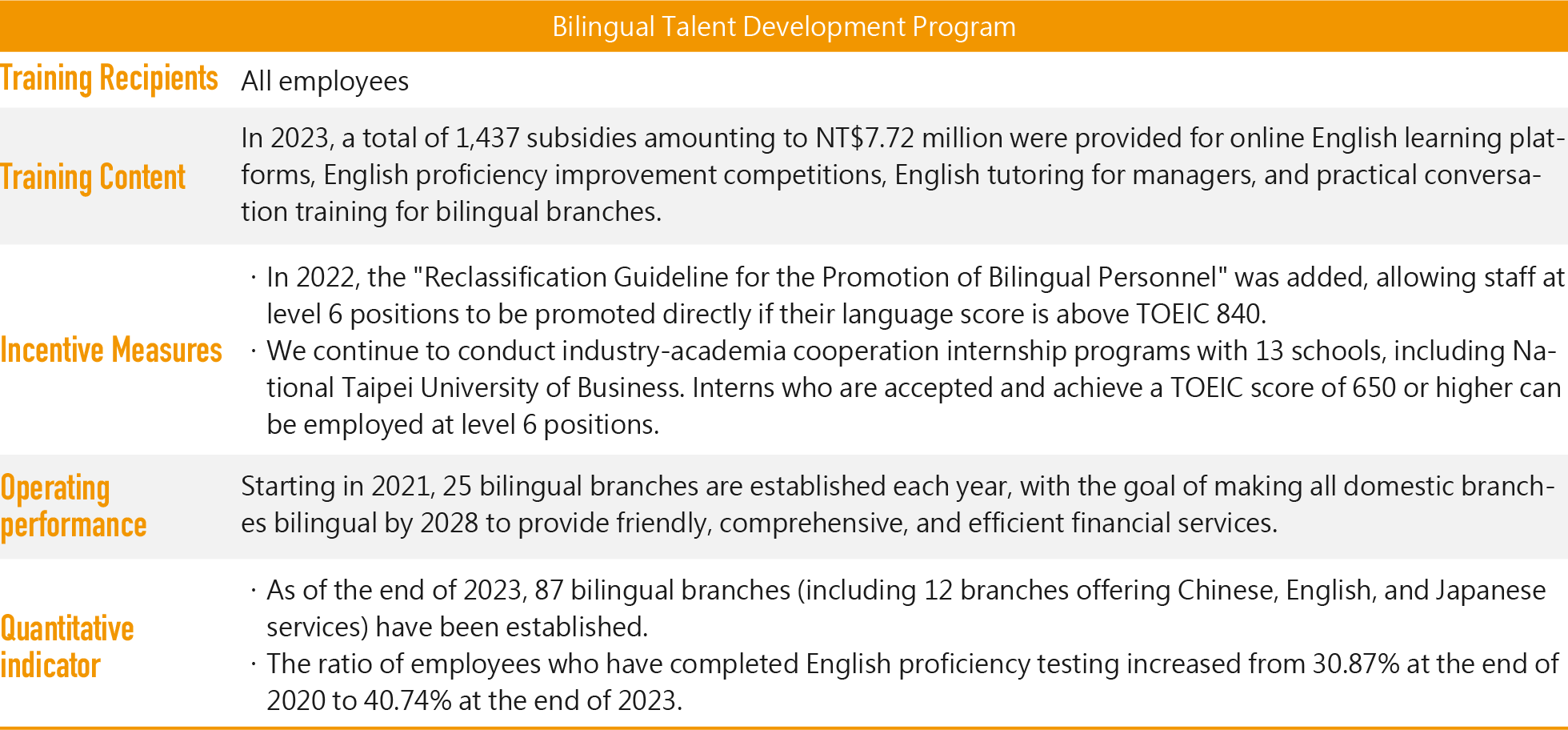

To enhance employee learning efficiency, 229,896 employees participated in internal and external training courses in 2023, with an average training time of 59 hours. Among these,

・in response to the Financial Supervisory Commission's bilingual policy and the goal of establishing bilingual branches, a foreign language training program was implemented. By the end of 2023, a total of 3,250 employees had passed English proficiency tests such as LTTC, IELTS, TOEFL, TOEIC, BULATS, and GEPT. Additionally, 356 employees passed the JLPT and LTTC proficiency tests in Japanese, Spanish, Korean, and German.

・To enhance knowledge and sensitivity regarding anti-money laundering (AML) and combating the financing of terrorism (CFT), employees are encouraged to obtain the Certified Anti-Money Laundering Specialist (CAMS) certification and the AML and CFT professional certification. By the end of 2023, a total of 1,466 employees across the group had obtained the CAMS certification, and 3,335 employees had obtained the AML and CFT professional certification.

・To strengthen digital finance literacy, we arrange external FinTech training courses and seminars for employees. As of the end of 2023, we organized 9,393 hours of internal FinTech courses for a total of 2,556 participants.

■ Average employee training hours and training expenses in past years

*1:Managers refer to employees who assume managerial roles and administrative duties.

*2:Training include physical and online courses.

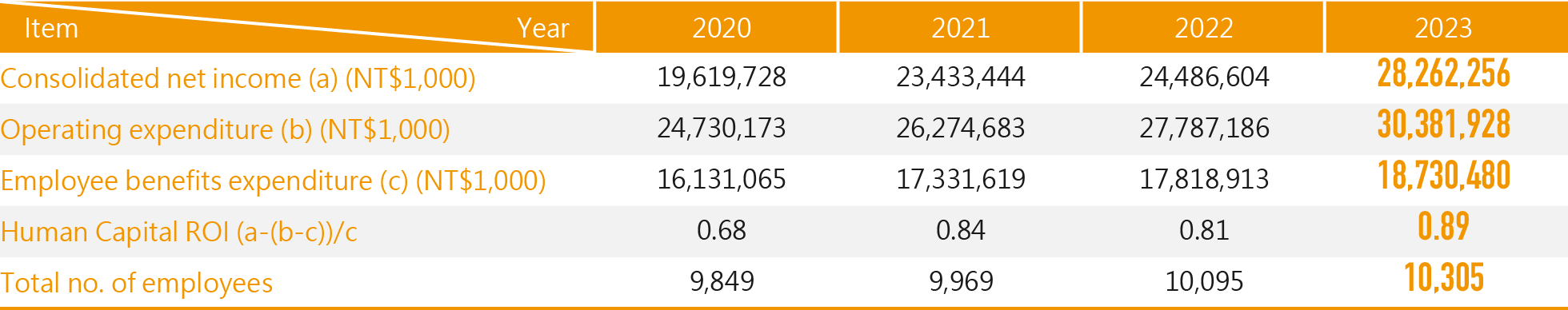

■ Return on human capital investment of First Financial Holding in the past 4 years