Sustainable Governance Operation Mechanisms >

Sustainable Governance Operation Mechanisms

Sustainable Governance Operation Mechanisms

Sustainable Governance Organizational Structure

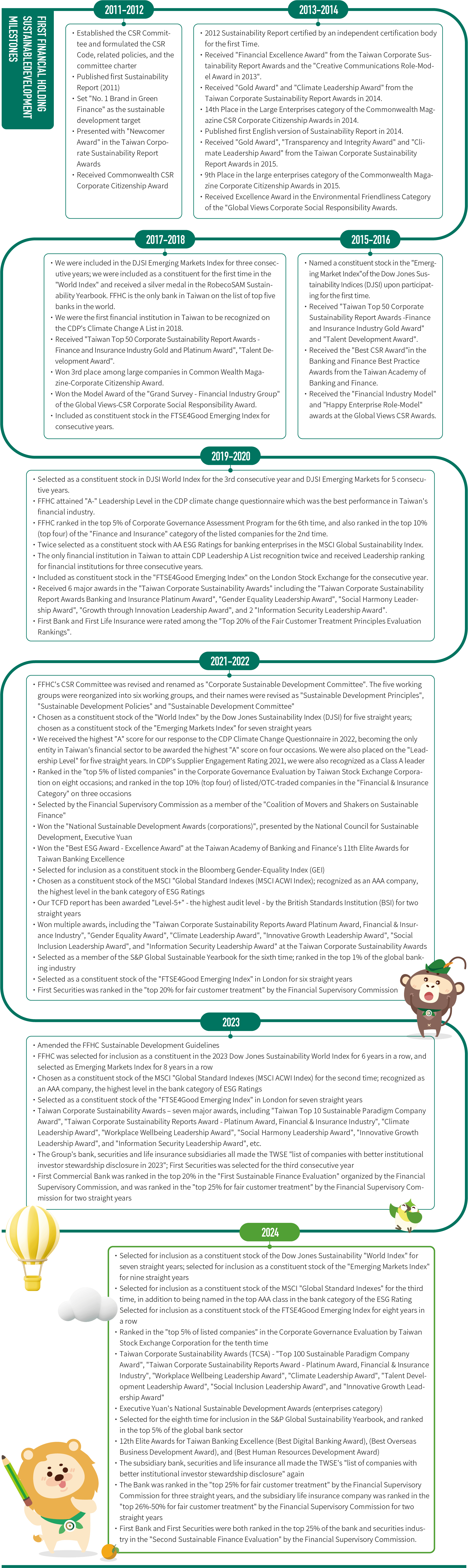

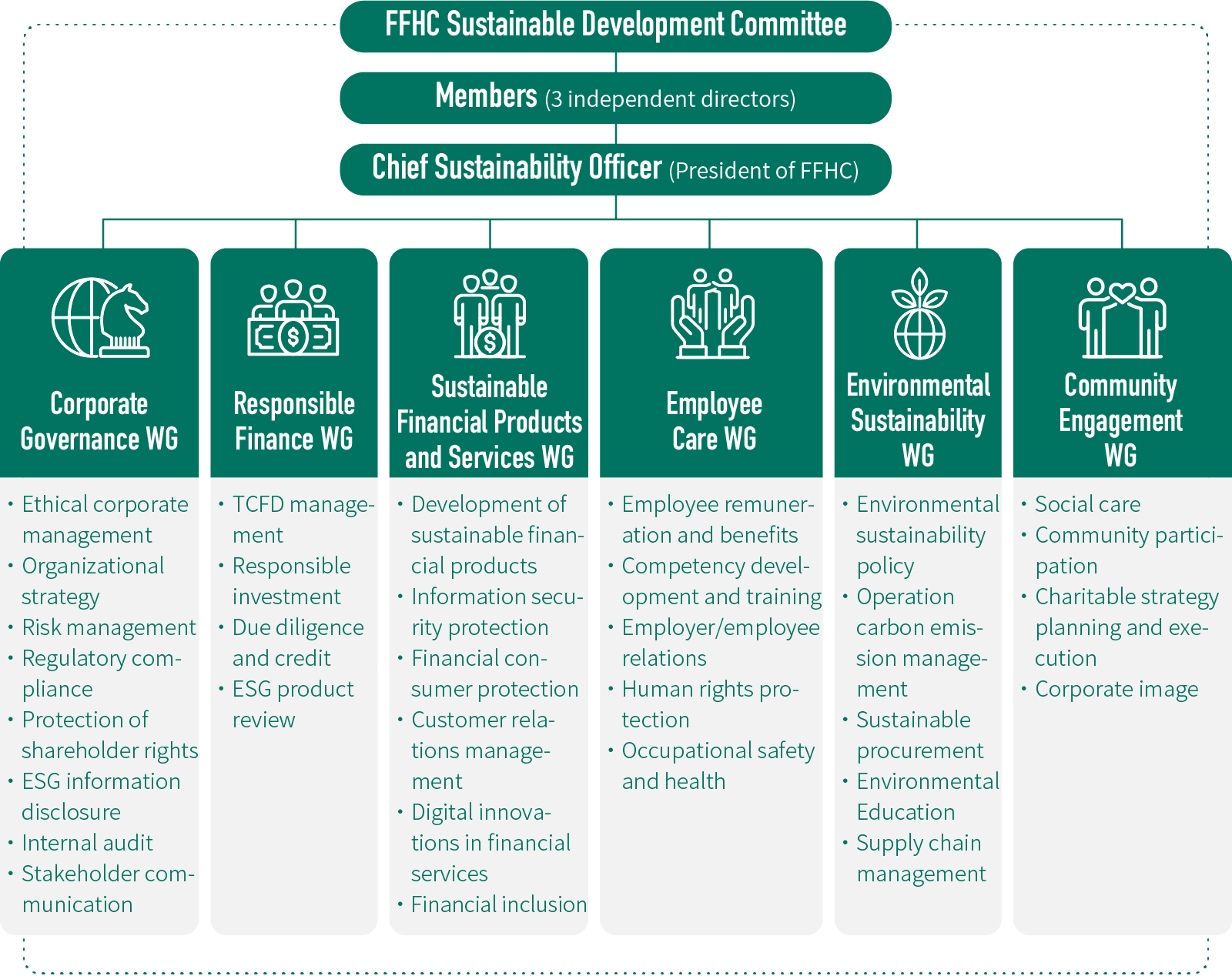

In 2011, the FFHC Board of Directors approved the establishment of the CSR Committee, and renamed as "Sustainable Development committee" in March, 2022, which is the core organization of the Group for promoting sustainable governance with the Chairman as the chair and Presidents of the companies of the Group as members of the Committee. The Committee set up trans-company working groups on "Corporate Governance", "Responsible Finance", "Sustainable Financial Products and Services", Employee Care", "Environmental Sustainability", and "Community Engagement". A dedicated ESG unit is also assigned by the President each subsidiary for ESG communications, liaison and the provision of related information. The core team consists of 92 people (1 chairman, 8 committee members, 2 conveners, 6 executive directors, and approximately 75 employees split among the various working groups). The Sustainable Development committee is administered by the Corporate Governance Section of the Administration Department, and 7 designated employees are responsible for the sustainable development plans and implementation of the Group. The top-down approach ensures the effective and concrete implementation of each annual ESG objective. To comply with international ESG development trends and regulatory changes, and to deepen the implementation and execution of the Group's policies on sustainable development, we have included ESG comprehensive performance as an item for evaluating each subsidiary company's annual operating performance, in order to ensure that annual targets for each ESG scope can be achieved. In June 2025, the Sustainability Committee was elevated to a functional committee under the Board of Directors. It comprises three independent directors as committee members, with the President of FFHC serving as the Chief Sustainability Officer. The company continues to enhance its sustainability governance practices.

FFHC has also formulated the "Sustainable Development Guidelines" and "Sustainable Development Policy", which serve as the ultimate guiding principle for the companies within the Group to respond to risks and seize the opportunity for business management with respect to various ESG aspects. To ride the trend of sustainable financial development, the Board of Directors has been designated as the highest supervisory unit for climate risk governance. An ESG Committee and a Risk Management Committee have been established under the Board. These two committees take stock of and identify the risks and opportunities posed by climate change to the Company's operations based on TCFD's suggestions on climate-related financial disclosures, and formulate risk management strategies and corresponding measures. We joined the Partnership for Carbon Accounting Financials (PCAF) in 2022, verified Scope 3 investment/financing and financial carbon emissions based on its suggested methodology, and formulated our near-term carbon reduction targets before submitting them to the SBTi for review, which were officially approved in June 2024. We have enforced accordingly, continued to incorporate the net-zero emissions mentality into our investment/financing policy-making process, and reduced the share of highly-polluting (carbon emissions) industries in our investment and financing portfolio, in order to achieve our SBT for carbon reduction. Results of the Group's risk assessment of climate change, mitigating measures and implementation status are reported to the Risk Management Committee, Audit Committee and Board of Directors. We also comply with the United Nations' Principles for Responsible Banking (PRB), Principles for Responsible Investment (PRI), and Principles for Sustainable Insurance (PSI), and have incorporated ESG issues into the development strategies and operating procedures of our core business operations such as investment, financing, underwriting and insurance. We comply with related policies on sustainable credit extension, sustainable investment and sustainable insurance, and strive to guide our customers and invested companies to fulfill the responsibilities of environment protection and social sustainability.

◎ FFHC Sustainable Governance Organizational Structure

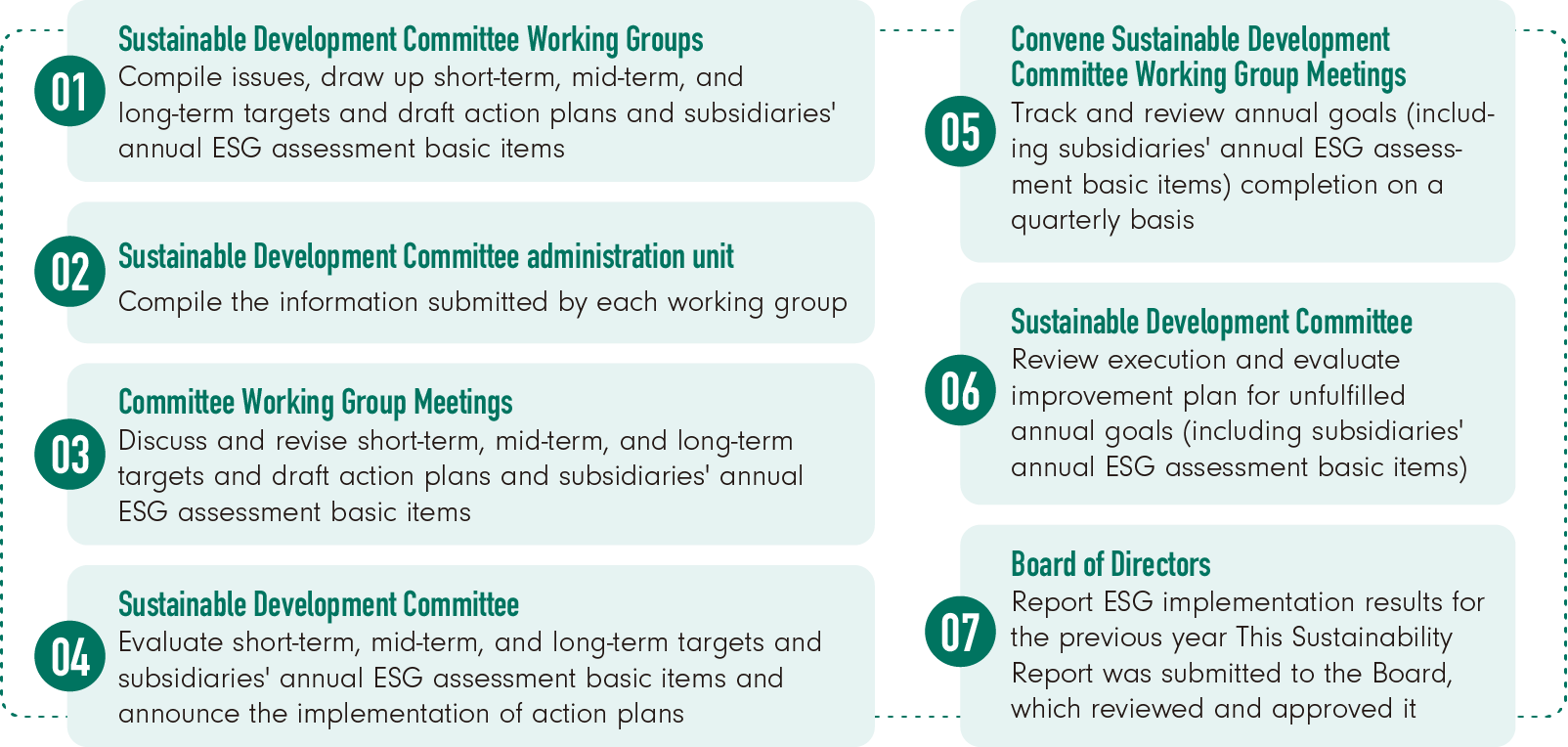

Sustainable Development Committee Functions and Team Operation Mechanism

Every year, each working group of the Sustainable Development committee compiles the E.S.G. Issues of Concern to FFHC stakeholders, then draws up the short-term, mid-term, and long-term ESG targets, and drafts action plans and subsidiaries' annual ESG assessment basic items. These are discussed and revised internally at WG meetings convened by the Chief Sustainability Officer (President of FFHC) and the executive directors (Chief Executives) of each group before being submitted to the " Sustainable Development committee" for review. Approved proposals are then announced for implementation. Progress on each annual goals and action plan is then tracked and reviewed on a quarterly basis by Sustainable Development committee WG meetings convened by the Chief Sustainability Officer (President of FFHC) and the executive directors (Chief Executives) of each group. Within 4 months after the end of the fiscal year, major sustainability issues of stakeholder concern in the 3 major aspects of governance, environment, and social were reported to the Board of Directors using the framework for sustainability reporting guidelines published by the Global Reporting Initiative (GRI) and SASB industry standards. The report contained the risks and opportunities generated by the Group's operations, short-, medium-, and long-term targets in sustainable development, and target achievement in the previous year.