Economic Factors >

ESG Products and Services

ESG Products and Services

Corporate Banking / Investment Business

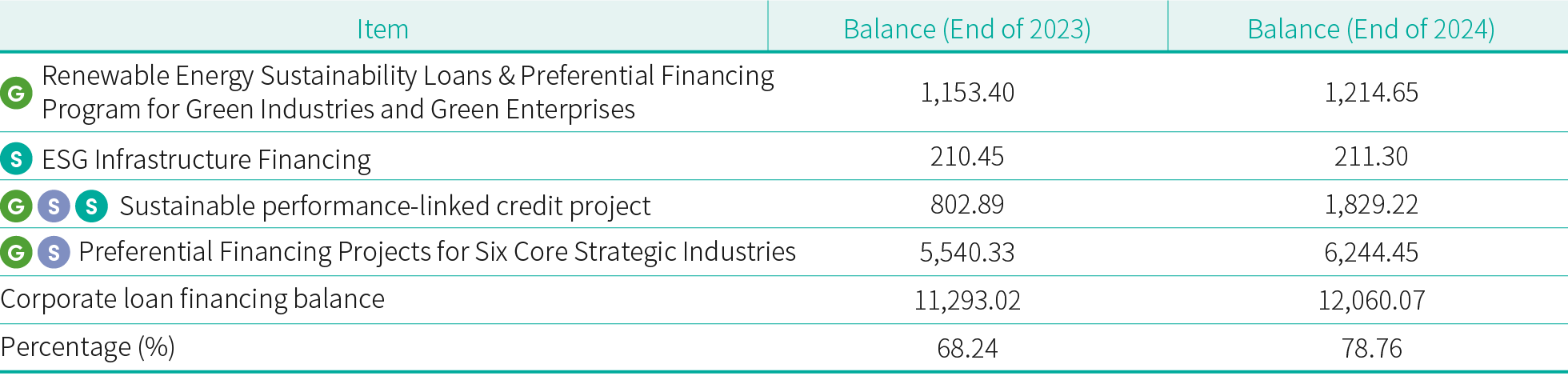

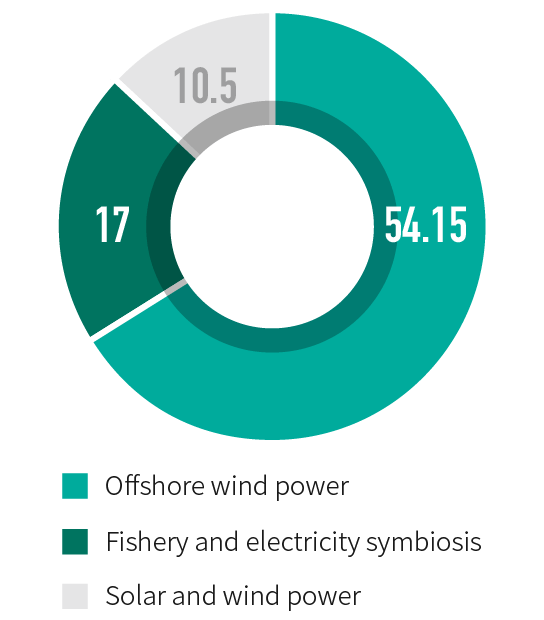

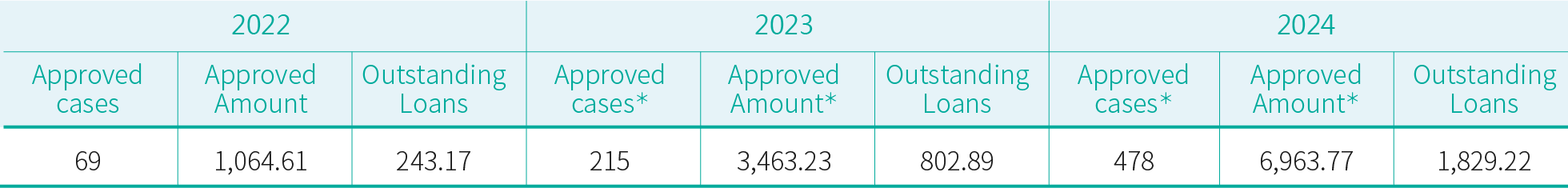

◎ Corporate finance - ESG-related products and their respective proportionsUnit: NT$100 million

Unit: NT$100 million

Unit: NT$100 million

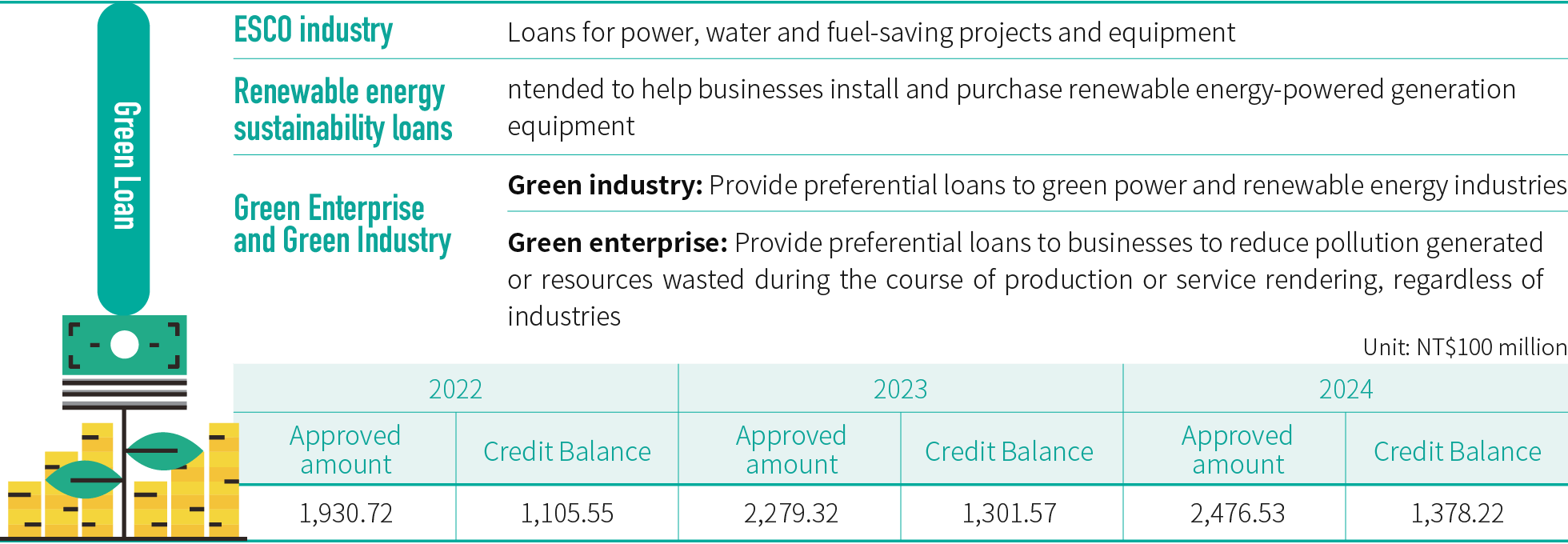

Green Finance

To help companies reduce the pollution and resources waste in the production or service process, First Bank launched the "No.1 Promoter in the Energy Industry" financing program in 2010 to support energy service companies (or "ESCO Industry"). First Bank also used the "Renewable Energy Sustainable Loan" in line with the "Million Solar Roof" policy by Bureau of Energy, Ministry of Economic Affairs (MOEA) and the power purchase guarantee from Taiwan Power Company to achieve three wins for the equipment user, supplier, and the Bank. To implement Green Renewable Finance policies and to coordinate with the "Productivity 4.0 Industry Transformation Loan" policy of government, First Bank issued "Loans for Green Sustainability-based Industry Transformation", helping Taiwanese corporations transform, and catch up with the global market trend of low-carbon production. Furthermore, FFHC organized "Green Finance Committee," with our President as the chairman in March 2017. The committee is responsible for setting up policy goals and reviewing the results. It is also responsible for incorporating the green industry financing projects mentioned above, and expanding the scope of green financing to "Green industries" and "Green enterprises". In 2018, the applicable scope was expanded to overseas branches across the globe to help achieve conservation of the local environment and help local industries complete their low-carbon transformation.

*:In light of the fact that all of First Commercial Bank's projects relating to green finance have been progressively set in motion, the "Green Finance Committee" has completed its scheduled mission. To increase the operating efficiency of the Bank's organizational structure for sustainable governance, it has therefore merged the "Green Finance Committee" into the "Sustainable Development Committee" in 2023.

*:Includes green financing loans from overseas branches in the amount of NT$33.698 billion and balance of NT$16.357 billion

Unit: NT$100 million

*:The amount of carbon absorption by one Da'an Forest Park is around 389 metric tons annually, as referenced from the "Bureau of Energy's photovoltaic target of 6.5GW for 2020" https://www.ey.gov.tw/File/D995A747C88EA053?A=C

Case Study :

ESG Infrastructure Financing

First Bank is dedicated in our support of domestic transportation infrastructure by actively financing construction projects for mass transit tools such as Taiwan High Speed Rail and Taipei Metro. This relieves the domestic north-south transportation capacity, improves the regional transportation of remote areas, and boosts transportation around airports to promote the development of travel and transportation both domestically and abroad, promote Taiwan's economic development, and improve benefits for the general public.

Unit: NT$100 million

Sustainable performance-linked credit project

In order to be in line with international ESG trends, First Bank launched the "sustainable performance-linked credit project"*, which differs from green loans in that the funds can be used without being confined to specific purposes. Through long-term monitoring of ESG indicators, connecting corporate borrowers' sustainability performance in controlling greenhouse gas emissions, electricity, energy, and total waste, etc. to loan interest rate pricing. The Bank will reduce the financing costs if the borrower meets the relevant ESG performance indicators to encourage corporate borrowers to actively manage their low-carbon transformation risks and support corporate borrowers that implement ESG governance in this engagement manner. The credit accounts tracked in 2023 accounted for a total decrease of 4,499,300 tons CO2e and conserved 1,483.92 million kWh of electricity for the year.

*:First Commercial Bank's "Preferential Credit Project for Green Sustainable Finance (including green enterprises and sustainability-linked credit extensions) incorporated the concept of the "Guidelines for Identifying Sustainable Economic Activities", promulgated by competent authorities in 2022. The project was designed for products with green capital expenditures, encompassing the range of forward-looking economic activities defined by the guidelines (such as renewable energy installations, architectural energy conservation, low-carbon transportation, and utilization of low-carbon and circular economic techniques, etc). Our sustainability-linked credit extensions have incorporated methods and concepts recognized by the guidelines to have substantive contributions in terms of mitigating climate change. Through sustainability performance indicators (such as controlling GHG emissions and electricity management) and the linkage to performance, we are able to provide favorable interest rates, encouraging customers to devote themselves to ESG. We also leveraged the project to engage in negotiations with enterprises, and encouraged and guided customers to make the low-carbon transition with preferential interest rates.

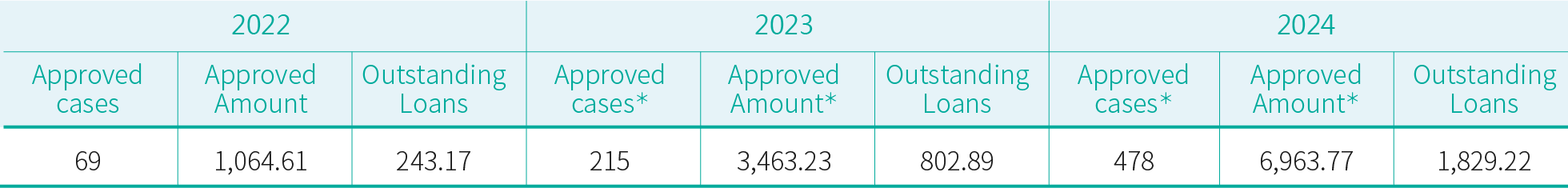

◎ Sustainable performance-linked credit projectUnit: NT$100 million

*:All the figures in the statistics refer to cumulative numbers from program initiation in April 2021

Case Study :

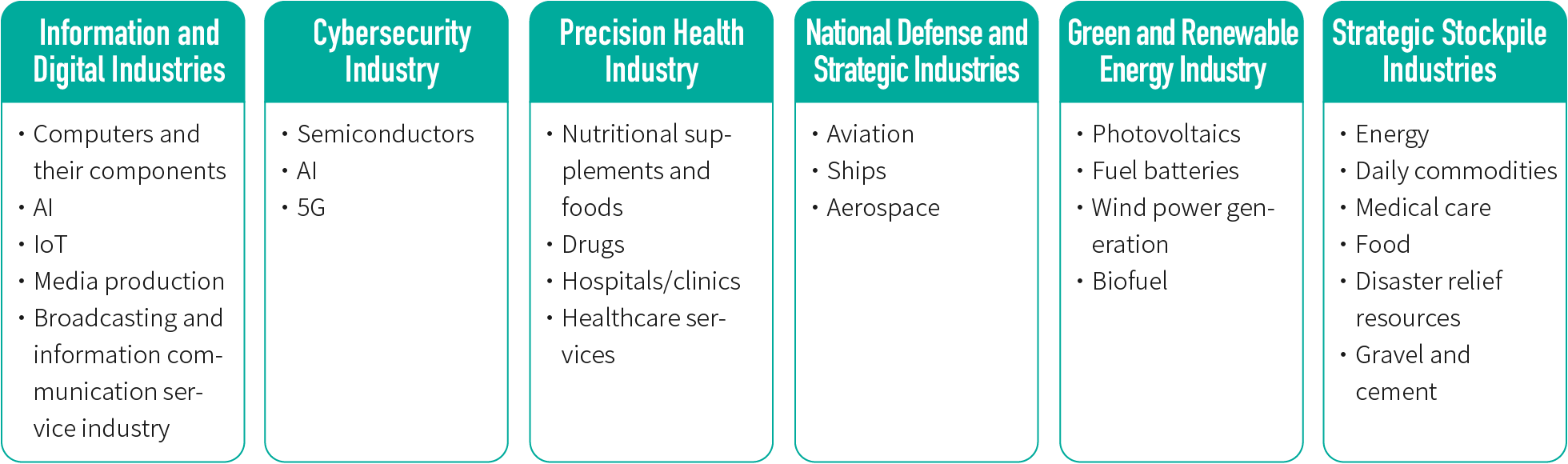

Preferential Financing Projects for Six Core Strategic Industries

In order to support the developmental requirements of key national policies and industries in the implementation of the Executive Yuan's "Program for Promoting Six Core Strategic Industries", First Bank initiated the "Preferential Financing Project for Six Core Strategic Industries" in 2022 to provide for the funding requirements of daily operations, R&D, plant expansion, transformation, and other various stages of operations for customers in the six core strategic industries.

Unit: NT$100 million

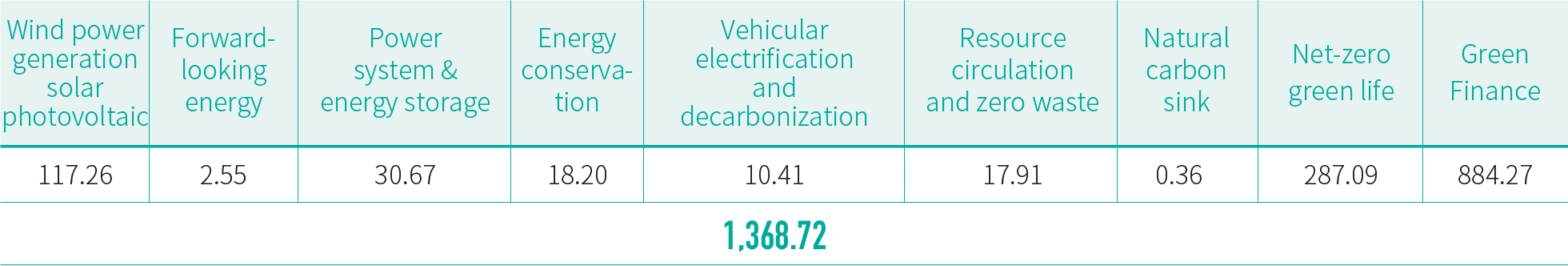

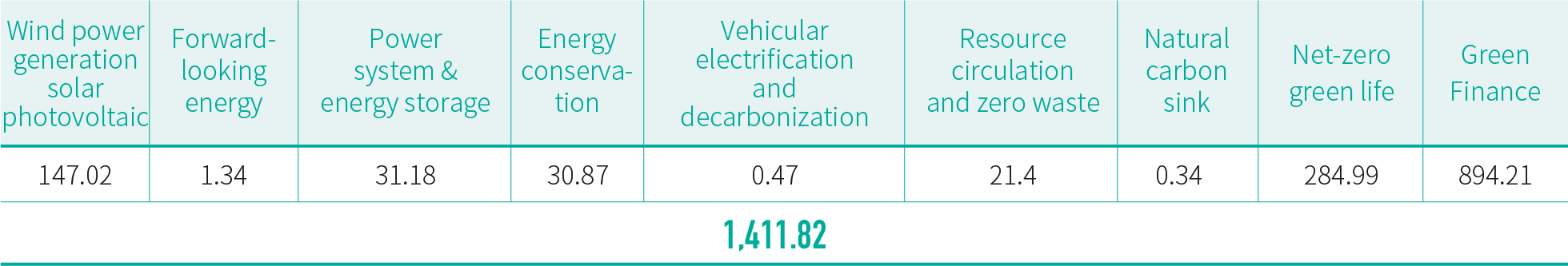

2023 Financing balance

2024 Financing balance

*:Excludes double counting.

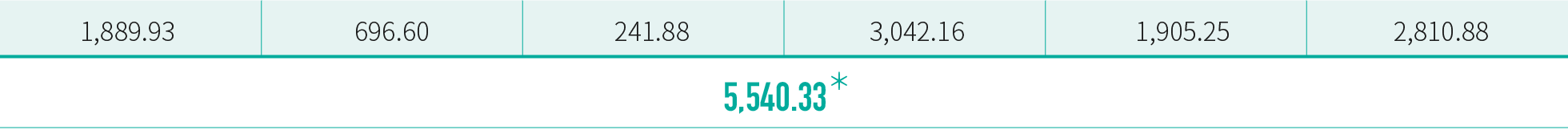

Financing Key Strategic Industries on the Pathway to Net-Zero Emissions in 2050

To respond to the global trend of net-zero emissions, the government officially published "Taiwan's Pathway to Net-Zero Emissions in 2050" in March 2022. The pathway is based on the four major transformations of "energy, industry, life, and society" and the two major governance foundations of "technology research and development" and "climate legislation", and supplemented by "12 Key Strategies". Action plans have been formulated for important domains where growth is expected as a result of government policies on energy, industrial and life transformations, in an attempt to implement our efforts to achieve the net-zero transformation goal. First Commercial Bank provides customers in the following related strategic industries with the funds needed for operations in accordance with the government's 12 key strategies.

2023 Loan Balance

Unit: NT$100 million

2024 Loan Balance

Unit: NT$100 million

Sustainable Investment

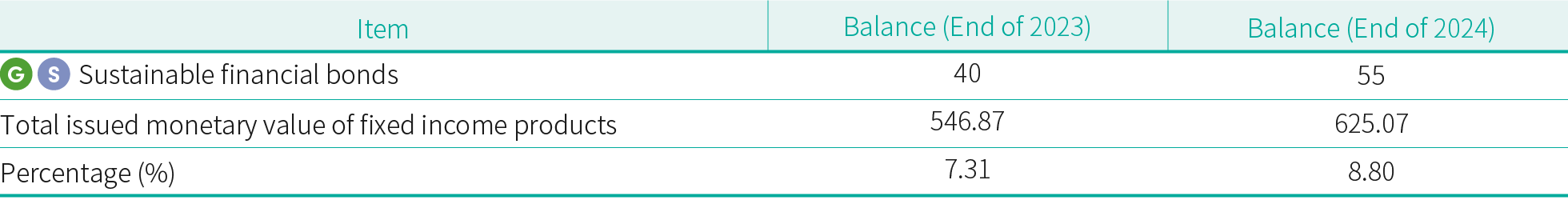

◎ Investment balance of sustainable development bonds in the past three years

Unit: NT$100 million

・The Group has gradually ramped up its share of investment in sustainable development bonds over the years, supporting invested companies to implement their low-carbon economy and reduction plans with action. As of the end of 2024, our cumulative investment in sustainable development bonds had reached NT$28 billion.

・To implement the spirit of sustainable investment and to actively participate in investing in related domestic green electricity and renewable energy industries, First Commercial Bank makes it a rule to examine the invested companies' publicly available information such as sustainability reports before making an investment, in addition to inspecting if their scope of operations or action plans are classified as part of the government's Six Core Strategic Industries. As of the end of 2024, First Commercial Bank's outstanding investment amount in the domestic green electricity and renewable energy industries had amounted to NT$44.5 billion. Its investment income for the year was around NT$550 million, and the cost of capital was around NT$80 million. The average investment duration was estimated to be one year. Additionally, according to data from the Market Observation Post System, the Bank's outstanding investment amount in businesses whose economic activities are deemed consistent with the FSC's Guidelines for Identifying Sustainable Economic Activities by themselves amounted to NT$4.35 billion. The Bank also continues to actively expand its positions, in the hope of effectively guiding funds toward the direction of related ESG applications, so we can take advantage of our influence as an institutional investor.

◎ Our outstanding investment amount in the domestic "green electricity & renewable energy" industries over the past three

years

・First Financial Management Consulting has successfully raised and managed three green energy funds totaling NT$780 million. Meanwhile, First Venture Capital also invested NT$333 million in the construction of a solar power plant with a capacity of approximately 47.6 MW. When the aforementioned project is completed, it is expected to reduce 47,600 metric tons of CO₂e every year, comparable to annual carbon absorption by around 122 Da'an Forest Parks.

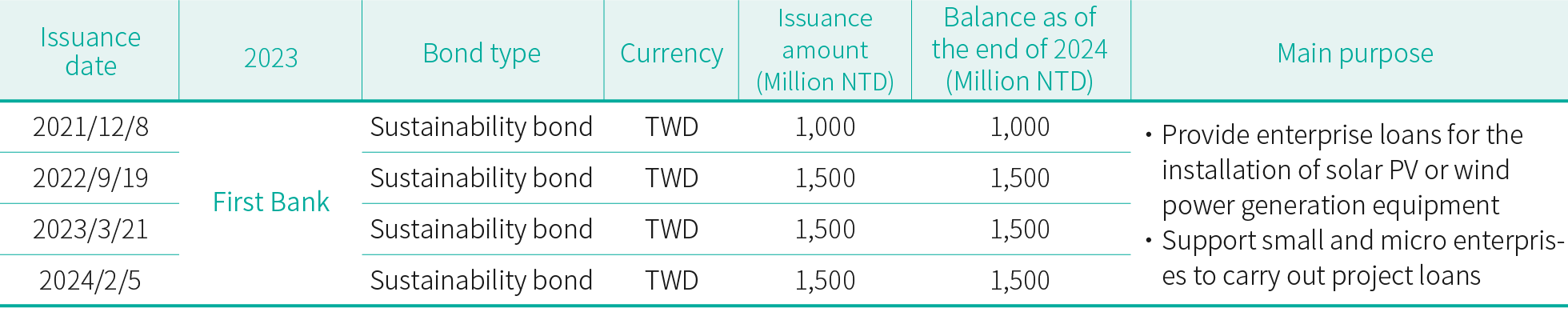

Issuance of Sustainable Development Bonds

In compliance with the International Capital Market Association's (ICMA) Green Bond Principles (GBP), Sustainability Bond Guidelines (SBG) standards, Sustainability-Linked Bond Principles (SLBP), as well as regulations of Taiwan's "Taipei Exchange Operation Directions for Sustainable Bonds", we have issued green/sustainable development bonds, and third-party certifications have been acquired. As of the end of 2024, First Commercial Bank had issued sustainable development bonds with a cumulative total of NT$5.5 billion.

Time Deposits for Sustainable Development

To respond to the government's "Green Finance Action Plan 3.0", First Commercial Bank has offered the "Time Deposits for Sustainable Development" program since 2023, and obtained a limited assurance report from an independent third party, ensuring that funds received from this program would be used on energy conservation and development of related green projects, in addition to social impact financing plans like affordable housing. In doing so, we are able to help enterprises that have demonstrated actual improvements in environmental and social benefits to obtain necessary funds. Our customers could thereby bring about positive influence and long-term effects on environment and society through making a deposit. In 2024, we undertook a total of 3* such cases. The amount we received totaled NT$1.62 billion, which has been used on credit cases involving construction of social housing.

*:Two of the three cases have expired and been canceled.

Retail Banking / Personal finance

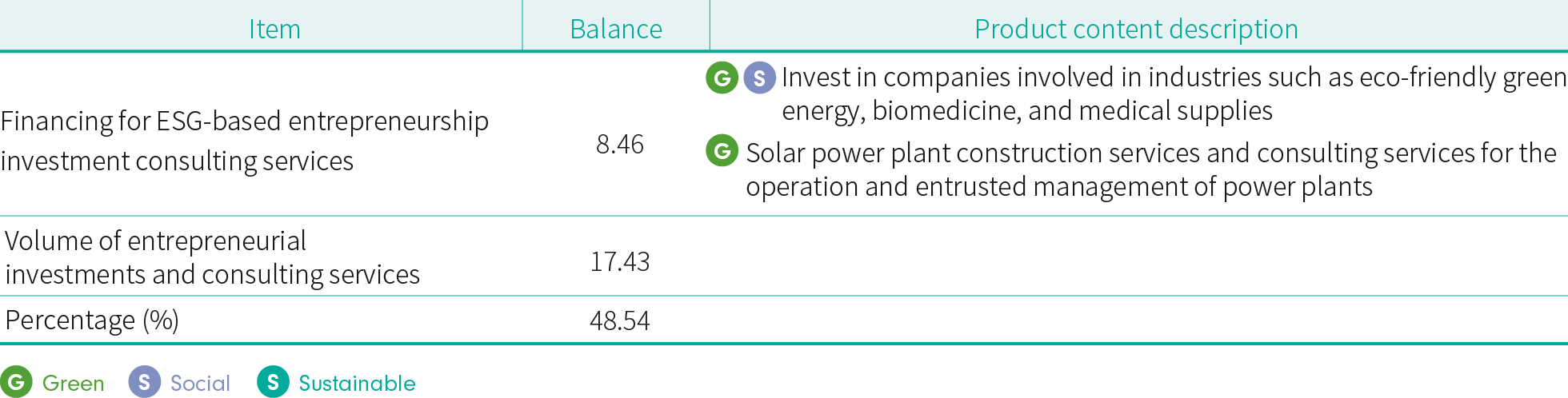

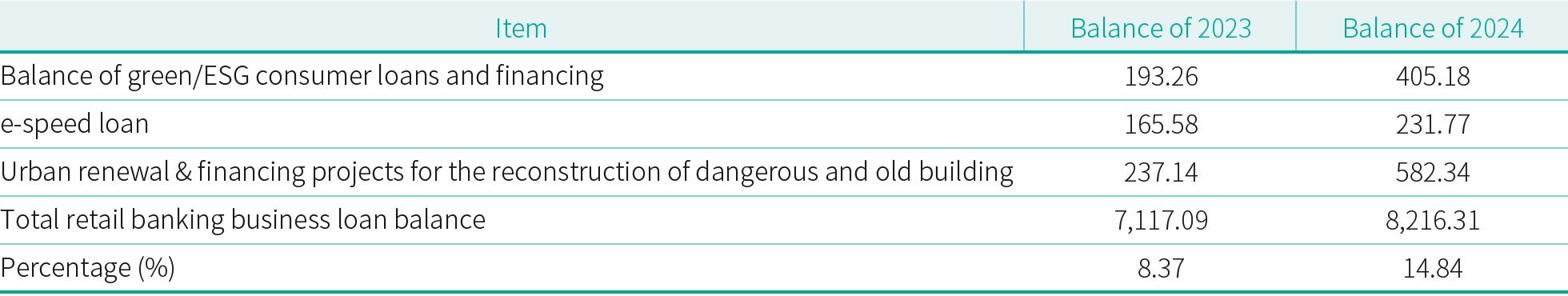

◎ Retail Banking - ESG related products and their respective proportions

Unit: NT$100 million

Unit: NT$100 million

Unit: NT$100 million

Green / ESG Loans

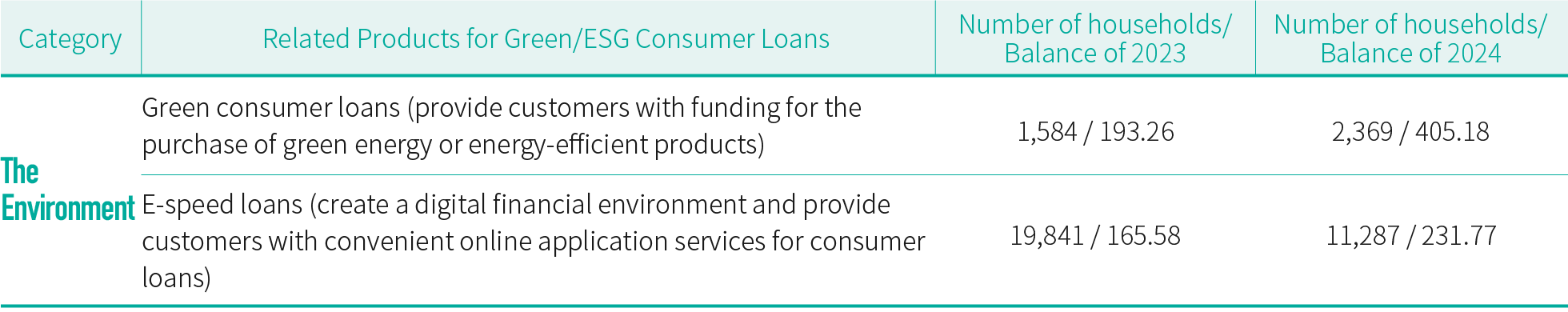

◎ Green / ESG Consumer Loans

In order to guide customers into adopting low carbon products, First Bank has launched "Green Consumer Loans" which targets the procurement of green energy or energy saving products (e.g.: green architecture, hybrid vehicles, electric vehicles, energy-saving appliances, etc.) in customers to provide preferential interest rate loans, thereby increasing incentives to procure green energy or energy saving products. Additionally, to build a paperless digital financial environment and meet the demand for zero contact financial services due to COVID-19, the "e-speed loan" service was launched so that customers could apply for loans through the internet from the comfort of their own homes.

Unit: households / NT$100 million

◎ Urban renewal

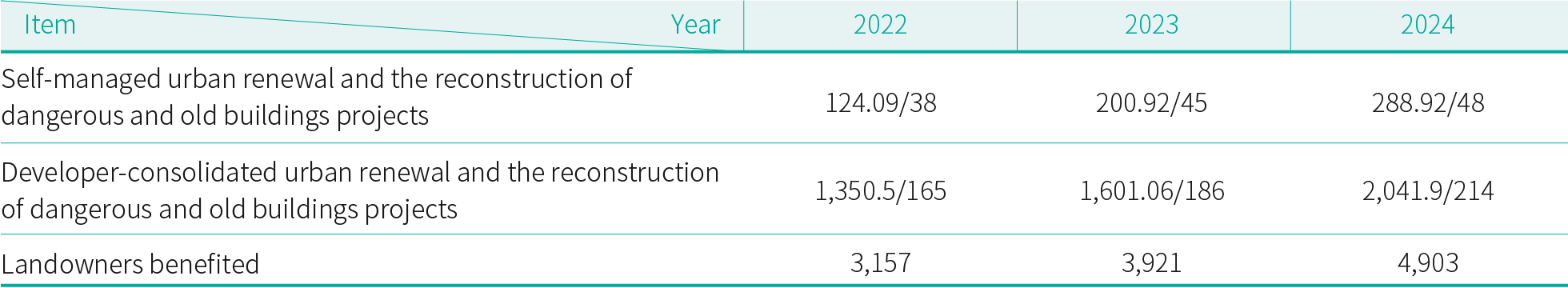

First Commercial Bank spares no effort in supporting the government's drive for urban renewal financing projects, as well as financing the reconstruction of dangerous and old buildings. The Bank also encourages its customers to apply for the Green Building Label, in addition to providing financing to green building projects for security deposit; In 2017, the Bank launched the "Preferential Loans for Accelerating the Reconstruction of Dangerous and Old Urban Buildings" program. Old and dangerous buildings that meet the requirements of the "Statute for Expediting Reconstruction of Urban Unsafe and Old Buildings" or "New Taipei City Simple Urban Renewal or Disaster Prevention Renewal" are eligible to apply for preferential loans for reconstruction. These loans can go as high as matching the total amount needed for reconstruction or related costs, and the repayment duration could be as long as five years. The Bank also partnered with East Asia Real Estate Management Company, a reinvested and affiliated company of the Bank, to provide comprehensive, one-stop financial service for urban renewal, allowing building owners to feel at ease during the reconstruction process. Reconstructed buildings are required to comply with green indicators, and minimize their emissions and discharge of exhaust heat, carbon dioxide, methane and waste water in order to transition to energy-efficient, low-carbon, and environment-friendly communities. The goal is to create a win-win scenario for environment, the residents and the Group. To date, a total of 164 projects related to urban renewal and reconstruction of dangerous old buildings have obtained Green Building Labels of silver or above and are expected to decrease carbon emissions by approximately 6,560 tons CO2e.

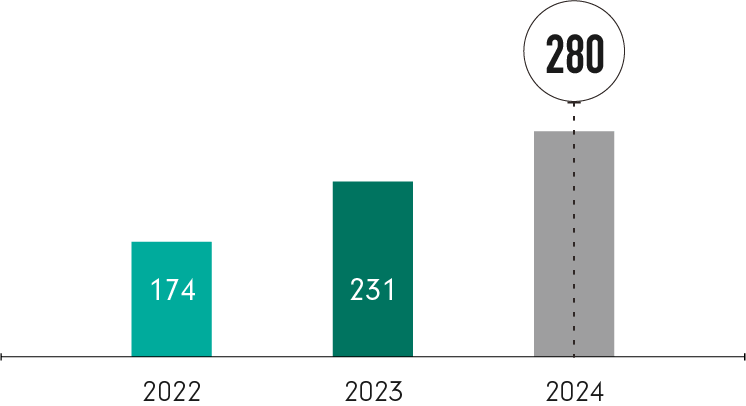

◎ Approved financing amount and the number of cases for urban renewal and the reconstruction of dangerous and old buildingsUnit: NT$100 million/Case

*:All statistical figures are cumulative.

Case Study :

In 2024, First Commercial Bank partnered with investee company East Asia Real-Estate Management Company to push forward the Urban Regeneration R&D Foundation's urban renewal case in Beitou District, Taipei City as well as the self-reliant reconstruction of houses damaged by the presence of chloride ions in Banqiao District, New Taipei City, with a financing amount totaling NT$8.7 billion to help around 104 landowners to embark on reconstructing their old buildings. We provided consultation services ranging from construction engineering management, financial audit to the continuation insurance mechanism. During the construction period, the landowners do not need to raise reconstruction funds themselves, and a total of NT$17.968 billion in revenue has been generated for them. A carbon reduction of 17.97 metric tons of CO2e is expected to be achieved every year, as we chip in to create safe, comfortable, environment-friendly housing of happiness for the residents.

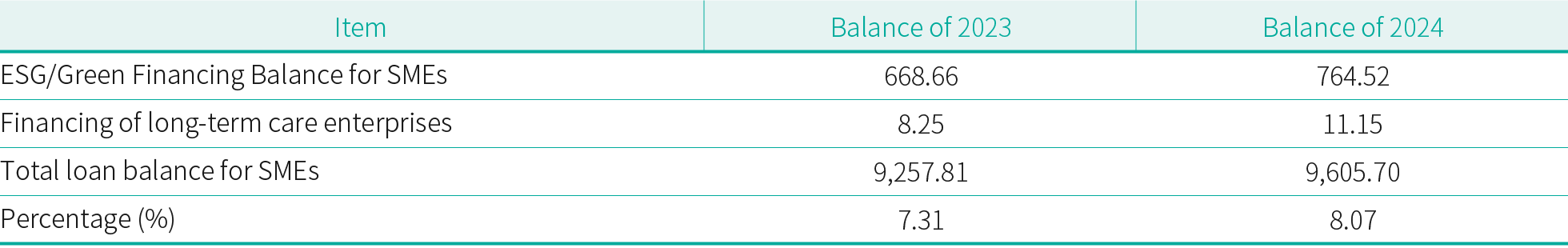

◎ ESG / Green financing for SMEs

First Commercial Bank supports local enterprises with action. Apart from our long-standing collaboration with the Small & Medium Enterprise Credit Guarantee Fund of Taiwan in providing credit guarantee, we have also expanded financing services for Taiwan's SMEs. In 2024, we won the "Credit Guarantee Golden Quality Award" for credit guarantee financing operations for SMEs for the 16th time. In addition, we also won the "Green Credit Promotion Award", a special credit guarantee award, back-to-back. Furthermore, we were also presented with the "Post-Pandemic Revitalization Award-Financial Institution Category" as well as "Local Assistance in Post-Pandemic Revitalization & Transition Award", which makes us the most awarded financial institution in the entire industry. To continue to support SMEs in the low-carbon transition and to drive their sustainable development, First Commercial Bank resorts to concrete actions to provide a range of preferential loans for green financing, as part of our efforts to guide businesses to value sustainable development and fulfill their corporate social responsibilities, so that we can march toward a sustainable ecosphere hand-in-hand. In addition, we also support the development of small and medium providers of long-term care. As of 2024, we had undertaken a total of 77 financing cases for small and medium providers of long-term care. As of the end of 2024, the total approved amount had reached NT$1.76 billion, with the outstanding loan amounting to NT$1.115 billion. We continue to inject funds into projects conducive to social and environmental benefits, and strive to develop ESG and sustainable business opportunities together with our borrowers.

Case Study :

In 2024, First Commercial Bank provided an SME electricity generator with the funds necessary for developing and installing land-based and rooftop solar PV sites. The company leased rooftop space at two private factories in the Kaohsiung area to build rooftop solar PV power generation equipment, with installation capacity of around 334.97 KWP and 499.38 KWP, respectively. The project is estimated to generate nearly NT$3.8 million in annual revenue from electricity sales. Aside from helping the company to expand its scale of operations and revenue, the project also echoes the nation's policy to develop green energy, as we partner with our customers to realize environmental sustainability.

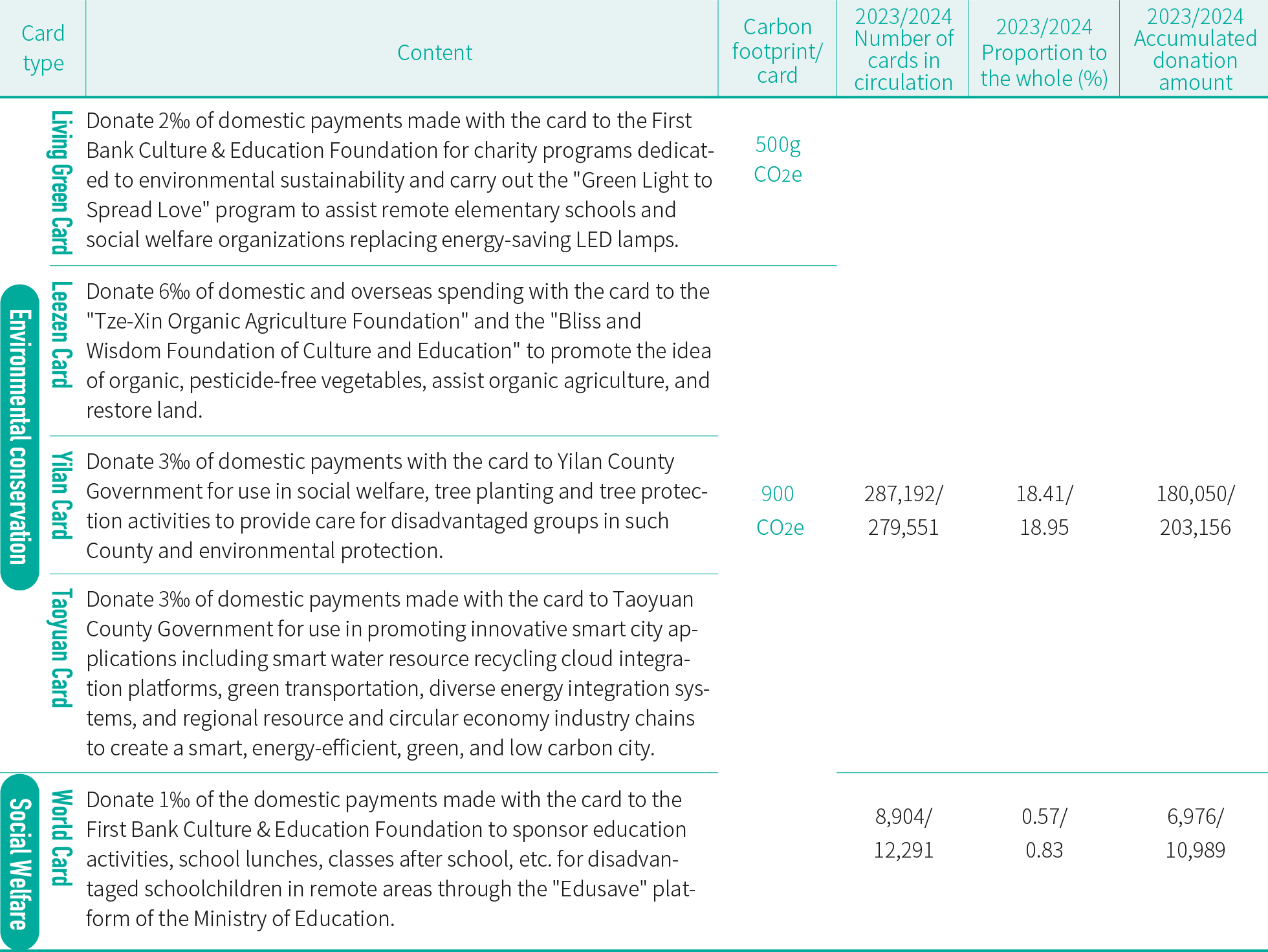

◎ Public Welfare / Green Credit Card

First Commercial Bank continues to push forward environmental and public welfare events with a fixed percentage of the amount of transactions made with its charity credit cards/Living Green cards. In 2023, the Bank was certified to both the British Standards Institution's "PAS2060: 2014 Carbon Neutrality" and the Ministry of Environment's "Carbon Footprint Reduction Label". Green electricity was used to help reduce carbon footprint during the course of credit card production, and carbon credits were purchased to offset the remaining carbon emissions in order to achieve carbon neutrality. The Bank added the "Carbon Calculator" function to its iLEO app for credit cards in 2023, allowing credit card holders to understand the amount of carbon emissions from their credit card transactions each month. This marks the first time that a government-owned bank offers such service. As of the end of 2024, a total of 33,983 customers had activated this function. In addition, we also hold carbon reduction & LOHAS marketing campaigns, in which holders of green credit cards who use them at designated green channels are entitled to cashback bonuses.

Unit: NTD thousand

*:・First Bank does not provide pre-paid card products.

・In 2024, the total number of valid credit card customers of First Bank was 719,702, and the number of cards in circulation reached 1,474,945.

・For the social and environmental benefits of credit cards, please refer to the chapter “Social Impact - Public Welfare Strategy”.

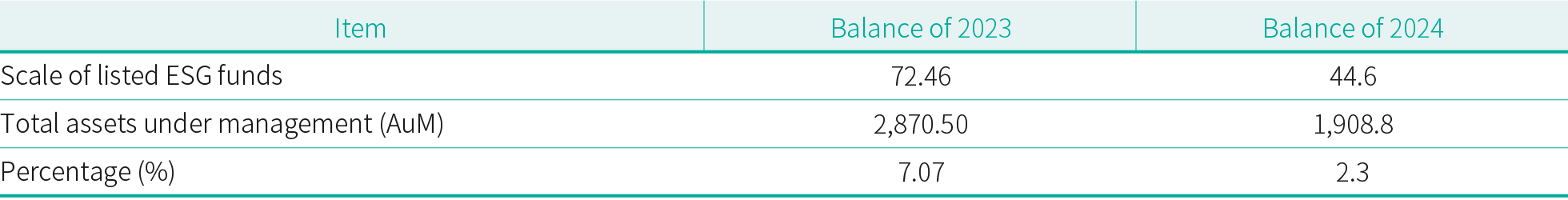

Sustainable Investment Products & Services

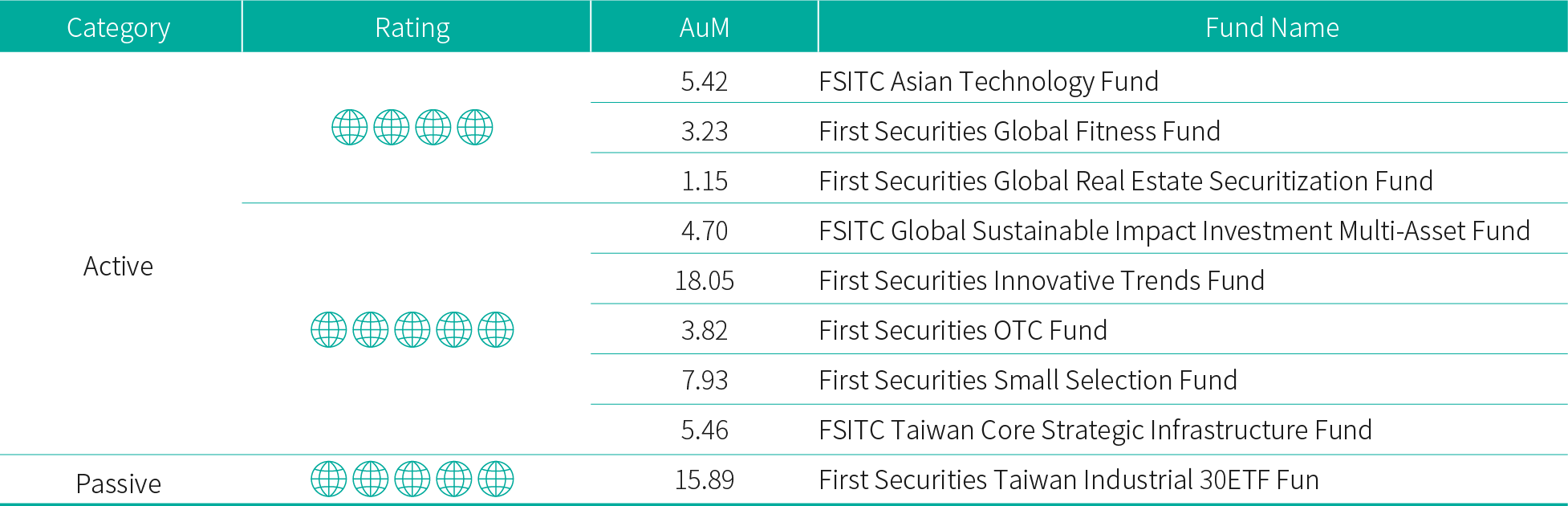

◎ FSITC issues funds rated four globes or higher by the Morningstar Sustainability Rating, with a substantial ESG fund

asset management scale

As of the end of 2024, FSITC had issued 3 funds with higher-than-average rating (four globes) by the Morningstar Sustainability Ratingnote, as well as 6 funds qualified for Morningstar's highest rating (five globes), with a total scale of around NT$6.565 billion while accounting for 5.24% of FSITC's publicly offered funds. In particular, the "FSITC Global Sustainable Impact Investment Multi-Asset Fund" is Taiwan's first ESG fund focusing on impact investment.

Unit: NT$100 million

*:Morningstar includes 3 major ESG factors in their rating of sustainable investments. The grading is classified into 5 tiers (bottom, below average, average, above average, and high end) represented by 1 to 5 globes. A rating of 5 globes represents an investment combination with extremely low ESG risks while 1 globe represents an investment combination with extremely high ESG risks.

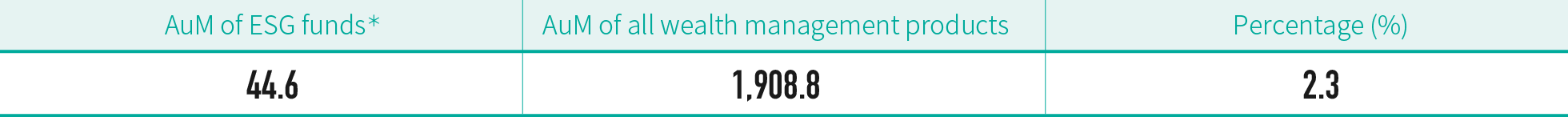

◎ Asset scale of ESG funds under the management of First BankUnit: NT$100 million

*:All ESG funds comply with the domestic competent authority's definition of ESG funds.

◎ ESG products of First Bank and First Life Insurance

The assessment, development, and listing operations of funds and insurance products consider ESG factors. All ESG funds listed by First Bank are compliant with the laws and regulations of the competent authority; The linked objects of First Life Insurance's investment type policies prioritize green funds compliant to the EU's SFDR.

◎ First Securities ESG Smart Sustainability Index & Data Platform

First Securities is the first securities company in Taiwan to offer scores and information relating to the sustainable development of individual stocks, providing investors with a platform that they can reference when investing. Referencing collected sustainability reports, the Market Observation Post System, news reports, and publicly available information from the Financial Supervisory Commission, Ministry of Environment and Ministry of Labor, ESG performance is scored and ranked through analyzing corporate ESG actions using AI quantization analysis and models. In the meantime, TWSE's corporate governance evaluation and rankings have also been included to make the scoring more diverse and objective. They have also been integrated into First Securities' customer order placement system, so that investors can promptly access corporate ESG scores and related analyses to significantly improve their decision-making efficiency.

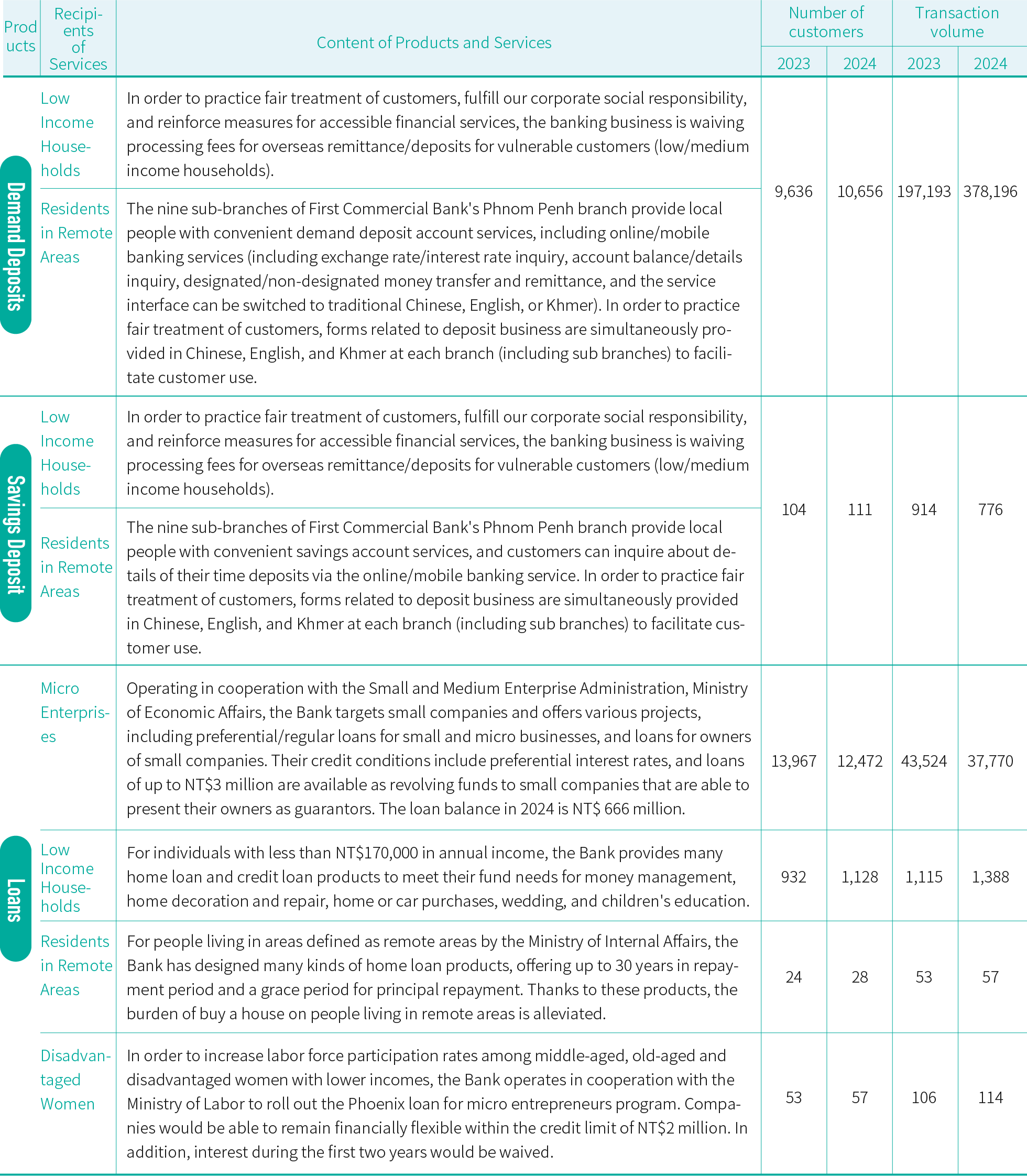

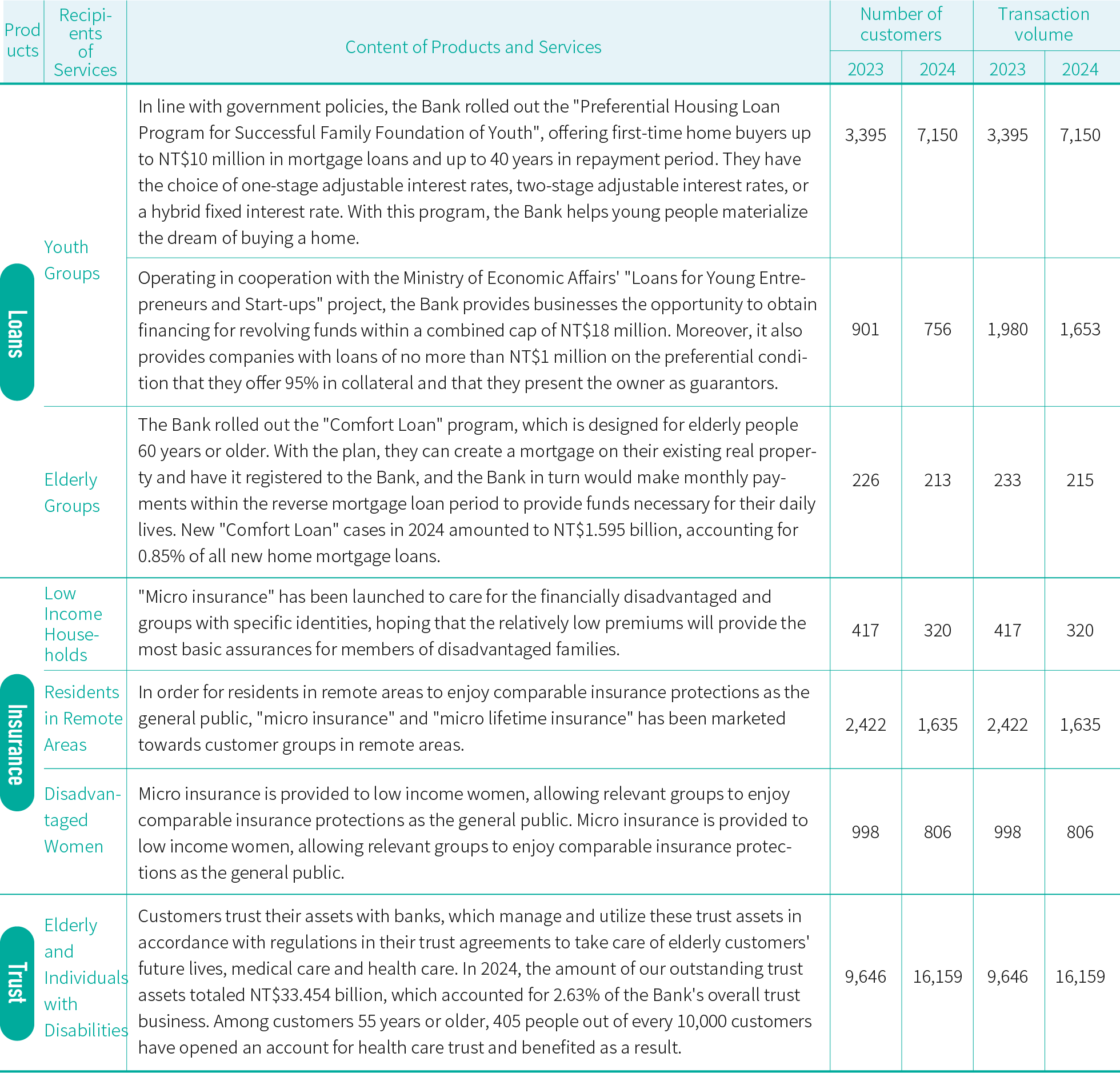

Inclusive Finance Products and Services

In response to the UN's promotion of financial inclusion for micro enterprises, low income households, residents of remote areas, disadvantaged women, youths, the elderly, and those with disabilities, basic financial services are provided for the goal of sustainable development. First Financial Holding continues to develop various products and services that support disadvantaged groups and provide them with a channel to obtain funding and financial services.

Unit: Households/Number

Unit: Households/Number

Aside from striving to provide various groups with fair and accessible financial products and services, First Financial Holding is actively combining core businesses to offer diverse non-financial support, such as training and seminars, free of charge. Relevant incentives are offered to encourage disadvantage groups into using financial products and services to fulfill the social responsibility of the financial industry.

◎ Social Impact Indicators of First Financial Holding's Non-Financial Supp

◎ Training in Financial or Digital Literacy

・Remote Areas:

First Securities makes it a rule to go deep into far-flung areas every year to provide fintech training to people with scarce financial resources. It also provides complimentary health check-up service for money management. In 2024, the company traveled to Lukang Township, Changhua County, Hengchun Township, Pingtung County, Magong City, Penghu County, Guanxi Township, Hsinchu County, and Donggang Township, Pingtung County, providing financial information and fintech training to a total of 186 customers.

◎ Measures for Friendly Financial Services

・Remote Areas:

The Bank actively develops mobile banking apps in developing countries and least developed countries such as Cambodia and Vietnam. It also joined the local Bakong blockchain system to boost payment/receipt efficiency and safety for local people, in addition to promoting inclusive finance.

・Youth Groups:

The Bank has developed the iLEO Digital Account that caters to young people. Through lively, cute and easy-to-understand interface designs, the service provides favorable interest rates for small-sum demand deposits. A 2% interest rate is available for demand deposits from NT$100 to NT$120,000. Such interest is paid out every month to encourage young people to get into a savings habit.

・Persons with Disabilities:

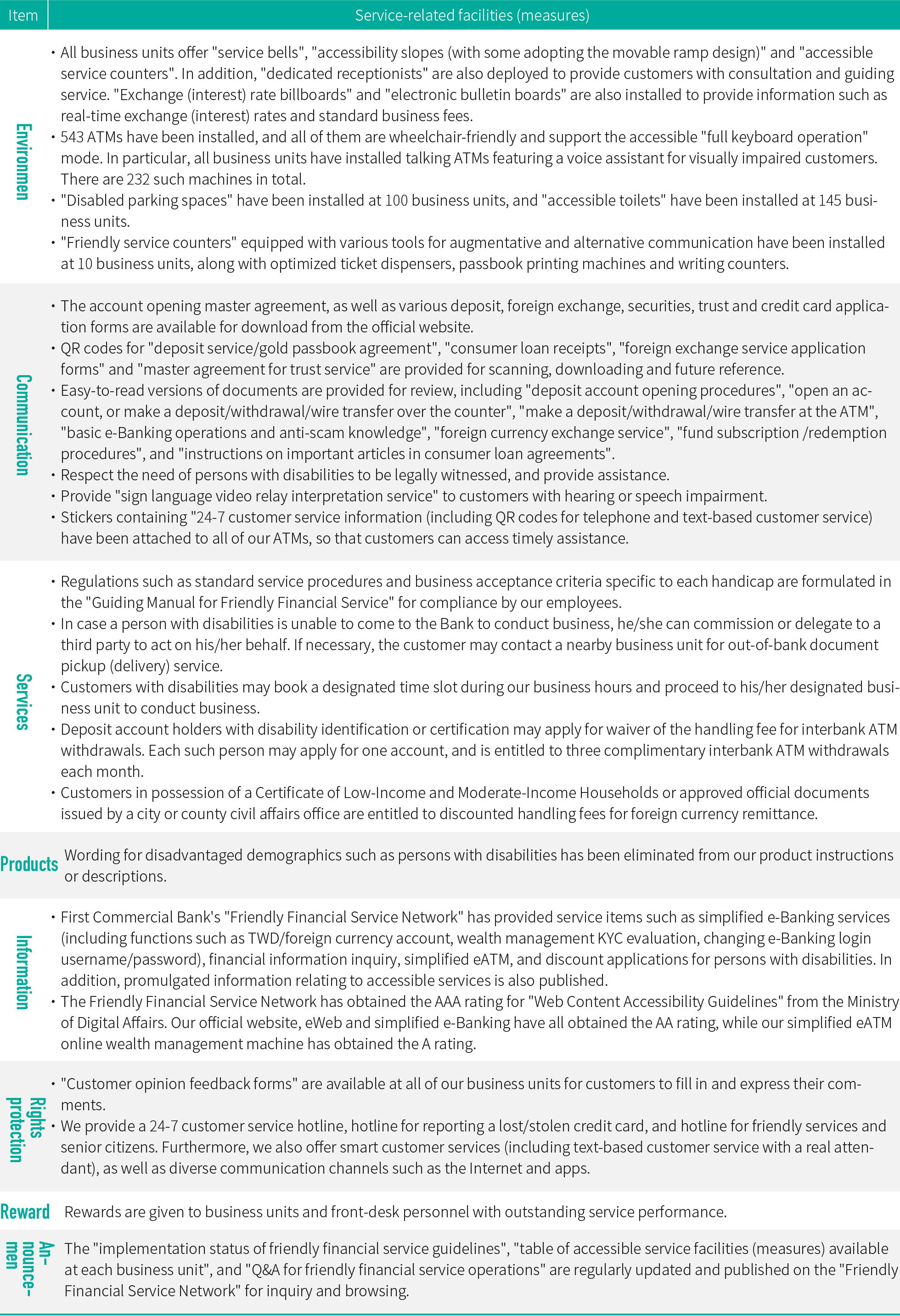

First Commercial Bank, in compliance with the "Guidelines for Friendly Financial Services in the Banking Industry", has pushed forward measures of various accessible services. As of the end of 2024, these services had encompassed the following:

・Foreign nationals:

As of the end of 2024, the Bank had built 111 bilingual branches. 12 of them provide trilingual service in "Chinese, English and Japanese". 25 bilingual branches are expected to be added each year. We plan to complete our bilingual drive at all of our domestic branches by the end of 2027.

◎ Technical Assistance

・Microenterprises, disadvantaged women:

First Bank has partnered with Industrial Technology Research Institute ("ITRI") so that the institute may provide enterprises with counseling in terms of patents, technologies, and market conditions while the bank handles financing loans for technology, intellectual property, or other matters. Also, long-term support for microenterprises has been provided in coordination with the Workforce Development Agency. Consultation and services for micro startup businesses, female entrepreneurs, and pre/post loan operations are provided by dedicated consultants stationed at the Ministry of Labor. Furthermore, the Bank also works with the Taiwan Small & Medium Enterprise Counseling Foundation. We would jointly host seminars to increase SMEs' financial competitiveness and provide counseling plans each year. We would invite industrial and economic experts or business owners for bilateral communication with enterprises, while providing counseling service from the industrial, economic and technical aspects.

◎ Business Management Tools or Training

・Microenterprises:

First Commercial Bank has partnered with the Taiwan SME Counseling Foundation in coordination with the government's development policy to support small, medium, and microenterprises by providing them with financial examination and diagnosis counseling services. In 2024, a total of 60 small, medium, and micro enterprises benefited as a result. In addition, 7 seminars were organized in 2024 to provide overall economic and industry trend analysis to small, medium, and microenterprises, in an effort to help business owners cultivate business insights.

・Microenterprises, low-income households, demographics living in remote areas and relatively disadvantaged women:

Through the "LEO's Life" blog, we provide professional articles on business administration, investment and money management, industrial trends, and financial knowledge. We have also designed and added the "Financially Savvy Leo Club" and "Leo News Flash" columns to our Facebook fan page, as knowledge-based infographics are disseminated. We also communicate information relating to wealth management with our official LINE account "Wealth Management Is A Cinch", in order to help would-be entrepreneurs increase their professional competence while implementing and promoting the value of inclusive finance.