Sustainable Governance Operation Mechanisms >

Stakeholder Communication and Materiality Analysis

Stakeholder Communication and Materiality Analysis

Stakeholder identification and communication

Since First Financial Holding Co., Ltd. (FFHC) issued its 2011 Sustainability Report in 2012, stakeholders' opinions have served as the guiding principles for the company's sustainable development strategy. By listening to stakeholders' opinions and collecting their concerns on ESG-related issues, the company understands the themes and aspects of ESG information that matter to them. This process also takes into account international sustainability standards and initiatives such as the GRI Standards, ISO 26000, SDGs*1, TCFD*2, and the Equator Principles*3. Sustainability evaluations such as the CDP*4, DJSI*5, and MSCI ESG Ratings*6, specific issues for the finance industry such as the PRB*7 PRI*8, SASB*9, and GRI disclosure indicators for the financial services industry, stakeholder communications and feedback, and the Group's development strategy for sustainable finance is adopted as the basis for materiality analysis. To further respond to the revision of GRI 2021 General Standards G3: Material Topics (2021), the Group has adopted economic, environmental, and social impact assessment methodologies developed by institutions such as the Value Balancing Alliance (VBA), Harvard Business School's Impact-Weighted Accounts research project, and the London Benchmarking Group (LBG). We have established an impact-based materiality analysis process (comprising three major stages and six key steps) to identify 18 material topics across three dimensions: governance, environment, and people (including human rights). These topics are internalized as the company's sustainable development goals and serve as the foundation for preparing the report.

*1:United Nations Sustainable Development Goals

*2:Task Force on Climate-Related Financial Disclosures, TCFD

*3:Equator Principles, EPs

*4:Carbon Disclosure Project, CDP

*5:Dow Jones Sustainability Index, DJSI

*6:MSCI ESG Ratings

*7:United Nations Principles for Responsible Finance, PRB

*8:United Nations Principles for Responsible Investment, PRI

*9:Sustainability Accounting Standards Board, SASB

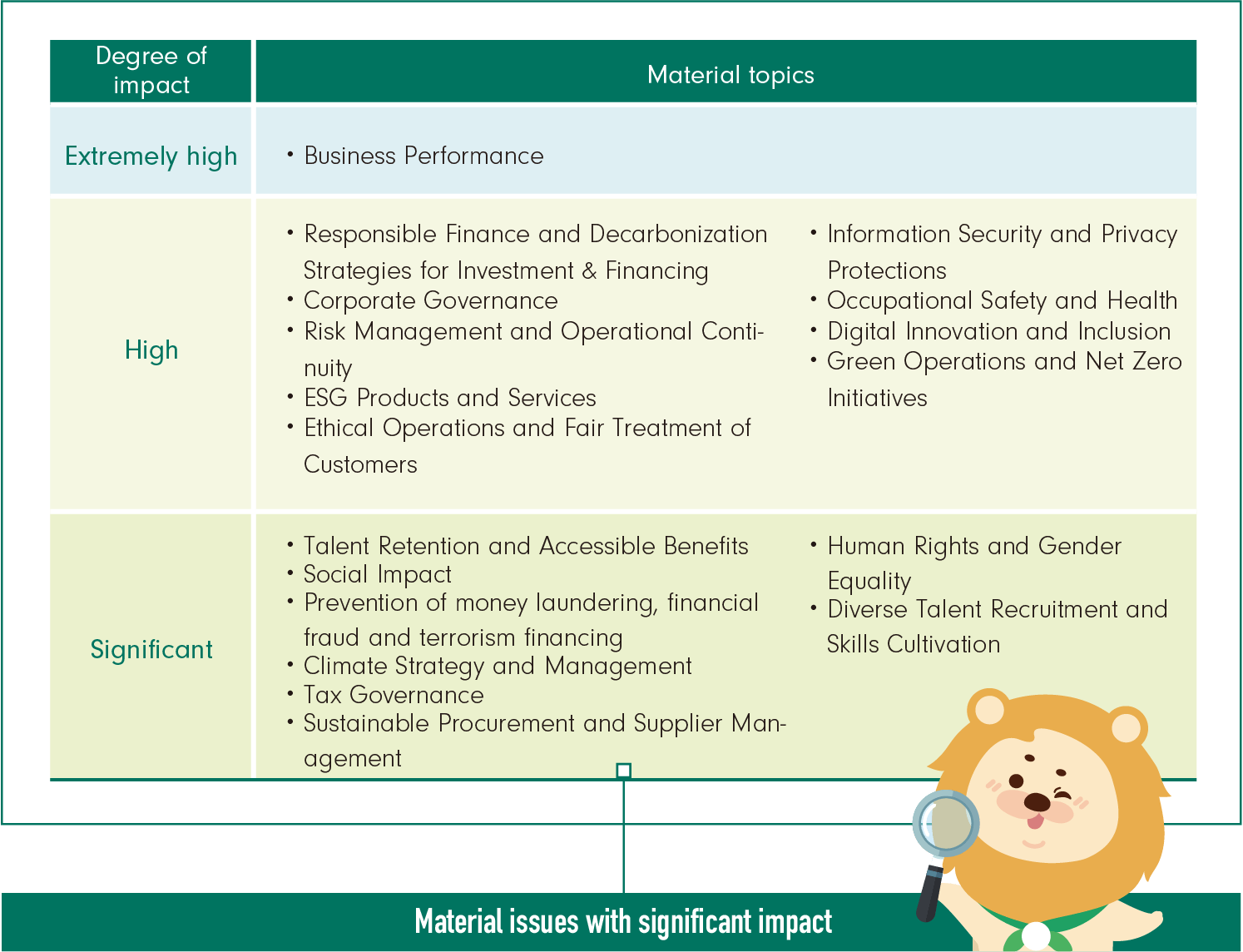

Material Topics Identification and Management

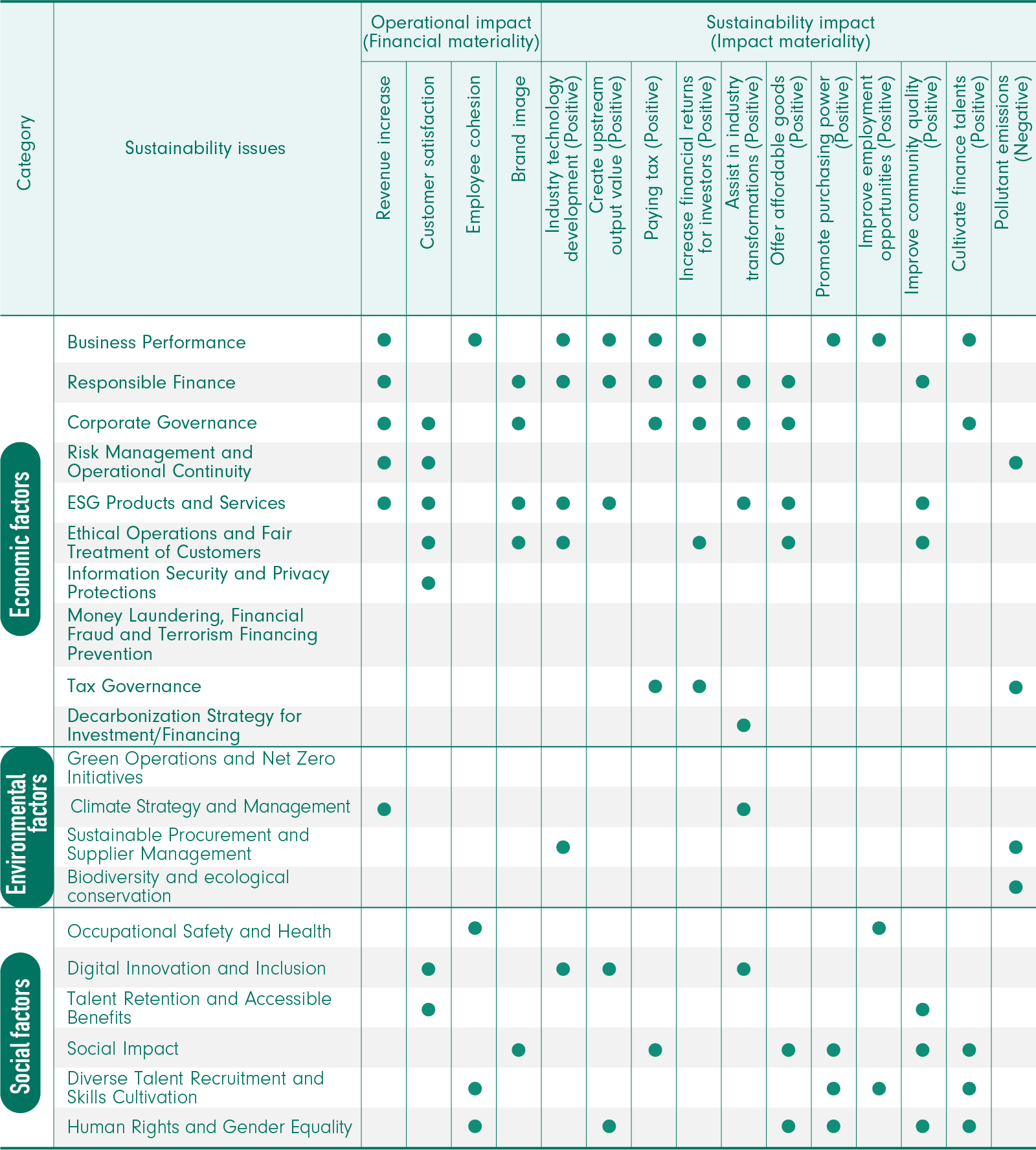

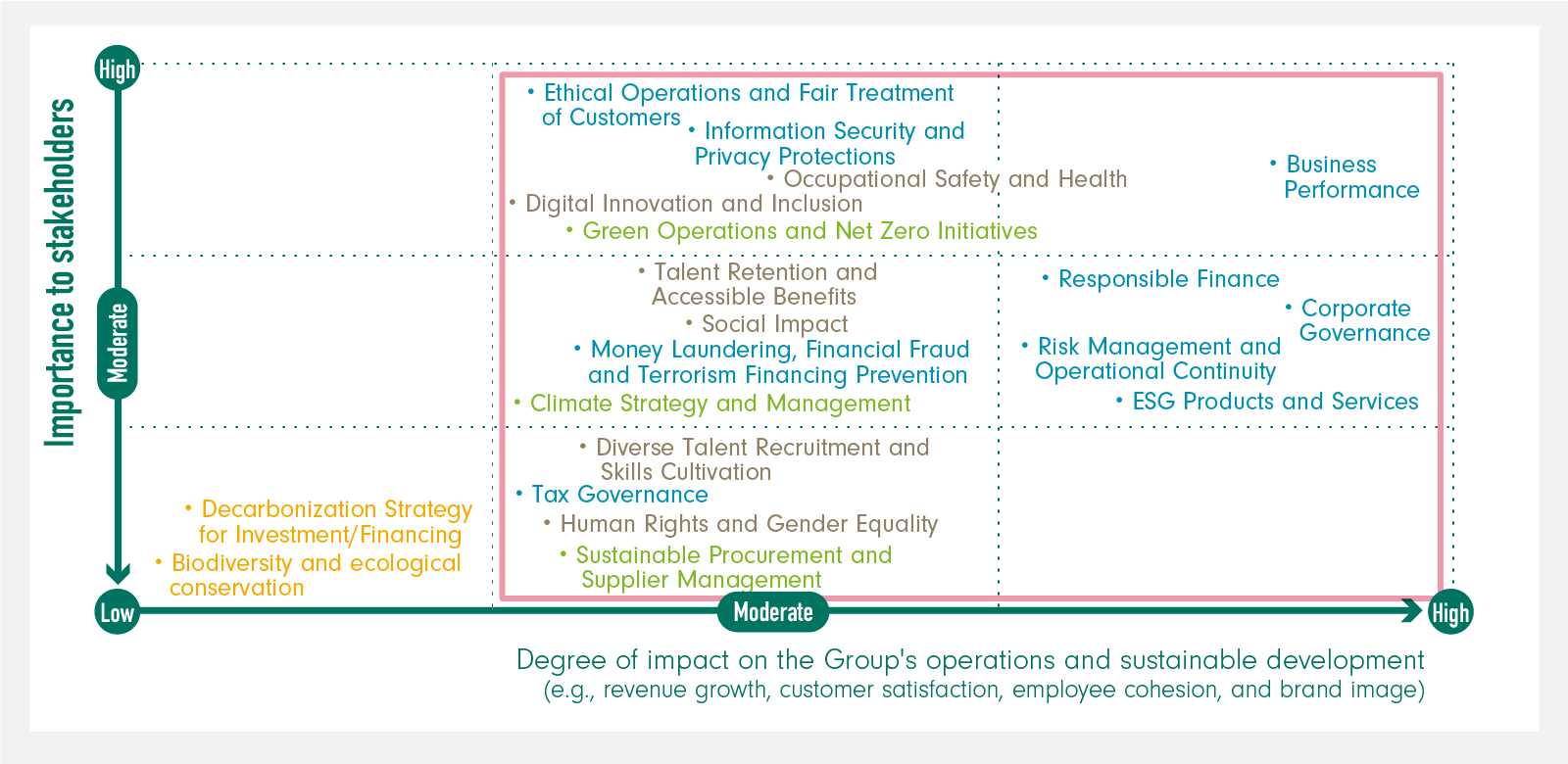

To obtain representative samples in the survey on the "level of concern to stakeholders", the number of questionnaires was determined based on the interaction, importance, and impact principles. The ESG Committee team members will then evaluate the "degree of impact of each issue on the outside", and score factors such as revenue, customer satisfaction, employee cohesiveness, and brand image to understand key issues under different factors and determine the importance of each sustainability issue and the order in which it will be disclosed.

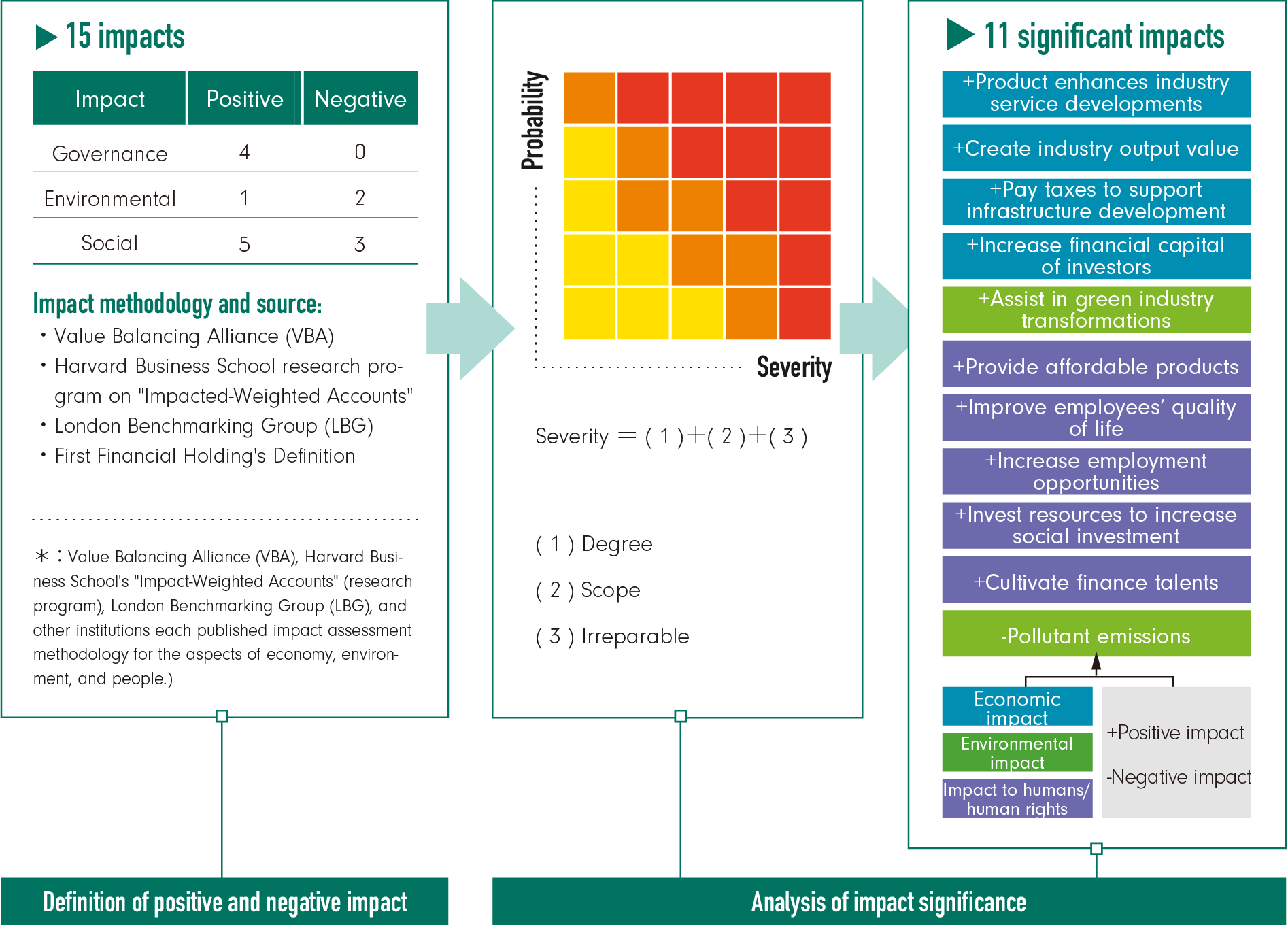

Considering the growing global investor concern over the environmental and social externalities arising from corporate operations, and in response to the revision of GRI 2021 Universal Standards G3: Material Topics (2021), FFHC has adopted impact assessment methodologies developed by institutions such as the Value Balancing Alliance (VBA), Harvard Business School's "Impact-Weighted Accounts" research project, and the London Benchmarking Group (LBG). Additionally, the EU Corporate Sustainability Reporting Directive, CSRD European Sustainability Reporting Standards, and Double Materiality concept of ESRS have been incorporated. By utilizing both monetized and non-monetized methodologies, an impact-based materiality analysis process has been established. This process considers both "organizational operational impacts" and “governance, environmental, and individual impacts," evaluating the significance of sustainability issues from both internal and external organizational perspectives. The resulting data is then cross-analyzed to create a materiality analysis matrix.

Assessment of Economic, Environmental, and Social Impact

●:It refers to the substantial impact of ESG on the organization's operational impact or sustainable development impact.

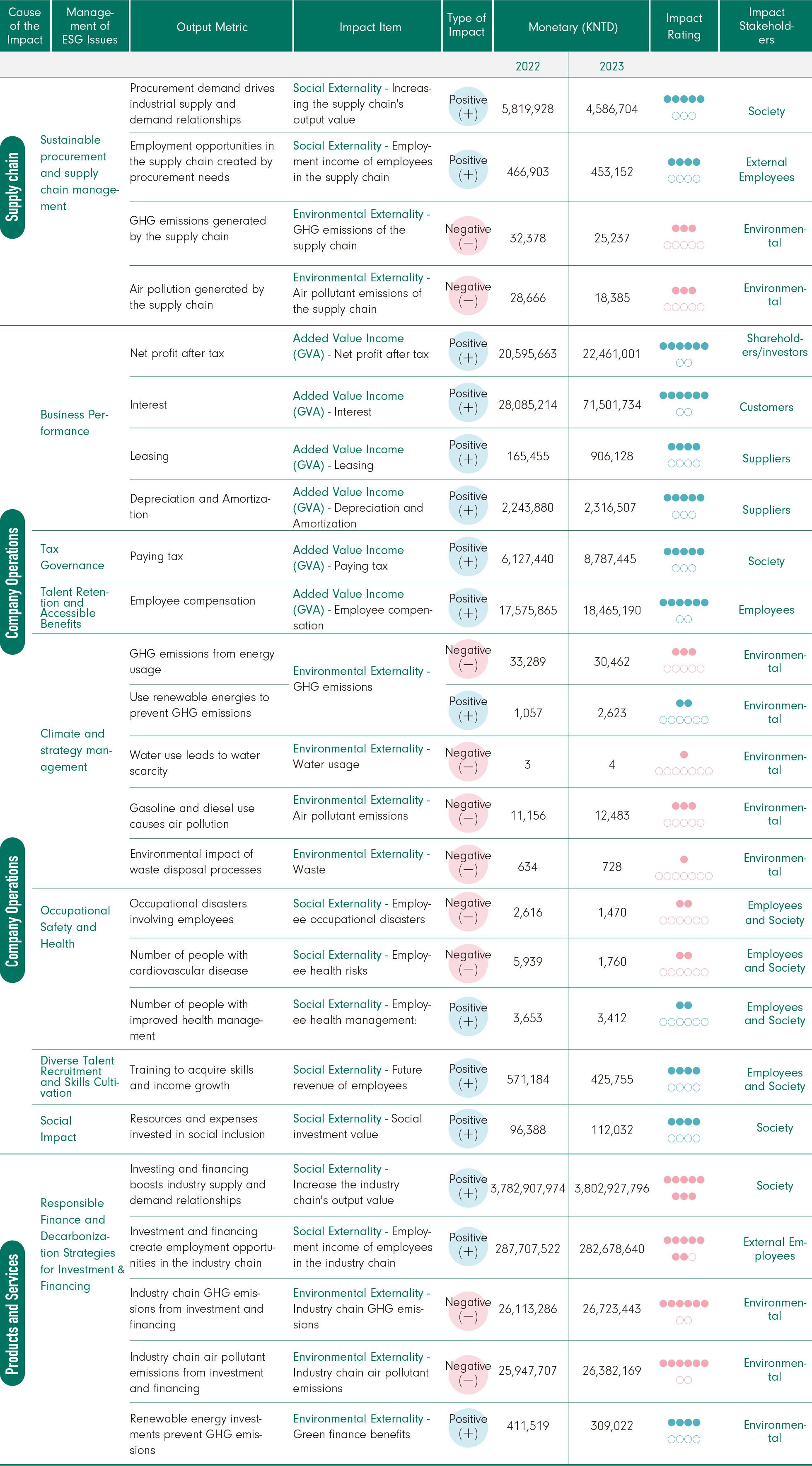

■ Sustainability issue impact assessment results

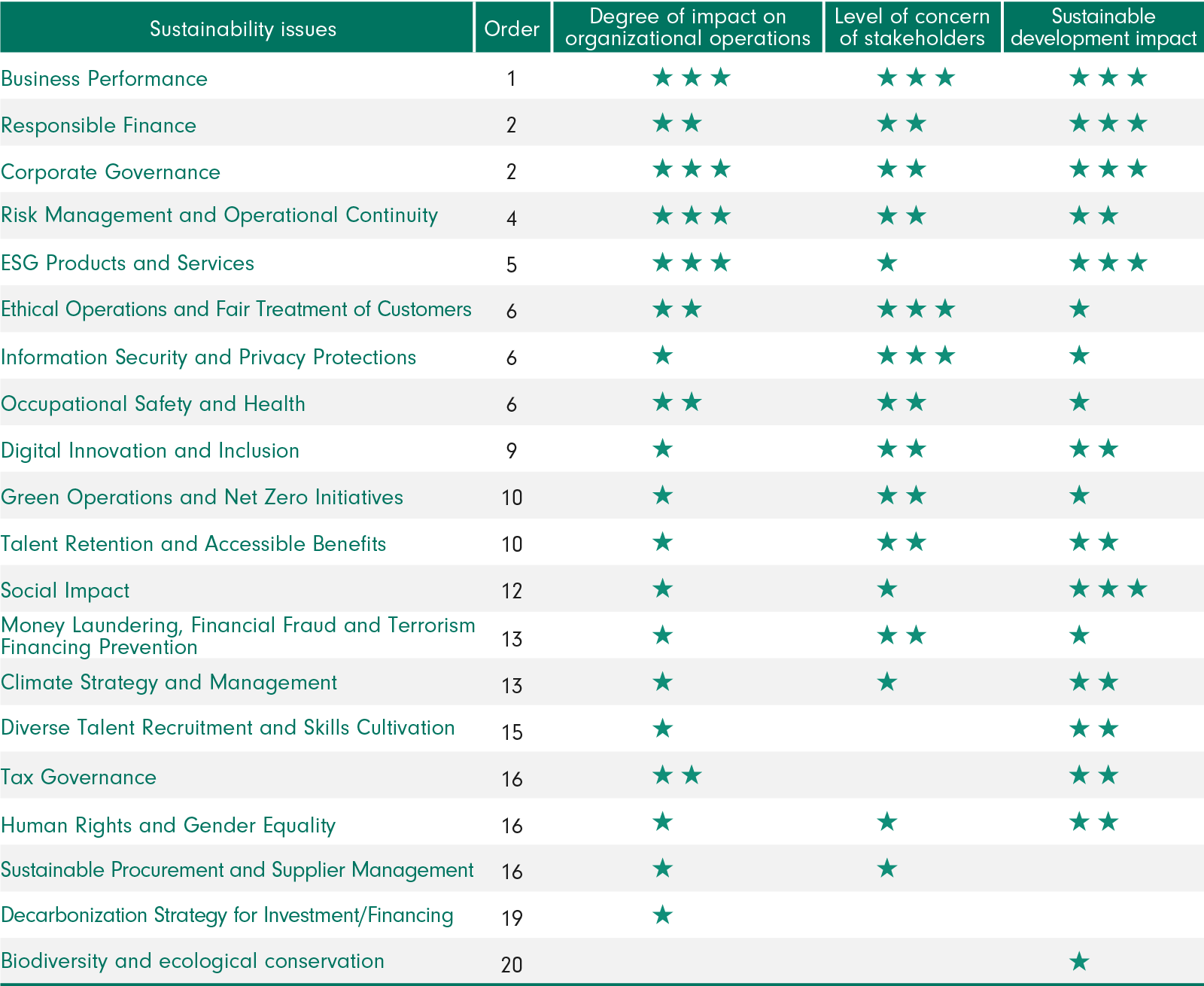

★★★Extreme concern/impact; ★★High concern/impact; ★Concern/impact

■ First Financial Holding ESG matrix

Explanation of differences and adjustments in material topics compared to 2022:Rename the material topic "Climate Action" to "Green Operations and Net-Zero Action." Additionally, considering that decarbonization has become an international development trend and that the company has already incorporated decarbonization mechanisms into its sustainable lending/investment policies, the investment and financing decarbonization strategy, though rated low in impact assessment, stakeholder concern, and operational impact, will still be included in the Responsible Finance section.

Sustainable impact assessment of value chain activities

As a cash flow provider for the industry chain, First Financial Holding is extremely concerned with the impact onto society and the environment. Our management thinking linked to financial performance can identify the positive/negative, potential/significant, and mid- and long-term impact of the Group's operations towards human life. In 2023, FFHC's value chain activities generated positive impacts amounting to NT$4.2 trillion while also resulting in a negative impact of NT$53.2 billion. Over 96% of this impact stemmed from downstream investment and credit businesses, highlighting the crucial role of the financial industry in driving sustainable transformation across various sectors. Through our investment and credit businesses, FFHC has driven the industrial chain to generate NT$3.8 trillion in output, creating 660,000 job opportunities and NT$282.7 billion in salaries. However, the consumption of natural resources and environmental pollution during the supply and demand processes within industries also resulted in NT$53.1 billion in social costs. In terms of positive impacts, investments boost industrial output, create job opportunities and salaries, after-tax net profit, interest, and employee compensation, which are considered high-impact items. The high negative impacts are mainly pollutant emissions caused by investments and credit. From these significantly high-impact items, we can define responsible finance and investment decarbonization strategies, operational performance, talent retention, and friendly benefits as high-impact ESG issues. In order to mitigate negative impact, First Financial Holding is dedicated to utilizing financial influence and core functions to expand the effect of sustainable investments and financing to more effectively allocate resources, support industry transitions towards sustainable development, and share sustainable values with stakeholders.

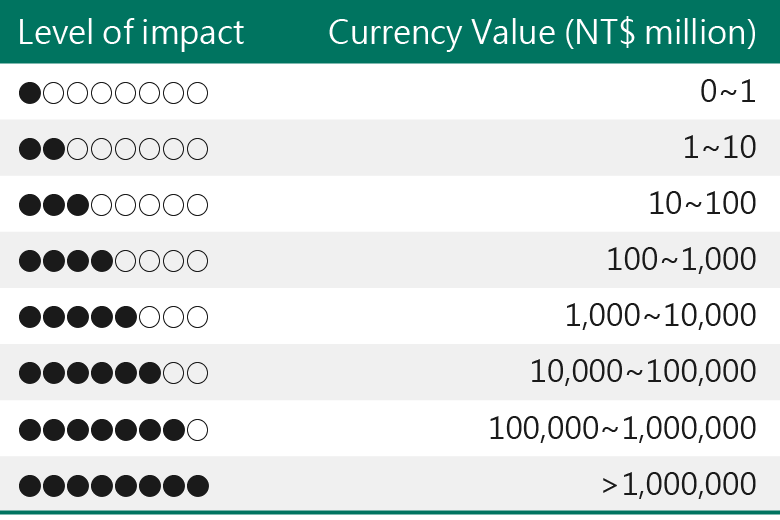

■ Impact assessment model - quantization method

■ Impact assessment model - currency method

*1:Added value income includes net profit after tax (shareholders/investors), interest (customers), leasing (suppliers), compensation (employees), depreciation and amortization (suppliers), and taxes (society), which directly generate financial benefits for stakeholders. The methodology references VBA (2022).

*2:Externality refers to the positive or negative impacts on human well-being resulting from the interactions between FFHC's operational activities and various types of capital. These impacts do not directly generate benefits or costs for the company. Environmental externalities consider the carbon social cost, human health loss costs, and ecosystem damage resulting from greenhouse gases, air pollution, waste, and water resource consumption. Social externalities consider the employment impact on employees and society brought by issues such as salary quality, career development, equal opportunities, health, and well-being.

*3:With consideration to the different economic conditions of each country, we use gross national income (GNI) assessed based on the purchasing power parity of each region to adjust value coefficients, and align the time boundary to the monetary value using 2017 as the baseline year. The methodology references OECD (2012) and PwC UK (2015)