Economic Factors >

Corporate Governance

Corporate Governance

Board Structure and Operation

The board members of First Financial Holding are re-elected every 3 years through a "candidate nomination system". The qualifications of all candidates for directors and independent directors is reviewed by the board before they are elected from a list of candidates at the shareholders' meeting, thereby ensuring that the nomination and selection procedures of directors is open and transparent. Additionally, the Company has established targets for the board meeting attendance of all directors to exceed an average of over 85%; the actual attendance of independent directors must exceed 80%. In 2024, 15 board of directors meetings were convened with an average attendance rate of 93.67% for all directors (100% when including attendance by proxy) and more than 80% for all independent directors, thereby fulfilling their supervisory duties.

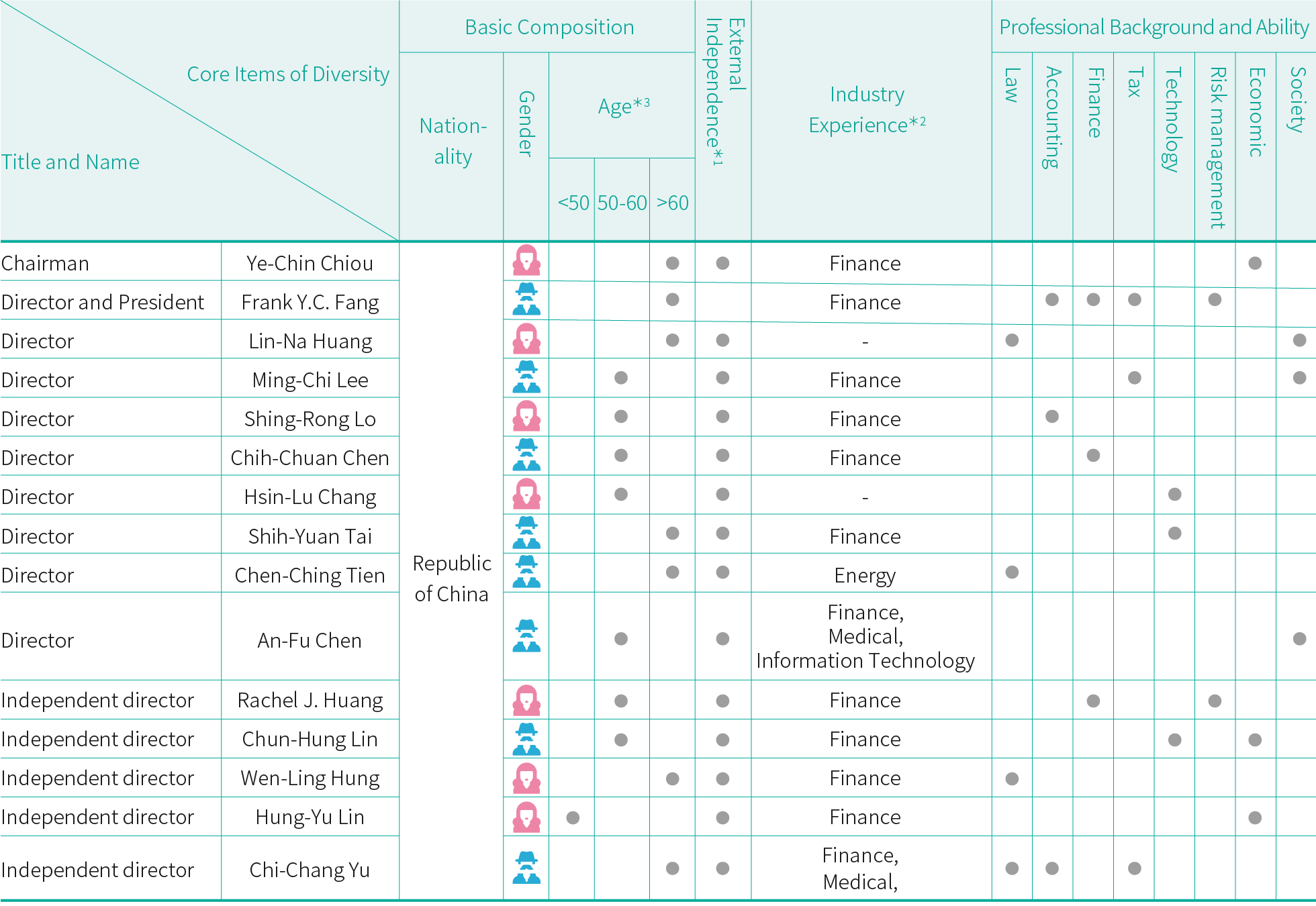

Diverse board members

After analysis of the Company's development of operations in the future, a diversity policy must be implemented to address the Group's emerging risks. The Company's directors possess industry and professional knowledge in banking, insurance, securities and laws, accounting, finance, tax affairs, technology, risk management economic or Society. Generally speaking, directors are capable in operations, management, leadership, accounting, financial analysis, crisis management, and decision-making as well as possessing plenty of knowledge in global market perspectives, industries, and risk management.

The Company's 8th-term board of directors is composed of 10 directors and 5 independent directors. Currently, including the Chairman and President, there are a total of 7 female directors who make up 47% of all directors.

◎ Implementation of the diversity policy for the Company's 8th-term Board of Directors

*1:The following criteria and standards have been adopted for the external independence compliance of directors. Directors cannot be executive directors and must meet at minimum 4 of the 9 following indicators; they must meet at least 2 of the first 3 criteria

・The director must not have been employed by the company in an executive capacity within the last year.

・The director or his/her family member did not accept any compensation from the Company or any of its subsidiaries exceeding US$60,000 in the last year, unless otherwise permitted by the US SEC 4200 clause.

・The Director's family members have not been employed by the Company or any of its subsidiaries as a senior executive.

・The Director is not a consultant of the Company or the management team and has no conflict of interest with consultants of the Company.

・The Director has no conflict of interest in the Company's main customers or suppliers.

・The Director has not entered into any service contract with other companies or their executives.

・The Director has no conflict of interest in non-profit organizations whose main sources of revenue are donations from the Company.

・The director must not have been a partner or employee of the company's outside auditor during the past year.

・The Director has no conflict of interest with the independent operations of the Board of Directors.

*2:Categorized by level 1 of the Global Industry Classification Standard (GICS Level 1).

*3:The number of directors less than the age of 50 is 6%, those 50-60 years of age is 47%, and those over the age of 60 is 47%; the average tenure is 4.93 years.

*4:Please refer to page 24-33 of the Company's Annual Report for detailed information on the Company's Directors and their independence determined in accordance with the standards of domestic regulations

Independence of directors and conflicts of interest prevention

"First Financial Holding Corporate Governance Best Practice Principles" clearly states that independent directors may not serve more than 3 consecutive terms in order to facilitate their objective use of authority and to prevent a reduction of their independence due to prolonged tenure; currently, all 5 independent directors have not served for more than 3 consecutive terms. Separate individuals, who are neither spouses or first-degree relatives, have been appointed as Chairman and President; furthermore, there are no instances of spouses or second-degree relatives between the directors.

"First Financial Holding Rules and Responsibilities of Independent Directors" provides clear terms stating "if independent directors have objections or reservations, they must be clearly documented in the board of directors meeting minutes", and "the Company may not obstruct, refuse, or avoid the execution of the independent director's duties. If an independent director finds it necessary when conducting duties, they may request the board of directors to assign personnel or independently hire a specialist for assistance, or request an internal audit to conduct special investigations or follow-up after the fact" to establish sound governance and system of independent directors, thereby allowing directors to express their function for the board and company operations.

Additionally, the Company's board of directors rules of procedure, the organizational rules of various functional (audit, remuneration, and integrity) committees, and managerial code of conduct include stipulations for directors or committee members to recuse from the discussion and voting of agenda matters in which individuals have personal interests or that which may harm the Company's interests.

Board Functionality

Evaluation of board performance

In order to implement corporate governance and to improve the operational effectiveness of the Board of Directors, the Company's "Board of Directors Performance Evaluation Guidelines" stipulate that the Board of Directors should conduct internal performance evaluation annually. Additional, evaluation shall be conducted by an external, professional, independent institution or a panel of external experts and scholars at least once every three years.

01. Internal performance evaluation results:

In 2024, the average score of the annual performance evaluation measurement indicators for the Board of Directors and individual directors was 4.93 points (top score being 5 and applicable hereinafter), and the evaluation result was "excellent"; The average score of the performance evaluation measurement indicators for functional committees was 4.95 points (the average scores for the Audit Committee, Remuneration Committee, and Ethical Management Committee were 4.97 points, 4.94 points, and 4.94 points, respectively), and the evaluation result was "excellent". On January 22, 2025, the evaluation results were submitted to the 8th meeting of the 8th Board of Directors for future reference.

02. Utilization of board performance evaluation results:

In accordance with the "Regulations for Evaluating the Performance of the Board of Directors", the Company's board performance evaluation results should serve as basis of reference for selecting or nominating directors; individual directors' performance evaluation results shall also be used as basis of reference for formulating individual remuneration.

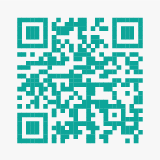

Training for directors

To improve directors' professional competence and to optimize their decision-making capabilities, the Company arranged a total of 132 hours of advanced core courses and professional courses for directors in 2024, per the Company's curriculum plan for directors' advanced studies.

According to the "Global Economic Crime Survey 2024" published by professional consultancy agency PricewaterhouseCoopers(PwC) in June 2024, "procurement fraud" has been among the top three most disruptive economic crimes experienced by companies globally in the past 24 months, just behind cybercrime and corruption. Upon evaluation, however, we found that the Company's procurement operations are relatively simple, and that the delineation of responsibilities and an educational training system against corruption have already been put in place. Therefore, the Company decided to focus on "cybercrime" as the theme of its directors' advanced studies in 2024, and organized two sessions of educational training in "Personal Information Protection Trends and Applications under the Development of Digital Financing" and "Trends and Patterns of Countermeasures against Money Laundering & Emerging Crimes". 41 of the Group's directors and 49 supervisors attended the training, respectively.

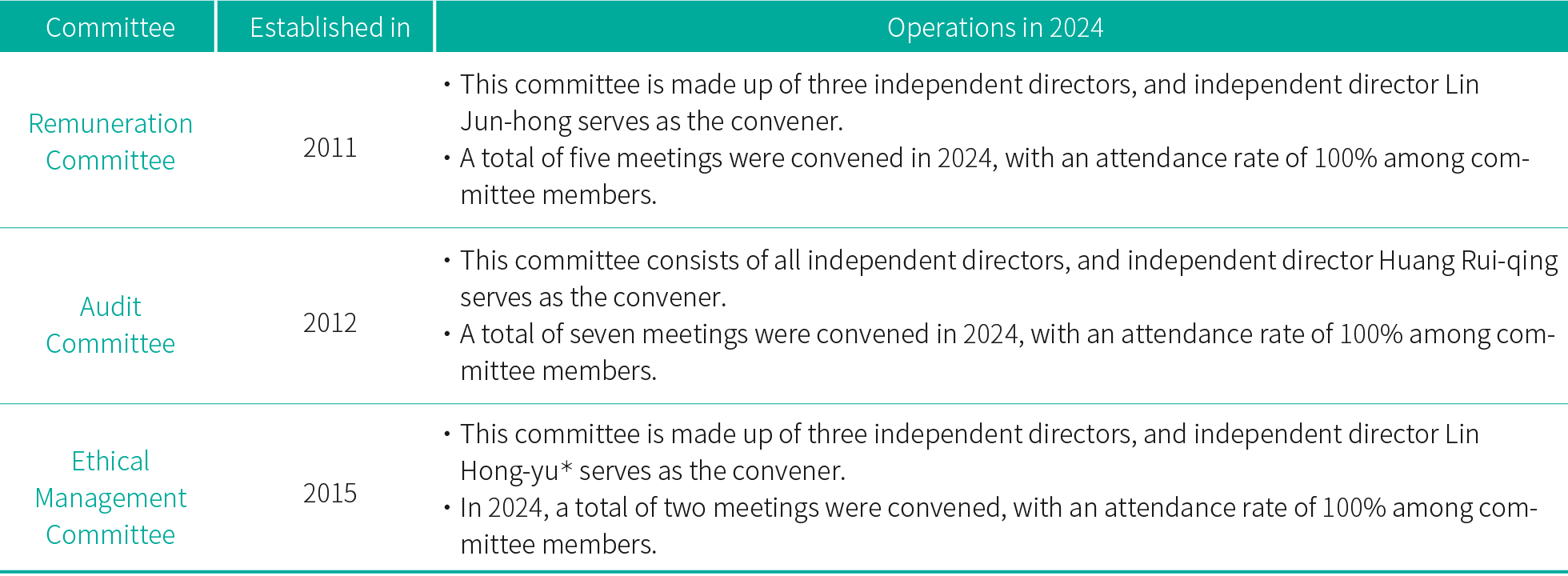

Functional Committees

To achieve sound supervisory functionality and to strengthen the management function, the Company's Board of Directors has progressively established functional committees made up of independent directors, including the "Remuneration Committee", "Audit Committee", and "Ethical Management Committee' since 2011. Each committee exercises its authority in accordance with its charter, in an effort to strengthen the Board of Directors' supervision over financial affairs as well as management over the remuneration system and ethical management.

*:Independent director Chen Yan-liang, convener of the third Ethical Management Committee, resigned on May 6, 2024. Therefore, a resolution was passed at the first meeting of the 8th Board of Directors on June 24, 2024 to entrust the selection of a successor to the fourth committee. Independent director Lin Hong-yu was approved unanimously in a committee meeting to become its convener on the same day.

Remuneration Policy

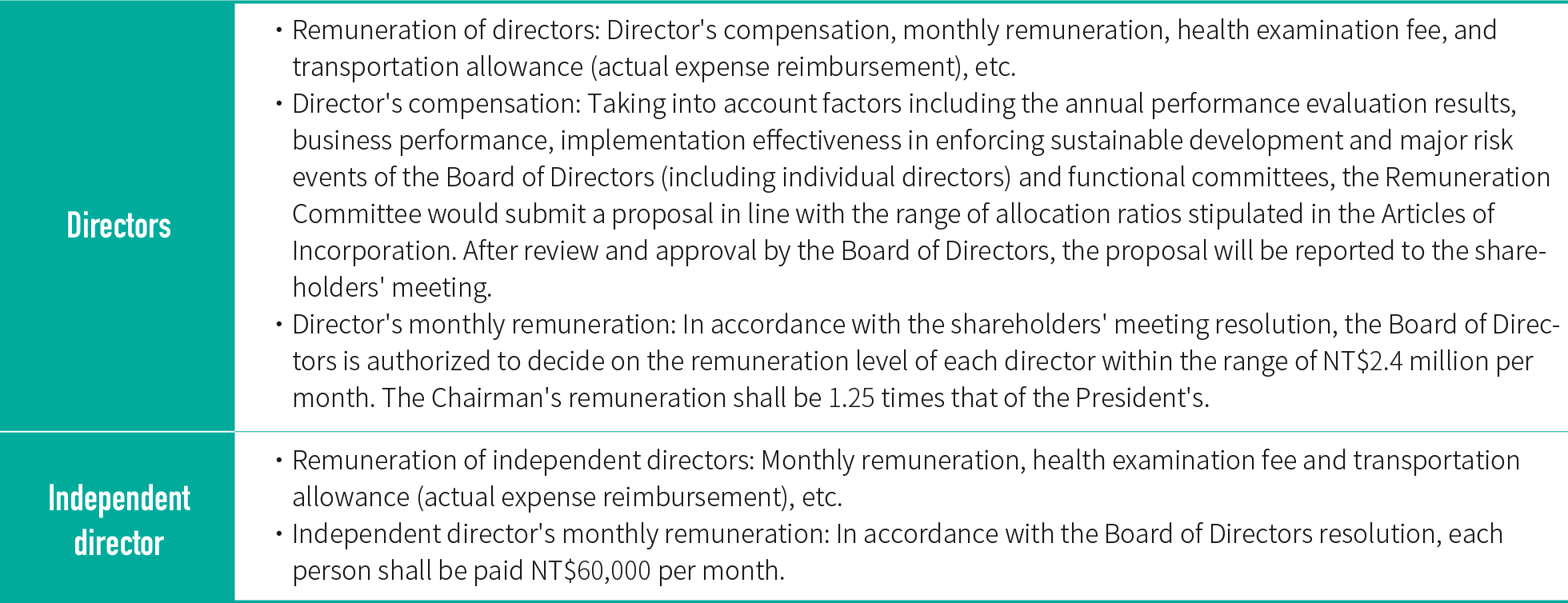

◎ Remuneration policy of directors (including independent directors) at First Financial Holding

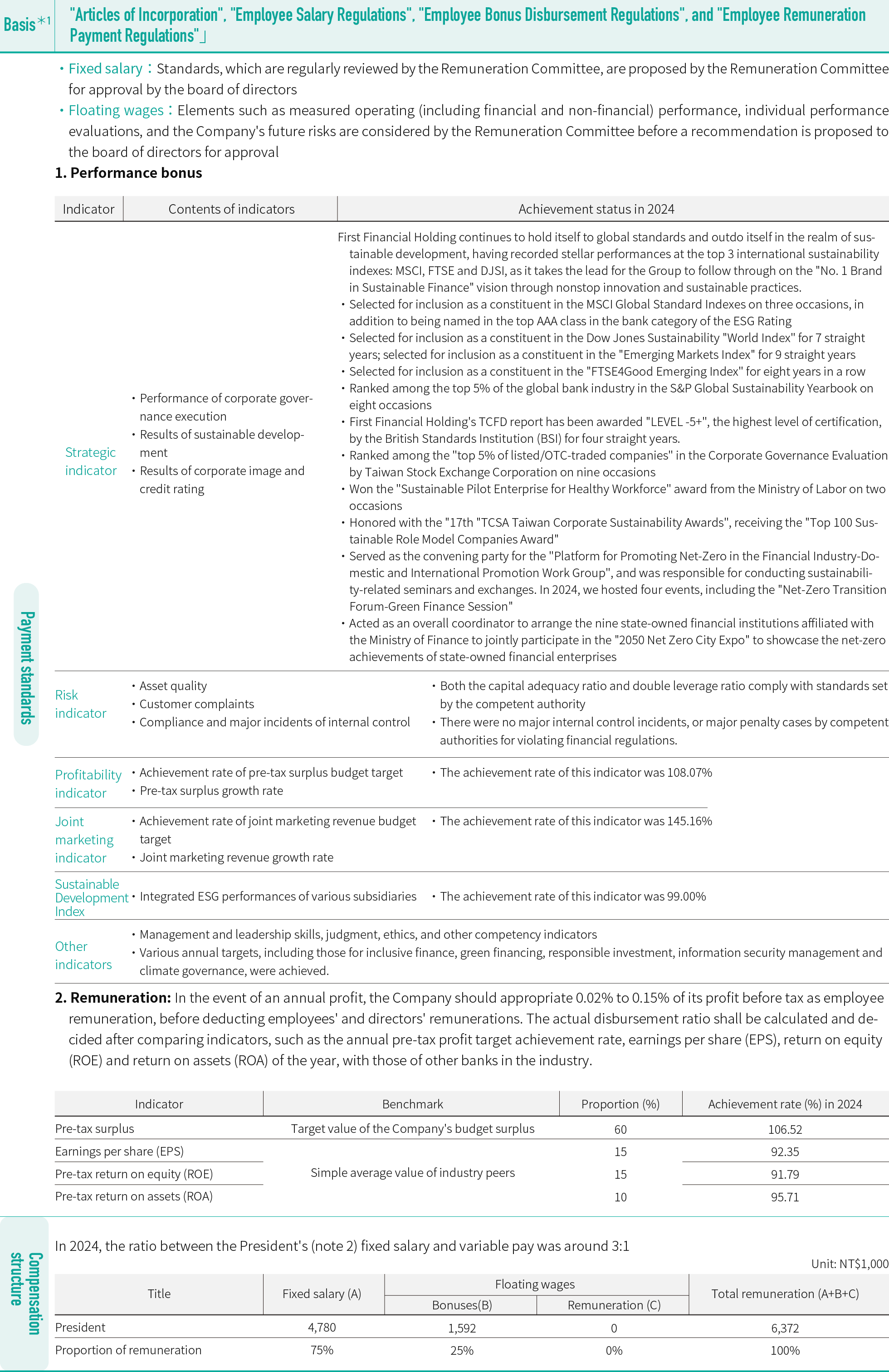

◎ President remuneration standards and approval procedures at First Financial Holding

*1:Formulation and revision of the payment levels of senior executives' (including those of the President) pay, bonuses and remunerations shall be proposed by the Remuneration Committee to the Board of Directors for review and approval.

*2:In 2024, the President's compensation (the Company's top salaried individual annually) was 3.29 times that of the average employee compensation (excluding the President; applicable hereinafter), and 3.89 times that of the median employee compensation. The rate of the President's compensation increase was 1.56 times that of the median employee compensation in terms of percentage points.

*3:All of the members of the Remuneration Committee were independent directors. Please refer to the company website for their independence.