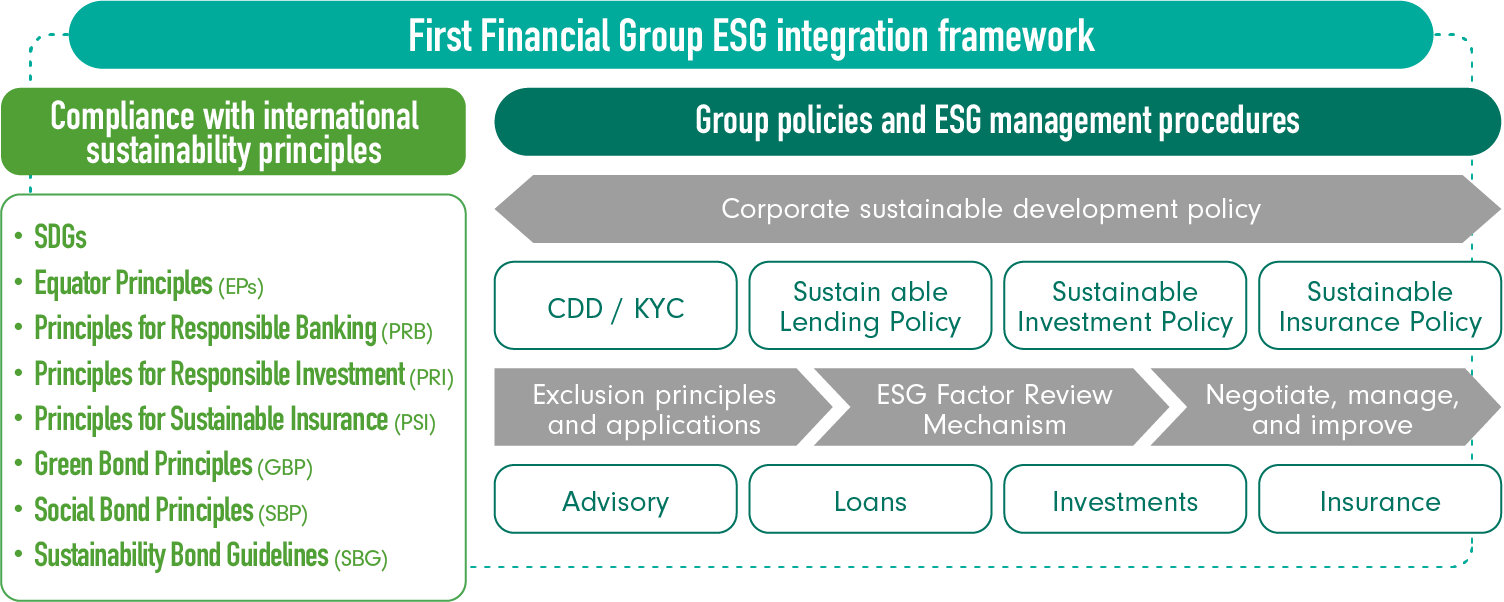

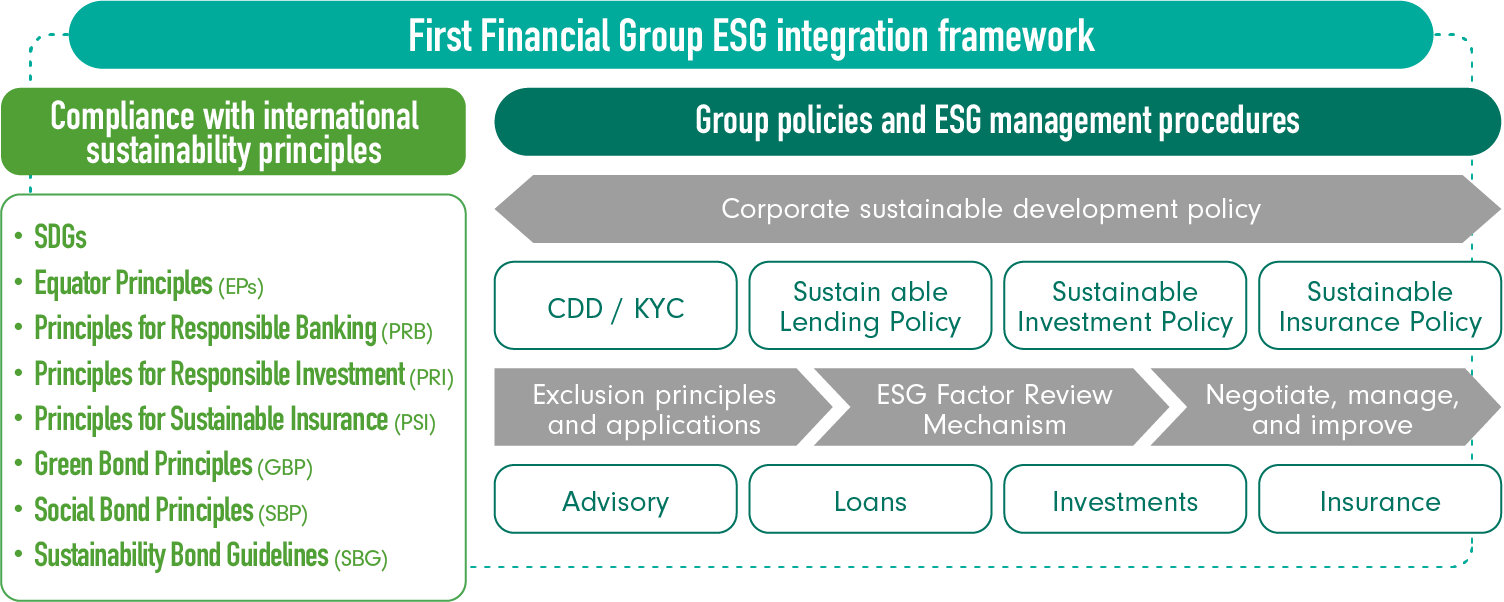

To realize the net-zero commitment of limiting the global temperature rise to within 1.5℃, financial institutions have implemented net-zero transition initiatives, strategies and governance systems, while demanding that their clients from both the investment and financing sides observe the same net-zero transition goals. The Group formulates sustainable credit, sustainable investments, and sustainable insurance policies in accordance with the "First Financial Holdings Sustainable Development Policy". The Group's ESG due diligence procedure encompasses all investment, financing, consulting and insurance operations, and it continues to advance its ESG Factor Review Mechanism. Apart from reviewing whether invested and financed enterprises have fallen short of the screening criteria for product sustainability, human rights, environmental protection, and major social controversies, it also has included industries dealing in coal and atypical oil and gas in the review. Additionally, the Coalition of Movers and Shakers on Sustainable Finance was formed with 5 major industry peers to reinforce the negotiation mechanism for enterprise investments and financing. If an enterprise seeking investments or financing is in major violation and fails to submit an improvement plan after negotiations, investment and financing positions will gradually decrease. We actively guide our customers to focus on issues of sustainability in hopes of achieving the 2050 net-zero emissions goal together.

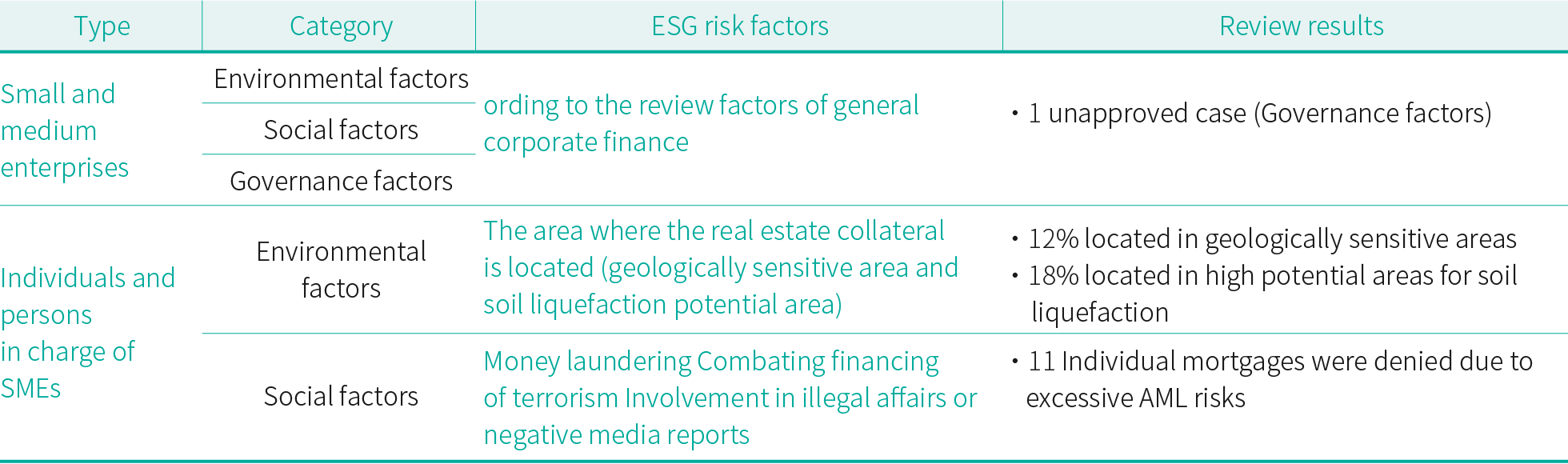

Uphold the sustainability commitment, the Group requires all domestic and offshore fund companies to sign the compliance statement for the "Stewardship Principles for Institutional Investors" and the "Principles for Responsible Investment (PRI)" before the launch of a new product. Insurance companies of the launched products are also 100% prepared "Sustainability Report" or "Sustainable Development Commitment" to protect the rights and interests of customers and beneficiaries.

Corporate Banking / Investment Business

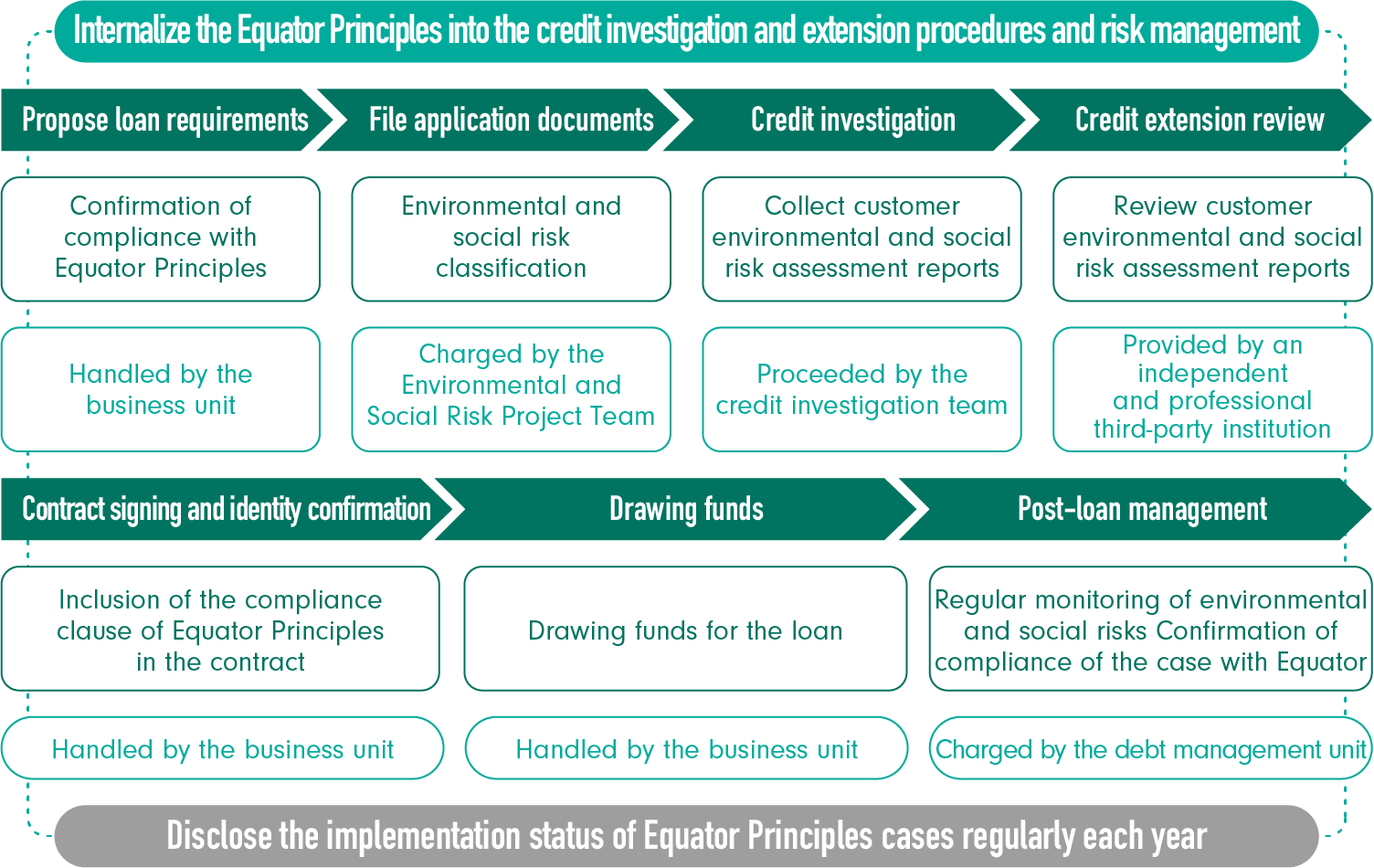

◎ Equator Principles

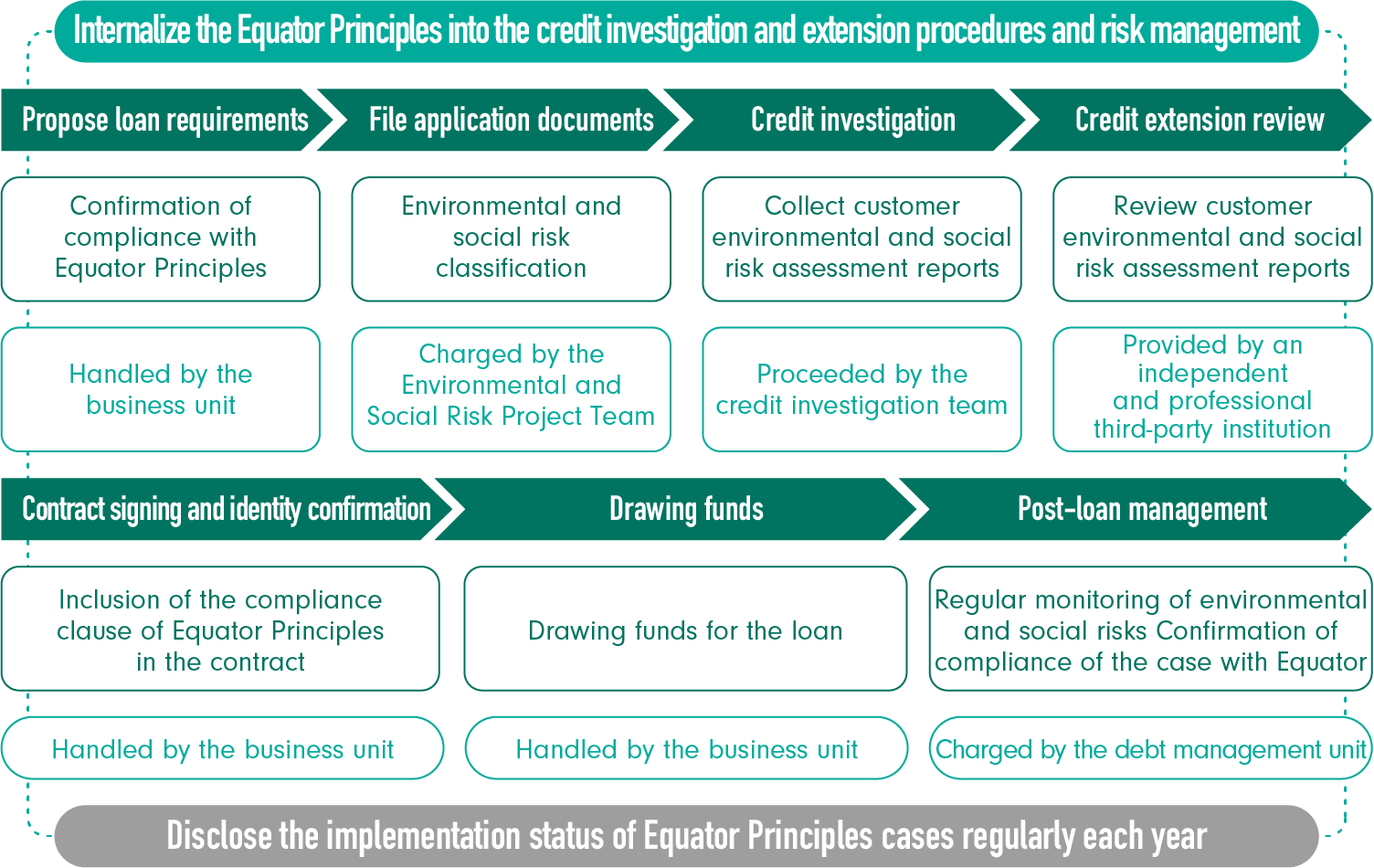

The subsidiary First Commercial Bank has also signed up to official join the Equator Principles Association on December 21, 2020, becoming its 114th member bank globally. It also promulgated and enforced the "Operation Directions on Credit Cases Applicable to the Equator Principles" on January 6, 2021. In compliance with the Equator Principles, the Bank must determine the applicability of the Equator Principles based on the amount and purpose of each case before accepting financing applications from all corporates. For applicable cases, a dedicated "Environmental and Social Risk Project Team" would be formed by the business, review, post-loan management and other units, which are put in charge of risk classification. In addition, based on the "Environmental and Social Risk Assessment Report" and "Environmental and Social Monitoring Report" issued by an independent and qualified third-party institution, First Commercial Bank will conduct environmental and social risk reviews and post-loan monitoring to confirm that undertaken cases align with the guidelines of the Equator Principles. In doing so, we could adequately reduce potential credit risks and leverage the financial industry's influence to support sustainable development for environment and society.

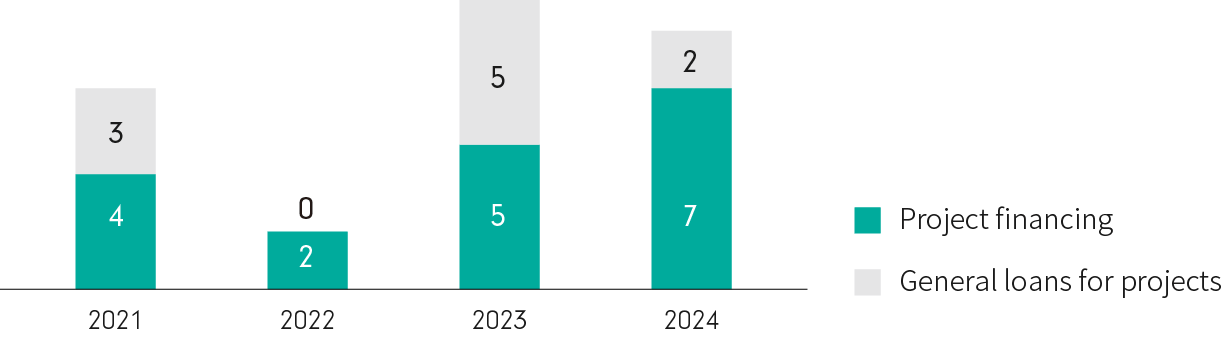

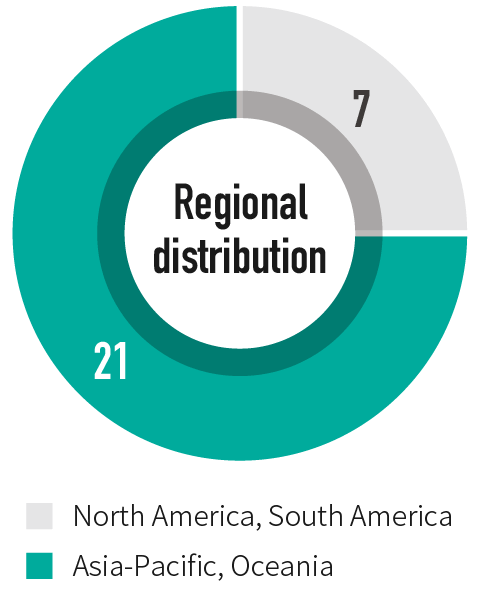

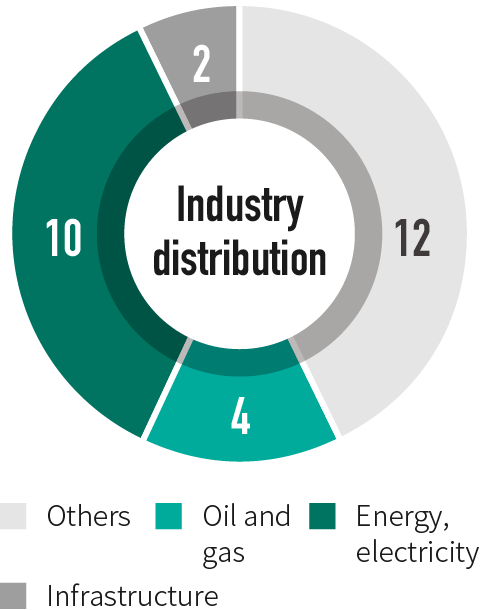

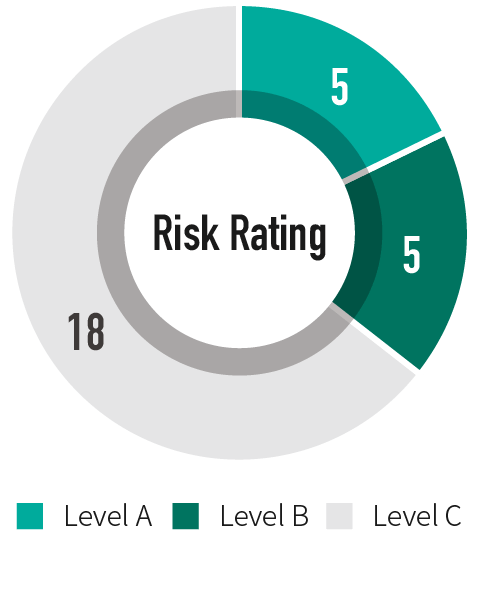

First Commercial Bank approved a total of 28 credit cases applicable to the Equator Principles between 2021 and 2024. Locations of these cases were mostly the Asia-Pacific region (Taiwan), with energy, electricity and oil and gas being the predominant industries. In 2024, one case failed to be approved, which was an energy storage system installation project. In view of market needs and future operations, we decided to defer our discussion on the case.

◎ Number of Equator Principles cases from 2021 to 2024Unit: Case

◎ 021-2024 Equator Principle CasesUnit: Case

Case Study :

Power supply industry/syndicated loan for rooftop (indoor farming type) solar-aquaculture project 3rd party institute: WSP International

In 2024, First Commercial Bank co-sponsored a syndicated loan for a rooftop (indoor farming type) solar-aquaculture project. The project site is in Yizhu Township, Chiayi County. The installation capacity is around 120 MW. The land near the project site is mostly fish farms and idle fish farms now, and is not part of any ecologically sensitive areas. Nor is it part of any cultural property/heritage conservation areas or indigenous reservations. An environmental impact assessment waiver has been obtained from the Ministry of Environment. An "environmental and social due diligence report", issued by an independent third-party institution, has also been obtained. According to evaluation, the project has limited impact on environment, and was rated as a grade C case by the lead bank of the syndicated loan.

With respect to potential environmental pollution and impact, the borrower has put in place an operations management plan, a contingency plan, and an "environmental safety & sanitation management plan". Initial identification was also made with respect to EPC vendors, safety hazards of the construction environment and environmental risks. Countermeasures include regular sprinkling to prevent dust emissions, adoption of low-noise construction machinery, avoiding nighttime construction, and installing temporary interceptions, drainage systems and silt basins, etc. Additionally, to protect the rights of all stakeholders, the project provided a dedicated contact person and set up a grievance mechanism, in addition to holding pre-construction orientations to elaborate on details such as location of the construction site, development configurations, environmental impact, access plans and construction timeline, in order to ensure a smooth communications channel.

As part of the agreement of this syndicated loan, the borrower should ensure that related environmental protection, pollution prevention and waste disposal must conform to regulations at all times. The project shall not involve incidents in violation of corporate social responsibilities with conspicuously adverse impact, including, but not limited to, incidents involving labor rights protection, environmental preservation and consumer protection. Moreover, the project must also align and comply with various guidelines and requirements of the Equator Principles, including, but not limited to, providing an annual Equator Principles Report issued by an independent third-party institution, which would be used by the bank consortium to review and ascertain if the borrower has developed improvements or action plans necessary to complete this project during the credit period.

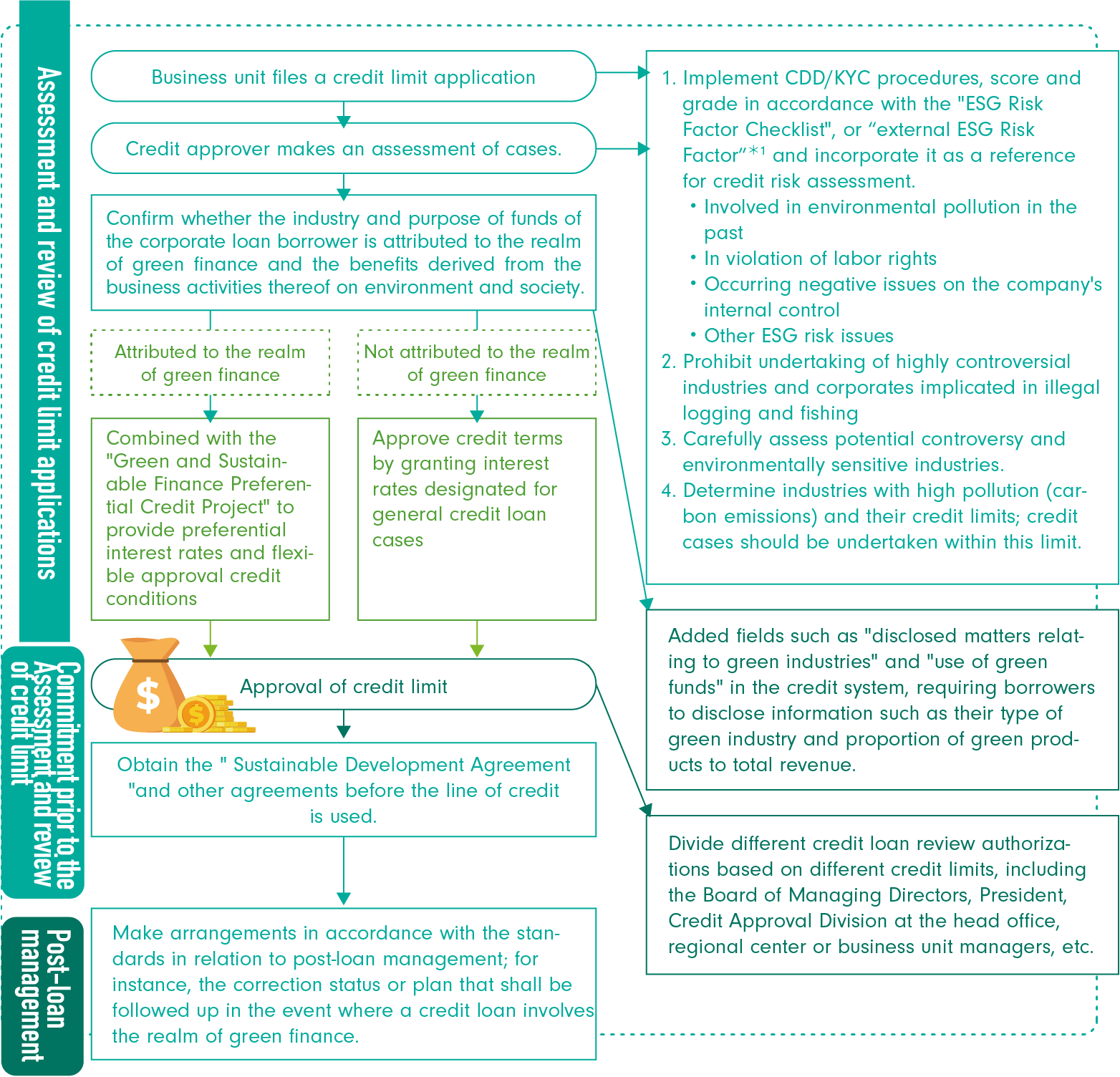

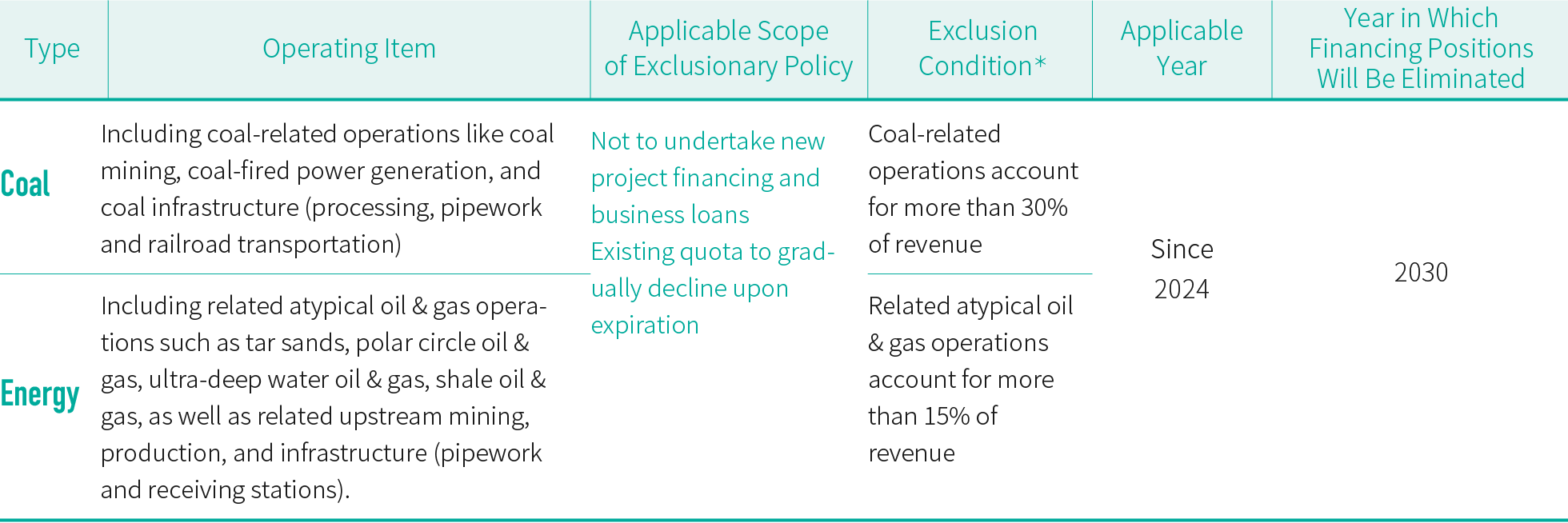

◎ Lending / Due diligence

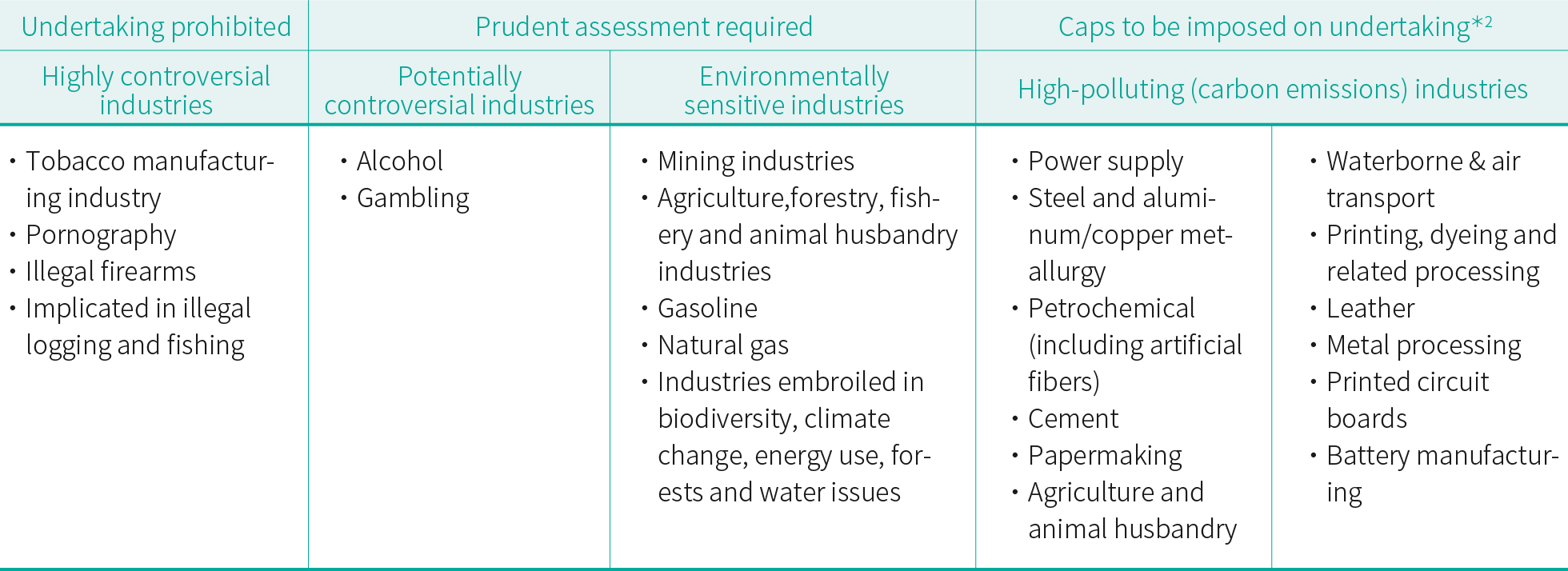

First Commercial Bank practices responsible finance to evaluate whether enterprise borrowers fulfill their responsibilities in environmental protection, social responsibility, and ethical management as key criteria of financing. We continue to advocate ESG review mechanisms to credit examiners through meetings related to risk management; the three stages of reviewing applications for line of credit, commitments prior to credit allocation, and post-loan management are as follows:

*1:Applicable to cases at the level of the Executive Board and above.

*2:Credit extended to these industries shall not exceed 13% of the Bank's total credit extension in 2024.

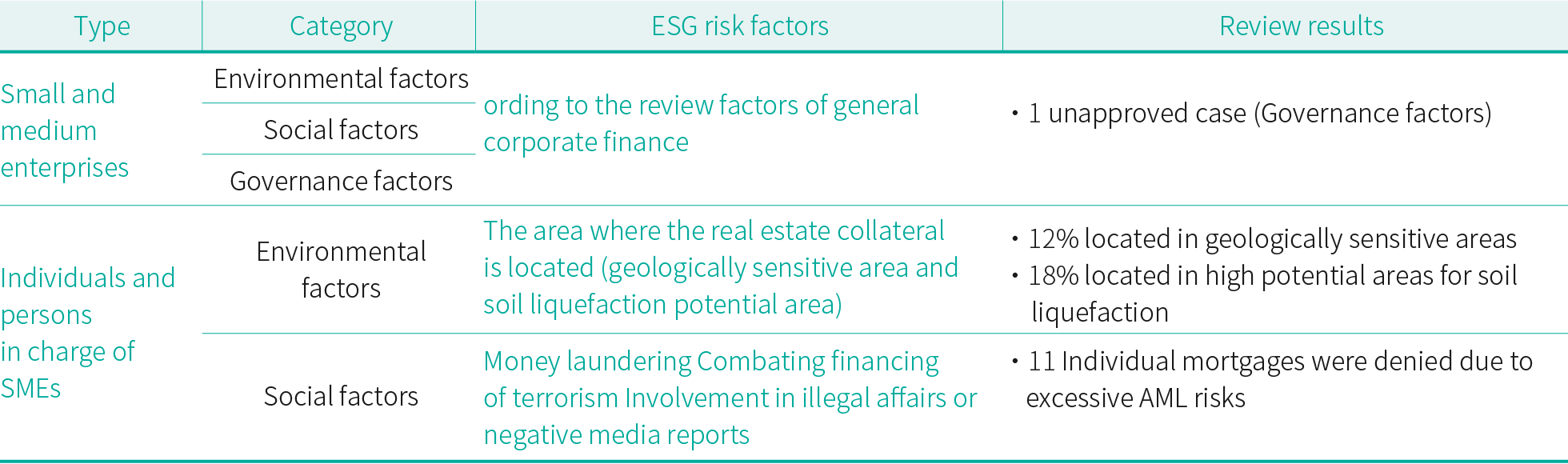

Practice procedures such as Client Due Diligence (CDD) and Know Your Customer (KYC) in business dealings and utilize the "ESG Factor Checklist" to separately review borrowers for their ESG related risks, conduct scoring and grading, and incorporate them into credit risk assessment. If customers have previously engaged in environmental pollution, infringement of human rights/labor rights, suffered negative allegations within the company, and other ESG controversies, negotiations shall be conducted with the customer immediately to clearly state their current handling or improvement plan during credit limit application. The credit examining unit shall modify restrictive conditions based on the severity assessment of hazards; if involvement in ESG risk factors cannot be eliminated or improved, the loan should be refused to fulfill the finance industry's social responsibility.

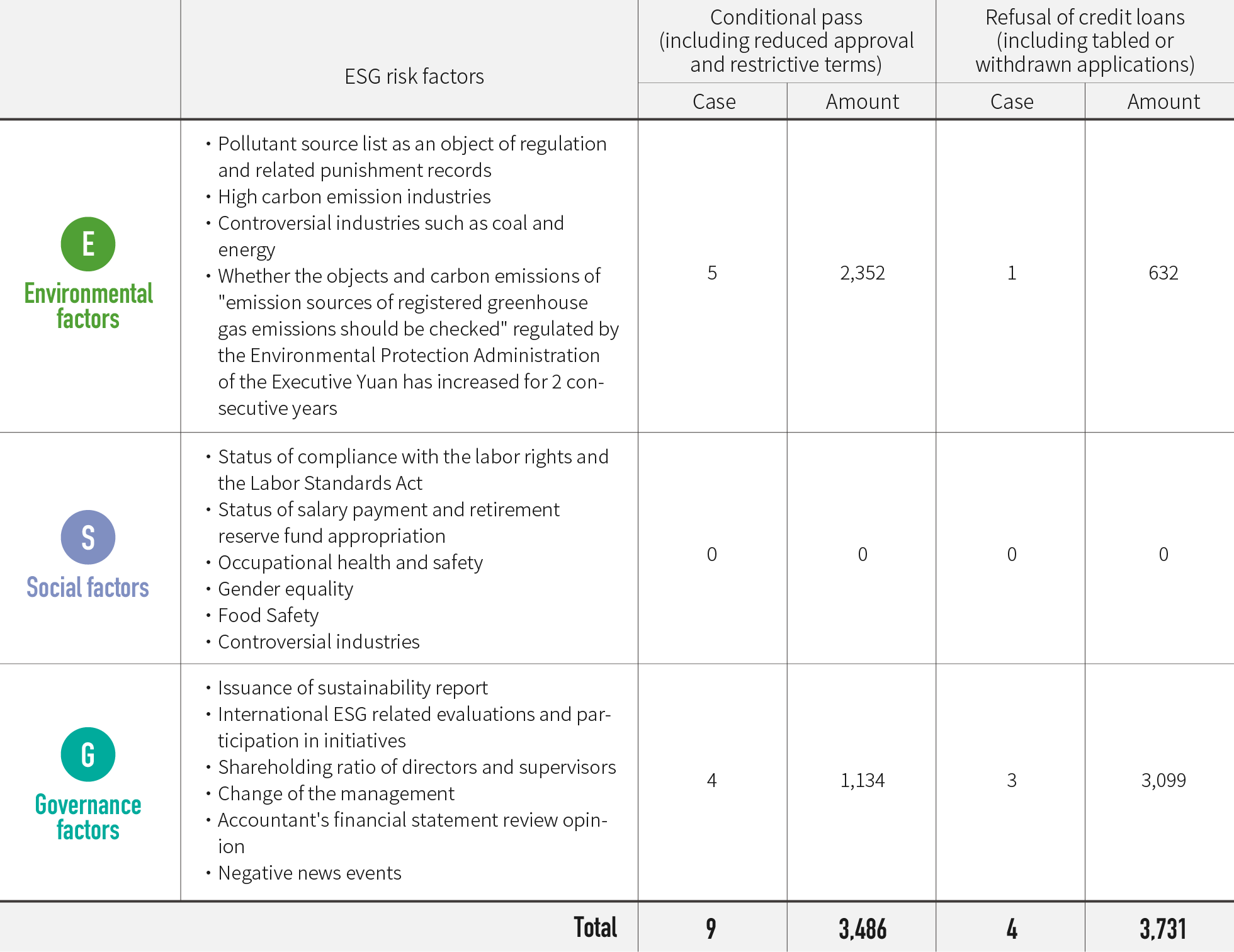

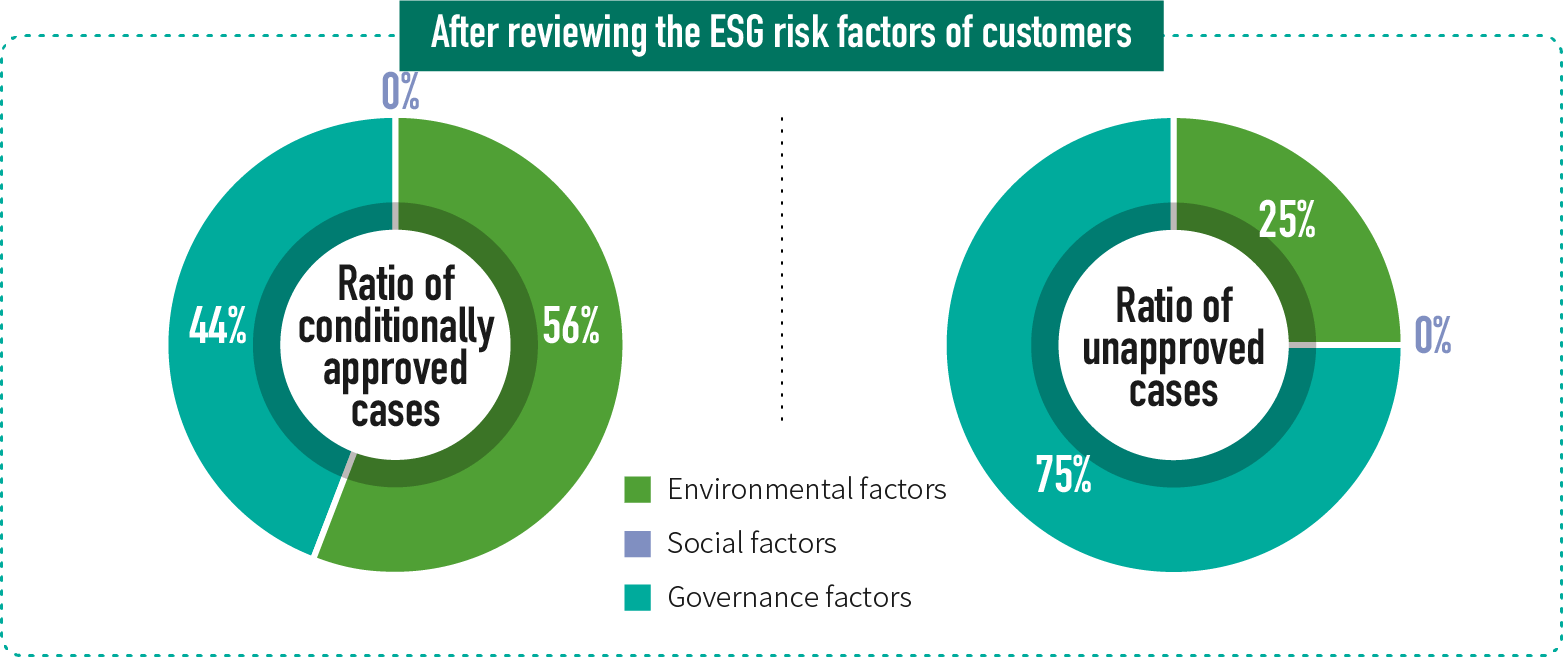

As of 2024, ESG has been included in the loan decision review process for 100% of enterprise credit loans with a total of 13 cases that received "conditional approval" (e.g.: loan amount decrease or increased interest rates) or "rejected" due to ESG risk factors as described in the following:

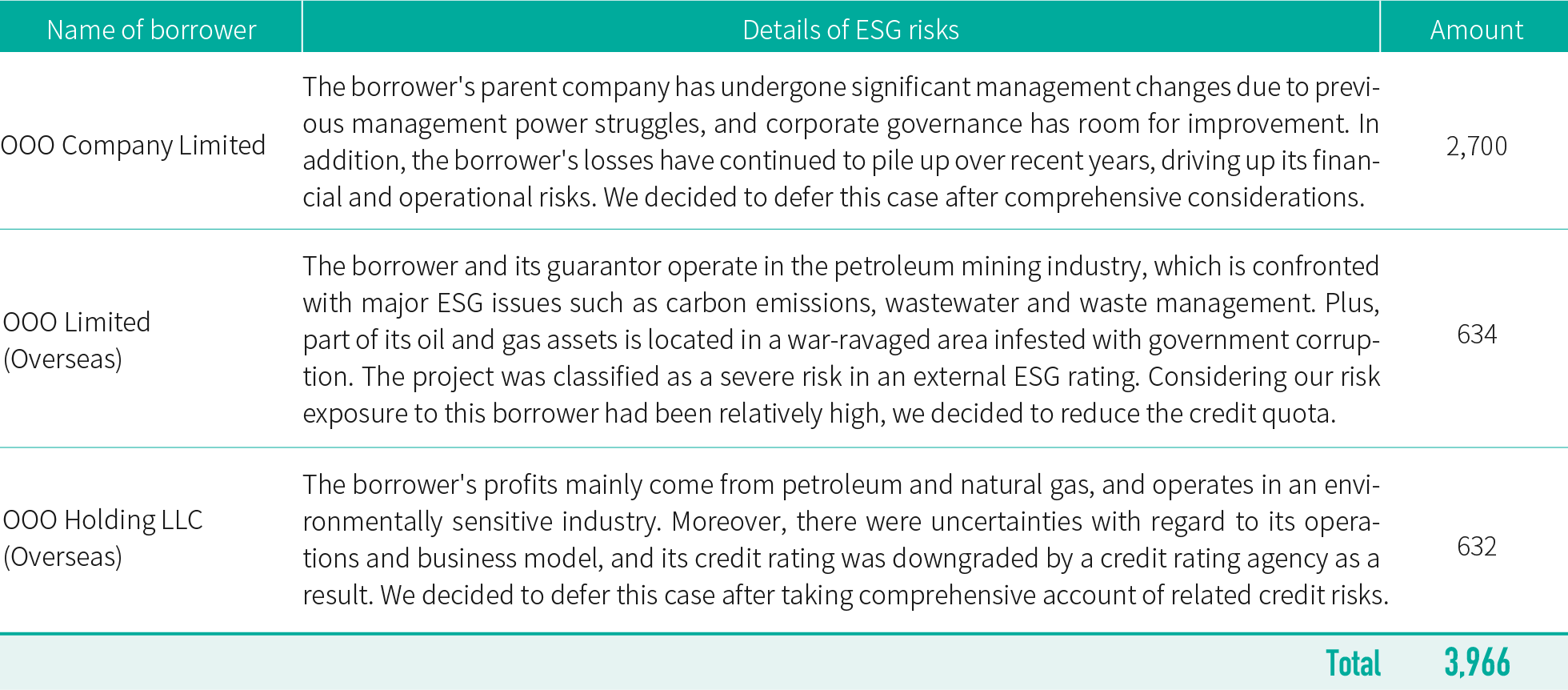

Cases that were conditional approved or not approved due to ESG risk factors identified by the reviewers, the following are the top three borrowers based on the amount:

To guide our borrowers to implement sustainable development, we actively urge our domestic customers to value sustainable development, and ask our borrowers to present their letters of commitment for sustainable development. We also urge our overseas customers to abide by local environmental laws and human rights regulations. In 2024, First Commercial Bank, FCB Leasing and First Financial AMC successfully collected letters of commitment for sustainable development from 99.9% of their borrowers.

◎ Sustainable Development commitment signed by domestic and foreign borrowers over recent yearsUnit: no. of borrowers

*:Includes the Declaration of Sustainable Development obtained by First Bank, FCB Leasing, and First AMC.

In 2024, to realize the investment/financing negotiation commitments of the Coalition of Movers and Shakers on Sustainable Finance, the Group even compiled a list of the top 60% financial carbon emitters from all of its domestic investment/financing positions by the end of 2023. For the financing part, First Commercial Bank prioritized negotiations with potential borrowers willing to sign letters of commitment for sustainable development (negotiation version). As of the end of 2024, 80.88% of potential borrowers had completed their negotiations.

For the purpose of strengthening the post-loan management and fulfilling the responsibility of being a financial institution for environmental protection and social sustainability, First Commercial Bank finds out whether the operations of early warning cases of borrowers who have been punished by government environmental protection agencies for violating environmental protection laws violate ESG principles and proposes improvement measures to these borrowers. In 2024 there are a total of 1 cases that meet the early warning signal of "those who violated environmental protection laws and regulations were punished by government environmental protection agencies", and the customer has been continuously tracked to determine if they have complied with the environmental protection authority's request to obtain a permit for waste disposal. In addition, if the borrower's loan is suitable for the purpose of green financing, the verification of the actual use of the fund after the review operation will be strengthened. If it is discovered that circumstances of environmental pollution are in violation of ESG principles, it shall be stated in the review opinion as a reference for future credit limit review. After review conducted by reviewers in 2024, no such matters have occurred.

◎ Responsible investment

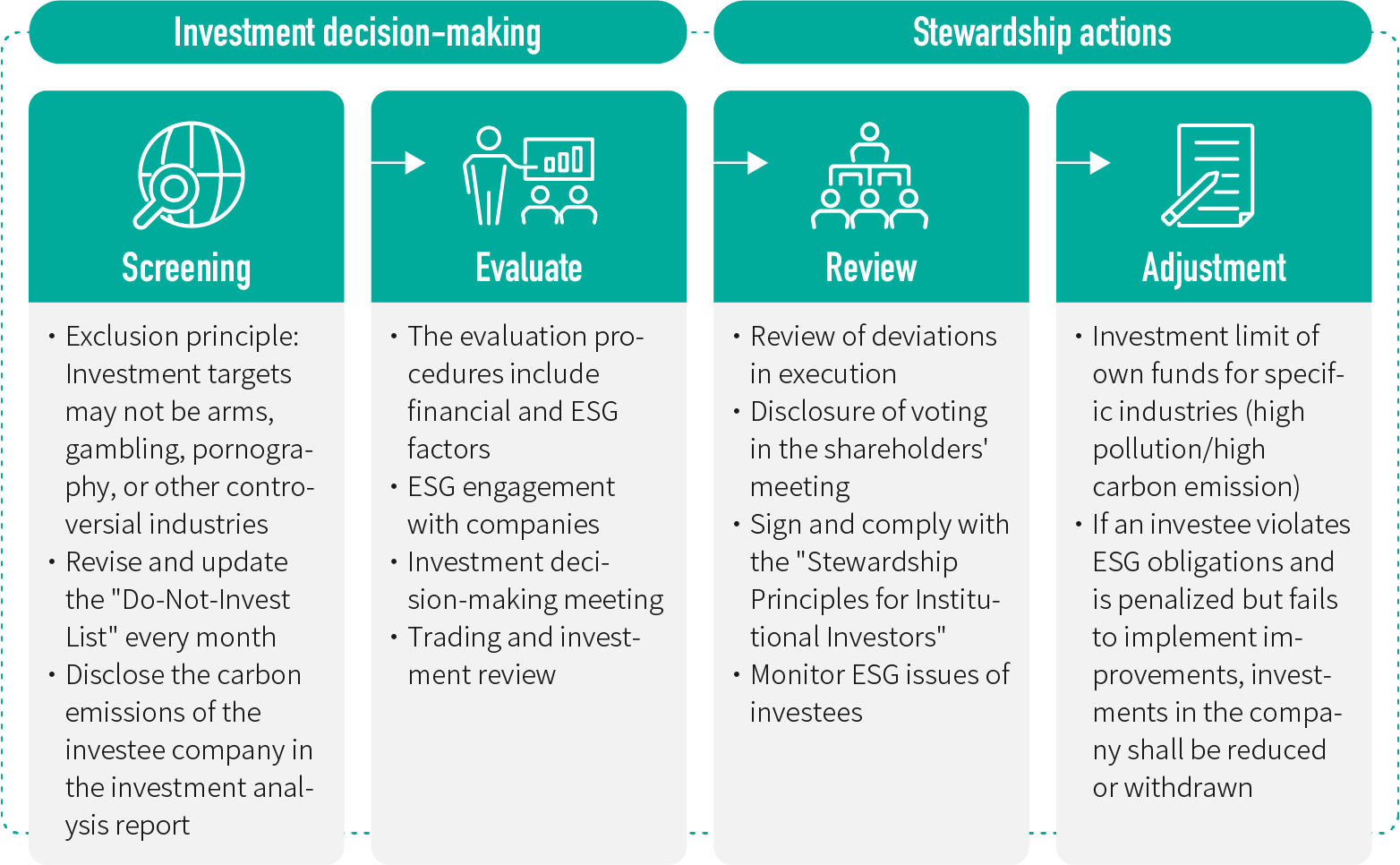

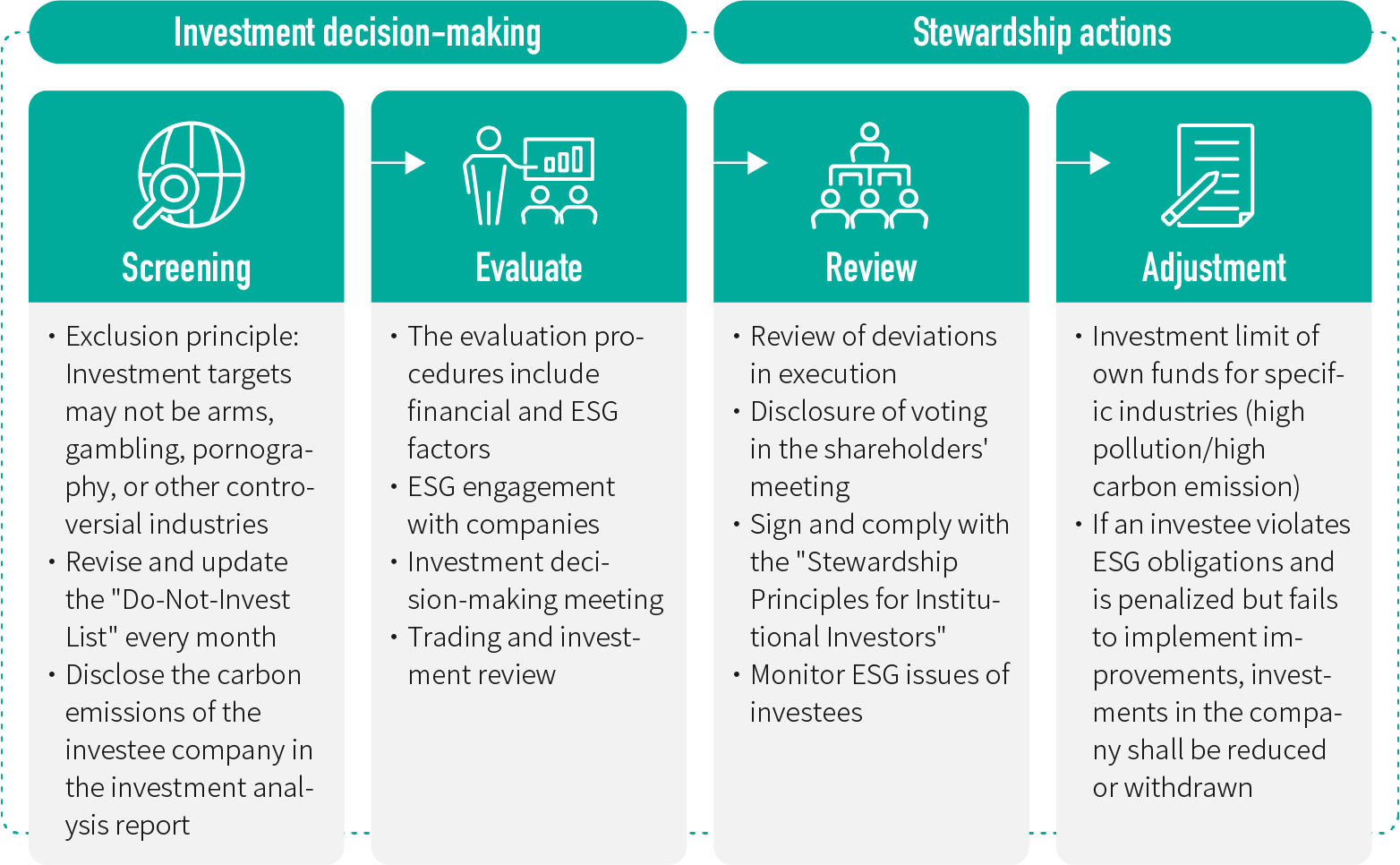

First Financial Group establishes standard evaluation procedures for responsible investment, abides by the Stewardship Principles, complies with related regulations, and fulfills fiduciary duties as an asset manager to maximize interests for beneficiaries and shareholders.

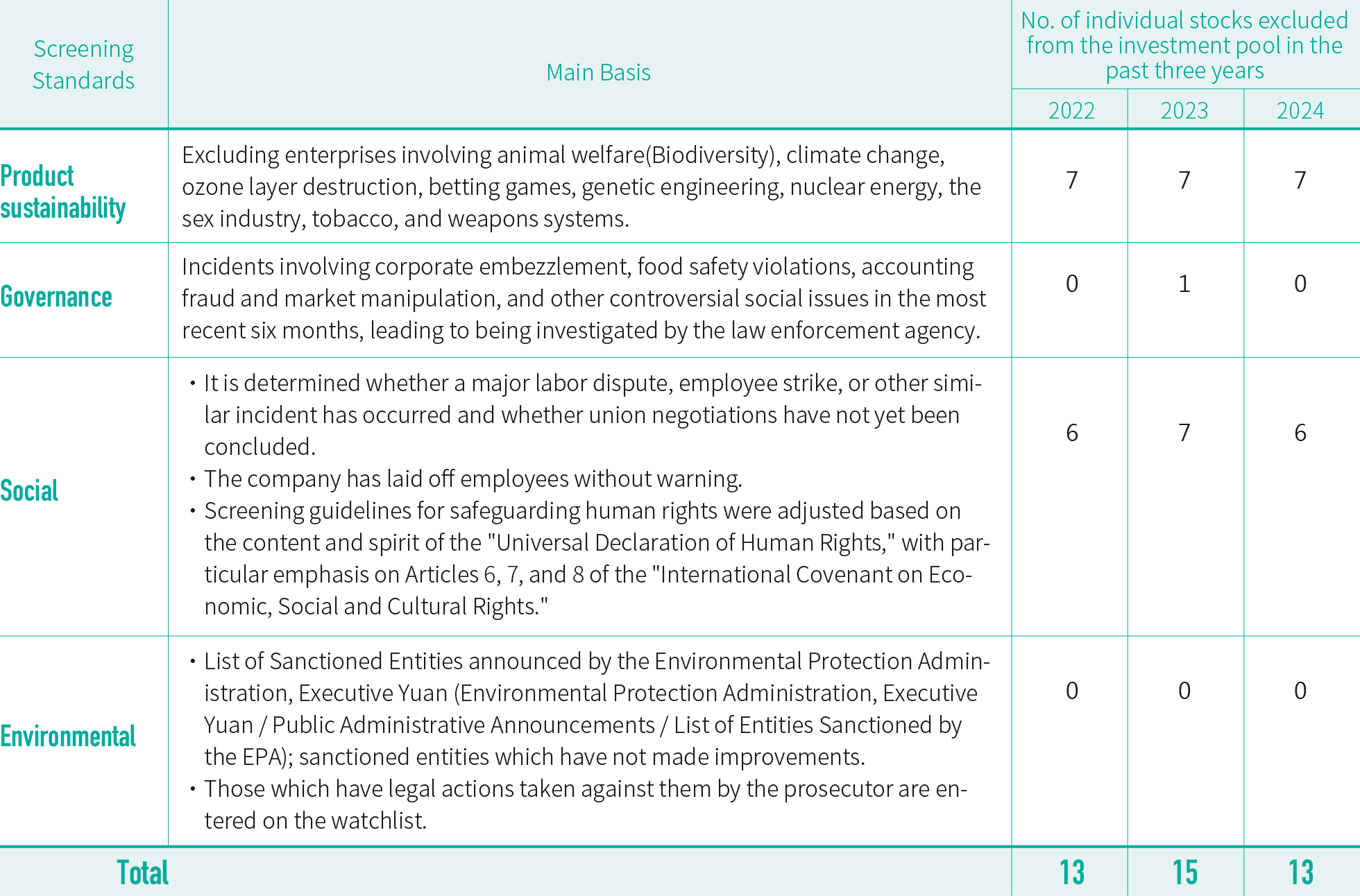

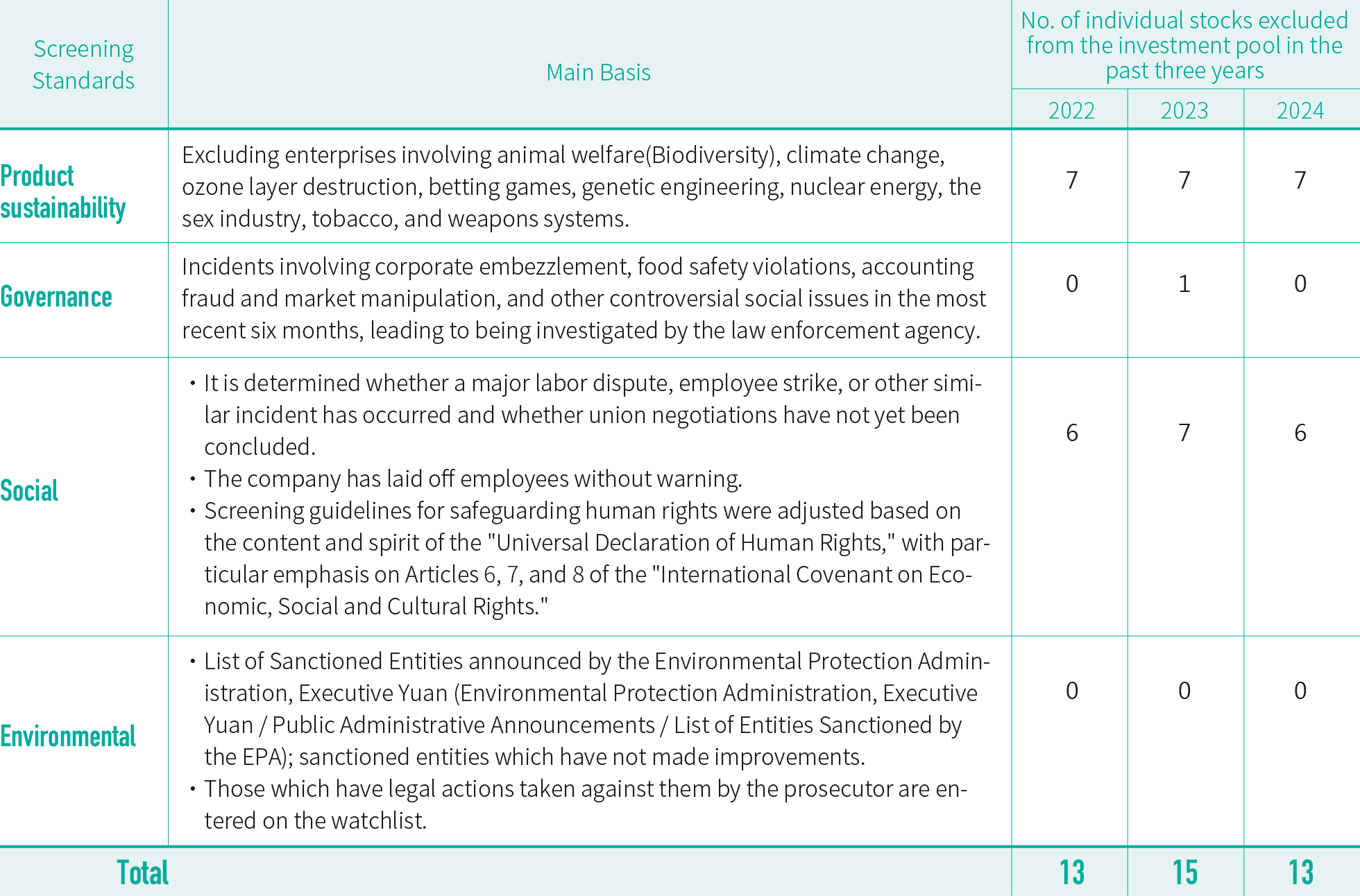

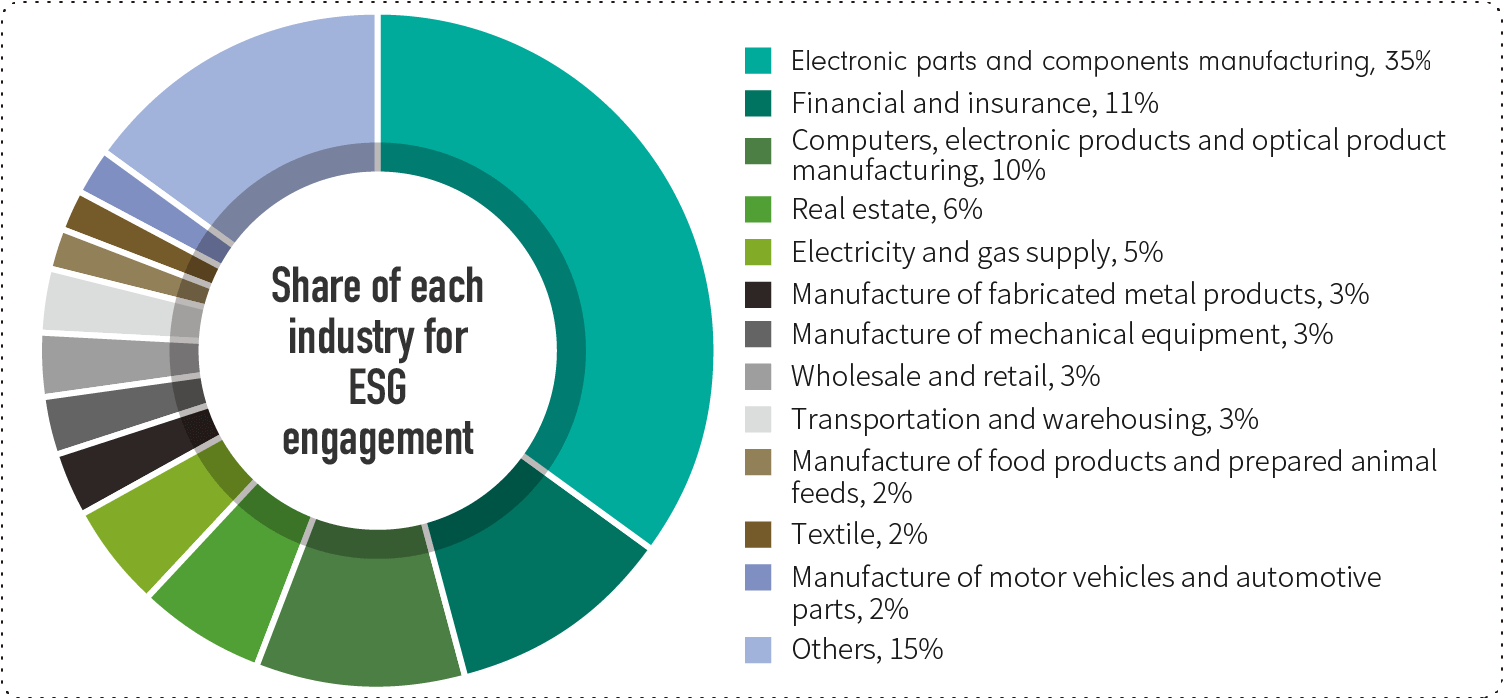

First Capital Management has revised and updated the "Do-Not-Invest List for Sustainable Development Violations" every month. It continuously reviews investees based on product sustainability, governance, social, and environmental criteria. Any company that is found to have engaged in conduct which is not in the spirit of sustainable development is added to the do-not-invest list. We fine-tuned our screening guidelines for social factors to better safeguard human rights based on the content and spirit of the "Universal Declaration of Human Rights," with particular emphasis on Articles 6, 7, and 8 of the "International Covenant on Economic, Social and Cultural Rights." The number of companies included in the do-not-invest list from 2022 to 2024 were 13, 15, and 13 companies, respectively. The list was provided to First Financial Holding, First Bank, First Securities, First Securities Investment Trust, First Life Insurance, and First Venture Capital for reference purposes. In 2024, the invested stock pool of the 6 domestic funds (small, innovative trends, electronics, core strategic, storefront, and balanced China) of FSITC did not include stocks from the "non-investment list of companies that violate sustainable development". Additionally, 88.3% of companies in the stock pool of domestic funds compiled their own sustainability reports.

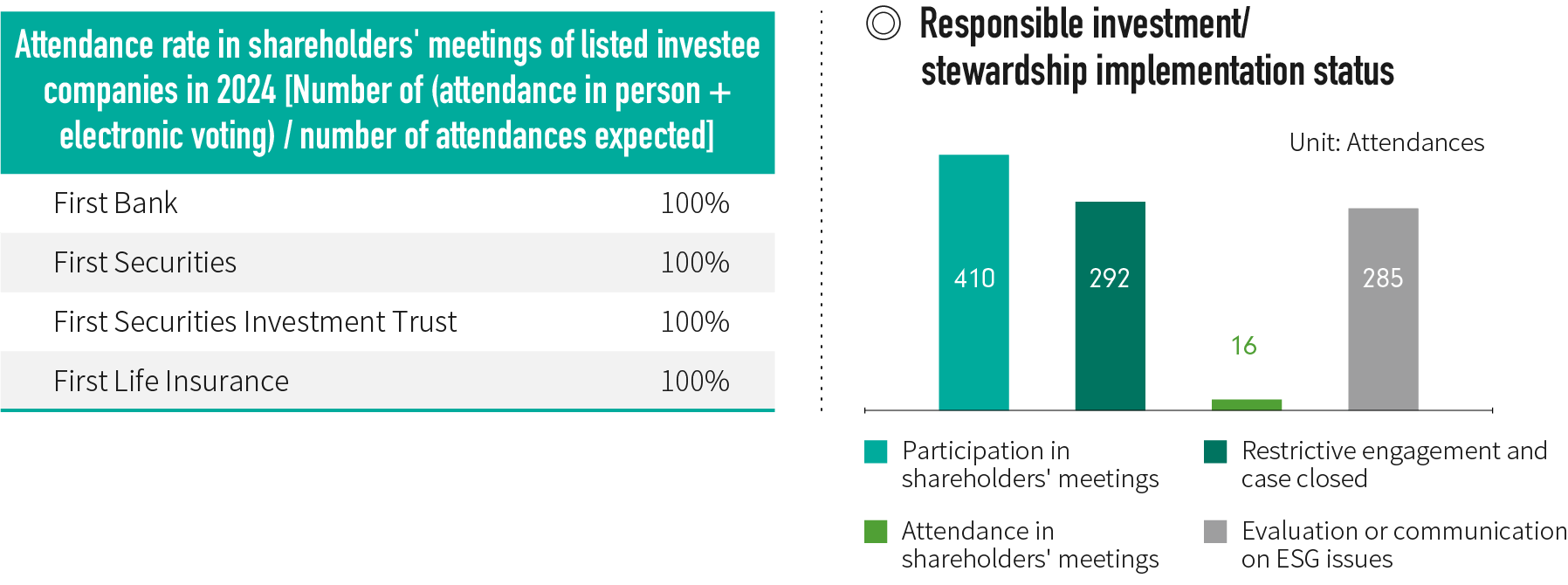

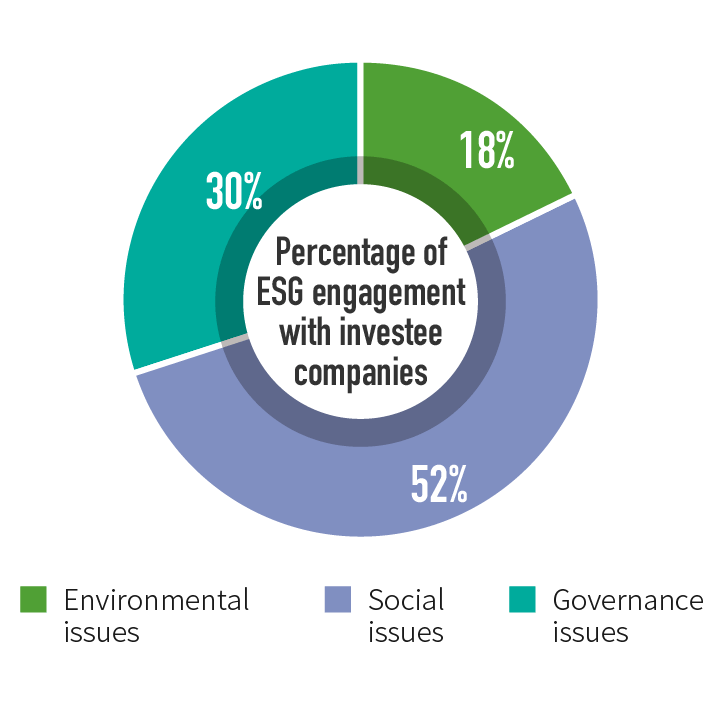

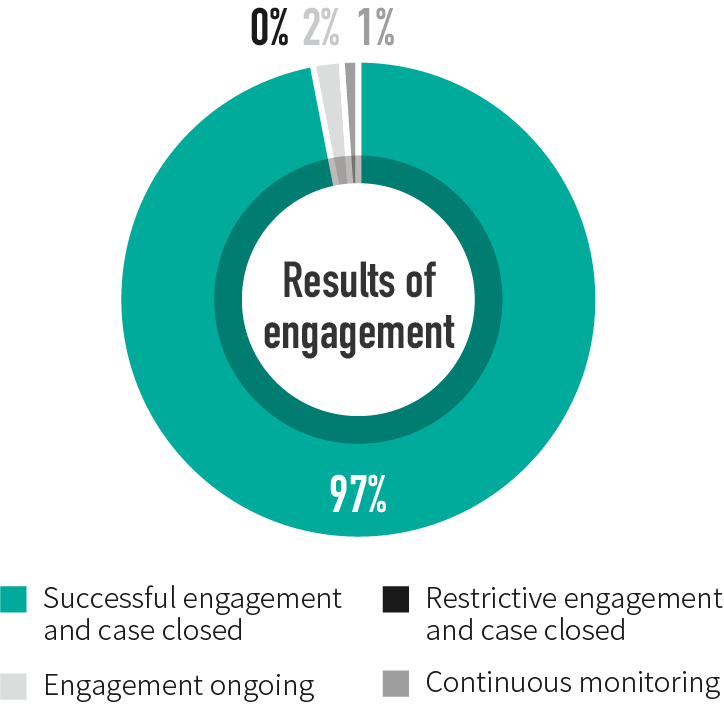

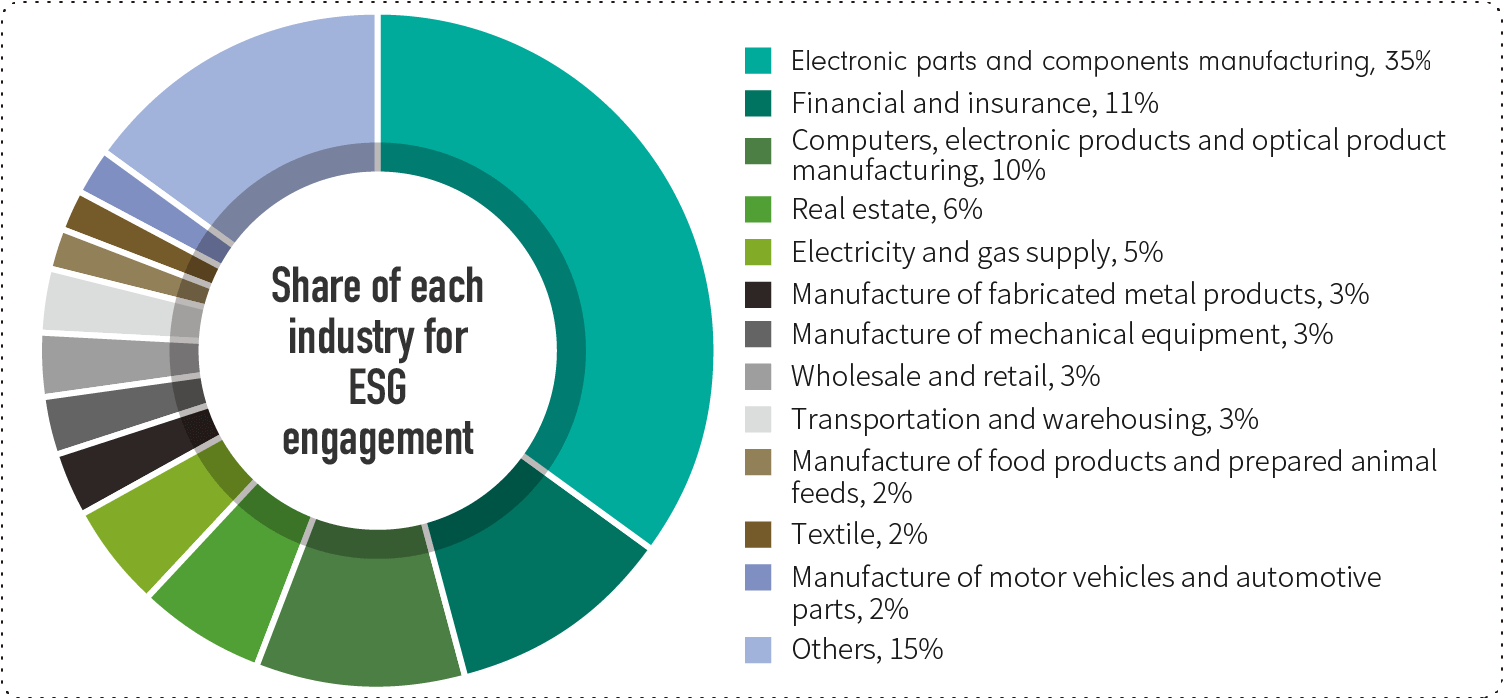

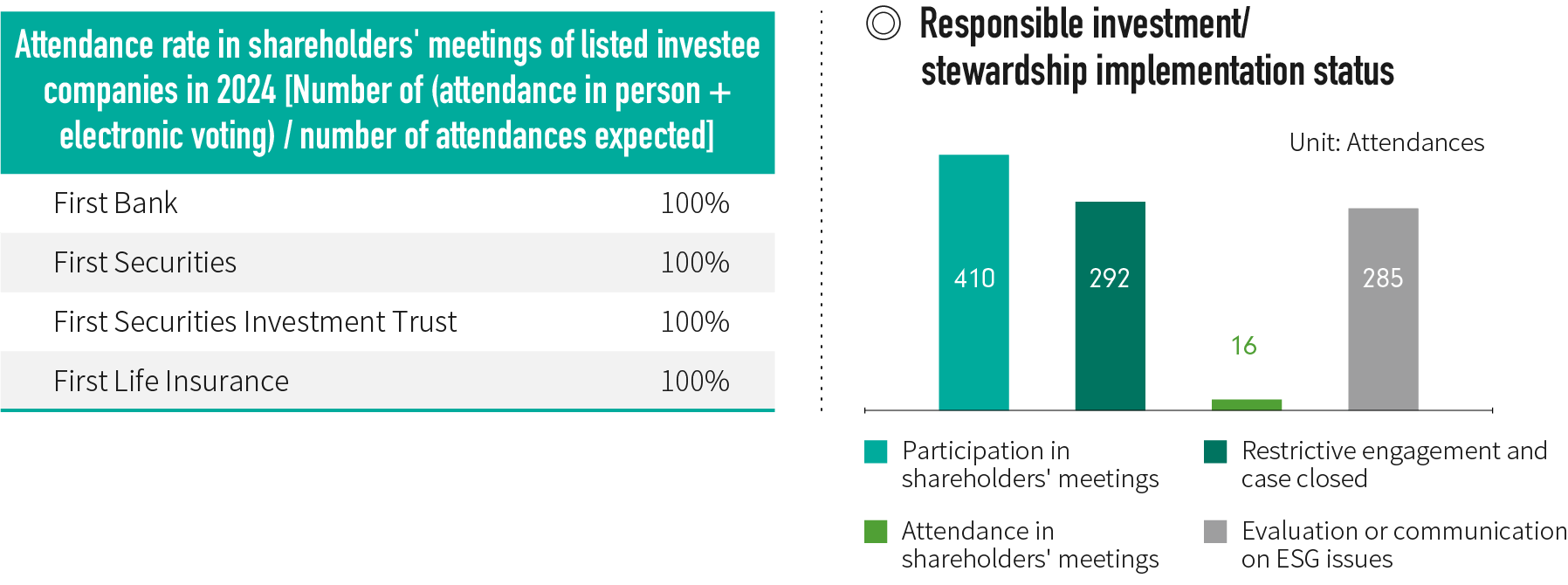

To better fulfill the responsibilities of an asset owner or manager, and to increase long-term value for the Group and fund providers, the subsidiary bank, securities company, investment trust company and life insurance company have all signed the "Stewardship Principles for Institutional Investors" compliance statement, and the status of their stewardship fulfillment is disclosed on each company's website. In 2024, both First Commercial Bank and First Securities made the TWSE's "list of companies with better institutional investor stewardship disclosure". With respect to investment targets identified as being in the top 60% for financial carbon emissions among the Group's domestic investment/financing positions at the end of 2023, First Commercial Bank inquired these investment targets about their action plans for climate change risks, net zero emissions and concrete carbon reduction goals through prompting them to sign a letter of commitment for sustainable development, distributing questionnaires, giving speeches at shareholders' meetings, as well as letter correspondence with them. We have already obtained their commitment. Furthermore, FFHC has also actively participated in the CDP's engagement programs. With the help of the international advocacy organization, we can jointly distribute questionnaires about risks associated with changes to the climate and natural environment, in order to increase engagement effectiveness. As of the end of 2024, the rate of successful engagement had reached 82.4%, as we lived up to our commitment to the "Coalition of Movers and Shakers on Sustainable Finance" in terms of investment/financing engagement.

Retail Banking / Individual Finance

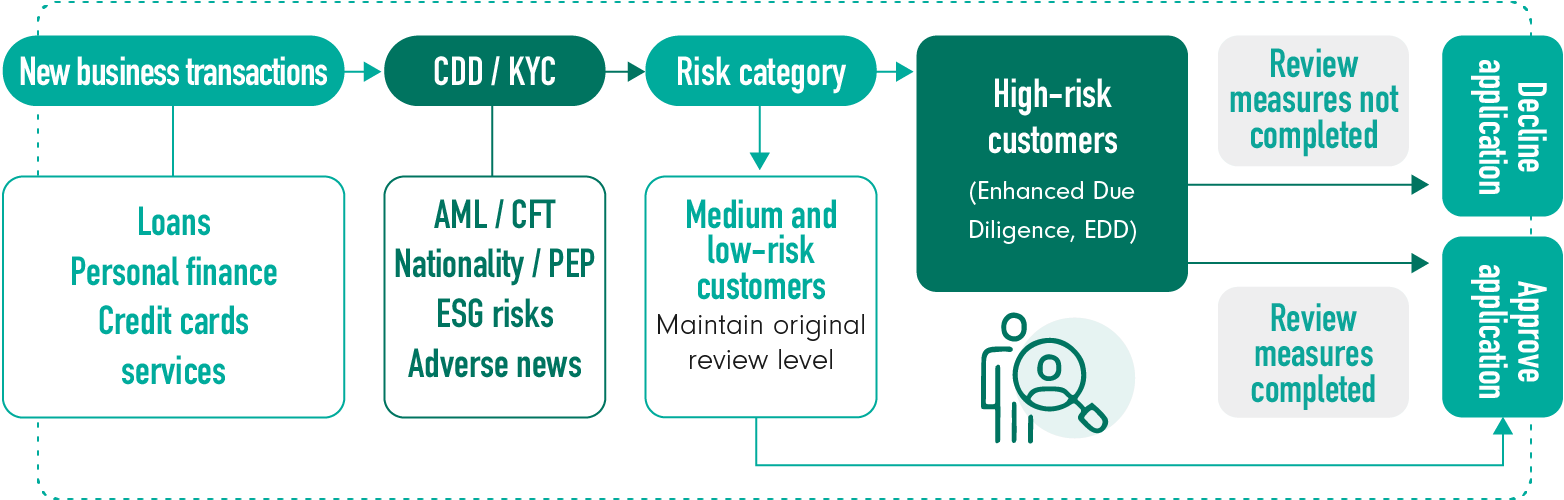

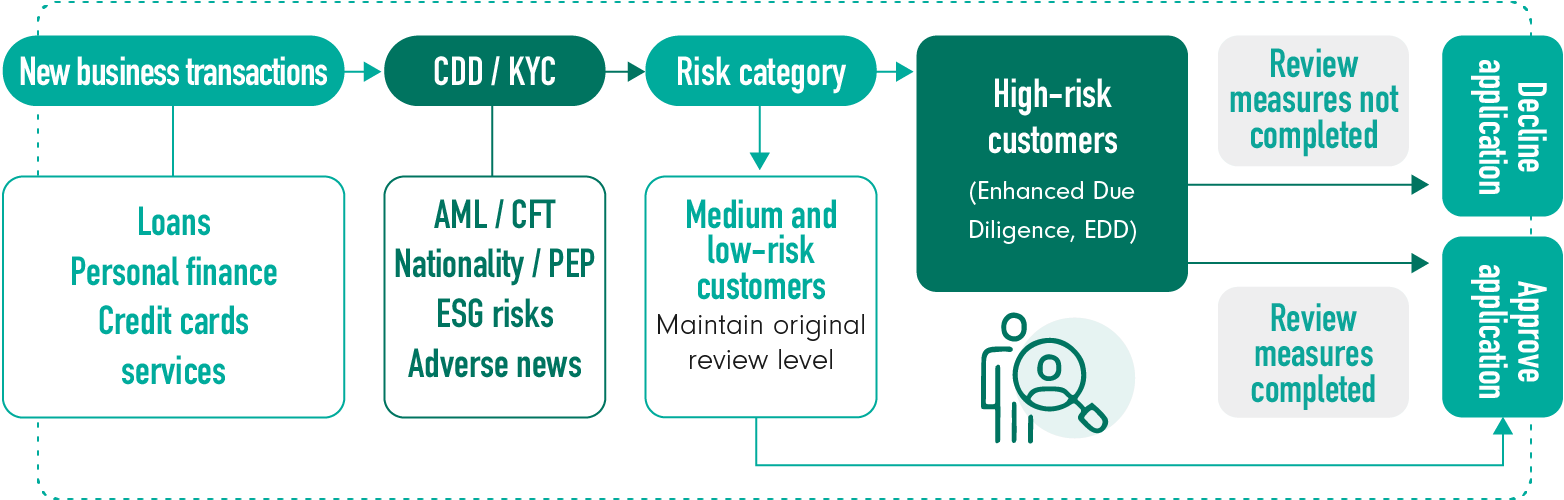

◎ CDD / KYC Review Procedures

In order to improve the quality and resilience of credit assets, we incorporate ESG risk factors into the review process of our retail bank business for small and medium enterprises (including sole proprietorship and partnerships) and personal finance. Customers must pass 100% of the financial assessment and ESG risk review procedure to ensure their financial sustainability and resilience against unforeseen risk events.

When new accounts are opened, or if existing customers add projects to their businesses Customer Due Diligence (CDD) and Know Your Customer (KYC) are diligently conducted. This includes checklists for anti-money laundering (AML) and countering the financing of terrorism (CFT) for individuals and persons in charge of small and medium enterprises (SMEs); high risk customers must undergo Enhanced Due Diligence (EDD). Additionally, investigations are conducted into whether customers have been involved in ESG risks and transactions are refused and customers declined if their ESG risks are deemed excessive. This reduces the negative social and environmental impact caused by their products and services; The financing business for SMEs incorporates similar credit limitations comparable to those imposed on high pollution (carbon emissions) industries as well as restrictions on undertaking controversial and environmentally sensitive industries based on an assessment of their impact on environmental and social sustainability.

In order to take the risks of value loss of collateral into appraisal considerations, information for "geologically sensitive areas" and "potential areas of soil liquefaction" are obtained from the Central Geological Survey on a case by case basis and disclosed in the appraisal report. This allows auditors to comprehensively consider climate change risks of collateral; if the real estate collateral is building on a type C construction site* and is a new or loan increase case, it must be appraised by the management department of First Commercial Bank headquarters, regional center, or independently appraised on its own.

*:This refers to land lots zoned for type C construction use (for users of buildings in forest zones, slope land conservation zones, scenic zones, and slope agricultural zones) in the land registration transcript.

◎ 2024 ESG Review Results of Retail Banking and Credit Business

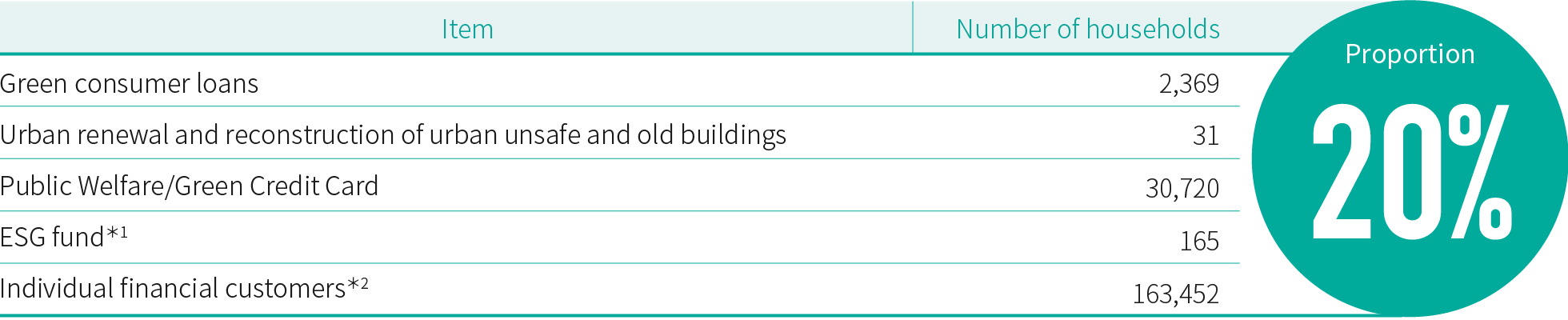

◎ Retail Banking Credit Review and ESG Engagement

To strengthen the communication with retail banking customers and identify ESG related risks and opportunities, First Bank interacts with customers and conveys ESG information from time to time through face-to-face conversations, lectures, dynamic/ static publicity and community interaction before engaging with customers, and also collaborates with the reinvestment East Asia Real Estate Management Company and government agencies to provide customers with ESG related consulting services so as to comprehensively enhance customer's ESG awareness; potential ESG risks and opportunities will be identified by integrating ESG risk factors audit mechanism when establishing business relationship, and more active actions will be taken in customers communication and the invitation of using perpetual financial products and services, including Green Industry/Enterprise ,Loan Green Consumption Loan, Green Credit Card and relevant consulting services, in order to enable customers to actually participate in ESG actions through every financial behavior; it will continue to monitor whether customers are in violation of ESG, and take corrective measures to reduce the negative impact of goods and services on the environment and society after the establishment of business relationship.

◎ Percentage of customers invited to interact or participate in ESG engagement in 2024

*1:29 ESG funds consistent with domestic regulatory regulations were cherry-picked in 2024.

*2: Number of housing loan, credit loan, and credit card loan customers in 2024.

Since 2023, First Commercial Bank has added the credit card "Carbon Calculator" function to its iLEO app, with which cardholders can understand the amount of carbon emissions generated from their credit card transactions each month. This is the first such function offered by a state-owned bank. As of the end of 2024, a total of 33,983 customers had activated it.

To encourage holders of green credit cards to convert to electronic billing and use their First Commercial Bank accounts for automatic bill payment, we continue to roll out campaigns to reward the low-carbon lifestyle. During the campaign period, consumers who purchase with their credit cards at designated green sales channels are eligible for cash back rewards, as we strive to realize green low-carbon consumption.

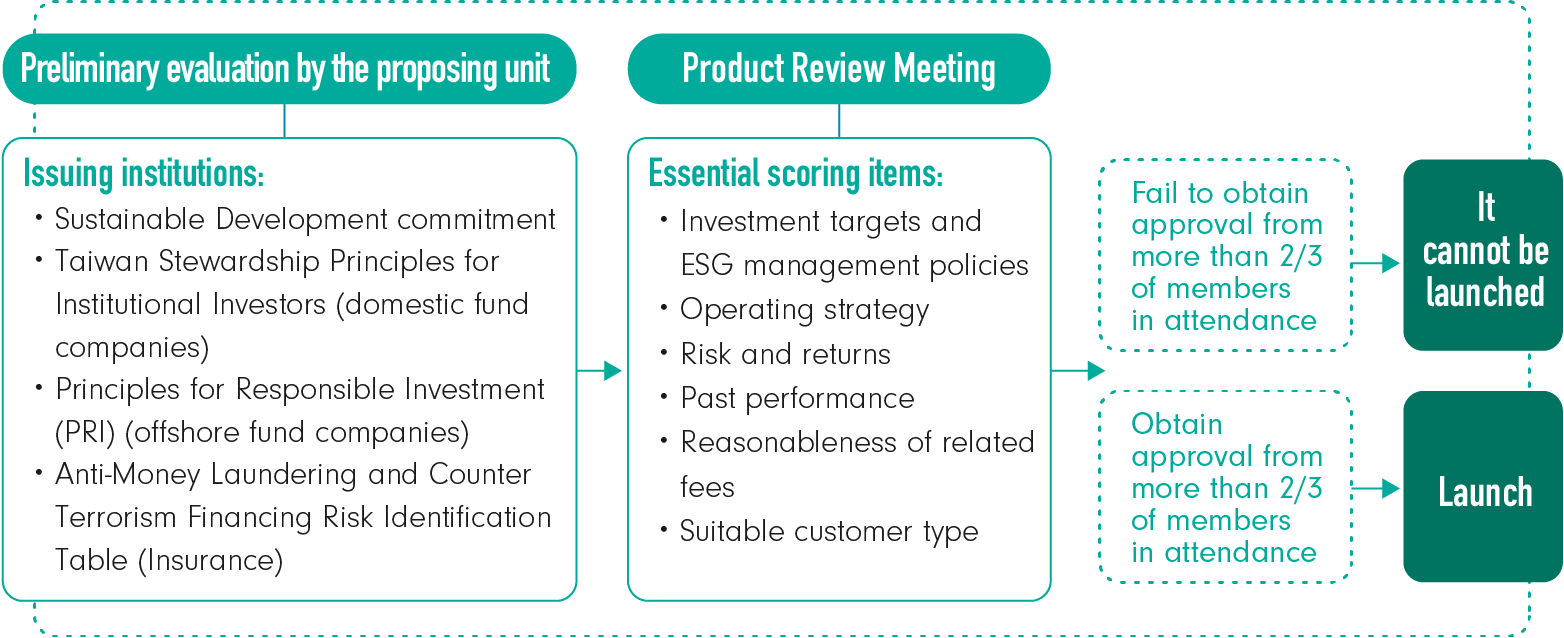

◎ Product Review - Include ESG risks and opportunities into the evaluation items for product launch reviews

In order to prevent our provided financial products and services from causing negative environmental and social impact, subsidiaries in banking, securities, credit, and life insurance have incorporated ESG factors in the selection criteria for the release of financial products. Rigorous product review that caters to risk controls and sustainable social and environmental development provides customers and investors the ability to pursue sustainable and long-term rewards. To fully understand product suitability, the financial products released by First Commercial Bank must utilize an evaluation chart to review whether ESG criteria are involved in significant negative ESG issues (such as air pollution, water pollution, violation of human rights and labor rights, poor internal control and unethical employee behavior, etc.) in combination with the competent authority's standards for ESG funds. The listing of ESG funds must pass review by the Financial Supervisory Commission and be listed in the dedicated ESG fund area on FundClear to prevent the act of greenwashing for listed products; After passing review by the proposing unit, relevant information is submitted to the "Financial Product Review Committee" for further review. Review items include at least the investment targets, ESG management guidelines, operating strategy, risks return and past performance, reasonableness of related fees, and suitable customer categories. The product risk ratings are established based on product characteristics and the product must obtain the approval of more than 2/3 of members in attendance before it can be launched and sold. In 2024 a total of 217 products were reviewed before launching, a total of 6 products were recalled and 100% of the launched products passed ESG review. The Bank must also implement anti-money laundering and counter terrorism financing regulations in the sales process and evaluate the compatibility of product risks and customer risks to ensure that the risks of the products sold are commensurate to the customers' risk tolerance to protect the interests of the customers and investors.

Decarbonization Strategy for Investment / Financing

To echo the government's goal of 2050 net-zero emissions, First Financial Holding has established a decarbonization mechanism for its investment/financing operations since 2023, and all of its banks, securities, life insurance, securities investment trust and venture capital subsidiaries have included related regulations in their sustainable credit/investment policies, as carbon reduction strategies are implemented from top to bottom. We encourage companies to embark on the transition to energy conservation, and direct their funds to projects with lower environmental impact.

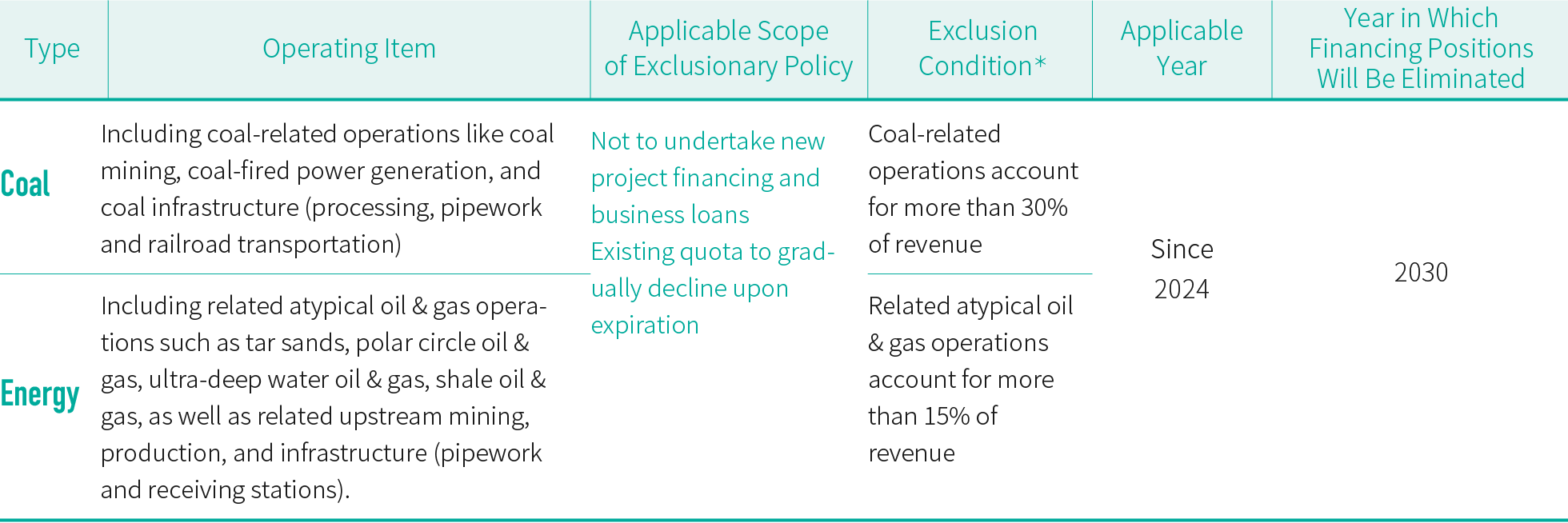

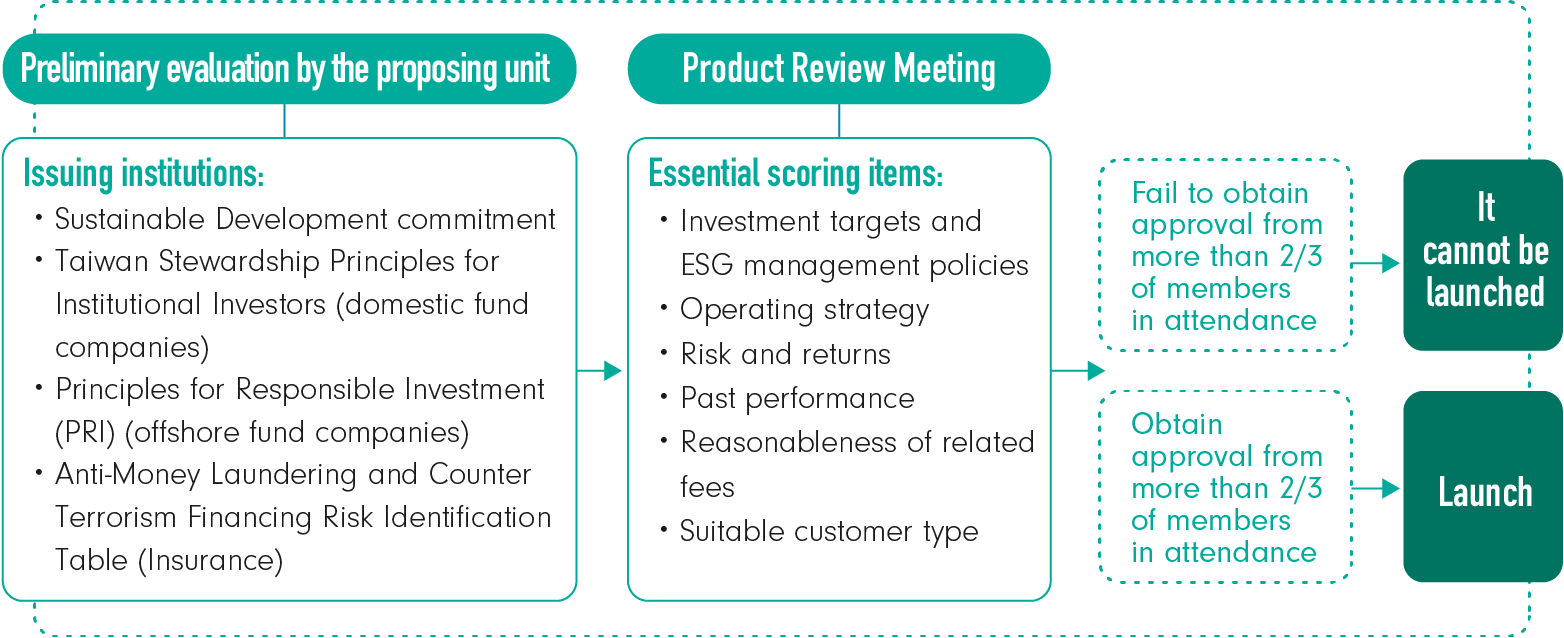

◎ Financing Decarbonization

Since February 2023, First Commercial Bank has created a decarbonization mechanism for its financing operation. Targeting corporate financing relating to coal mining, project financing relating to building coal-fired power plants (excluding those qualified for the transition to carbon reduction), as well as corporate financing cases where the share of revenues from atypical oil & gas exceeds a certain threshold, the Bank pledged not to undertake any such new cases or approve additional funds for existing loans. The Bank went on to further expand the pool of restricted parties in September 2024, and existing positions should also be reduced after they expire, as we gradually reduce financing to related industries. These positions are expected to return to zero by 2030.

*Exceptions may be made to those who meet the following conditions: (1)The purpose of the loan is for carbon reduction transformation.(2) The borrower or the group to which it belongs has publicly announced net- zero or carbon reduction commitments, or has proposed specific carbon reduction targets or transformation plans.(3)The borrower is a government agency or state-owned enterprise affiliated to the government which has committed to net-zero emissions or has proposed carbon reduction targets.

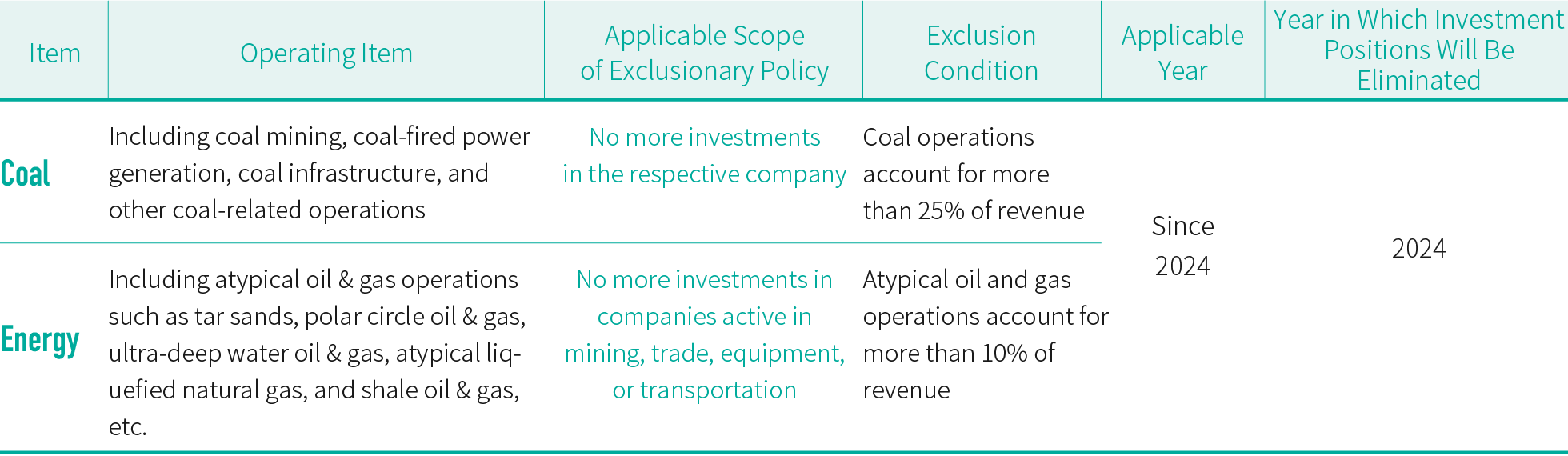

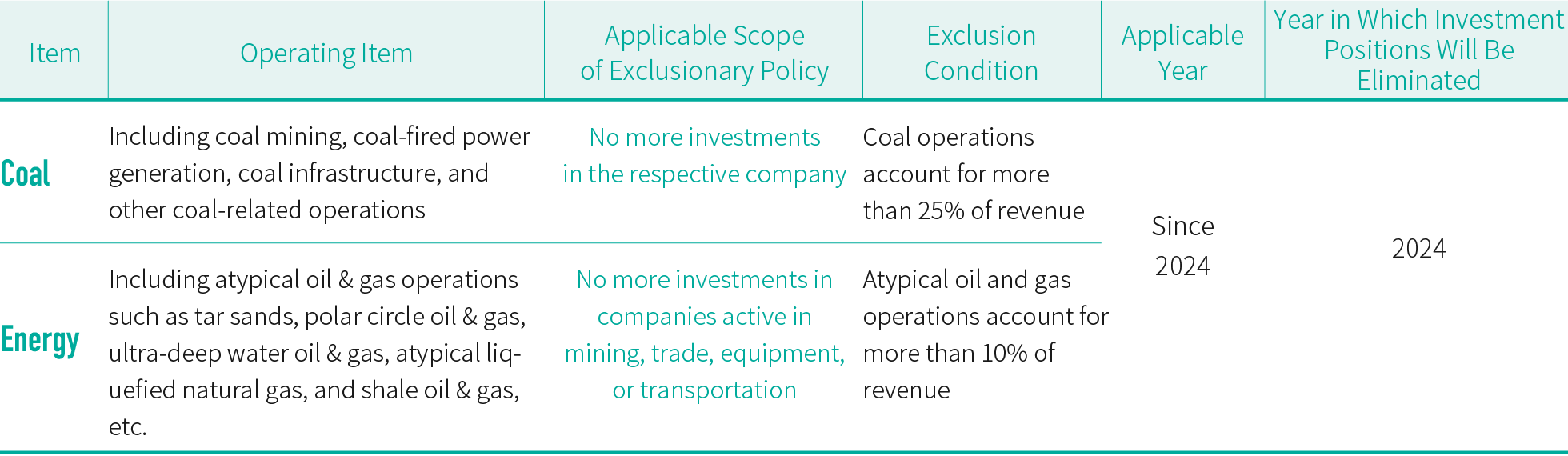

◎ Investment Decarbonization

We have formulated a financial exclusionary policy for sensitive industries such as coal and energy, and the applicable scope mainly includes active investment and investment business managed by third parties. We also actively negotiate with clients to encourage the transition to energy conservation. If the client fails to cooperate, we will gradually reduce investment positions in order to promote sustainable development of the Company. To take advantage of its influence as an institutional investor, and to accelerate the decarbonization progress for its investment operations, First Commercial Bank further enhanced its decarbonization commitment in 2024, as it reduced the share of its related operations, publicly pledged not to make new investment in high carbon-emitting enterprises with no plan for low-carbon transition. Unless funds can be definitively confirmed to be used on low-carbon transition, or unless the borrower is a state-owned enterprise with net-zero commitments and carbon reduction goals already made and set by local government, the Bank will make no more new investment in "enterprises whose coal operations account for more than 25% of revenue" and "enterprises whose atypical oil & gas operations account for more than 10% of revenue". In 2024, the Bank eliminated its positions on all such enterprises altogether. In addition, the Bank plans to reduce its investment amount in high-polluting and high carbon-producing industries year by year, in order to enhance the climate change risk management mechanism for its investment operations. The Bank also stipulates that, if invested companies fall into the category of high-polluting and high carbon-emitting industries, they must regularly examine the effectiveness of their mitigating measures for transition risks based on the frequency of inspection, in addition to conducting regular assessment in accordance with the investment risk rating derived from their ESG implementations. The Bank would use those data to follow and negotiate their implementation of decarbonization strategies.

Investment / financing strategies catering to biodiversity

To leverage the financial industry's influence in investment and financing, and to promote biodiversity and environmental sustainability through core competencies, First Financial Holding has added screening items related to "Biodiversity," "Energy Use," and "Forestry and Water Issues" to the "ESG Risk Factor Checklist" in its credit application forms. This serves as a preliminary identification of nature-related risks. In 2024, the Board of Directors approved the Sustainable Credit Policy, which incorporates forestry and water issues into the credit review and assessment process. In accordance with the TNFD's approach of Locate, Evaluate, Assess, Prepare (LEAP; version V1.0), the Company conducted significance analyses on the nature and biodiversity reliance and impact of our own operating locations, suppliers and investment/financing targets and disclosed our findings, in hopes of achieving the objective of communicating with stakeholders. The execution structure of the LEAP approach is as follows:

Locate the sites of value chain activities

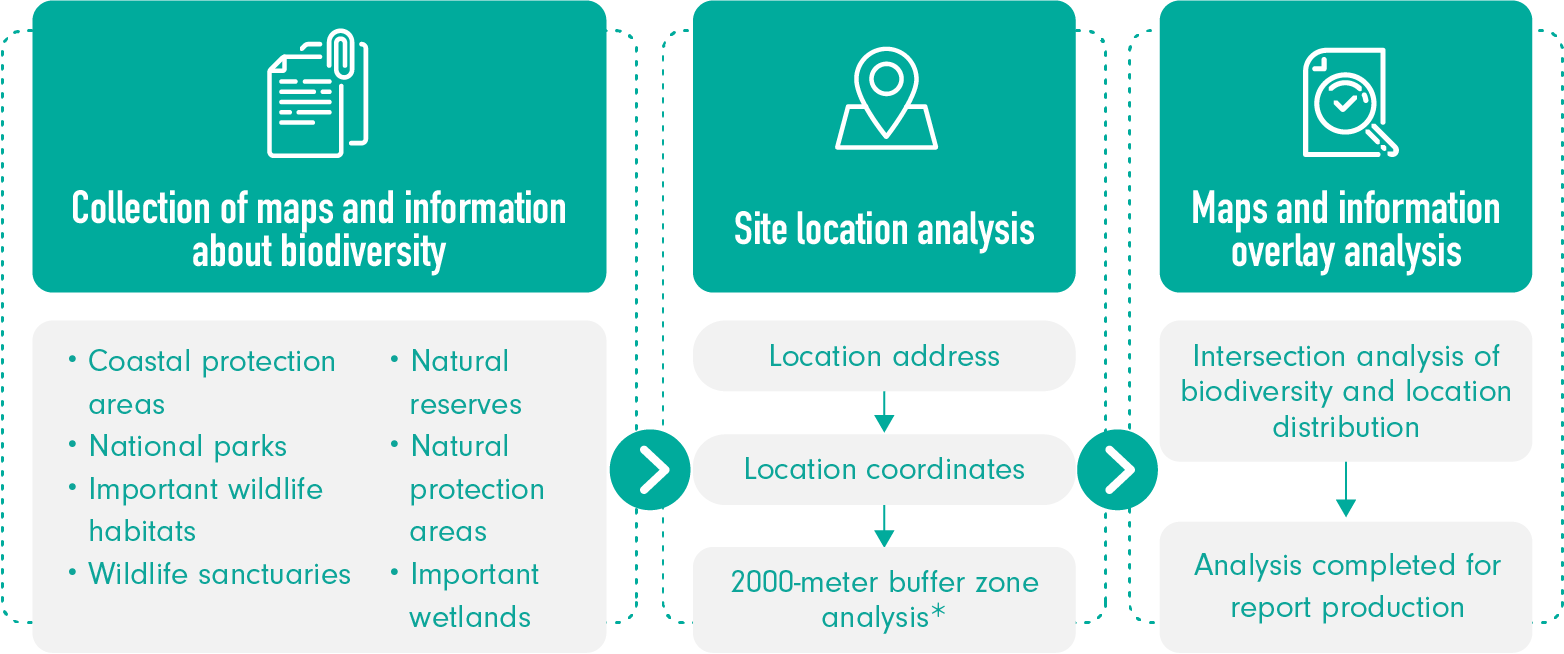

・Use the map overlay analysis approach: To identify the impact of the activities of the Company, our investment/financing targets and suppliers in the value chain on nature and biodiversity, we use location map overlay to analyze overlaps with biodiversity areas within a 2,000-meter buffer zone radius of various locations.

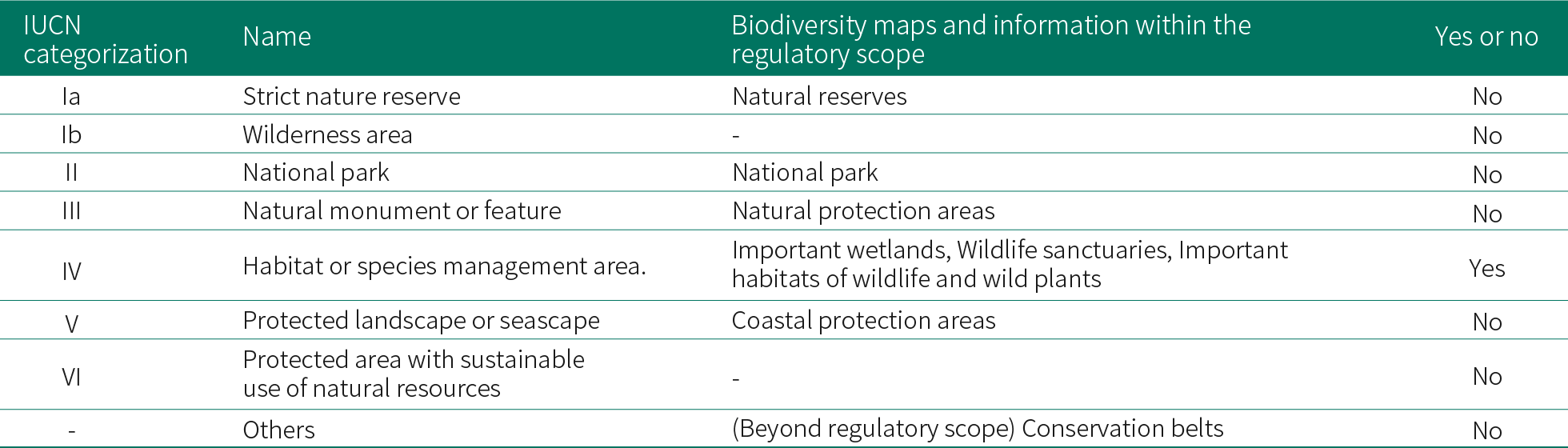

◎ Three stages of location map overlay analysis

*:Maps and information about nature and biodiversity were collected and sourced from the National Park Service, Ministry of the Interior and Ministry of Agriculture.

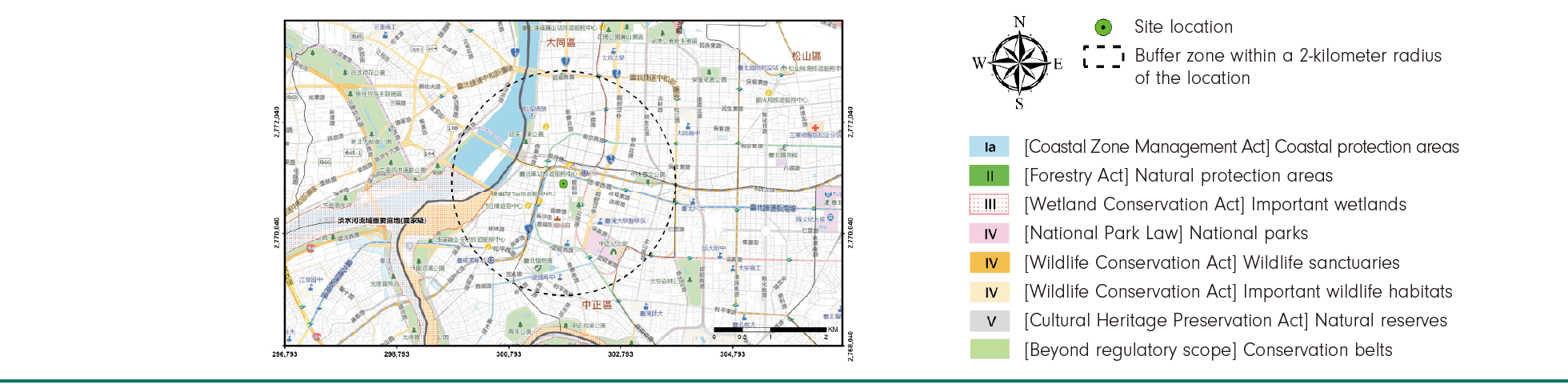

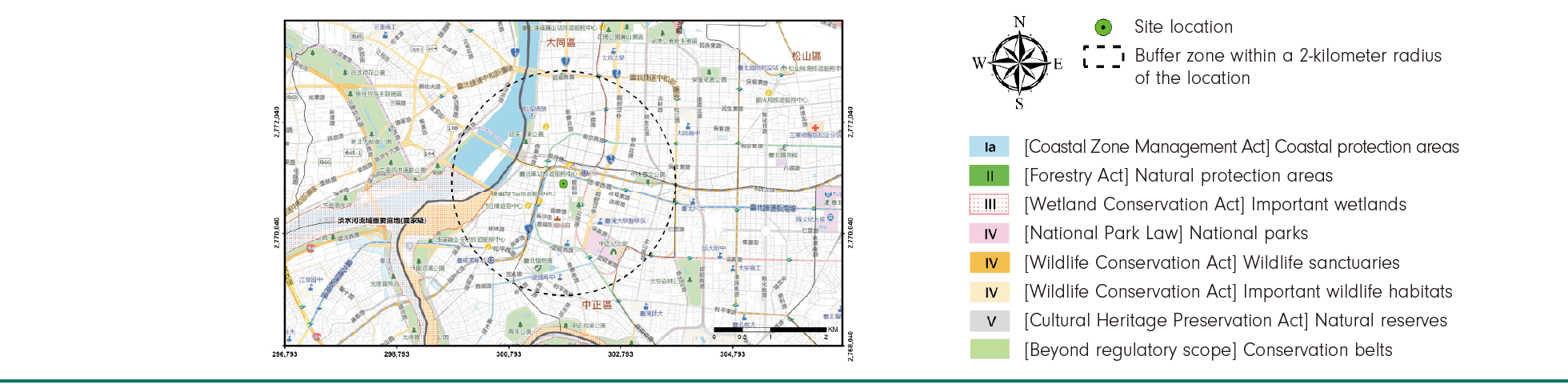

・Exposure-biodiversity hotspot analysis: First Financial Holding conducted nature and biodiversity impact assessments with respect to the locations of 53,663 sites on its value chain in Taiwan (including 206 of our operating locations, 137 suppliers' locations, and 53,320 locations of investment/financing targets). The analysis results indicated that there were 28,283 locations on the First Financial Holding value chain that had nature and biodiversity impact potential, including our own operating locations, suppliers' locations, and investment/financing targets' locations.

Biodiversity assessment & analysis report

Name of analysis object: Operating location - Head office building

Location of analysis object: No. 30, Section 1, Chongqing South Road, Zhongzheng District, Taipei City (Latitude:25.045751,Longitude:121.513087)

◎ Is it located in an area with impact on biodiversity

Significance analysis on value chain reliance & impact

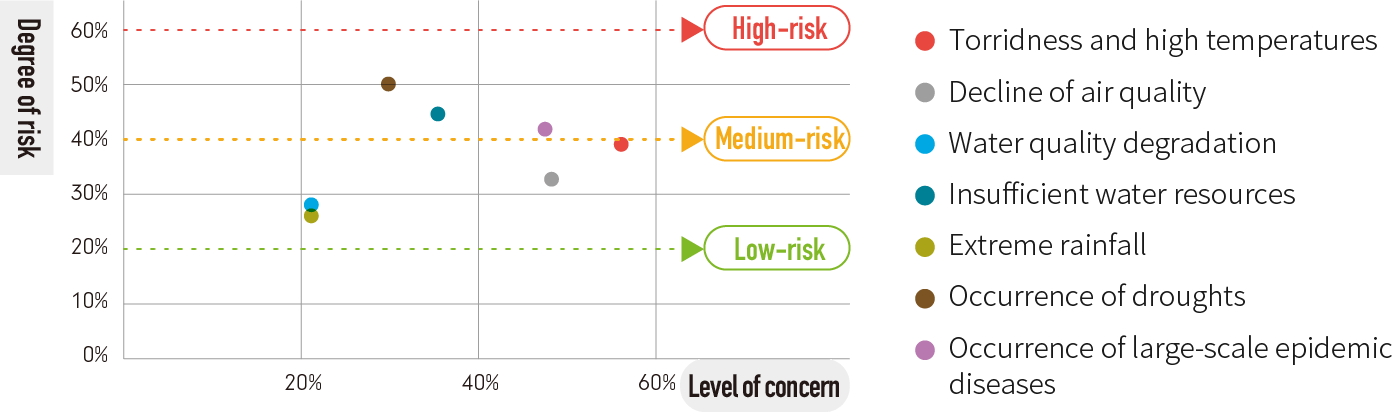

With respect to the significance analysis of our value chain's reliance & impact on nature and biodiversity, First Financial Holding conducted a survey on the level of concern and risks via internal assessment, or by distributing the "Identifying the significance of investment/financing targets' biodiversity and natural environments" questionnaires. By aggregating the numbers of stakeholders' responses to a particular environmental issue, we were able to decide the level of concern for that issue. When more companies reply that they are confronted with a particular issue, the level of concern would be higher in terms of percentage points, which means that the level of exposure to this issue is likely to be higher among the stakeholders. With respect to environmental issues that the stakeholders were concerned about and the level of theses issues' impact on their companies, we prepared different topics out of consideration for differences in reliance and impact. There were four major categories, including the level of concern, the degree of risks, risk calculation based on the types of reliance, and the level of mitigation achieved by management measures.

◎ Identification & assessment of suppliers' nature-related reliance and impact

Based on the analysis of the Company's survey results about our suppliers nature-related risks, we have concluded that they reply on the ecosystem to provide water resources and disease control; they also have relatively higher impact on natural environments with the greenhouse gases generated from the fossil fuel and electricity that they use. Therefore, the Company will focus on our suppliers' management of water resources, air pollution and disease control and prevention. We plan to incorporate their performance in the aforementioned prevention and management into our pre-procurement "vendor data checklist" and the "supplier grading assessment" in 2024. With the "pre-audit" mechanism, we seek to strengthen suppliers' natural risk management as well as the "post-management" mechanism, in addition to encouraging them to take more active actions in terms of natural risk management.

Identification of suppliers' nature-related reliance:

・To understand our suppliers' degree of reliance on nature and biodiversity, First Financial Holding conducted industry-specific reliance and impact analyses through the distribution of questionnaires.

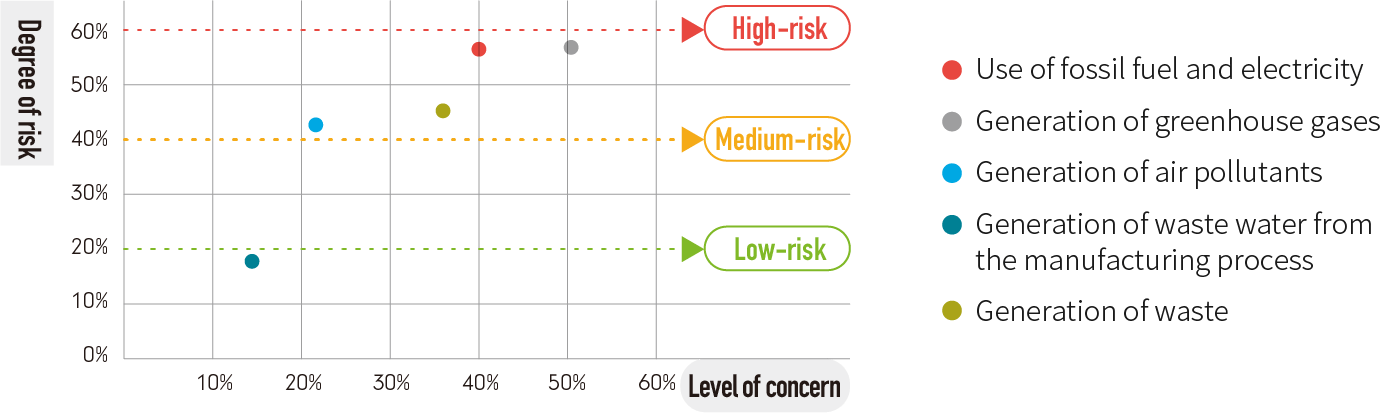

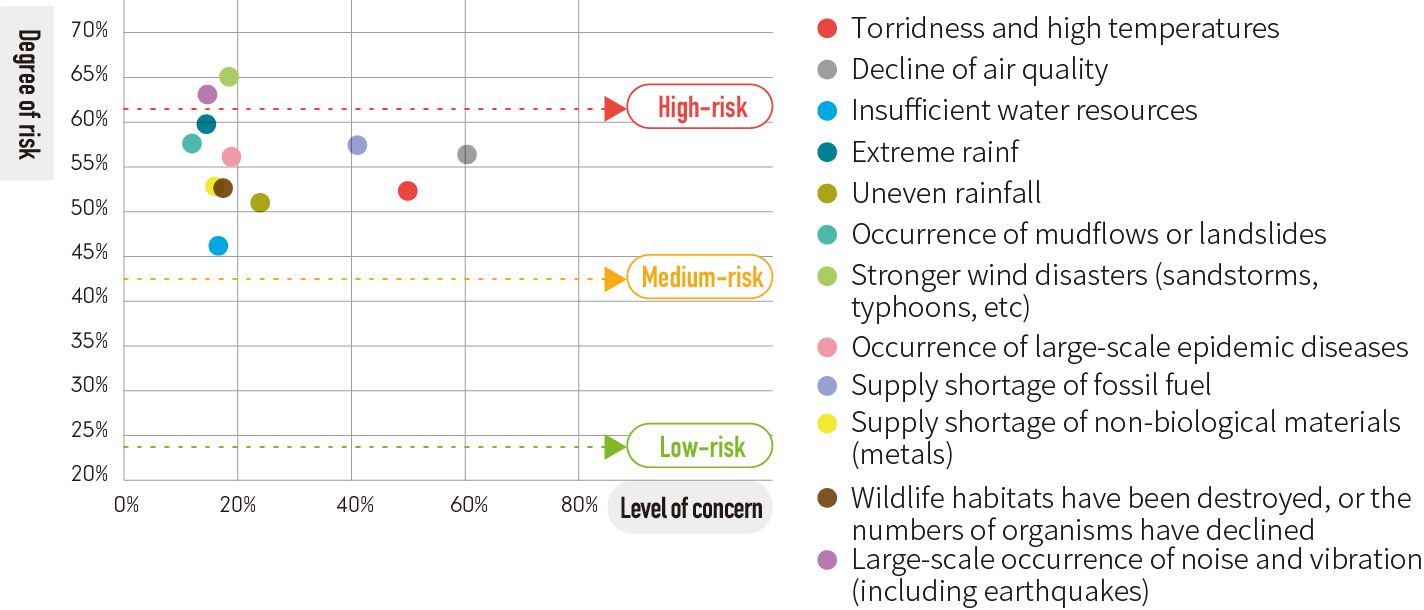

・Risks are classified into various degrees. When the degree of risk is higher than 60%, it is considered high-risk. When it is 20% to 60%, it is considered medium-risk. When it is below 20%, it is deemed low-risk.

・For this survey, we only chose high-risk issues and those with a level of concern 20% or higher, and considered them to be high degree of reliance. In particular, the risk of droughts was the highest, with a level of concern of around 25%; Torridness and high temperatures drew the highest level of concern at 57%, and the degree of risk was medium.

Identification of suppliers' nature-related impact:

・We only chose medium-risk reliance issues with a level of concern 10% or higher.

・Supplier activities generating obvious pollution include: There are four types, including the use of fossil fuel and electricity, the emission of greenhouse gases, air pollution, and waste discharge.

・The higher the degree of risk for an item, the more evident it became that the supplier's management measures and goal setting remained inadequate even after its own assessment of that item. With regard to the identification results of the impact of supply chain management, First Financial Holding has established corresponding investigation indicators and measurement units for subsequent risk management.

◎ Identification & assessment of domestic investment/financing targets' nature-related reliance and impact

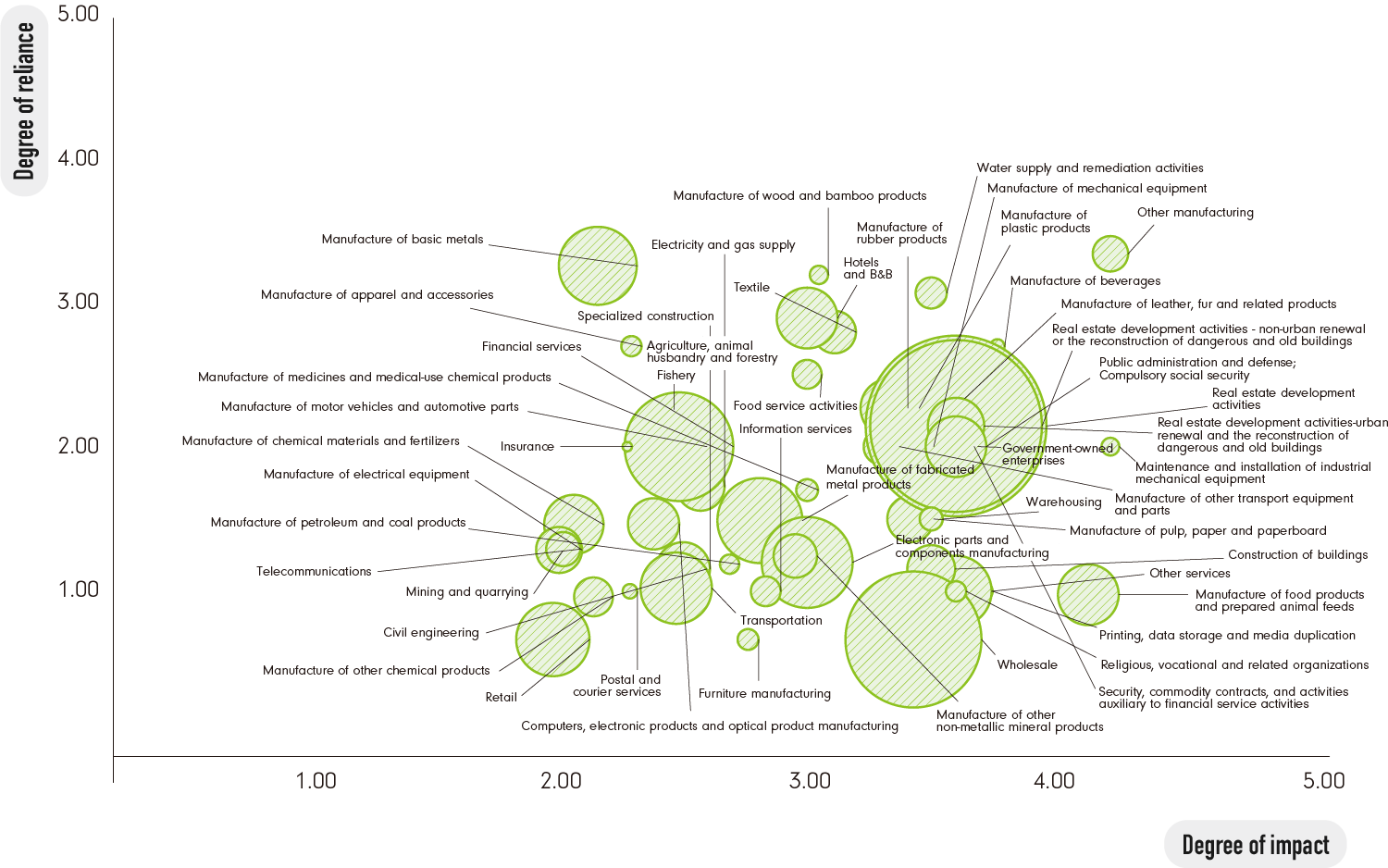

Investment and financing targets are key to assessing the financial industry's related impact on nature and biodiversity. First Financial Holding has conducted assessments of 54 industries via survey by distributing questionnaires to its internal business units.

Identification of investment/financing targets' nature-related reliance:

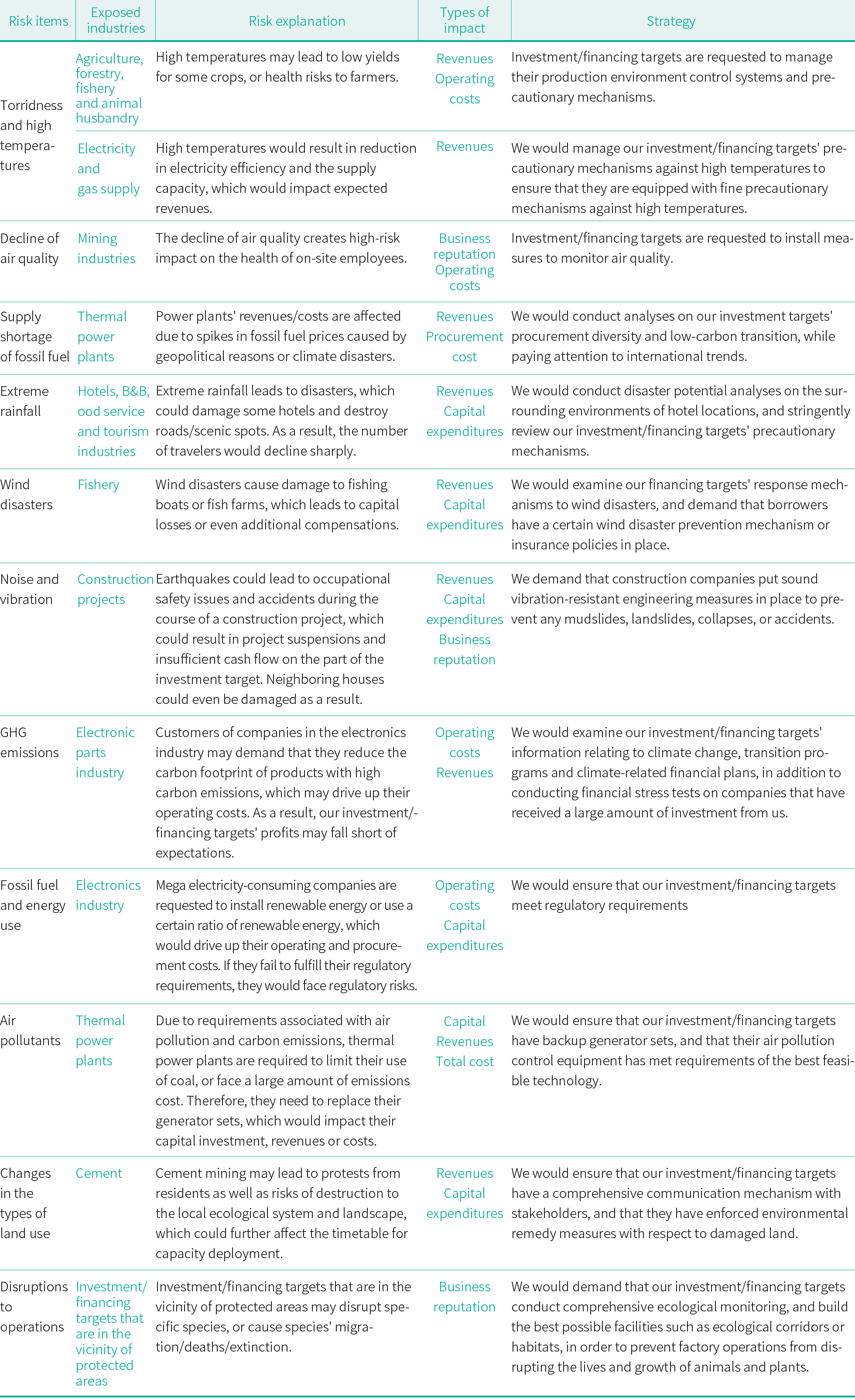

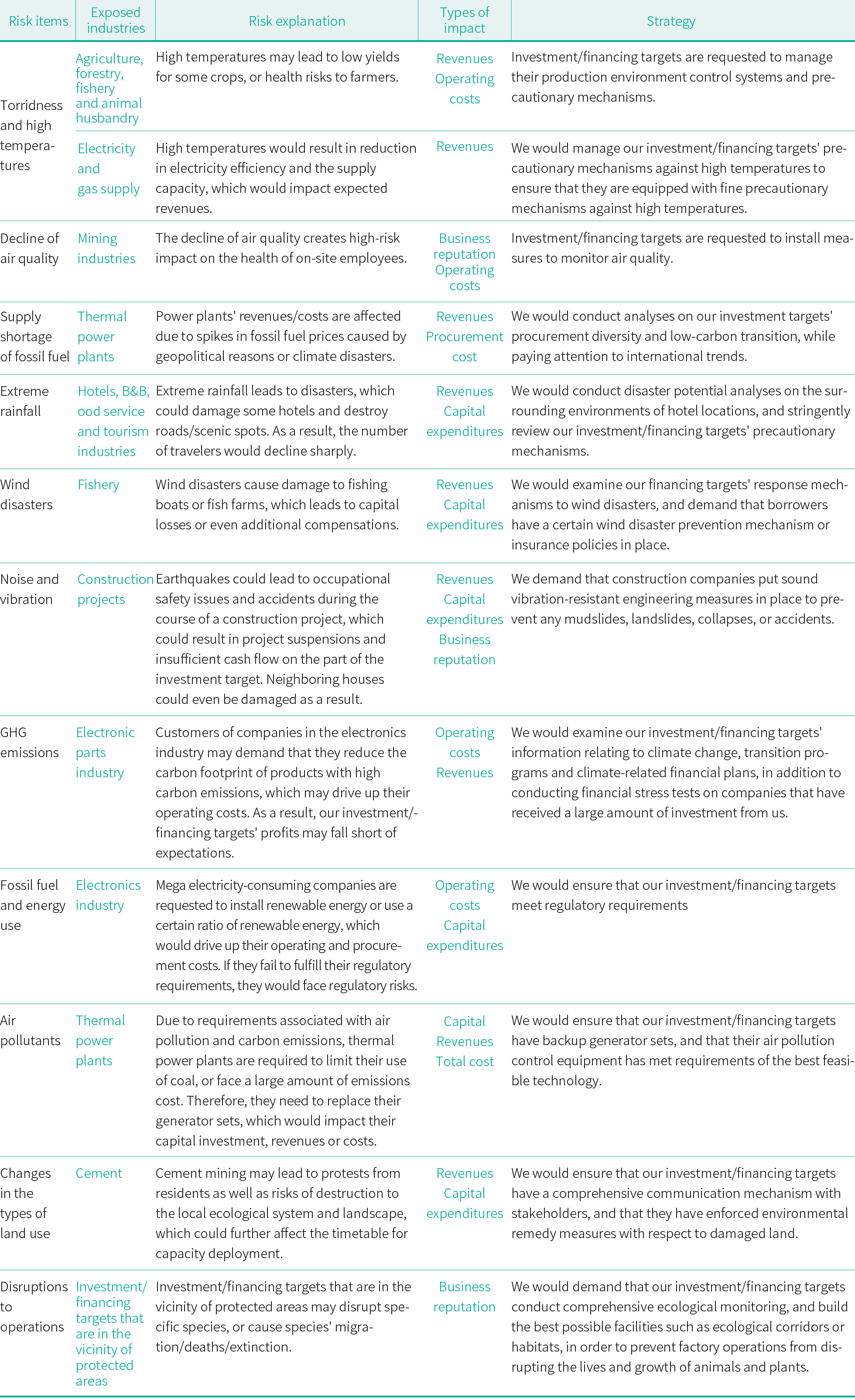

During the course of identifying our investment/financing targets' nature-related reliance and biodiversity, we only chose items with a level of concern 10% or higher, or industries with a high degree of risk for assessment. Nature-related reliance items that drew a level of concern higher than 40% included: Air quality, torridness and high temperature, as well as fossil fuel. Items with a relatively high degree of risk -- and thereby falling into the high-risk category -- included wind disasters, noise and vibration, and extreme rainfall. However, the level of concern was lower.

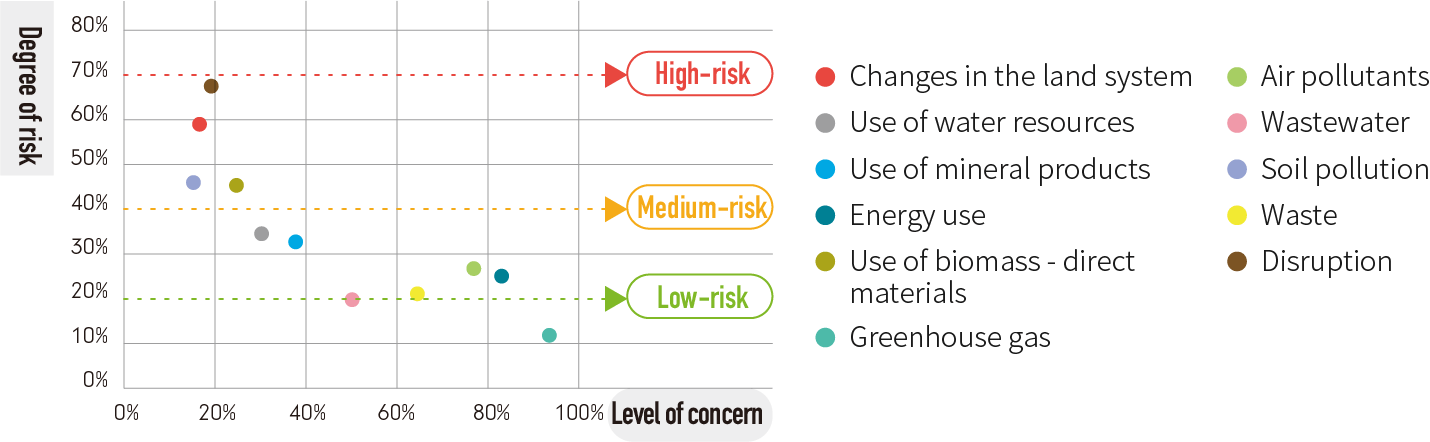

Identification of investment/financing targets' nature-related impact:

The top 3 nature-related impact items with a high level of concern included: Greenhouse gases, energy use and air pollutants. High-risk items with a degree of risk 60% or higher included surrounding disruptions to operations and changes in the land system. The main reason that some items were determined to be high-risk items is due to the questionnaire respondents' self-assessment results of these disasters. The higher the level of concern, the more management measures are put in place. Therefore, issues with a degree of risk lower than their concern level is relatively low-risk.

◎ Risk and opportunity management that investment/financing targets rely upon

Assessment of biodiversity impact regarding the locations of overseas investment/financing targets

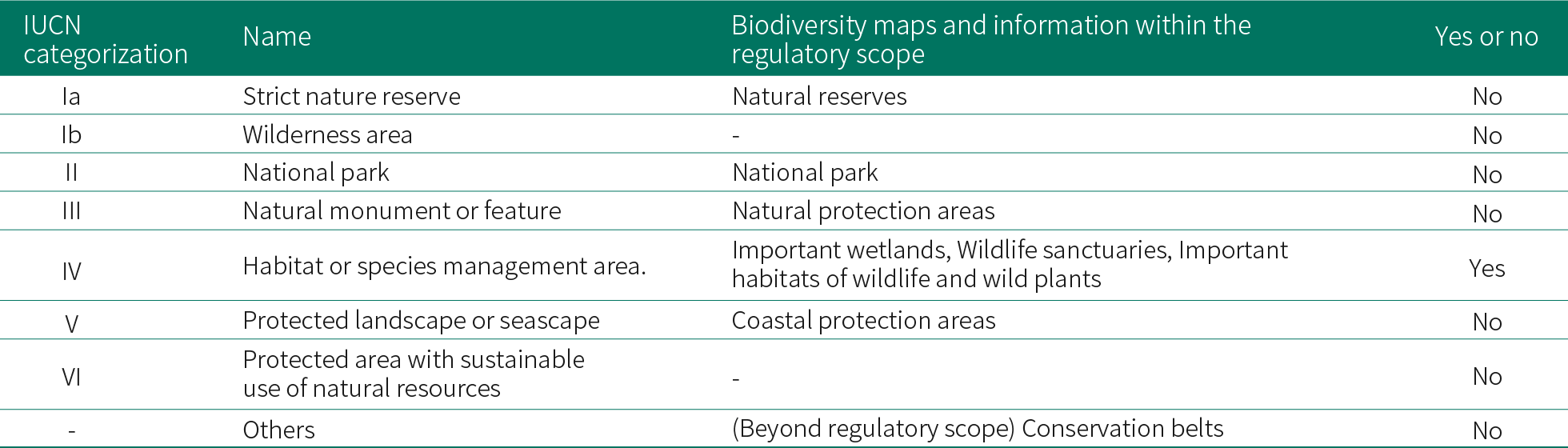

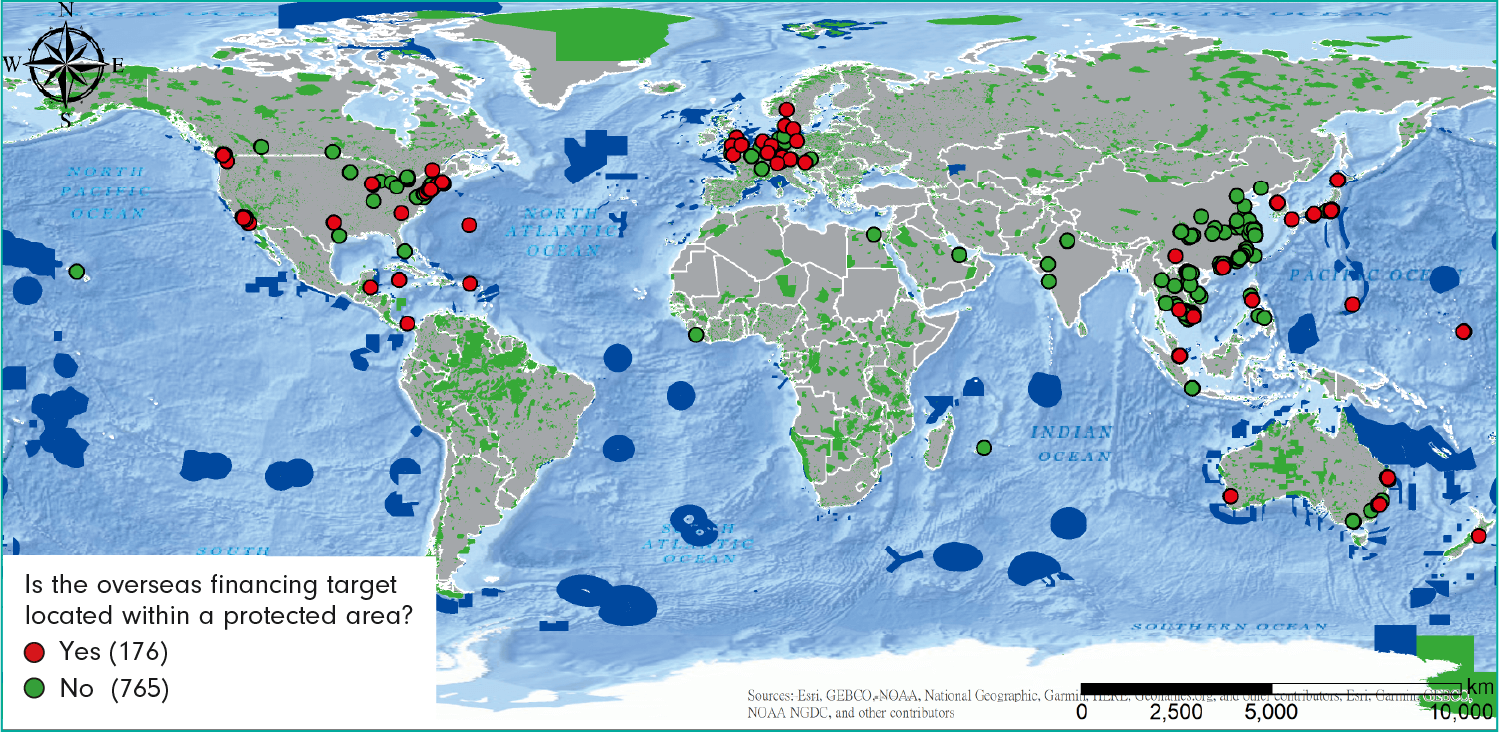

The Company has conducted assessments of biodiversity impact regarding the locations of its 941 overseas investment/financing targets. Referencing the DJSI index, the analysis designates a buffer zone within a radius of 2 kilometers form the operating location as the potential impact area. Maps and information about protected areas from around the world as recorded by the International Union for Conservation of Nature (IUCN) are also used for overlay analysis. The IUCN divides the world's protected areas into 8 categories (strict nature reserve, wilderness area, national park, natural monument or feature, habitat or species management area, protected landscape or seascape, protected area with sustainable use of natural resources, and the unclassified category). The analysis result indicates that (as shown in the illustration below) a total of 176 locations have touched on the IUCN's scopes of protected areas, including 61 locations in Asia (34.66%); 27 locations in Europe (15.34%); 44 locations in America (25.0%); 19 locations in Australia (10.80%) and 25 Oceanic locations (14.20%).

◎ Locations of overseas financing targets & distribution of the IUCN's scopes of protected areas

*:Maps and information are sourced from the World Database on Protected Areas established by the IUCN.