Social Factors >

Digital Innovation and Inclusivness

Digital Innovation and Inclusivness

FFHC supports the United Nations Sustainable Development Goal SDG 8.2 for "achieve higher levels of economic productivity through diversification, technological upgrading and innovation" and SDG 8.10 "strengthen the capacity of domestic financial institutions to encourage and to expand access to banking, insurance and financial services for all". We are committed to providing diverse digital finance services through application innovation technologies and providing online banking and mobile banking app FinTech services to least developed countries. FFHC also integrated various online businesses, smart customer services, and open API connections with big data, cross-industry alliances, and differentiated services to optimize the user interface and functions and provide customers with a more diverse and smooth digital finance experience with the aim of becoming customers' top choice and a leading brand in the market.

Optimize Digital Channel Platforms and User Experiences

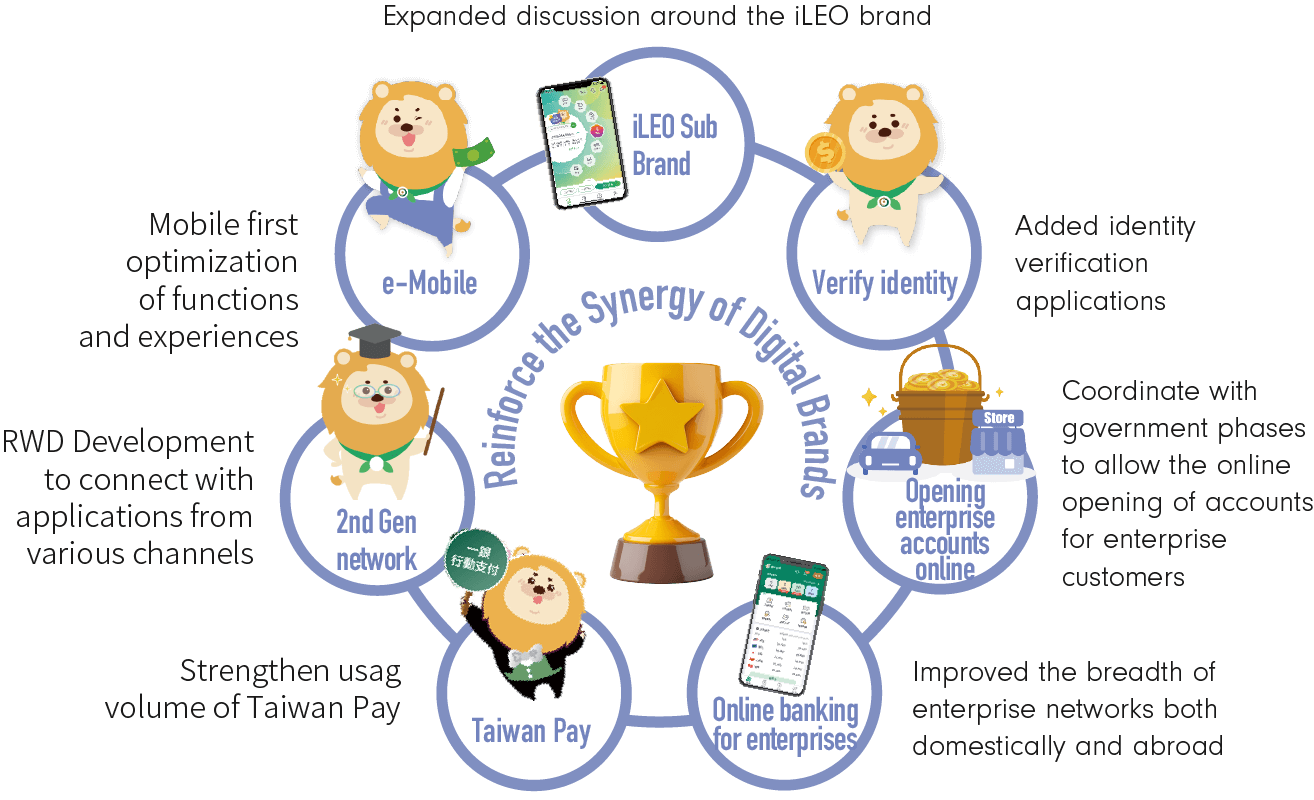

First Financial Holding has been dedicated to the digital native market through a variety of channels, especially the core values of "simple, fast, innovative, and most knowledgeable of customers" promoted by the digital account sub brand iLEO. Since launch, iLEO has generated more than 1.91 million users, and recorded an increase of 22.6% in new accounts in 2024, making it the 4th largest digital account on the domestic market. The iLEO app was downloaded 1.49 million times for a YOY growth rate of 35.5%. In order to continue to heed our customers' voice, First Commercial Bank introduced Net Promoter Score - a real-time questionnaire mechanism - to the iLEO app in September 2022. The Bank also tries to stay on top of customers' needs instantaneously, and continues to strive for swift iterative optimization of each product and service through various feedback channels, such as face-to-face interviews with users and comments left at the app store.

FFHC actively embraces the digital wave, encourages and educates customers to

use e-channels, thus reducing counter transactions, and achieving outstanding results:

Smart Applications and FinTech Innovation

Smart Customer Services

In response to the digital transformation of traditional finance, First Commercial Bank launched smart robot "Little E" to the customer service center. AI technologies such as natural language analysis and machine learning were applied to create a virtual teller capable of comprehensive services, allowing customers to utilize official LINE account, website, and APP device to submit professional inquiries online, by text or voice 24-hours a day, and immediately receive responses through the simple interface and life-like interactions. Furthermore, as part of our effort to echo the drive for bilingual financial services, the Bank has also added an English version to its smart customer services, which meet foreign nationals' need for digital banking services. A cumulative total of 1,825,018 people utilized "smart customer service" by the end of 2024 and received an accurate response rate of 98%.

Smart wealth management

In response to the high demand for retirement planning in Taiwan's aging society, First Bank launched the "e-First smart wealth management" service in October 2020. It is the first such service that makes use of algorithms of the international investment research institute Morning Star. With the knowledge of more than 300 experts, the service offers a "human-machine collaboration" model to assist investors in allocating assets and selecting suitable investment targets. The service is distinct from other robo wealth management advisory services on the market because it caters to the investment requirements of customers with limited capital, office workers, and the general public. It also features the unique "elderly monthly pension plan" to provide customers with fixed monthly cash income upon retirement to make up for the deficiencies in personal savings and investments in the three major pillars of pension (social security, occupational pension, and personal savings and investments), and increase the income replacement ratio. We have accumulated nearly 40,000 investors by the end of 2024. The investment balance is nearly NT$1.801 billion

Implementation of blockchain technology in supply chain financing

First Commercial Bank partnered with Test-Rite International to apply the temper-resistant properties of blockchain technology to transmit transaction data such as invoices and payment of Test-Rite International's supply chain financing via blockchain from the enterprise ERP system directly to First Commercial Bank's supply chain financing platform. In addition to reducing human error, saving on operation costs, and strengthening internal controls of data, it accelerated the transmission of transaction data, increased the efficiency of funds dispatch, and shortened the time required for suppliers to obtain financing.

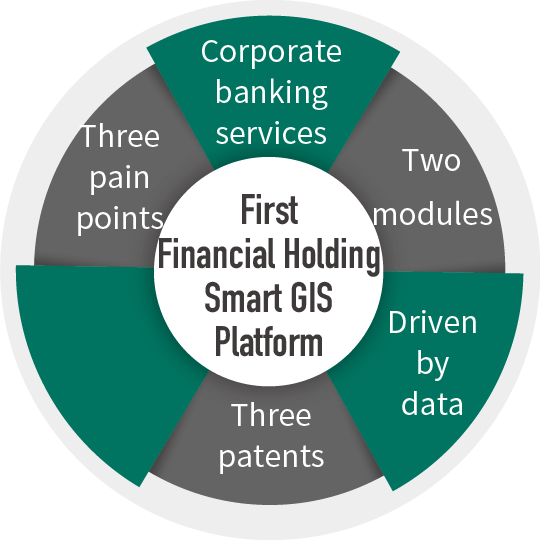

Smart (GIS) dispatch system and customer data collection and management platform

To continue to promote digital development, First Commercial Bank has introduced and applied the Geographic Information System (GIS) technology to the corporate loans domain. The Bank has launched "intelligent GIS work assignment" and "customer intelligence collection and management platform", two modules that link patented big data analysis model to internal and external data. A new corporate banking account model has also been developed, which visually presents customers' locations and business intelligence on mobile devices. Combining the 3 patents on the ability to calculate the best visiting route, marketing resource deployment and assistance in reaching out to enterprises and developing new customers, they not only address the three pain points of existing business process, i.e., lacking real-time lists, lacking dispatch tools and lacking information integration, but also increase front-line salespersons' ability in and success rate of developing and exploring surrounding corporate customers independently.

As of the end of 2024, the project had established 815 preferred lists, consisting of 34,179 corporate customers. Big data models have also been used to help set up two marketing activities, in addition to adding 126 active corporate customer accounts. In particular, 79 customers have been granted credit lines. As a result, the Bank won the nation's top accolade in the "Best Product Category" of the 21st National Brand Yushan Award, as well as the recognition of the 12th Taiwan Elite Financial Institution Awards, where it was presented with the Excellence Award in the "Best Digital Finance" category.

Building an Environment for Digital and Innovative Finance

Artificial intelligence applications

・First Bank promoted the "e-speed loan" which provides online calculation of loan limits and application services. It also used AI appraisal models for customers to immediately calculate mortgage limits and interest rate by entering the address of the real estate in the mortgage and basic personal information online. In addition, in order to enhance the efficiency of microfinance loan approval, the "single loan application access" has been established, actively inviting payroll transfer clients of the bank to apply for credit loans; also, the automatic review mechanism has been introduced to reduce manual work processes. In 2024, a total of 40,878 credit loan and mortgage limit calculations were conducted through digital channel and 55,502 applications were filed.

・To cooperate with government policies for supporting the development of small and micro enterprises, First Bank actively promoted "Micro Enterprise e-Services" and used smart AI models to provide small and medium enterprises with online loan limit calculation services. First Bank processed a total of 5,621 loan applications on "Micro Enterprise e-Services" in 2024.

Robotic Process Automation, RPA

RPA is applied to various operating procedures. For example, it can help collect regular and highly repetitive customer data for analysis or review during the credit investigation process. As of the end of 2024, as many as 187 RPA operating procedures had officially gone online, reducing 1.06 million man hours cumulatively. That is equivalent to the workload of 530.11 full-time employees.

Mobile and online insurance

We provide consumers with diverse channels to purchase insurance products. Customers can purchase mobile insurance policies via First Commercial Bank's financial consultants, or they can go to First Commercial Bank's digital channels to purchase mobile or online insurance policies. 750 insurance products were purchased via the mobile channel in 2024, while 3,787 insurance products were sold online.

One-stop opening of accounts

First Securities and First Commercial Bank collaborated to allow new customers to simultaneously open securities and digital banking accounts online while also completing setup of the securities delivery account. In 2024, a total of 735 accounts were opened.

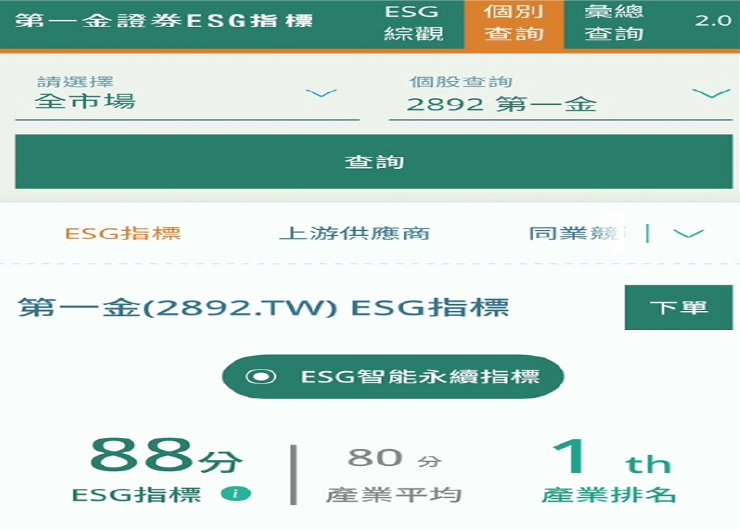

First Securities' ESG Smart Sustainability Index Data Platform

The platform provides ESG grading information to investors with the help of AI algorithms, including inquiries about individual stocks, compiled data for select sectors, ESG sub-categories, and account inventory. ETF can also be linked to constituent stocks for inquiries about the grades of individual stocks. Inquiries about such information can be made by accessing the two transaction platforms of "FCB e-Winner" and "First Gold Securities-Mobile Winner". It can also be directly linked to the area for placing an order, where the user can access the transaction page to inquire about the real-time quotes of individual stocks and place an order to buy or sell stocks.

Digital Money Transfers

First Bank's leading position in corporate banking as well as comprehensive overseas network have been used to set up the First Bank International e-Banking (including "Financing e-Bank App - Overseas Branch Internet Banking" and " Financing e-Bank App - Global e-Banking Service"), international business cash flow (e.g. Supply chain financing, sales chain financing), international consumer cash flow (e.g. international third-party payment) and international clearing system.

Digital Financial Services Provided by the Phnom Penh Branch

In addition to providing traditional brick-and-mortar financial services to the local population, our Phnom Penh Branch also provides e-banking and apps for mobile banking services, including functions such as "money transfer/remittance to non-designated accounts and eSecure push notification and verification service", uploading the remittance slips of large sums of money via mobile banking apps, and interbank fund transfer. The Branch joined the local Bakong blockchain system in 2023. which improves receipt and payment efficiency as well as security for our customers while facilitating inclusive finance; In 2024, National Bank of Cambodia approved our Phnom Penh Branch's application to add the Account Link feature, making it easier for individual customers to manage their bank accounts. It also provides businesses with a solution for cross-bank cash management, which improves operating efficiency financially while optimizing the flow of funds.

Mobile Payment

First Bank has fully introduced the shared QR Code service of "Taiwan Pay." Its "First e-Mobility" , "iLEO Taiwan Pay ",or "Taiwan Pay t wallet +" facilitate mobile payment, shopping, payment/ tax payment, fund transfer, and withdrawal through scanning QR codes and combine cloud invoices, thereby infinitely extending the convenience of smart life.

Credit Card Mobile Payments

To provide credit card holders with swift and convenient payment tools, credit cards issued by First Commercial Bank can be used on various payment platforms, such as Taiwan Pay, Google Pay, Apple Pay, and Samsung Pay. Customers can choose appropriate payment methods based on their mobile devices. A range of marketing campaigns have been held to guide customers to gravitate toward mobile payment tools, reduce cash usage, and increase the amount of mobile payment transactions in Taiwan. To motivate card holders to use mobile payments, we activated the feature to rapidly link our credit cards to Apple Pay and LINE Pay in December 2024. As of the end of 2024, the number of our credit cards linked to mobile payments had reached 1,249,423 cards, up 17.6% from 2023.

Payment Facilitated by Pre-arranged Deposit Account Link

To expand mobile payment applications of deposit accounts, First Bank continues to work with 9 electronic payment operators such as "JKOS (JKOPAY)", "iPass (iPass MONEY)", "EasyCard (Easy Wallet)", "PX Mart (PXPay)". First Bank ranked first among partner banks in the "Payment Facilitated by Pre-arranged Deposit Account Link" by satisfying customers' demands for day-to-day payments. First Bank implemented the "integrated account binding for digital account opening" in collaboration with iPASS and launched the " iPass MONEY " direct connection to digital account opening service, becoming the first government-owned bank to launch the service. The system automatically connects the account after it is opened to optimize the mobile payment experience. Also, collaboration with iPASS is currently underway for "reverse linking', which allows customers to utilize their iLEO app to link their account with "iPASS MONEY", thereby accelerating the linking process and expanding the content of mobile banking services.

Accessible Digital Banking Services for Persons with Disabilities

In order to provide basic, equal, reasonable, and convenient financial services to persons with disabilities, First Commercial Bank, First Securities, and First Life established a financial accessibility service section on the digital platform to improve the digital finance gap for customers with disabilities, as well as First Securities Investment Trust.

・Our Friendly Financial Service Network provides service items such as simplified e-Banking (including features such as TWD/foreign currency account service, wealth management KYC evaluation, changing login username/password for e-Banking), financial information inquiries, simplified eATM, and discount applications for persons with disabilities. In addition, information relating to accessible services is also promulgated and published on this network.

・First Commercial Bank's simplified eATM, simplified e-Banking and Friendly Financial Service Network have obtained A, AA and AAA emblems respectively from the National Communications Commission based on the "Web Content Accessibility Guidelines 2.0", as we strive to provide premium and barrier-free Internet services.

・It provides 24-7 search for online market updates, opening accounts online, placing online orders, securities trading app, and other accessible investment services

・The interface allows adjustment of text size, graphical instructions, and discloses a dedicated phone number for detailed explanatory services

・The voice quotation and transaction service over the telephone is available online, so that customers with auditory or physical disabilities can also participate in investments and transactions. An audio guide service was added in 2023, offering text-to-speech functionality.

・We received the AA-class emblem from the National Communications Commission in accordance with the "Web Content Accessibility Guidelines 2.0"

・The zone provides information on micro insurance products, accessible services and measures, and company introduction

・The "A + Life" section on the official website analyzes customers' policy needs and offers insurance planning services

・Platforms such as "First Life Insurance Online Insurance" and FundRich's "Protection Type Insurance Product Platform" offer accessible channels for obtaining insurance

・We received the AA-class emblem from the National Communications Commission in accordance with the "Web Content Accessibility Guidelines 2.0"

・FSITC provides accessible facilities, with a "wheelchair ramp" installed at the business hall on the first floor. Elevators in the building are also fitted with hand rails.

・Personalized service with respect to financial products on offer is available to persons with disabilities.

First Commercial Bank continues to make it more convenient for persons with disabilities and foreign customers to use ATMs. As of the end of 2024, 543 of our ATMs had been wheelchair-friendly. In particular, 523 ATMs conform to accessibility requirements (such as ramps), (including 5 accessible ATMs with an auxiliary screen); furthermore, 232 of them are talking ATMs made available to people with visual impairment, and the cash deposit feature has been added. People with visual impairment can plug their headsets in the headphone jack to access the speech mode. Braille instructions are deployed at various operating positions for clear tactile identification. With the aid of speech instructions, people with visual impairment can be walked through the whole process step by step, and do not need help from others to independently complete his intended ATM transaction or inquiry. Multi-lingual service was deployed on existing ATMs in 2023, offering new interfaces in Japanese, Vietnamese, Indonesian and Thai to improve the inclusiveness of financial services.

Cross-Industry Alliance

The Group continues to embed its financial services into various fields including food, clothing, housing, transportation, education and entertainment through strategic alliances. We seek to create application scenarios closer to consumer needs by teaming up with partners from other industries. Since 2020, we have accumulated 110 collaboration cases, as we employ the twin core strategies of the "Bank as a Service (BaaS) model" and "Bank as a Platform (BaaP) model" to expand digital channels and implement customer management, in order to create a synergistic cross-industry ecosystem.

In terms of the BaaS model, we continue to guide customers through packaged exclusive benefits, expand and create synergy, and cultivate customer stickiness. For example, we have collaborated with "Internet shopping" company Yahoo Shopping and gaming company "Soft-World International Corporation" on digital account opening and promoting diverse business operations. Thanks to these collaborations, we are able to embed our financial services into different fields, and serve more diverse demographics from various age brackets.

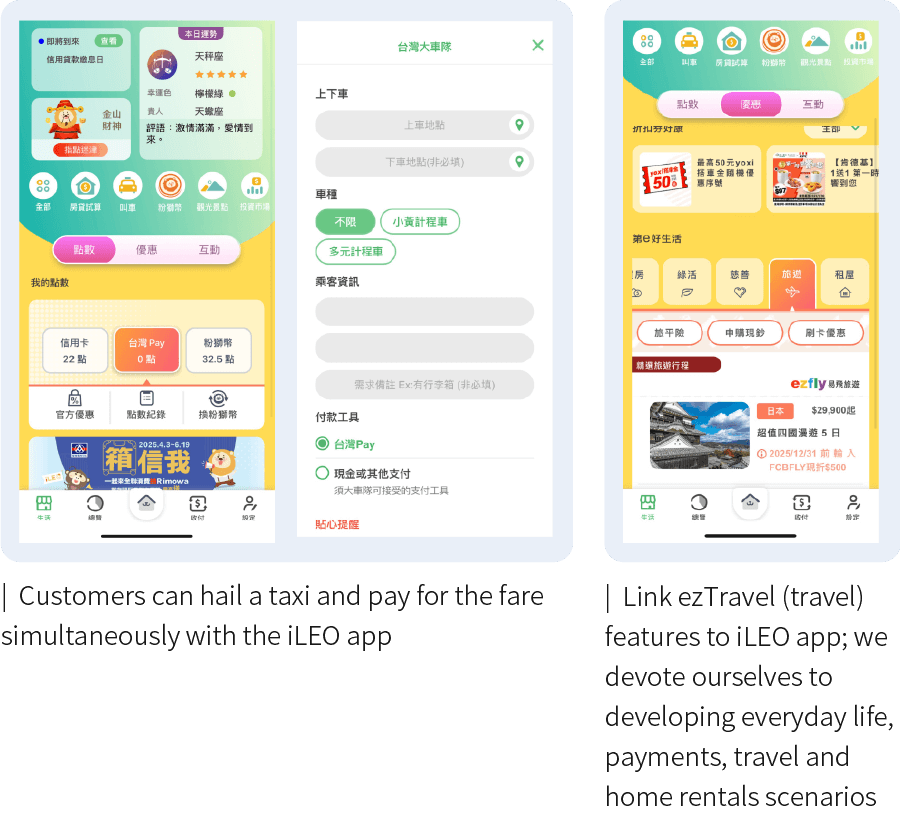

Development of the Bank as a Platform (BaaP) model has gradually matured. For example, we have rolled out the dedicated one-stop shopping "First Good Life" zone on the iLEO app, covering four scenarios including travel, home rentals, green consumption and charity. Since going online in November 2023, the service had accumulated more than 200,000 visits as of the end of 2024. Moreover, we have also partnered with the 55688 Group's Taiwan Taxi, the largest taxi fleet operator in Taiwan. Through cross-industry alliance and API integration, customers can hail a taxi and pay for the fare simultaneously with the iLEO app, as part of our efforts to provide a convenient, friendly and safe service platform.

In addition, cross-industry alliance can also realize inclusive finance and the concept of ESG sustainable life. We have partnered with FET Intelligent Technology's uTagGo to provide customers the opportunity to convert their iLEO coins into "decarbonization automotive coins", which can be used for deducting highway tolls and parking fees and can also reduce printing of paper bills. Moreover, we have aligned our offerings with "cloud invoice app" companies' services, such as utilities payment, checking the winning numbers with three simple digits, and LINE invoice winning notification. We would also conduct marketing and promotional events to respond to the call for environmental protection with concrete actions.

Social Media

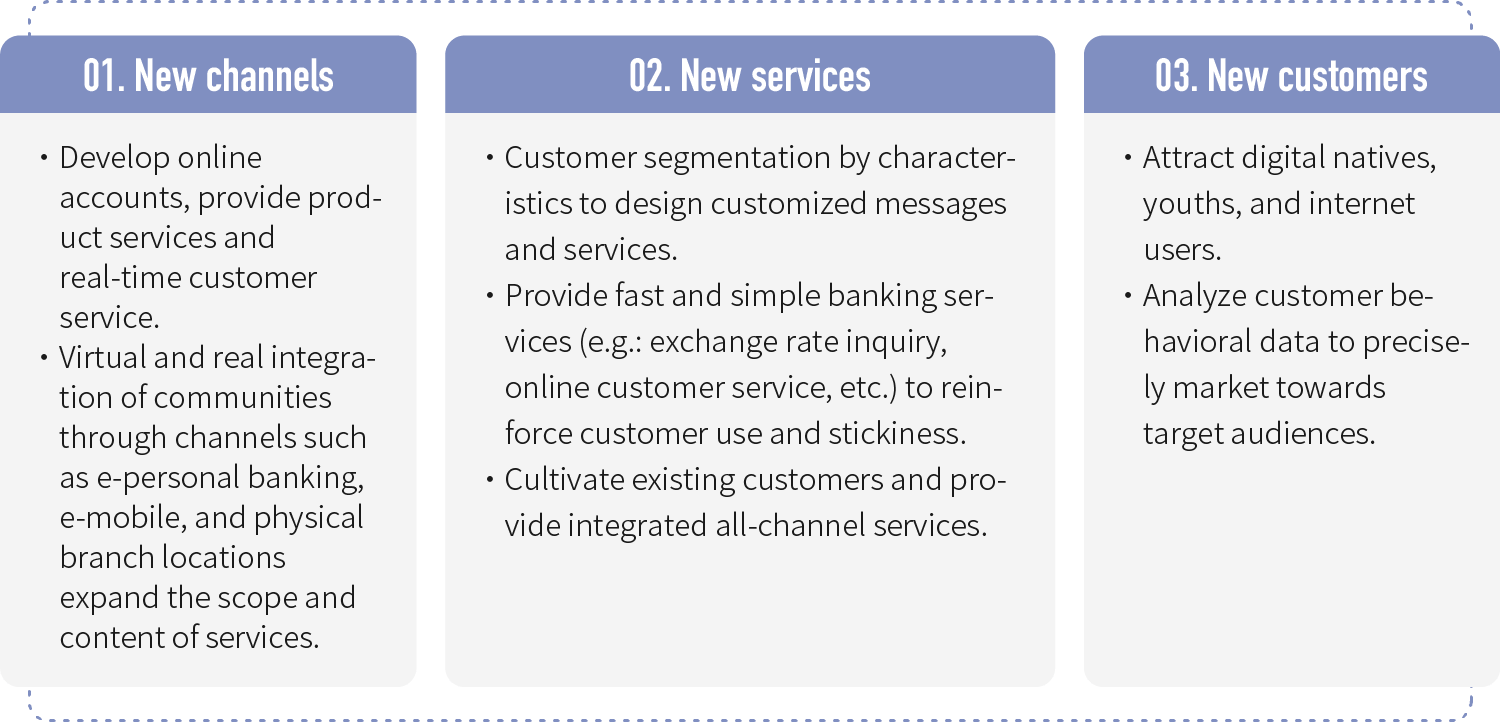

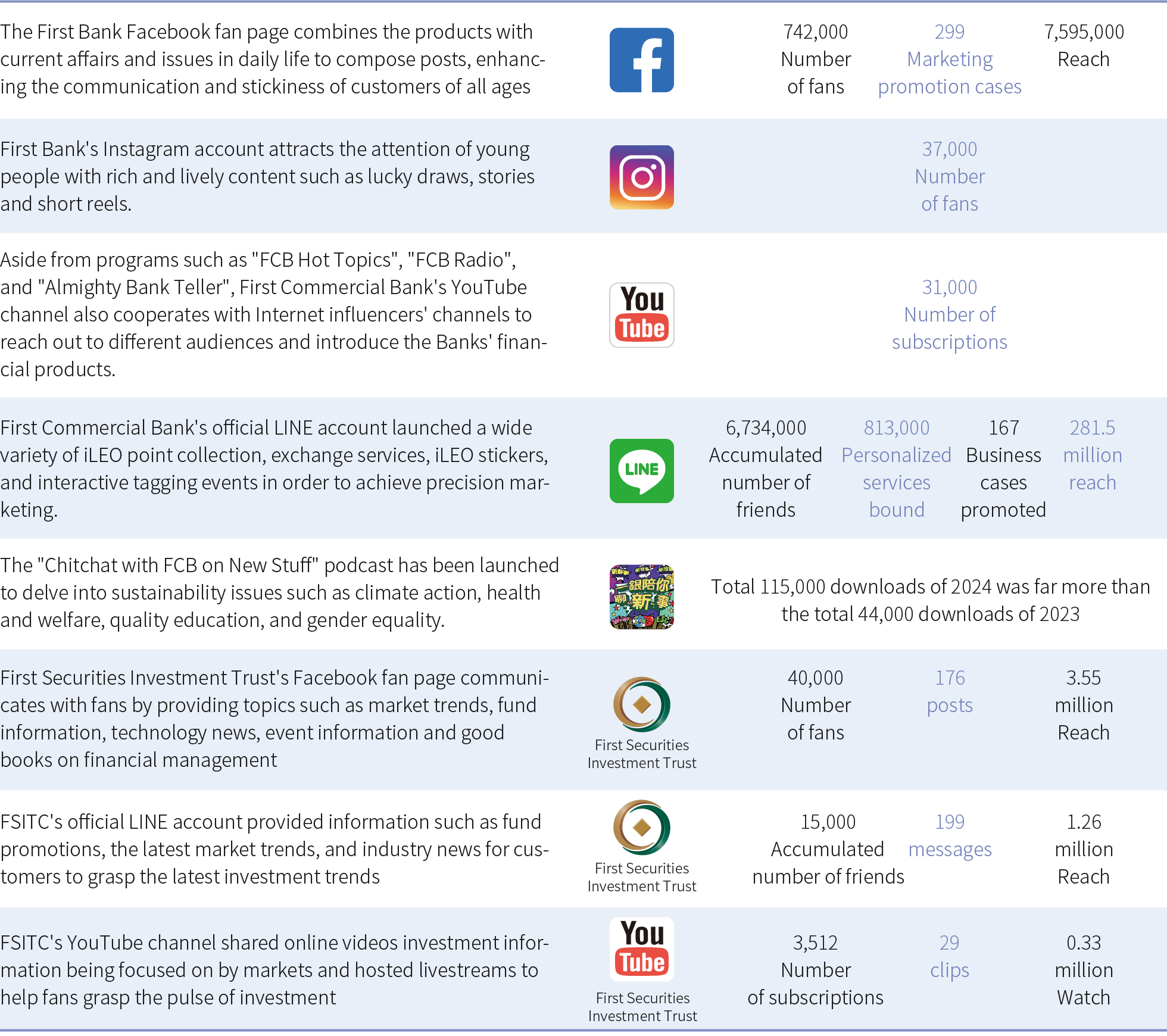

First Financial Group views social media as an important bridge of communications with customers and a means to develop new channels, services, and customers.