Social Factors >

Inclusive Finance Products and Services

Inclusive Finance Products and Services

Inclusive Finance Products and Services

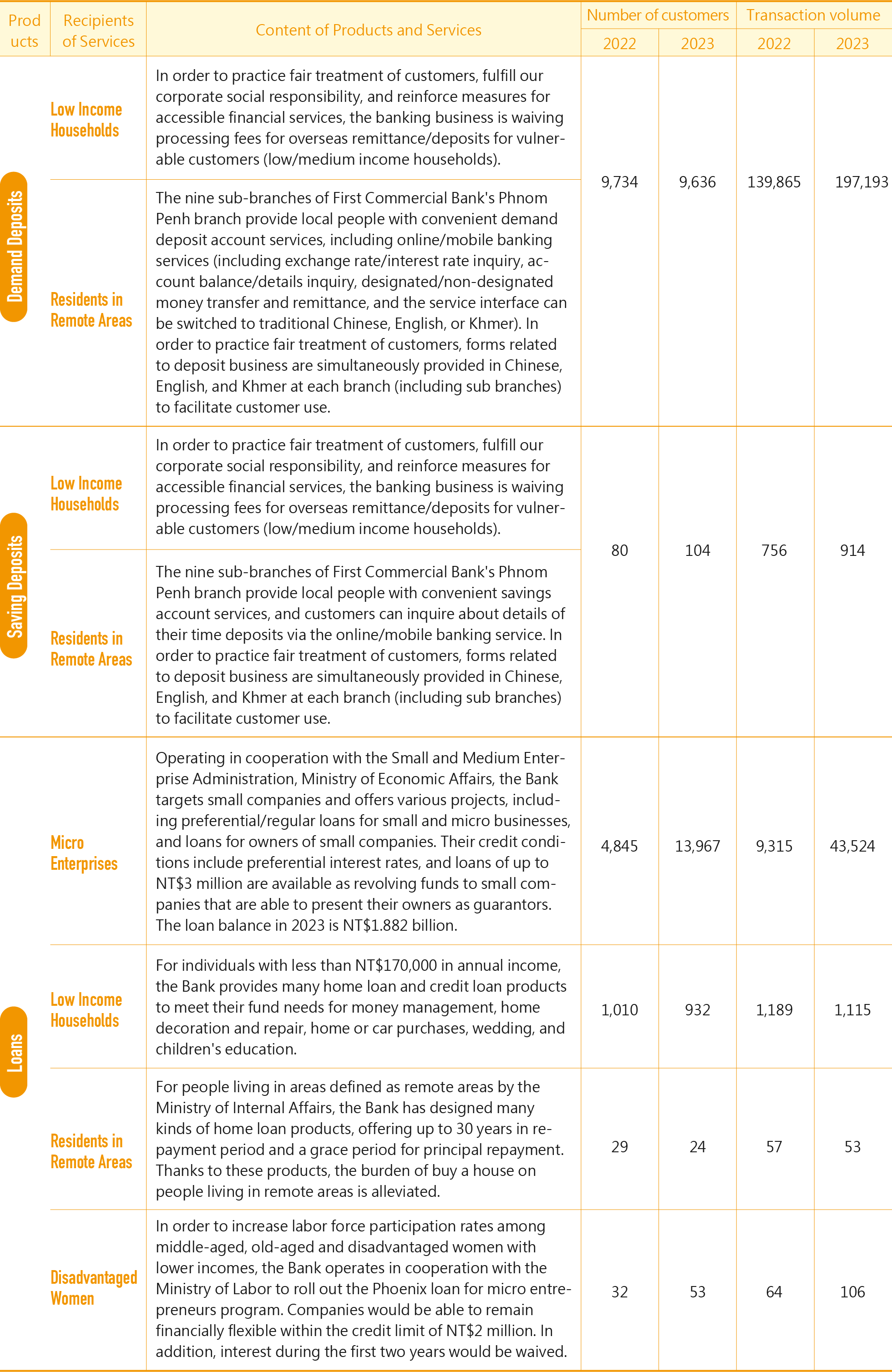

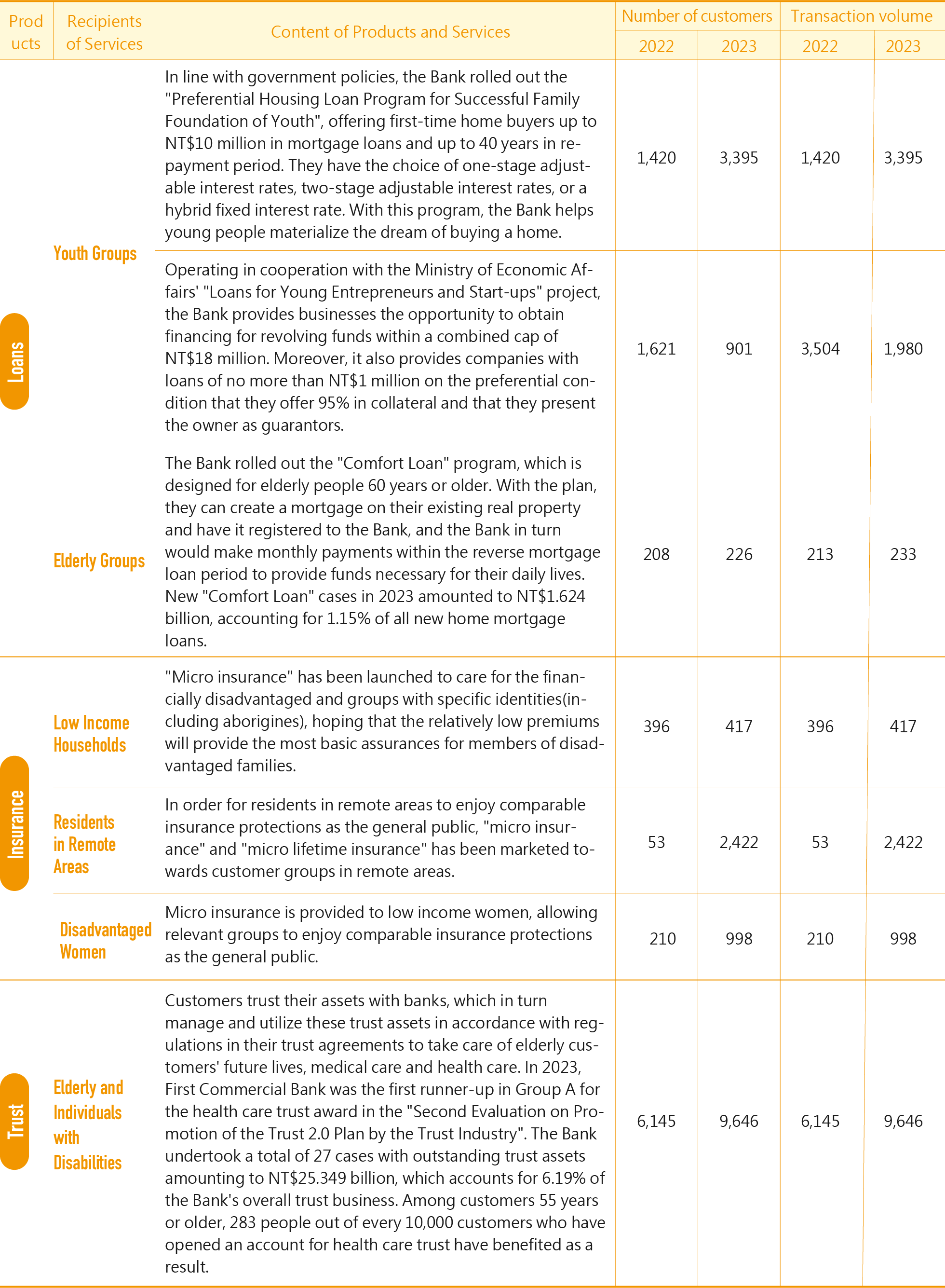

In response to the UN's promotion of financial inclusion for micro enterprises, low income households, residents of remote areas, disadvantaged women, youths, the elderly, and those with disabilities, basic financial services are provided for the goal of sustainable development. First Financial Holding continues to develop various products and services that support disadvantaged groups and provide them with a channel to obtain funding and financial services.

Unit: Households/Number

Unit: Households/Number

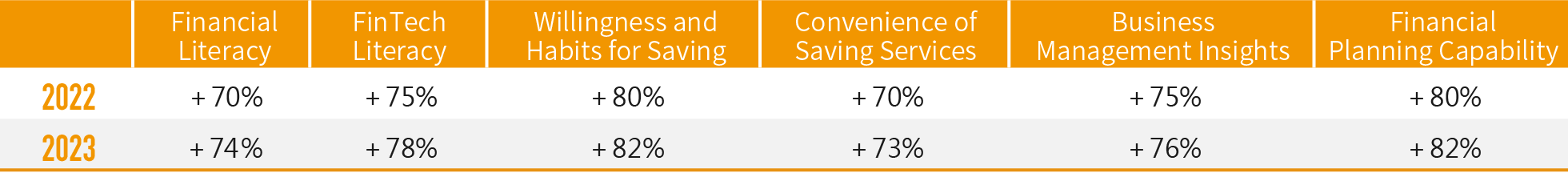

Aside from striving to provide various groups with fair and accessible financial products and services, First Financial Holding is actively combining core businesses to offer diverse non-financial support, such as training and seminars, free of charge. Relevant incentives are offered to encourage disadvantage groups into using financial products and services to fulfill the social responsibility of the financial industry.

■ Social Impact Indicators of First Financial Holding's Non-Financial Support

Training in Financial or Digital Literacy

・Remote Areas:

First Securities makes it a rule to go deep into far-flung areas every year to provide FinTech training to people with scarce financial resources. It also provides complementary financial health check-up service. In 2023, the company traveled to Xiluo Township, Yunlin County, Beigang Township, Yunlin County, Hemei Township, Changhua County, Zhunan Township, Miaoli County, and Qishan District, Kaohsiung City, providing financial information and FinTech training to a total of 202 customers.

・Youth Groups:

To encourage young students to devote themselves to academic research and financial innovation, the Bank organized the "Research Paper Award for Financial Innovation and Sustainable Finance". Academics and experts from various domains across Taiwan as well as the Banks' vice presidents were invited to form a judging panel to issue a total of 16 awards, including excellence and honorable mention awards. Sustainability and innovation values were deeply rooted on the academic level through active industry-academia exchanges.

Financial-Friendly Service Measures

・Remote Areas:

The Bank actively develops mobile banking apps in developing countries and least developed countries such as Cambodia and Vietnam. It also joined the local Bakong blockchain system to boost payment/receipt efficiency and safety for local people, in addition to promoting inclusive finance.

・Youth Groups:

The Bank has developed the iLEO Digital Account that caters to young people. Through lively, cute and easy-to-understand interface designs, the service provides favorable interest rates for small-sum demand deposits. A 2% interest rate is available for demand deposits from NT$100 to NT$120,000. Such interest is paid out every month to encourage young people to get into a savings habit.

・Persons with Disabilities:

All business units of First Bank offer accessible environments and facilities such as "accessible service counters", "service bells", and "accessibility slopes" as well as dedicated receptionists to help guide disabled individuals in conducting various financial operations. Information such as real-time exchange (interest) rates and standard business fees are provided on "exchange (interest) rate billboards" and "electronic bulletin boards" and offer more convenient saving services for persons with disabilities.

・Foreign Nationals:

A.To provide friendly financial service, and to allow customers of different cultures and nationalities to experience kind, warm and professional financial services, the Bank had built 87 bilingual branches as of the end of December 2023. 12 of them provide Chinese, English and Japanese service. 25 bilingual branches will be added every year. We expect to complete our bilingual drive with 187 domestic branches by the end of 2027.

B.To create a friendly environment for migrant workers, new immigrants and tourists, and to align with the Financial Supervisory Commission's decision to add the "percentage of ATMs offering multilingual service" to the indicators for measuring inclusive finance, the Bank has expanded its service to add Japanese, Vietnamese, Indonesian and Thai to the operating interfaces for the following transactions frequently used by foreign nationals, including cash withdraws with international cards, cash advance and account balance checks, as well as cash withdraws, deposits, cash advance, money transfers and balance checks with domestic cards. The expanded service is intended to boost our exchanges with Southeast Asian countries, create a friendly atmosphere for foreign nationals, and highlight our devotion to align our financial services with the rest of the world.

Technical Assistance

・Micro enterprises, disadvantaged women:

First Bank has partnered with Industrial Technology Research Institute ("ITRI") so that the institute may provide enterprises with counseling in terms of patents, technologies, and market conditions while the bank handles financing loans for technology, intellectual property, or other matters. Also, long-term support for microenterprises has been provided in coordination with the Workforce Development Agency. Consultation and services for micro startup businesses, female entrepreneurs, and pre/post loan operations are provided by dedicated consultants stationed at the Ministry of Labor. Furthermore, the Bank also works with the Taiwan Small & Medium Enterprise Counseling Foundation. We would jointly host seminars to increase SMEs' financial competitiveness and provide counseling plans each year. We would invite industrial and economic experts or business owners for bilateral communication with enterprises, while providing counseling service from the industrial, economic and technical aspects.

Business Management Tools or Training

・Micro Enterprises:

irst Bank has partnered with Taiwan SME Counseling Foundation (Taiwan SMECF) in coordination with the government's development policy to support small, medium, and micro enterprises by providing them with financial examination and diagnosis counseling services. The plan hopes to elevate small, medium, and micro enterprise customers through comprehensive financial planning, thereby ensuring they are financially sound. In 2023, financial examination and diagnosis counseling services were provided to 50 small, medium, and micro enterprises; each year, enterprise seminars are organized to provide overall economic and industry trend analysis to small, medium, and micro enterprises in an attempt to cultivate business insights in business owners. In 2023, a total of 5 seminars were organized.

・Micro enterprises, low income households, residents of remote areas, disadvantaged women:

Through the "LEO's Life" blog, we provide professional articles on business administration, investment and money management, industrial trends, and financial knowledge. We have also designed and added the "Become Savvy in Money Management in 1 Minute" column to our Facebook fan page, in an effort to help young wound-be entrepreneurs increase their professional know-how at all times, so that they can increase their chance of success.