Social Factors >

Fair Customer Treatment and the Protection of Clients Privacy

Fair Customer Treatment and the Protection of Clients Privacy

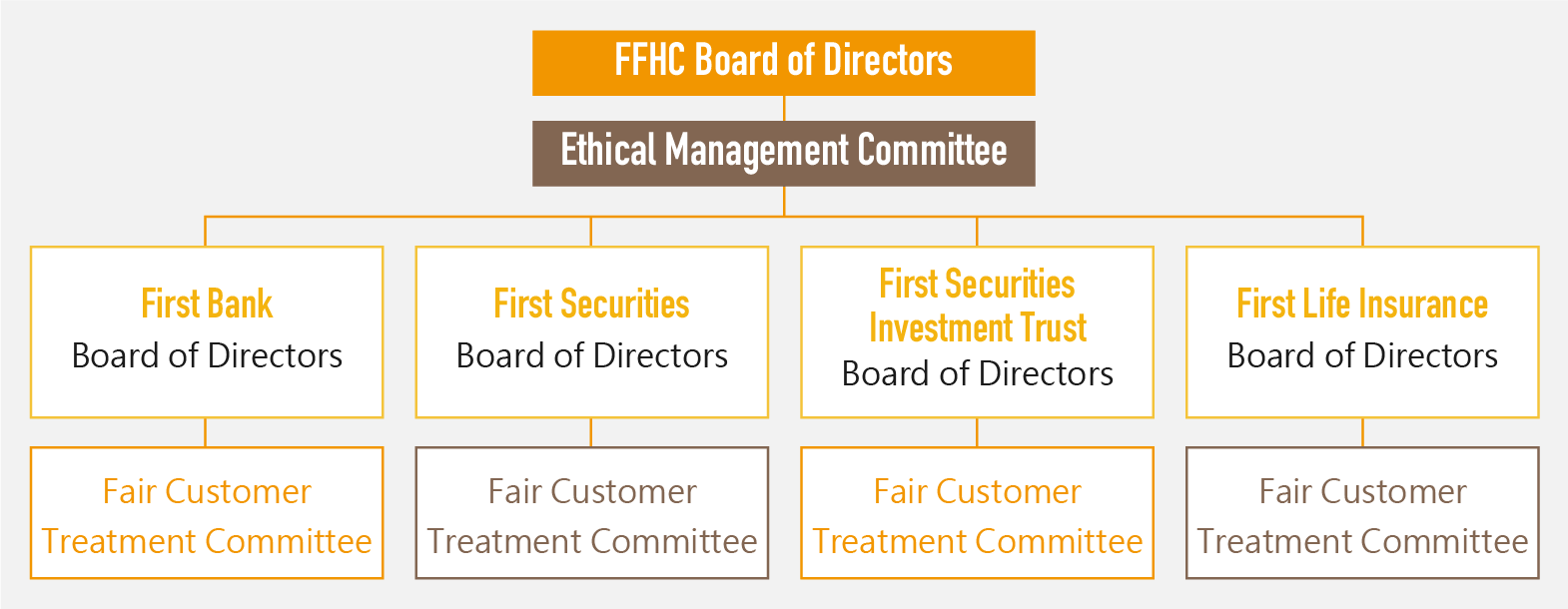

Implementation of Fair Customer Treatment

Ethical corporate management is the cornerstone of fair customer treatment in the financial industry. The Company has formulated the "Code of Conduct for Ethical Management" in accordance with the "Principles for Fair Treatment of Customers in the Financial Services Industry" and "Standards Governing Friendly Financial Service". It stipulates that, during the course of product/service R&D, provision or sales, companies within the Group shall not infringe upon the rights of consumers or any other stakeholders. It also demands that related operating procedures and code of conduct be formulated, and that education training be conducted. First Commercial Bank, First Securities, First Securities Investment Trust and First Insurance have all formulated and promulgated the "Policy of Fair Customer Treatment & Related Strategies", which have been submitted, reviewed and approved by the Board of Directors of each company. Furthermore, inspection comments made by internal audit divisions about improvement measures for inadequacies relating to consumer protection are regularly incorporated in the regulatory compliance status report, which is submitted to the Board every six months. In 2023, First Commercial Bank formulated notes for banks in the event that commercial marketing practitioners exercise their right to refusal. It also established a supervisory mechanism for handling major customer complaints and material financial consumption disputes. As a result, the Bank was once again ranked in the top 25% in the Financial Supervisory Commission's review for fair customer treatment. Meanwhile, both First Securities and First Insurance made list of top 26%-50% companies. Moreover, each company also established their dedicated committees to supervise the implementation and execution of the "Principles for Fair Treatment of Customers in the Financial Services Industry". Review on the implementation status of fair customer treatment would be conducted on a quarterly basis or semi-annually, and improvement measures would be submitted to each company's Board, before being submitted to the Company's Ethical Corporate Management Committee and Board of Directors. We also conducted education training relating to the "Principles for Fair Treatment of Customers in the Financial Services Industry". A total of 8,833 people have received the training, with a training completion rate of 100%.

To enhance protection for financially disadvantaged demographic groups such as the elderly people and persons with disabilities, the Company partnered with the Economic Daily News to jointly host the "Ethical Finance-Build a Financial Safety Net for the Elderly" forum in 2023. The Board of Directors also instructed various subsidiary companies to beef up their KYC operations and countermeasures against financial exploitation, and implement control on operating procedures in order to prevent fraud. With respect to improper marketing to disadvantaged people or customer complaints and disputes arising from rules violations, First commercial Bank has incorporated them into the annual review of business units. They are also incorporated into the evaluation scope of the Compliance Risk Assessment (CRA) and Institutional Risk Assessment (IRA). The "Reference Practices for Bank Services for People with Dementia or People Suspected of Dementia" published by the Bankers Association has also been incorporated into the "Friendly Financial Service Guiding Handbook"; The Bank also compiled personality trait analysis reports on vulnerable demographic groups (including the elderly) published by the Financial Conduct Authority (FCA) in the UK, which have been shared with our front-line staff at operating locations for reference; 24 red-flag indicators for elder financial exploitation published by FinCEN in the U.S. have been introduced and applied to over-the-counter outreach operations at our branch offices; The Bank referenced the "Recovering from Elder Financial Exploitation" report promulgated by the United States Consumer Financial Protection Bureau as well as domestic practices to formulate measures to protect vulnerable people from financial exploitation, such as the "Standard Protocols for Assisting Elder Customers in Retrieving Funds Lost to Financial Exploitation", in an effort to strengthen protection for such demographic groups. In addition, the Bank also monitors the implementation status on service measures for the fair treatment of elderly customers on a quarterly basis, which is submitted to the Committee for Advancing Fair Customer Treatment.

To protect consumer rights, the Group's bank, insurance, securities and securities investment trust subsidiaries all implement the Know Your Product/Service (KYP) policy. Since Q1 of 2016, First Commercial Bank has suspended the undertaking of complex and high-risk products. With respect to structured notes, the Bank has formulated special notifications to customers in addition to informing them of the risks associated with structure notes, in order to make sure that customers are well aware of our product details; In 2023, the Group recorded four incidents relating to product sales and services, in which we were subject to regulatory punishments and underwent litigation proceedings. The total loss was NT$0 (please refer to the appendix: sustainable operation indicators), the Group has improved the relevant deficiencies and added relevant control mechanisms, effectively enhancing the protection of consumers' rights and interests.

Customer complaints and satisfaction surveys

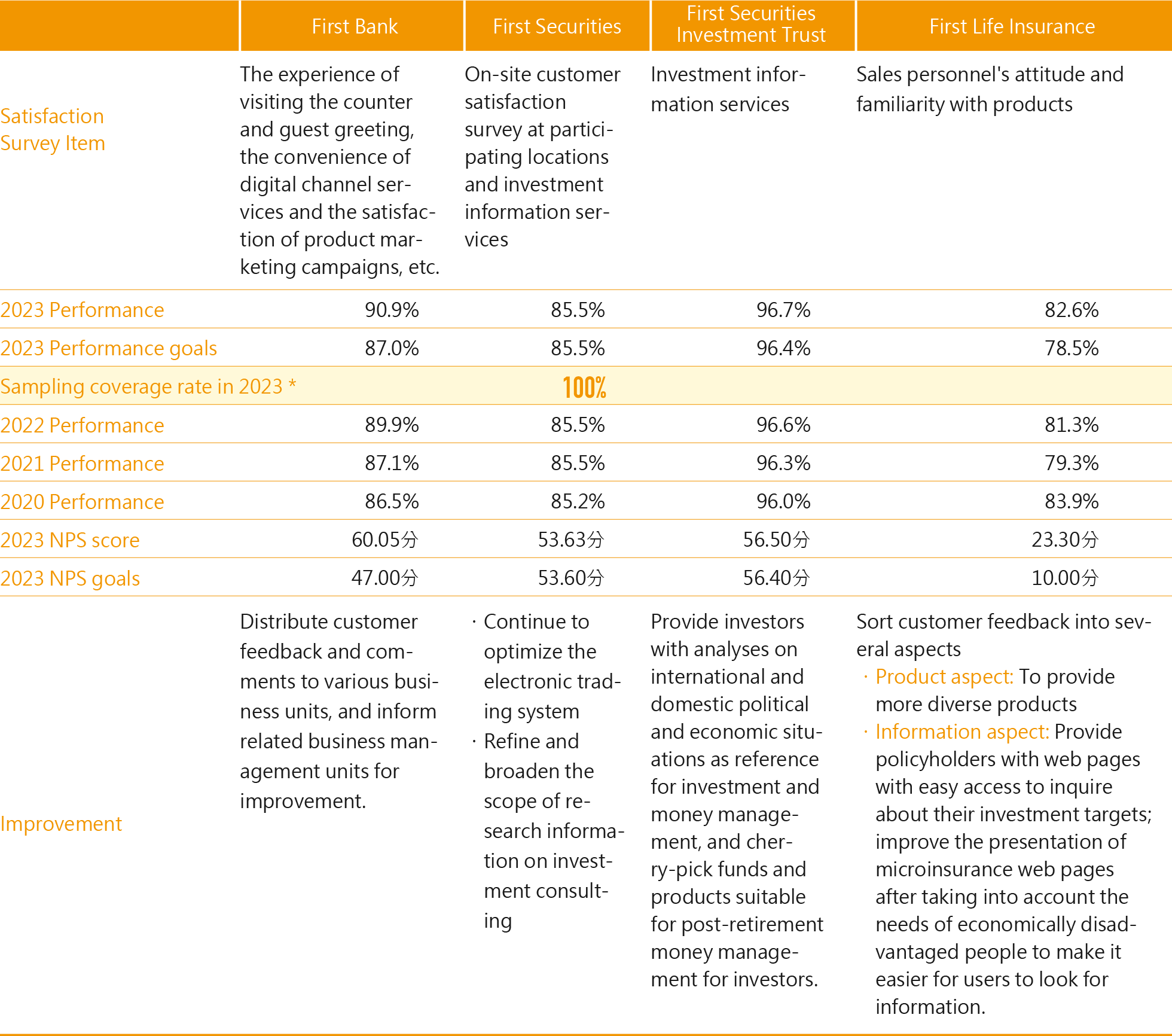

We value rating and suggestions for products or services by customers, every year we conduct complete sampling to savings, foreign exchange, credit, financial management, credit cards, insurances, securities, investments lectures, APP functions, etc and through phone calls, email surveys, activity pages, customer service or retaining market survey companies we conduct customer satisfaction survey, and since 2022 we has conducted an online satisfaction survey and disseminated information about fraud prevention to on-site elderly customers in order to protect their rights and provide a service more close to their needs. At the same time, we use Net Promoter Score (NPS) to count and relevant departments will conduct improvements on items of lower satisfaction scores and customer suggestions.

■ Customer satisfaction survey of past years

*:The samples drawn by each subsidiary covers the main business of each such company, which is sufficient to infer the current status of the overall active customers.

Moreover, a mechanism has been established to handle consumer complaints and disputes. Aside from formulating the "Operating Guidelines for Handling Customer Complaints" and procedures for handling various business disputes, First FHC also provides access to the online customer service of its subsidiaries, toll-free customer service phone numbers, dedicated phone numbers for business consultation, and complaint mailboxes under the "Stakeholder Communication" menu item on its official website. First Commercial Bank has also installed a 24-7 customer service hotline as well as an email box to remain in constant communication with its customers. In 2023, the Bank obtained the "AA" accessibility label for its official website and major e-banking services. In addition, it also enhanced its over-the-counter outreach mechanism for disadvantaged and elderly people as well as people suspected of suffering from dementia when they approached us for online banking, debit cards/voice-activated money transfer and foreign exchange operations. We also provided the "friendly reservation service", in addition to installing the "Senior Citizens & Friendly Service Hotline". To cooperate with the competent authority's policy to reinforce the review and evaluation mechanism for fair customer treatment, First Commercial Bank, First Securities, First Securities Investment Trust and First Insurance continued to refine their procedures for handling customer complaints in 2023. They regularly compile and sort major cases of customer complaints, and submit them to the Board. Customer complaints lodged with the Financial Ombudsman Institution are also regularly submitted to their respective Board of Directors for future reference, including the types, number, indemnity and handling status of such cases.

To effectively improve our operating procedures and reduce customer complaints, First Commercial Bank has incorporated the performance for handling customer complaints into the performance review of each unit, in addition to establishing a customer complaint review mechanism. Education training will be intensified for employees with poor attitudes, and units with repeated negligence are required to submit concrete improvement measures. Moreover, a dedicated customer complaint area has been created on the internal network, providing business units with information such as analyses on customer compliant cases and related statistical tables for their reference. We applied for ISO10002 "Customer Complaint Management Certification" and the ISO10004 international standard for customer satisfaction certification in 2024. We expect to receive double certifications in August, as we continue to improve the quality of our handling of complaint cases and align ourselves with international standards. The Group accepted and handled a total of 231 customer complaint cases via various grievance channels in 2023. In particular, we were notified of 212 of these cases via competent authorities (please refer to the appendix for more details: sustainable operation indicators). For most complaint cases, we were able to complete customer pacification and replies within the required timeframe. We also analyzed customer feedback and compiled related statistics in accordance with business types, before sending them to related units for improvement.

Customer Care Events

To promote financial knowledge and improve different groups' ability to utilize financial tools and services, we strengthened the people's understanding of financial products and services and improved financial risk resistance. We organized various seminars that tour rural, urban and remote areas and provide customers with information on different financial products and offer investment analysis and advice. We promoted regional revitalization and community development while increasing the financial tolerance of the entire society to help customers start businesses, grow, live in happiness, and retire with security.

■ 2023 Customer Care and ESG Engagement Activities

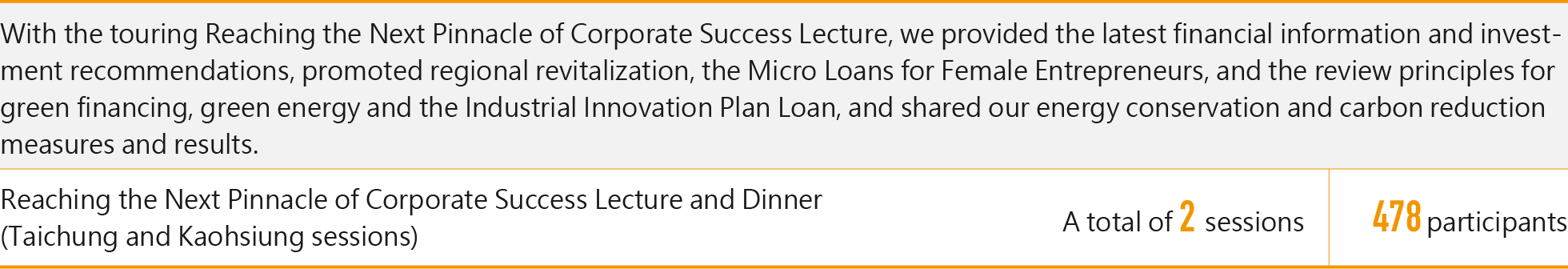

Reaching the Next Pinnacle of Corporate Success Lecture

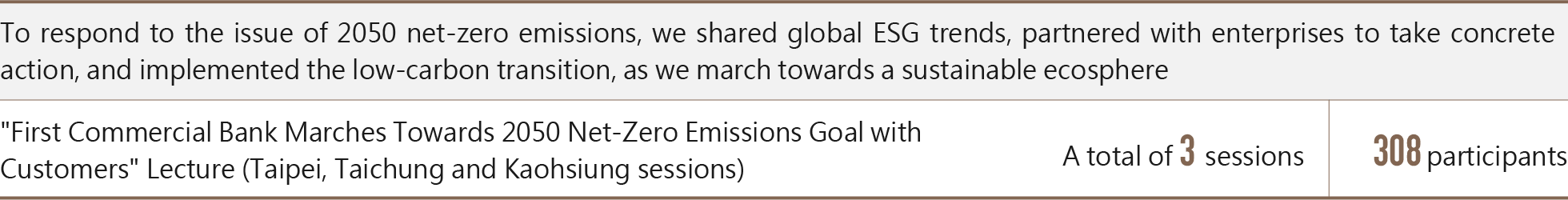

"First Commercial Bank Marches Towards 2050 Net-Zero Emissions Goal with Customers" Lecture

Investment & Money Management Lecture for Customers

Financial Planning Clinic Seminar

Customer care investment checkup seminar in rural communities

Investment & Money Management Lecture; Celebrity Money Management Class

Seminars and regular live broadcasts of financial management courses

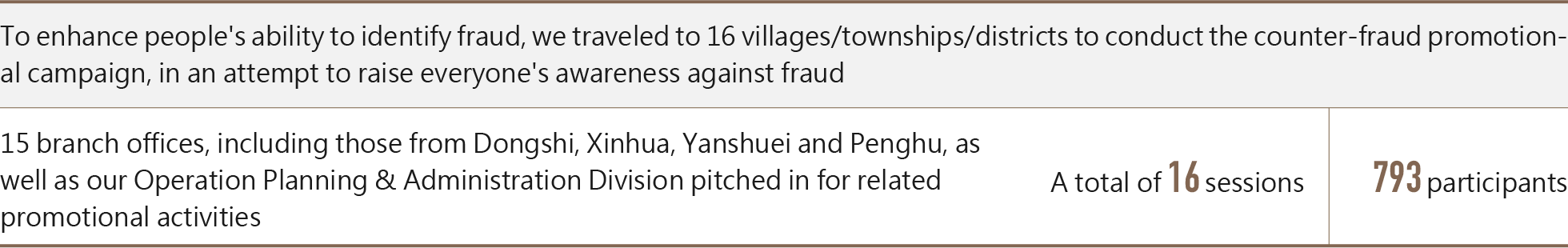

Anti-fraud promotional campaign throughout 368 townships across Taiwan by financial institutions

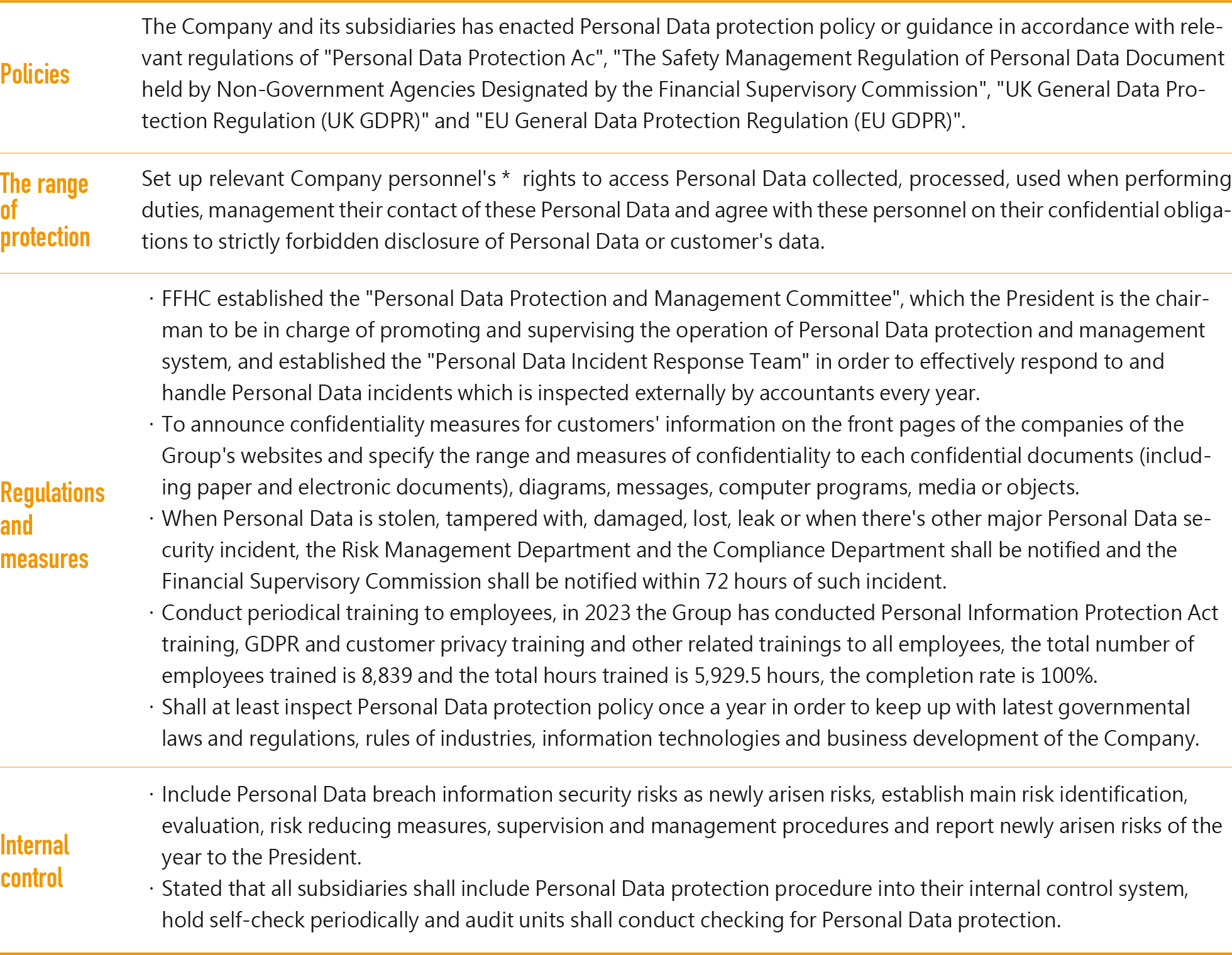

The protection of clients’ privacy

Value customer privacy, FFHC and its subsidiaries has enacted Personal Data Protection Policy and Guidance, its relevant range, regulation, measures and internal controls is stated as follows:

*:Include employees of the Company, temp worker sent by the temp agency and appointed institution which has appointment relationship with the Company and personnel of such institution.

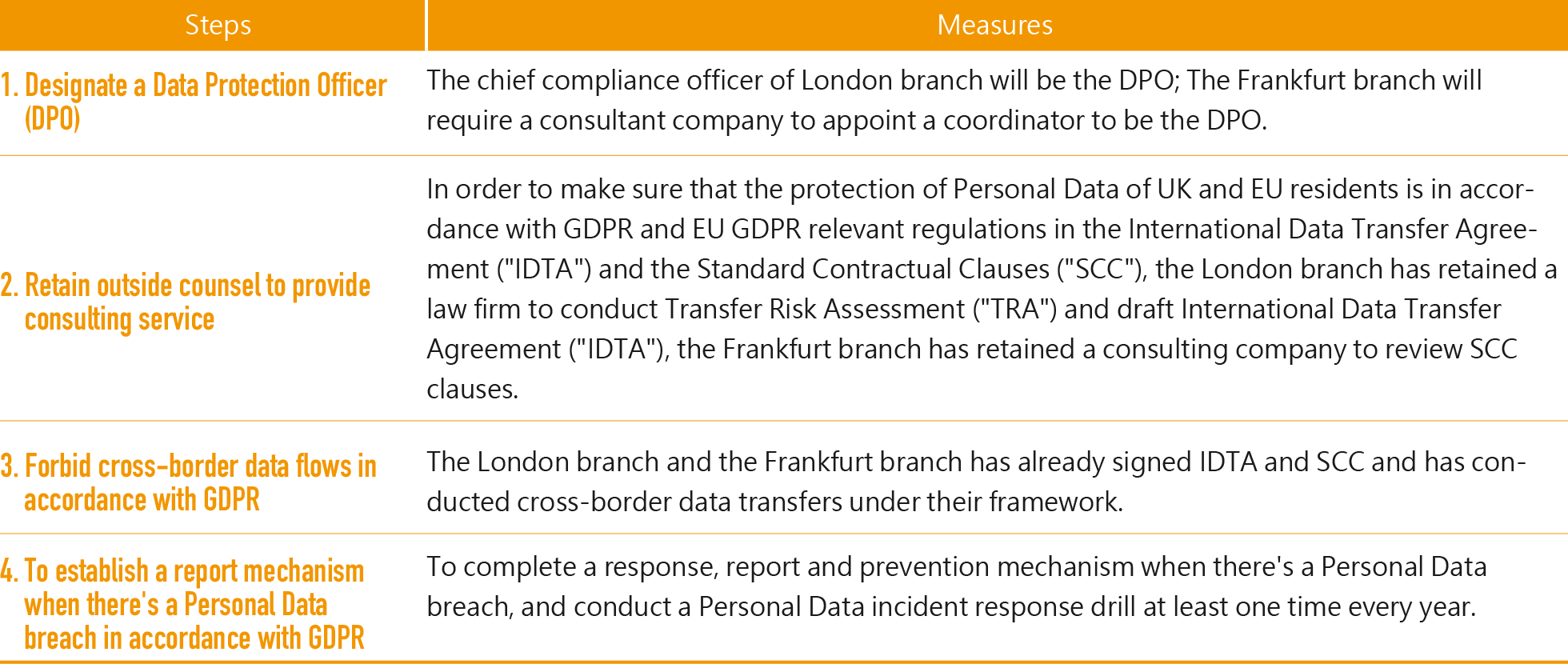

Except that the domestic units of First Bank shall follow EU General Data Protection Regulation (EU GDPR) and relevant regulations, other overseas branches shall also follow regulations policies of competent authorities of each country (for example: UK General Data Protection Regulation (UK GDPR)) and in order to request employees to follow Personal Data Protection Act, the breach of Personal Data has been included into deduct items of business units' evaluation and personal punishment will be made according to the degree of seriousness of the violations.

■ First Bank take the following measures according to the UK General Data Protection Regulation (UK GDPR) and EU General Data Protection Regulation (EU GDPR):

First Financial Holding highly values the security of our customers' personal information. To implement the management of personal information protection, both First Commercial Bank and First Life Insurance have obtained the "BS10012: Personal Information Management Systems" verification certificates, in addition to undergoing continuing secondary reviews and re-verification every year. Moreover, we take 100% control of how our customers' personal information is used. Around 4.36 million pieces (46.2%) of customer information are made available for secondary use (such as marketing or product/service quality improvement) under the condition that no related laws and regulations or agreements with our customers are violated.